- Introduction

- Who is a Research Analyst?

- Educational Requirements

- Key Skills Needed

- Certifications (CFA, NISM, etc.)

- Gaining Experience

- Learning Financial Tools

- Research Methodologies

- Building a Portfolio

- Networking and Internships

- Industry Trends

- Research Analyst Career Path and Roles

- Growth and Opportunities

- Conclusion

Introduction

In today’s data-driven and fast-paced financial world, Research Analysts play a crucial role in helping organizations make informed investment decisions. They analyze financial data, industry trends, and economic conditions to provide actionable insights to investors, fund managers, and corporate clients. This profession blends analytical rigor, market knowledge,Learning Financial Tools and communication skills to support sound decision-making in capital markets and business strategies. This article explores who a Research Analyst is, the educational and skill requirements, certifications that enhance credibility, gaining experience, essential tools, research methodologies, portfolio building, networking, industry trends, career opportunities, and growth prospects.Research Analyst Career Path

Are You Interested in Learning More About Web Developer Certification? Sign Up For Our Web Developer Certification Courses Today!

Who is a Research Analyst?

A Research Analyst is a professional who studies financial markets, companies, and economic conditions to provide investment recommendations and strategic advice. They collect and analyze data from various sources, including company financial statements, Equity Research Analyst market reports, and economic indicators. The role can vary based on the sector such as equity research, credit research, economic research, or industry-specific analysis. Key Responsibilities:

- Analyzing financial data such as balance sheets, income statements, and cash flow statements.

- Evaluating market trends and economic developments.

- Building financial models to forecast future performance.

- Preparing detailed reports with investment recommendations.

- Communicating findings to portfolio managers, clients, or senior management.

- Tracking and monitoring investment performance.

- Finance

- Economics

- Accounting

- Business Administration

- Mathematics

- Statistics

- Engineering (with strong quantitative skills)

- Financial modeling and valuation

- Corporate finance

- Portfolio management

- Quantitative methods and econometrics

- Data analysis and programming

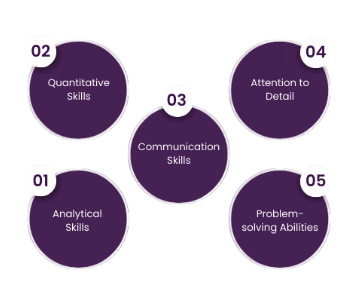

- Analytical Skills: The ability to examine financial statements, identify patterns, and interpret data is fundamental. Analysts must evaluate the quality of earnings, detect risks, and estimate future growth.

- Financial Modeling and Valuation: Expertise in building and maintaining financial models such as discounted cash flow (DCF), comparable company analysis, and precedent transactions is critical for projecting company value.

- Attention to Detail: Precision is key because small errors can significantly impact recommendations. Analysts must be meticulous in data collection, validation, and interpretation.

- Communication Skills: Research Analysts must translate complex data into understandable reports and presentations. Written and verbal communication skills help articulate insights to clients and management.

- Problem-Solving: The ability to approach ambiguous problems methodically and come up with actionable insights is highly valued.

- Time Management: Meeting tight deadlines in a fast-moving market environment requires efficient time management and prioritization.

- Technological Proficiency: Familiarity with financial databases, Excel, programming languages like Python or R, and visualization tools is becoming increasingly important.

- Chartered Financial Analyst (CFA): The CFA charter is one of the most prestigious credentials in investment analysis and portfolio management. It covers topics like equity analysis, Learning Financial Tools, fixed income, derivatives, ethics, and portfolio management. The program consists of three levels and requires passing rigorous exams along with relevant work experience.

- NISM Certifications (India): The National Institute of Securities Markets offers various certifications relevant to financial professionals:

- NISM-Series-VIII: Equity Derivatives Certification

- NISM-Series-XV: Research Analyst Certification

- NISM-Series-XV-A: Investment Adviser (Level 1) Certification

- Financial Risk Manager (FRM): Offered by the Global Association of Risk Professionals, FRM certification is beneficial if you want to specialize in risk analysis within the research domain.

- Certified Market Technician (CMT): If your research role leans towards technical analysis, the CMT program can boost your expertise.

- CPA (Certified Public Accountant) – if accounting is a core focus Data Science and Machine Learning Certifications – increasingly important for quantitative research

- Internships: Look for internships at investment banks, asset management firms, financial consultancies, or research houses. Internships provide exposure to real-world projects, data sets, and mentorship.

- Entry-Level Roles: Roles such as Junior Analyst, Research Assistant, or Data Analyst can serve as stepping stones. They help you understand industry workflows and develop analytical and communication skills.

- Freelance and Personal Projects: Work on personal projects like stock market analysis, company valuations, or economic research. You can publish reports on platforms like Seeking Alpha or build a blog to showcase your work.

- Volunteering or Pro Bono Work: Some startups or NGOs may need financial analysis support, providing opportunities to build your portfolio.

- Financial Databases: Familiarity with platforms such as Bloomberg Terminal, Thomson Reuters Eikon, Capital IQ, FactSet, and Morningstar helps access real-time data and analytics.

- Statistical and Programming Tools: Knowledge of Python, R, SQL, and SAS is increasingly demanded, especially for handling large data sets and automating tasks.

- Visualization Tools: Tools like Tableau, Power BI, or Qlik Sense help create compelling charts and dashboards for effective communication.

- Accounting Software: Understanding ERP systems like SAP or Oracle Financials can be useful when working closely with company data.

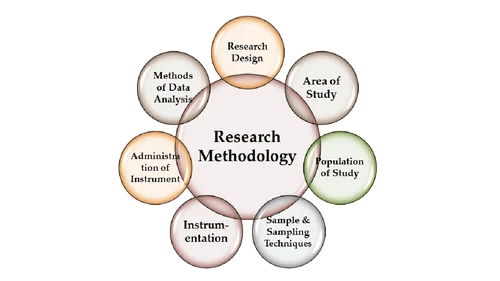

- Quantitative Research: Involves numerical data analysis using statistical methods, regression analysis, and modeling to forecast company performance or market trends.

- Fundamental Analysis: Focuses on analyzing a company’s financial statements, business model, management quality, and market position to estimate intrinsic value.

- Technical Analysis: Examines historical price and volume data to predict future price movements based on chart patterns and indicators.

- Macro and Microeconomic Analysis: Analyzing economic indicators, policy changes, and sector-specific dynamics to assess their impact on companies and markets.

- Risk Analysis: Identifying and quantifying potential risks, including market risk, credit risk, and operational risk.

- Financial Models: Include Excel models with valuation scenarios.

- Data Visualizations: Create dashboards and charts explaining market trends.

- Project Summaries: Highlight key findings and insights from internships or personal projects.

- Publications: Blogs, articles, or contributions to financial platforms.

- Certifications and Courses: Showcase completed relevant programs. A digital portfolio website or LinkedIn profile can help you reach potential employers.

- Join Professional Organizations: Such as CFA Institute, local finance clubs, or online forums.

- Attend Industry Conferences: Gain insights and meet experts.

- LinkedIn Networking: Connect with industry professionals and recruiters.

- Informational Interviews: Seek advice and mentorship.

- Internships and Entry-Level Jobs: Use these as learning and networking opportunities.

- Artificial Intelligence and Machine Learning: Automating research, improving forecasts, and processing alternative data.

- Big Data Analytics: Using vast unstructured data from social media, satellite imagery, etc.

- Sustainable Investing: ESG (Environmental, Social, and Governance) factors gaining importance.v

- egulatory Changes: Compliance and transparency requirements evolving globally.

- Remote and Hybrid Work Models: Changing how analysts collaborate and share research.

- Cryptocurrency and Blockchain: Emerging asset classes and market analysis techniques.

- Equity Research Analyst: Focused on stock market and company analysis.

- Credit Analyst: Analyzes bonds and debt instruments.

- Quantitative Analyst: Uses mathematical models for risk and pricing.

- Economic Research Analyst: Studies macroeconomic factors.

- Portfolio Manager: Oversees investment portfolios using research insights.

- Financial Advisor or Consultant: Provides personalized investment advice.

- Risk Manager: Identifies and mitigates financial risks.

- Data Scientist: Applies analytics to broader financial data challenges.

- Investment Banks

- Asset Management Firms

- Hedge Funds and Private Equity

- Credit Rating Agencies

- Financial Advisory Firms

- Government Agencies and Think Tanks

- Consulting Firms

Research Analysts help investors understand the risks and opportunities associated with various investment options, facilitating better portfolio management and strategic planning.

Educational Requirements

A strong educational background is essential to becoming a Research Analyst. Most professionals in this field hold at least a bachelor’s degree in relevant disciplines such as:

Many employers prefer candidates with a master’s degree or higher, such as an MBA with a finance specialization or a Master’s in Financial Economics, especially for advanced roles.

Why these fields?They provide a solid foundation in financial principles, Equity Research Analyst quantitative methods, and economic theory, which are critical for analyzing companies and markets effectively. Additional helpful academic topics include:

Key Skills Needed

Successful Research Analysts possess a blend of technical and soft skills:

Excited to Obtaining Your web developer Certificate? View The web developer course Offered By ACTE Right Now!

Certifications (CFA, NISM, etc.)

Certifications can significantly enhance a Research Analyst’s credibility and job prospects. Some of the most respected certifications include:

Other Relevant Certifications

Interested in Pursuing web developer certification Program? Enroll For Web developer course Today!

Gaining Experience

Experience is invaluable for aspiring Research Analysts. Here’s how to start building yours:

Learning Financial Tools

Research Analysts rely on specialized tools to perform their duties efficiently: Microsoft Excel:A fundamental tool for data analysis and financial modeling. Proficiency in advanced functions, pivot tables, and VBA macros is essential.

Research Methodologies

Sound research requires a systematic approach:

Building a Portfolio

A professional portfolio demonstrates your abilities and differentiates you:

Research Reports: Publish sample equity research or market analysis reports.Networking and Internships

Building a strong professional network is vital:

Networking helps you learn about job openings and trends, and mentors can provide career guidance.

Industry Trends

Keeping abreast of trends is essential to stay relevant:

Adaptability to these trends can open new research areas and job roles.

Research Analyst Career Path and Roles

Research Analyst Career Path can advance in various directions:

Many analysts transition into leadership roles, fund management, or entrepreneurial ventures.

Growth and Opportunities

The demand for Research Analysts is strong in:

With experience and certifications, analysts can command lucrative salaries, bonuses, and international career opportunities. Continuous learning and adapting to new analytical techniques ensure long-term success.

Conclusion

Research Analyst Career Path is intellectually stimulating, challenging, and rewarding. It requires a robust educational foundation, a diverse skill set, relevant certifications, Equity Research Analyst and practical experience. The role sits at the intersection of finance, economics, and technology, offering numerous opportunities to grow and specialize. By continuously honing your skills, building a strong network, Learning Financial Tools and staying updated on industry trends, you can build a successful and fulfilling career contributing to the financial markets and business decision-making.