- Concept of Wealth Maximization

- Objectives vs Profit Maximization

- Role in Financial Planning

- Shareholder Value Creation

- Methods to Maximize Wealth

- Time Value of Money

- Risk and Return Trade-off

- Capital Structure Decisions

- Investment Decisions

- Dividend Decisions

- Limitations Of Wealth Maximization

- Conclusion

Concept of Wealth Maximization

Wealth maximization in financial management , also known as value maximization or shareholder wealth maximization, is a financial management goal that aims to increase the overall value of a firm for its shareholders. It is the primary objective of financial decision-making, wherein wealth maximization in financial management works to enhance the market value of the firm’s equity, often measured by the share price. The key factor in wealth maximization is ensuring long-term sustainable growth and creating value for shareholders. Unlike profit maximization, which focuses only on short-term earnings, wealth maximization considers both time and risk, providing a more comprehensive approach. This concept is based on the principle that decisions made by a company should ultimately aim to increase the present value of future cash flows, adjusted for risk. The wealth maximization in financial management approach is more in line with modern financial theory, as it accounts for the time value of money and the associated risks.

Objectives vs Profit Maximization

The concept of profit maximization has been a traditional goal for businesses. However, the shift toward wealth maximization represents a more strategic approach that recognizes the limitations of focusing solely on profits. Here’s a comparison of the two concepts:

Profit Maximization:

- Focuses on achieving the highest level of profit in the short term.

- It does not consider the timing of cash flows, risks, or the long-term implications of decisions.

- The goal is to maximize earnings in the immediate period without much regard for shareholder value or market conditions.

- A long-term goal that considers the time value of money and risk.

- Emphasizes the creation of value for shareholders, measured by the market price of the firm’s stock.

- Takes into account the impact of business decisions on the firm’s future cash flows and their risk-adjusted present value.

Wealth Maximization:

In essence, profit maximization is a narrower and often shortsighted goal, whereas wealth maximization provides a broader and more sustainable approach for growth and shareholder value creation.

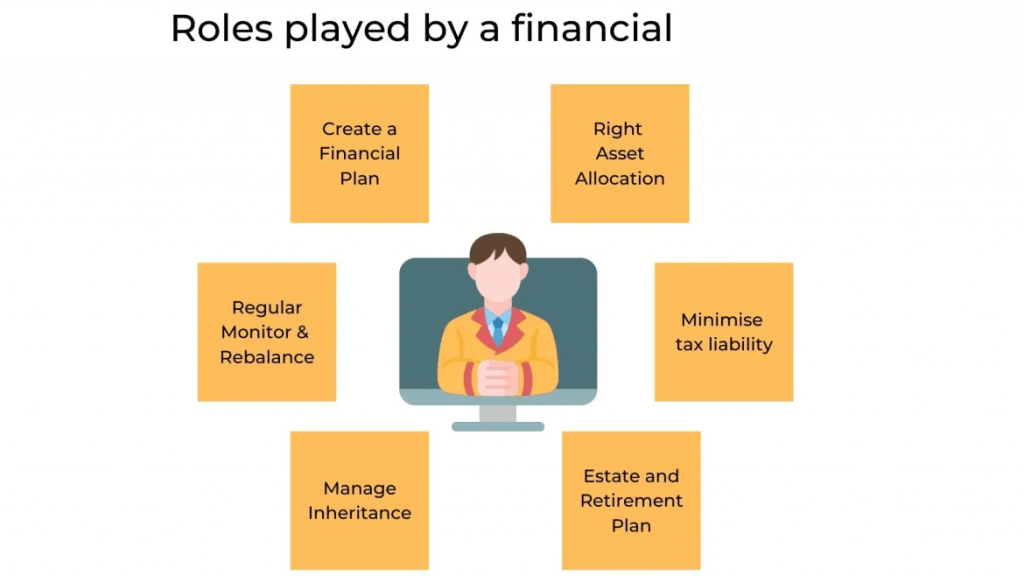

Role in Financial Planning

Wealth maximization plays a crucial role in financial planning. Financial planning involves making strategic decisions regarding investment, financing, and dividend policies to optimize the overall value of the firm. Wealth maximization ensures that the company’s resources are allocated effectively, and financial decisions are made with the objective of increasing shareholder wealth in the long run.

- Investment Decisions: Wealth maximization guides the allocation of funds into projects that generate the highest return relative to their risk, ultimately maximizing the firm’s market value.

- Financing Decisions: It helps determine the optimal capital structure (the mix of debt and equity financing) that minimizes cost and maximizes value.

- Dividend Decisions: Wealth maximization also influences dividend policies, ensuring that dividend payouts strike a balance between providing returns to shareholders and reinvesting in the firm for future growth.

Wealth maximization is integrated into the financial planning process, helping ensure that the firm’s overall strategy aligns with long-term growth objectives and market value enhancement.

Shareholder Value Creation

Shareholder value creation shows how well a company can boost the value of its shares over time. It is key to maximizing wealth. When management makes smart choices that lead to ongoing profits and a rise in market value, it ultimately benefits shareholders. There are several important ways to create shareholder value. First, effective capital allocation ensures that resources go to investment opportunities that are both profitable and aligned with the company’s long-term goals. Additionally, improving processes and managing costs can significantly boost profits by making operations more efficient. Constantly developing new products or entering new markets is another vital factor. This approach allows businesses to drive future growth and gain an edge over competitors. Furthermore, a strong risk management system protects against uncertainties and ensures steady returns. By focusing on these strategies, companies can enhance their overall performance, offer long-term gains for shareholders, and steadily increase the value of the company’s equity.

Methods to Maximize Wealth

Several methods can be employed to maximize wealth, and the most effective strategy depends on the specific circumstances of the firm. Some of the key methods include

- Capital Budgeting Decisions: Choosing investment projects that generate returns higher than the cost of capital (net present value or NPV method). These projects should ideally create more wealth than they cost to implement.

- Dividend Policy Decisions: Determining an optimal dividend payout ratio that balances returning profits to shareholders with reinvestment into high-growth opportunities.

- Capital Structure Optimization: Finding the right mix of debt and equity financing that minimizes the cost of capital while managing risk effectively.

- Risk Management: Implementing strategies to minimize the risks faced by the firm, such as diversification, hedging, or insurance, to ensure a stable flow of returns.

By employing these methods, firms can increase shareholder wealth by ensuring that every financial decision contributes to the overall value of the company.

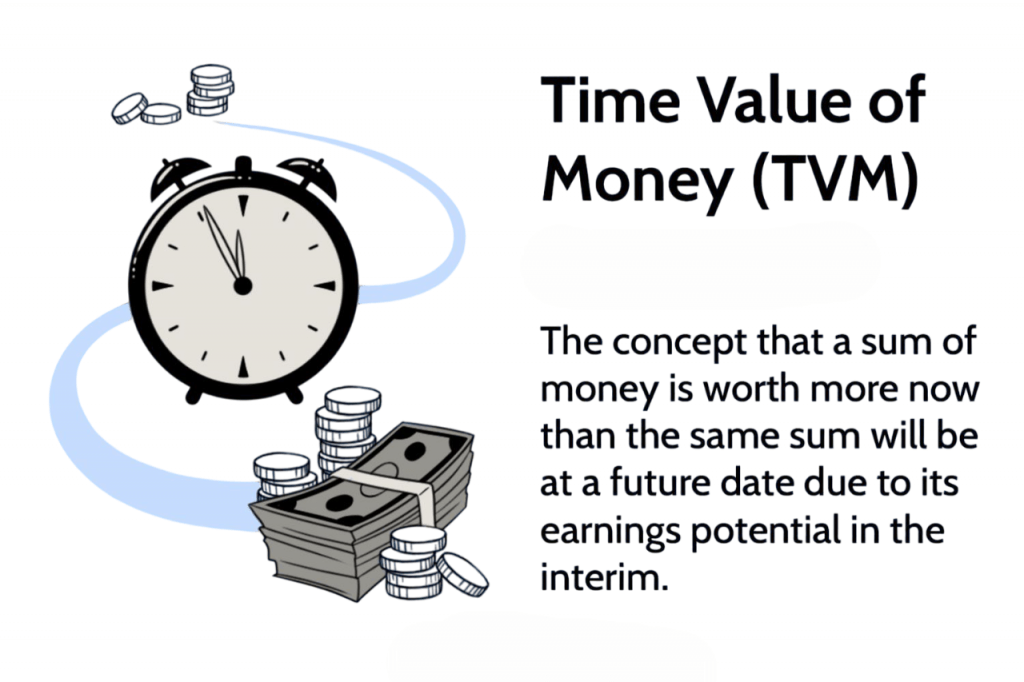

Time Value of Money

The main idea of finance, the time value of money (TVM), highlights that a dollar today is worth more than the same dollar in the future. This concept is key to building wealth. It allows companies to determine the current value of future cash flows, which is vital for making wise investment choices. The Discounted Cash Flow (DCF) method adjusts future income for the time value of money, helping businesses evaluate the real worth of a project or investment. Another important tool is Net Present Value (NPV), which involves discounting future cash flows to their current value. Generally, projects with a positive NPV are seen as good investments because they contribute to a company’s wealth.

The Internal Rate of Return (IRR) shows the discount rate at which a project’s NPV is zero. It helps compare the profitability of different investment options, allowing companies to focus on projects with higher returns. By using the time value of money, businesses can make smarter and more informed decisions about capital allocation, ensuring resources are invested in ways that provide the best long-term return.

Risk and Return Trade-off

The risk and return trade-off is a fundamental concept in finance, which asserts that the potential return on an investment increases with an increase in its associated risk. In the context of wealth maximization, companies must carefully balance risk and return to maximize shareholder wealth.

Risk Considerations:

- Business Risk: Risk arising from the nature of the firm’s operations or industry, such as market demand fluctuations, competition, or regulatory changes.

- Financial Risk: Risk related to the firm’s financing decisions, such as the use of debt, which can increase the likelihood of default if not managed properly.

To maximize wealth, companies must evaluate investment opportunities with a high risk-return profile while managing the downside risk to protect shareholder value.

Capital Structure Decisions

Capital structure decisions involve determining the optimal mix of debt and equity financing for a company. The right capital structure minimizes the overall cost of capital and maximizes shareholder wealth by balancing the advantages of debt (tax benefits and financial leverage) with the risks associated with high debt levels (increased financial risk).

Capital Structure Considerations for Wealth Maximization:

- Debt vs. Equity: Companies with too much debt may risk default, while those with too little may miss out on growth opportunities. Striking the right balance is crucial.

- Cost of Capital: Lowering the weighted average cost of capital (WACC) increases the firm’s value, which can be achieved by optimizing the capital structure.

- Financial Flexibility: Having access to capital when needed, without over-leveraging, allows firms to seize investment opportunities while maintaining stability.

Investment Decisions

Investment decisions are vital for maximizing wealth since they determine how a company allocates its capital among projects and assets. Making smart investment choices, which offer a good return when weighed against the risks, helps boost shareholder value and increase the company’s long-term worth. Several key factors impact these decisions. The first is risk-return analysis, where investors evaluate whether the expected returns justify the risk involved. To make smart choices, it is important to find a careful balance between risk and anticipated rewards. Second, estimating cash flow is crucial. This helps investors figure out the true profit potential of an investment by accurately predicting future cash flows. Even the best opportunities can carry hidden risks without reliable forecasts. Lastly, market factors like interest rates, inflation, and competition also influence investment decisions. These external factors significantly affect the feasibility of projects and the cost of capital, making them important parts of the assessment process.

Dividend Decisions

Dividend decisions involve determining the portion of profits to be paid to shareholders as dividends and the portion to be retained in the company for reinvestment. The goal is to strike a balance between satisfying shareholder expectations for immediate returns and reinvesting in the business for future growth.

Dividend Policy and Wealth Maximization: A company’s financial plan and long-term value creation depend heavily on its dividend policy. The retention ratio measures how much profit a company keeps instead of paying out as dividends. This ratio is crucial because retaining profits allows a company to fund future projects internally. By doing this, the company reduces its reliance on external funding and helps develop sustainable wealth over time. In contrast, the dividend payout ratio indicates the percentage of earnings distributed as dividends. This ratio can affect shareholder satisfaction in the short term. While a higher payout ratio might attract investors looking for quick returns, it also reduces the funds available for reinvestment. This could limit the company’s future growth potential. Finally, dividend stability is an important factor to consider. Companies that consistently pay dividends send a message of financial strength and stability to shareholders. This reliability can increase investor confidence and positively affect share prices, thereby enhancing the company’s overall market value.

Limitations of Wealth Maximization

While wealth maximization is a valuable goal, it does have limitations:

- Market Fluctuations: Shareholder value can be influenced by factors beyond the company’s control, such as market volatility or economic downturns.

- Short-Term Pressure: In some cases, there may be a focus on short-term stock prices rather than long-term wealth maximization, leading to decisions that do not align with sustainable growth.

- Agency Issues: Conflicts of interest between shareholders and management may hinder the proper alignment of goals, as management may prioritize personal interests over shareholder value.

Conclusion

Wealth maximization in financial management is a comprehensive and long-term approach to financial management. Unlike profit maximization, it considers the time value of money, risk, and shareholder value creation, offering a more balanced and sustainable way to ensure a firm’s growth and profitability. By focusing on capital allocation, investment decisions, risk management, and shareholder value, companies can effectively maximize wealth, benefiting shareholders and ensuring long-term success. While there are limitations, such as market volatility and short-term pressures, wealth maximization remains the guiding principle for financial planning and decision-making in the modern business world.