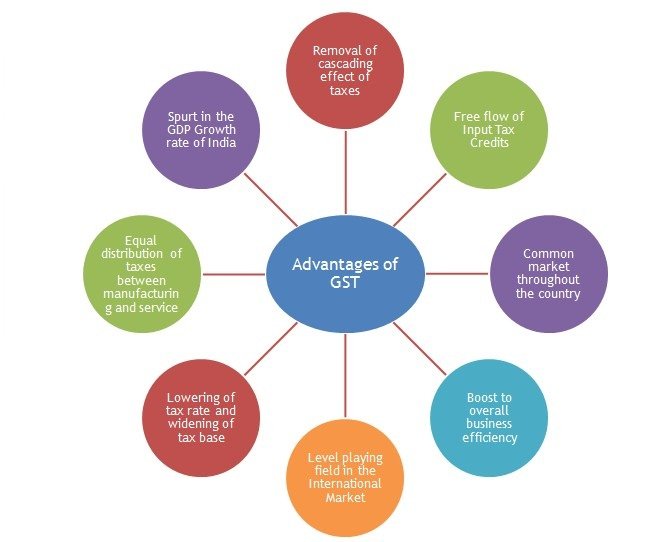

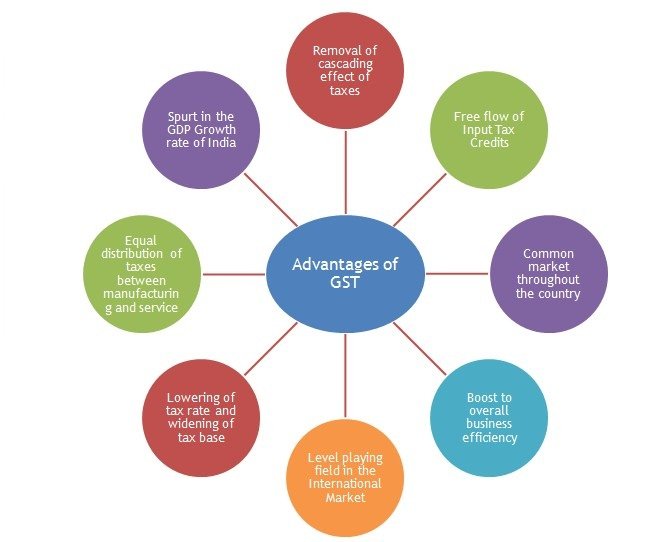

With GST, it is anticipated that the tax base will be comprehensive, as virtually all goods and services will be taxable, with minimum exemptions. It will impact the tax structure, tax incidence, tax computation, tax payment, compliance, credit utilization and reporting, leading to a complete overhaul of the current indirect tax system.

GST will have a far-reaching impact on almost all the aspects of the business operations in the country, for instance, pricing of products and services, supply chain optimization, IT, accounting, and tax compliance systems.Start Learning with us ACTE GST Classroom and Online Training Course.

Yes,there is a huge benefit of the GST Certification Course in India. Of course, there is a value of this. In fact, I would say, opting GST certification course is a golden opportunity to get hired immediately with high salary, career growth, and promotion to the senior position.

- The execution of GST has created various job opportunities as now businesses need an expert professional to help them in GST management, upgradation, and reconciliation.

- Over 1 lakh job opportunities are expected which includes specialization in taxation, accounting, and data analysis.

- For aspiring accountants, adding of GST certification course in your CV will act as a turning point.

- GST opens job opportunities for finance and commerce graduates – The Hindu Business Line

- Job market seeks over 100,000 employment opportunities. The job market is looking forward to a big boost from the new GST regime and expects over one lakh immediate new employment opportunities, including in specialized areas like taxation, accounting, and data analysis. – Business Standard

- Consultancy firm Ernst & Young India. In its Indirect Tax practice, the firm has seen over 60 percent increase in hiring.

YES,GST certification courses can be taken by the person who has completed his/her graduation, CAs, corporate secretaries, financial and taxation professionals, and those people who want career opportunities in these areas. It also increases job opportunities, salaries, and develops skills.It helps in increasing the salary of a person from 15% to 25% on an average.This increases the number of job opportunities available to individuals.This enables individuals to start their own consultancy.It helps in developing the skills of various taxation, finance, and accounting professionals.

We are happy and proud to say that we have strong relationship with over 700+ small, mid-sized and MNCs. Many of these companies have openings for GST .Moreover, we have a very active placement cell that provides 100% placement assistance to our students. The cell also contributes by training students in mock interviews and discussions even after the course completion.

- Clear understanding of GST concepts

- Understanding of Invoicing and Input Credit Mechanism

- Tax Rate structure and Refund of Tax

- Transition to GST and Input Service Distributor (ISD)

- Knowledge of GSTN and GSP

- Understand the role of Tax Return Preparer

- Prepare Returns and Payment of Tax

- E-Commerce and Compliance Rating

There are no mandatory pre-requisites for taking this training.

YES,It doesn't require prior programming experience.

Our courseware is designed to give a hands-on approach to the students in GST . The course is made up of theoretical classes that teach the basics of each module followed by high-intensity practical sessions reflecting the current challenges and needs of the industry that will demand the student's time and commitment.

Yes,The aim of the course is to help businessmen, accountants, Chartered Accountants (CAs) Certified Management Accountants (CMAs), Company Secretaries (CSs), and other professionals to enhance their knowledge regarding the Goods and Services Tax by offering specialised, updated knowledge systematically, improving their problem-solving and analytical skills to enhance decision making, and imparting skills and knowledge required for self-employment and employment in the industry.

GST is a vital area of many IT job roles and gaining the applicable expertise and passing GST exams in this area will greatly enhance your employability.

Its better to select ACTE which comprises these below factors.

- Appropriate training with well Equipped facilities.

- Technical GST certifications

- Complete knowledge in the GST

- Technical theory

- Mock Interviews

GST Development is undoubtedly a promising career option. The field has the potential for continued growth in the years to come. GST Developer is just not an in-demand role across multiple organizations, it’s also a well-paid role. For those who are looking for a competitive, as well as a lucrative job, GST Development is a smart and ideal career choice.

Here are a few reasons for you to pursue a career in GST :

- Hands-on engagement with the best-Engineering platform in human history.

- A sense of mission and higher purpose

- The emergence of agile Analyst(GST )

- Enterprise applications are multiplatform/specialization in taxation, accounting, and data analysis.

- community support and training.

- Build a lucrative career.

How Goods and Services Tax course will boost your career

If you are thinking about the job opportunities for GST trained people, you need to know all of this. The implementation of GST has increased the jobs in the automobiles, logistics, e-commerce and cement industries. E-commerce and logistics have created tremendous employment due to more demand. According to a survey done by various staffing firms, because of implementation of GST, high growth in the job market expected and the single-tax system have played an important role.

Study shows that there will be 11-18 percent of additional jobs per year in the above-mentioned sectors due to implementation of GST and companies appointed accountants and tax consultants for a better approach towards the GST. However, GST has been considered necessary to the corporate professionals and also in demand around one lakh tax consultants. There are other various sectors like e-commerce, retailing, manufacturing, services, logistics, supply chain, banking and financial sectors resulted a high rise in the job opportunities in the future also.

Also, IT companies are producing GST software as the IT sector is playing a significant role in expanding the GST around the nation. GST supposed to help to increase new job opportunities as India has the largest population and due to that the biggest problem arises is the unemployment of the educated and skilled persons. After application of GST, the business process became easier and the expansion of business is possible. GST has increased the new business plans and motivated the new businessmen to make new start-ups and therefore, the jobs and self-employment have increased in India.

The multinational companies’ tie-up their business without any difficulties as GST attracts multinational companies to help in increasing employment opportunities. All businesses, no matter about of size, adapted to the new tax system and went digital. This has resulted in demand for specialised fields like taxation, accounting, and data analysis. Corporates have already set up special GST cells internally to deal with the new tax system. There has been a high demand in jobs post GST especially for such professionals across industries from junior to senior level.

Who is the GST Certification Course for?

The GST Certification Course can be attended by the following entities:

- Graduates of arts or commerce or engineering, Chartered accountants, Certified Management Accountants, Company Secretaries, and law aspirants.

- Professionals moving from the finance domain to taxation.

- Individuals who want career opportunities in taxation.

- Finance professionals who wish to meet their own professional requirements in taxation.

EASY COMPLIANCE

A robust and comprehensive IT system would be the foundation of the GST regime in India. Therefore, all tax payer services such as registrations, returns, payments, etc. would be available to the taxpayers online, which would make compliance easy and transparent.

UNIFORMITY OF TAX RATES AND STRUCTURES

GST will ensure that indirect tax rates and structures are common across the country, thereby increasing certainty and ease of doing business.

REMOVAL OF CASCADING

A system of seamless tax-credits throughout the value-chain, and across boundaries of States, would ensure that there is minimal cascading of taxes. This would reduce hidden costs of doing business

IMPROVED COMPETITIVENESS

Reduction in transaction costs of doing business would eventually lead to an improved competitiveness for the trade and industry.

Benefits of GST Practitioner Course

- It helps in raising an individual’s salary by 15% to 25% on average.

- It increases the number of job opportunities available to individuals.

- It enables individuals to start their own consultancy.

- It helps develop skills of different taxation, finance, and accounting professionals.

- It offers a classroom-environment for better learning along with structured course content.