- What is the Cost of Capital?

- Importance in best Financial Decisions-Making

- Types of Capital (Debt, Equity, Preferred)

- Cost of Debt

- Cost of Equity

- Weighted Average Cost of Capital WACC formula

- Marginal Cost of Capital

- Factors Affecting Cost of Capital

- Estimating Capital Structure

- Practical Applications

- Limitations

- Conclusion

What is the Cost of Capital?

The concept of the cost of capital in Financial Management plays a pivotal role in financial decision-making, serving as the benchmark for evaluating investment opportunities, financing options, and corporate financial strategies. The cost of capital is essentially the rate of return a company needs to achieve in order to meet the expectations of its investors and stakeholders. It represents the cost of securing funds through various sources, which include debt, equity, and preferred equity, to finance operations and expansion. Understanding the cost of capital is essential for companies to make informed decisions regarding their capital structure, investment choices, and funding options. By determining the cost of capital, a firm can Weighted Average Cost of Capital its financing options and decide which mix of debt and equity would be the most effective in achieving its financial objectives. This detailed exploration will dive deeper into the components and importance of cost of capital, including its estimation and its practical applications.

Importance in best Financial Decisions-Making

Cost of capital is crucial in best financial decisions-making because it serves as the hurdle rate that projects or investments must exceed to be considered profitable. Companies make decisions on how to allocate capital, choose between various financing options, and assess potential projects or investments based on whether the expected returns are greater than the cost of raising the funds for those investments. The cost of capital also helps in determining the optimal capital structure. A company needs to balance between debt and equity financing to minimize the overall cost of capital while ensuring financial flexibility. This balance can affect the company’s profitability, risk, and ability to invest in growth opportunities. Moreover, What is the cost of capital? is instrumental in valuation processes. When valuing a company or investment, the cost of capital is used to discount future cash flows, which helps in determining the present value. A company with a lower cost of capital is generally considered more efficient in generating returns for its investors, thus potentially increasing its market value.

Types of Capital (Debt, Equity, Preferred)

Capital for financing business operations and investments generally comes in three primary forms: debt, equity, and preferred equity. Each of these sources of capital carries its own cost and characteristics.

- Debt Capital: Debt is borrowed money that must be repaid with interest over time. It can come in the form of loans, bonds, or other financial instruments. The cost of debt is the interest rate the company pays on its borrowings. It is often considered the least expensive form of capital because interest payments on debt are tax-deductible, reducing the effective cost.

- Equity Capital: Equity is raised through the sale of shares to investors, either through public offerings or private placements. Equity capital does not require repayment, but shareholders expect returns in the form of dividends and capital gains. The cost of equity is the return required by equity investors based on the risks they take in investing in the company. This is generally higher than the cost of debt because equity investors assume more risk.

- Preferred Equity: Preferred equity is a hybrid form of financing that has characteristics of both debt and equity. Preferred shareholders receive fixed dividends, similar to debt payments, but they are paid after debt holders and before common equity holders. The cost of preferred equity lies between the cost of debt and the cost of equity, as it carries more risk than debt but less than common equity.

Cost of Debt

The cost of debt refers to the effective rate a company pays on its borrowed funds. It can be computed as the interest rate on debt adjusted for tax benefits since interest payments are deductible for tax purposes. The formula to calculate the after-tax cost of debt is: Cost of Debt=Interest Rate×(1−Tax Rate)\text{Cost of Debt} = \text{Interest Rate} \times (1 – \text{Tax Rate})

For example, if a company borrows funds at an interest rate of 6% and is in a 30% tax bracket, the after-tax cost of debt would be: Cost of Debt=6%×(1−0.30) =4.2%\text{Cost of Debt} = 6\% \times (1 – 0.30) = 4.2\%

This means the company is effectively paying 4.2% for its debt after considering the tax deductibility of interest. The cost of debt is generally lower than the cost of equity because debt holders are prioritized in case of liquidation, and interest payments are predictable, which lowers the overall risk. However, too much debt can increase the risk of financial distress, leading to higher borrowing costs over time.

Cost of Equity

The cost of equity is the return required by equity investors for holding a company’s stock. Unlike debt, the cost of equity does not have a fixed rate. It is generally higher because equity holders bear the risk of the company’s performance, including potential losses. There are different ways to calculate the cost of equity, but one of the most widely used methods is the Capital Asset Pricing Model (CAPM).

The CAPM formula is: Cost of Equity=Risk-Free Rate+β×(Market Return−Risk-Free Rate)\text{Cost of Equity} = \text{Risk-Free Rate} + \beta \times (\text{Market Return} – \text{Risk-Free Rate})- Risk-Free Rate: The return on a risk-free asset, typically government bonds.

- Beta: A measure of the stock’s volatility compared to the overall market.

- Market Return: The expected return of the overall market.

For instance, if the risk-free rate is 3%, the expected market return is 8%, and the company’s beta is 1.2, the cost of equity would be:

Cost of Equity=3%+1.2×(8%−3%) =3%+1.2×5%=9%\text{Cost of Equity} = 3\% + 1.2 \times (8\% – 3\%) = 3\% + 1.2 \times 5\% = 9\%Thus, the cost of equity for the company is 9%, meaning the company needs to provide an annual return of at least 9% to meet investor expectations.

Weighted Average Cost of Capital WACC Formula

The Weighted Average Cost of Capital WACC formula is a key financial metric used to measure the overall cost of a company’s capital, weighted by the proportion of debt, equity, and preferred equity in its capital structure.Weighted Average Cost of Capital WACC formula reflects the cost a company must pay to finance its operations through various sources of capital. The formula for WACC is: WACC=(EV×Cost of Equity)+(DV×Cost of Debt×(1−Tax Rate))\text{WACC} = \left( \frac{E}{V} \times \text{Cost of Equity} \right) + \left( \frac{D}{V} \times \text{Cost of Debt} \times (1 – \text{Tax Rate}) \right)

- E is the market value of equity.

- D is the market value of debt.

- V is the total market value of the company’s financing (E + D).

- Cost of Equity is the cost of equity capital.

- Cost of Debt is the cost of debt capital.

- Tax Rate is the corporate tax rate.

Thus, the company’s WACC is 7.17%, meaning that the company must generate a return of at least 7.17% on its investments to meet its capital costs.

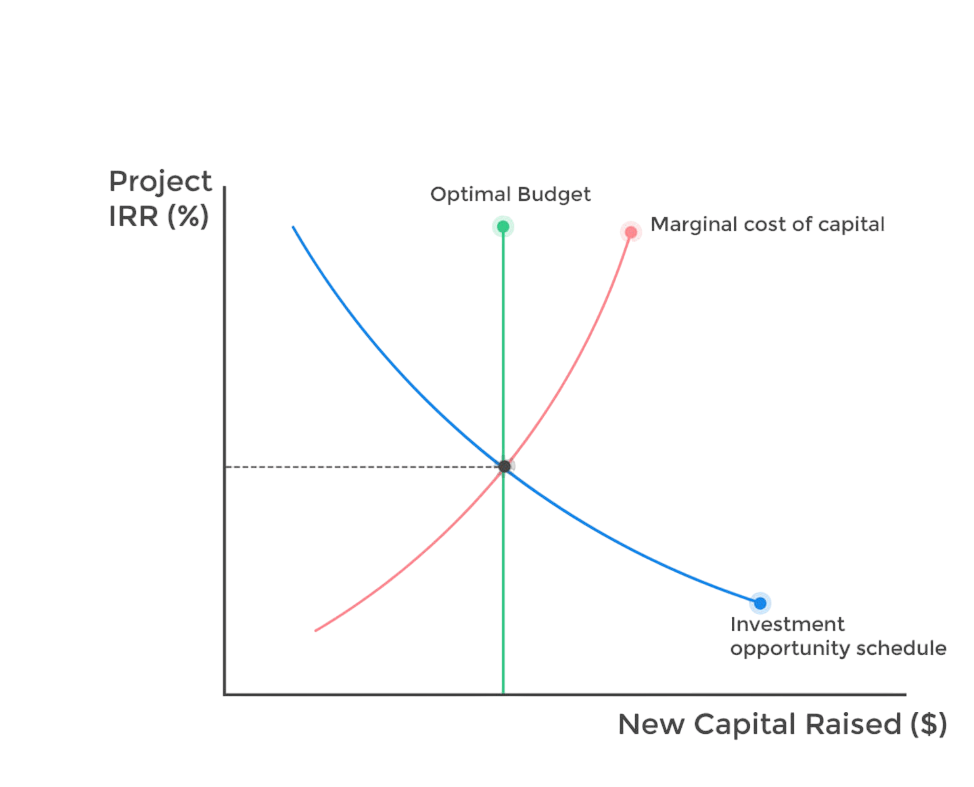

Marginal Cost of Capital

The marginal cost of capital refers to the cost of obtaining additional capital for financing new investments. It is important for firms to evaluate the marginal cost of capital when considering whether to pursue new projects or investments. Typically, the marginal cost of capital increases as a company takes on more debt or equity due to the risks associated with higher levels of financing. For instance, if a company is already highly leveraged, the cost of debt may rise as lenders perceive more risk. Similarly, issuing more equity can lead to higher costs due to dilution of existing shareholders’ stakes. Therefore, assessing the marginal cost of capital is essential in determining the optimal amount of new capital to raise.

Factors Affecting Cost of Capital

Several factors influence the cost of capital, including:

- Market Conditions: Economic conditions, interest rates, and market volatility can all impact the cost of debt and equity.

- Risk Profile: Companies with higher levels of business risk or financial risk will have a higher cost of capital.

- Capital Structure: The mix of debt and equity financing affects the WACC, with higher levels of debt typically reducing the cost of capital.

- Company Performance: A company’s financial health, profitability, and growth prospects influence investor expectations and, subsequently, the cost of equity

Estimating Capital Structure

A company’s capital structure is the combination of debt, equity, and preferred stock it uses to finance its operations. Estimating the capital structure involves determining the optimal mix of these financing sources that minimize the cost of capital while maintaining financial flexibility. Key considerations include:

- Debt-to-Equity Ratio: This ratio helps determine the proportion of debt and equity in the capital structure. A higher debt ratio generally lowers the cost of capital, but it also increases financial risk.

- Risk Tolerance: Companies with lower risk tolerance may prefer equity financing, while those willing to take on more risk may opt for debt financing.

- Industry Standards: Companies in different industries have different norms for capital structure, influenced by factors like market stability and the capital intensity of the industry.

Practical Applications

Cost of capital is applied in various areas of corporate finance, including: Capital Budgeting: Cost of capital is used as a discount rate for evaluating investment projects, ensuring that the expected returns exceed the cost of financing.

- Valuation: Cost of capital is used to discount future cash flows when determining the value of a company or project.

- Optimal Capital Structure: Firms use the cost of capital to determine the best mix of debt and equity financing to minimize their overall cost of capital.

- Estimation Challenges: Accurately estimating the cost of capital can be difficult, especially when dealing with volatile market conditions or complex financial instruments.

- Assumptions: The calculations often rely on assumptions, such as constant risk-free rates and market returns, which may not hold true in dynamic markets.

- Risk Sensitivity: The cost of capital can vary significantly depending on the company’s perceived risk, which may be subjective and difficult to measure accurately.

Limitations

While the cost of capital in financial Management is a useful tool in financial decision-making, it has its limitations:

Conclusion

In conclusion, What is the cost of capital? In Financial Management is a fundamental concept in corporate finance, providing companies with the necessary tools to make informed decisions regarding investments, capital structure, and financing. By understanding the components of the cost of Types of Capital —debt, equity, and preferred equity—companies can evaluate their financing options and strive to minimize their overall cost of capital. Through careful estimation and strategic decision-making, firms can enhance shareholder value, achieve growth, and maintain financial stability. However, it is important to recognize the limitations and challenges associated with calculating the cost of capital, particularly in a rapidly changing financial environment.