- Introduction to Investment Multiplier

- Keynesian Theory and Multiplier Effect

- Formula of Investment Multiplier

- Role in National Income

- Marginal Propensity to Consume (MPC)

- Leakages and Limitations

- Multiplier in a Closed Economy

- Government Expenditure and Multiplier

- Dynamic vs Static Multiplier

- Conclusion

Introduction to Investment Multiplier

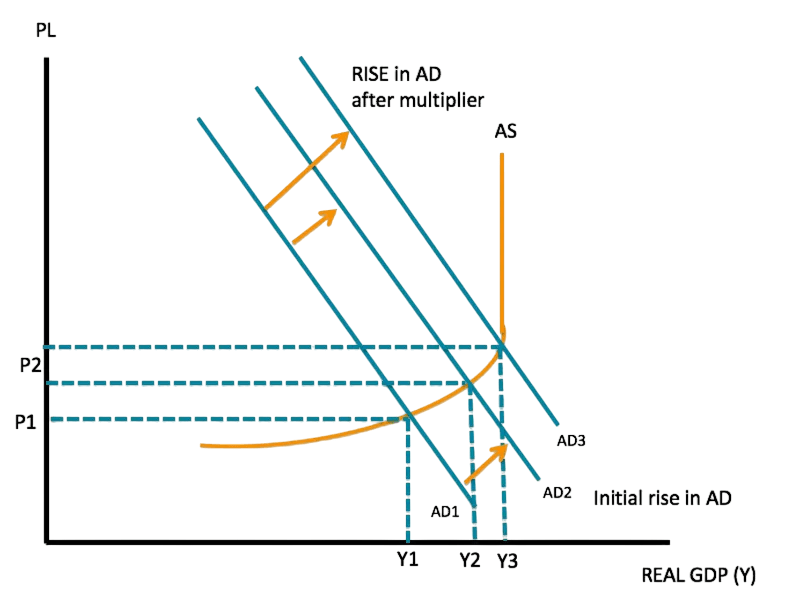

At its core, the investment multiplier quantifies how changes in investment lead to magnified changes in total income. Often termed the Kahn-Keynes multiplier (bearing names of its originators), Static multiplier the concept shows that spending has ripple effects across the economy.An increase in investment doesn’t just boost GDP by the amount spent it leads to income for others, who then consume more,Formula of investment multiplier, Closed economy creating successive rounds of spending.The Investment Multiplier is a key concept in Keynesian economics that explains how an initial increase in investment can lead to a greater overall increase in national income. It highlights the ripple effect of spending within an economy—when investment rises, it boosts income and consumption, which in turn leads to further increases in output and employment. This chain reaction continues until the total increase in income is a multiple of the original investment. The multiplier effect demonstrates the powerful role of aggregate demand in influencing economic activity and forms the foundation of many fiscal policy decisions.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Keynesian Theory and Multiplier Effect

- Keynesian multiplier: ∆Y = k × ∆I, where ∆Y is the change in national income, ∆I is the change in investment, and k is the multiplier.

- The multiplier emerges from a series of induced spending after initial investment, workers spend part of their income, generating further demand, and so on.

This was a departure from classical economics, emphasizing how demand deficiency can cause unemployment and how policy can counteract it.

Formula of Investment Multiplier

Formula of investment multiplier in its simplest form (closed economy with no government), the multiplier k is:

k = 1 / (1 – MPC)

Where MPC (Marginal Propensity to Consume) measures how much of additional income is spent vs saved.With government and foreign trade included, the formula becomes:

k = 1 / (1 – MPC × (1 – t) + MPM + MPT)

where t is tax rate, MPM is marginal propensity to import, and MPT is marginal propensity to tax.These expanded versions account for real-world leakages that dampen the multiplier effect.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Role in National Income

- The multiplier effect is central to Keynesian aggregate demand analysis: An uptick in investment raises national income beyond the original injection.

- Through fiscal policy, such as increased public spending during downturns, governments can raise total output and income.

- However, the final increase in output depends on the size of the multiplier k, which is influenced by consumption habits, taxes, imports, and savings.

Marginal Propensity to Consume (MPC)

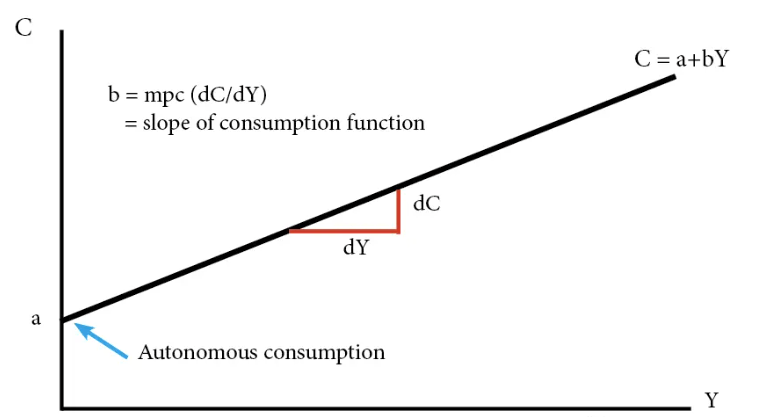

Marginal Propensity to Consume (MPC), a pivotal determinant of k, measures the change in consumption per unit change in income:

MPC = ∆C / ∆Y

- Higher MPC → larger multiplier.

- Individuals in lower income brackets often have higher MPC and thus contribute more to multiplier expansion.

- For instance: if MPC = 0.8, then k = 1 / (1–0.8) = 5. Thus, a $1 million investment would theoretically increase national income by $5 million.

Leakages and Limitations

Leakages reduce the multiplier’s impact:

- Savings: Part of income that isn’t spent.

- Taxes: Divert income away from spending.

- Imports: Spending that flows abroad, not into the domestic economy.

Multiplier with leakages:

k = 1 / (MPS + MPT + MPM)

- Where MPS (Marginal Propensity to Save) = 1 – MPC.

- Other limitations include price changes (inflation), capacity constraints, and time lags that dilute iterative rounds of spending.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Multiplier in a Closed Economy

In a simplified closed economy (no foreign trade, no taxes):

k = 1 / (1 – MPC)

- A straightforward model useful for theory.

- Highlights that higher Marginal Propensity to Consume(MPC) yields higher k.

- Not realistic, but a foundation for more complex analysis.

Government Expenditure and Multiplier

Government spending also benefits from a multiplier effect:

∆Y = k_g × ∆G

Here k_g is often smaller than investment multipliers due to taxation and substitution effects, but still significant in stimulating demand.,/p>

Effectiveness depends on:

- Government efficiency,

- Timing of spending,

- Economic conditions (e.g., recession vs full employment).

Dynamic vs Static Multiplier

Static Multiplier

- Definition: Measures the total change in national income resulting from a change in investment, assuming instantaneous adjustment.

- Key Assumption: All effects happen at once, with no time lag.

- Use: Ideal for theoretical analysis or simplified models.

- Definition: Describes how national income changes gradually over time after an initial investment, recognizing that adjustments occur in successive periods.

- Key Feature: Accounts for time lags in spending and income generation.

- Use: More realistic and useful for analyzing short-run economic changes and policy impacts.

Formula:

k=11−MPCk = \frac{1}{1 – MPC}k=1−MPC1

Dynamic Multiplier

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Conclusion

Investment multiplier explains how initial spending leads to a magnified impact on national income.Core determinants are MPC and economic leakages (savings, taxes, imports).While theoretical simplicity offers insight, real-world application is moderated by time delays, Keynesian formula, Formula of Investment Multiplier, Dynamic and Static multiplier capacity constraints, leakages, crowding out, and structural conditions.Despite limitations, governments worldwide continue to rely on multiplier-driven policies for crisis recovery, Closed economy making it one of the most enduring and operational macroeconomic tools.In conclusion, the Investment Multiplier is a fundamental concept in Keynesian economics that illustrates how initial changes in investment or government spending can have a magnified impact on national income. By emphasizing the importance of aggregate demand and the role of the marginal propensity to consume, Keynesian theory provides valuable insight into how economies can be stimulated, particularly during periods of underemployment and low growth. While the multiplier effect offers powerful policy implications, its actual impact depends on various factors such as savings, taxes, and imports, which can dilute its effectiveness. Understanding these dynamics is essential for crafting effective fiscal policies and promoting sustainable economic growth.