ACTE’s GST training is a comprehensive guide to the Goods and Service Tax regulations. It give you the updated law with real class experience.

GST aims to replace all indirect levied on goods and services by the Indian Central and State governments. GST would subsume with a single comprehensive tax, bringing it all under a single umbrella, eliminating the cascading effect of taxes on the production and distribution prices of goods and services.Start Learning with us ACTE GST Classroom and Online Training Course.

Yes,there is a huge benefit of the GST Certification Course in India. Of course, there is a value of this. In fact, I would say, opting GST certification course is a golden opportunity to get hired immediately with high salary, career growth, and promotion to the senior position.

- The execution of GST has created various job opportunities as now businesses need an expert professional to help them in GST management, upgradation, and reconciliation.

- Over 1 lakh job opportunities are expected which includes specialization in taxation, accounting, and data analysis.

- For aspiring accountants, adding of GST certification course in your CV will act as a turning point.

- GST opens job opportunities for finance and commerce graduates – The Hindu Business Line

- Job market seeks over 100,000 employment opportunities. The job market is looking forward to a big boost from the new GST regime and expects over one lakh immediate new employment opportunities, including in specialized areas like taxation, accounting, and data analysis. – Business Standard

- Consultancy firm Ernst & Young India. In its Indirect Tax practice, the firm has seen over 60 percent increase in hiring.

YES,GST certification courses can be taken by the person who has completed his/her graduation, CAs, corporate secretaries, financial and taxation professionals, and those people who want career opportunities in these areas. It also increases job opportunities, salaries, and develops skills.It helps in increasing the salary of a person from 15% to 25% on an average.This increases the number of job opportunities available to individuals.This enables individuals to start their own consultancy.It helps in developing the skills of various taxation, finance, and accounting professionals.

We are happy and proud to say that we have strong relationship with over 700+ small, mid-sized and MNCs. Many of these companies have openings for GST .Moreover, we have a very active placement cell that provides 100% placement assistance to our students. The cell also contributes by training students in mock interviews and discussions even after the course completion.

- Clear understanding of GST concepts

- Understanding of Invoicing and Input Credit Mechanism

- Tax Rate structure and Refund of Tax

- Transition to GST and Input Service Distributor (ISD)

- Knowledge of GSTN and GSP

- Understand the role of Tax Return Preparer

- Prepare Returns and Payment of Tax

- E-Commerce and Compliance Rating

There are no mandatory pre-requisites for taking this training.

YES,It doesn't require prior programming experience.

Our courseware is designed to give a hands-on approach to the students in GST . The course is made up of theoretical classes that teach the basics of each module followed by high-intensity practical sessions reflecting the current challenges and needs of the industry that will demand the student's time and commitment.

Yes,The aim of the course is to help businessmen, accountants, Chartered Accountants (CAs) Certified Management Accountants (CMAs), Company Secretaries (CSs), and other professionals to enhance their knowledge regarding the Goods and Services Tax by offering specialised, updated knowledge systematically, improving their problem-solving and analytical skills to enhance decision making, and imparting skills and knowledge required for self-employment and employment in the industry.

GST is a vital area of many IT job roles and gaining the applicable expertise and passing GST exams in this area will greatly enhance your employability.

Its better to select ACTE which comprises these below factors.

- Appropriate training with well Equipped facilities.

- Technical GST certifications

- Complete knowledge in the GST

- Technical theory

- Mock Interviews

GST Development is undoubtedly a promising career option. The field has the potential for continued growth in the years to come. GST Developer is just not an in-demand role across multiple organizations, it’s also a well-paid role. For those who are looking for a competitive, as well as a lucrative job, GST Development is a smart and ideal career choice.

Here are a few reasons for you to pursue a career in GST :

- Hands-on engagement with the best-Engineering platform in human history.

- A sense of mission and higher purpose

- The emergence of agile Analyst(GST )

- Enterprise applications are multiplatform/specialization in taxation, accounting, and data analysis.

- community support and training.

- Build a lucrative career.

Scope and Trends in GST

Gain to manufacturers and exporters. The subsuming of major Central and State taxes in GST, complete and comprehensive set-off of input goods and services and phasing out of Central Sales Tax (CST) would reduce the cost of locally manufactured goods and services.

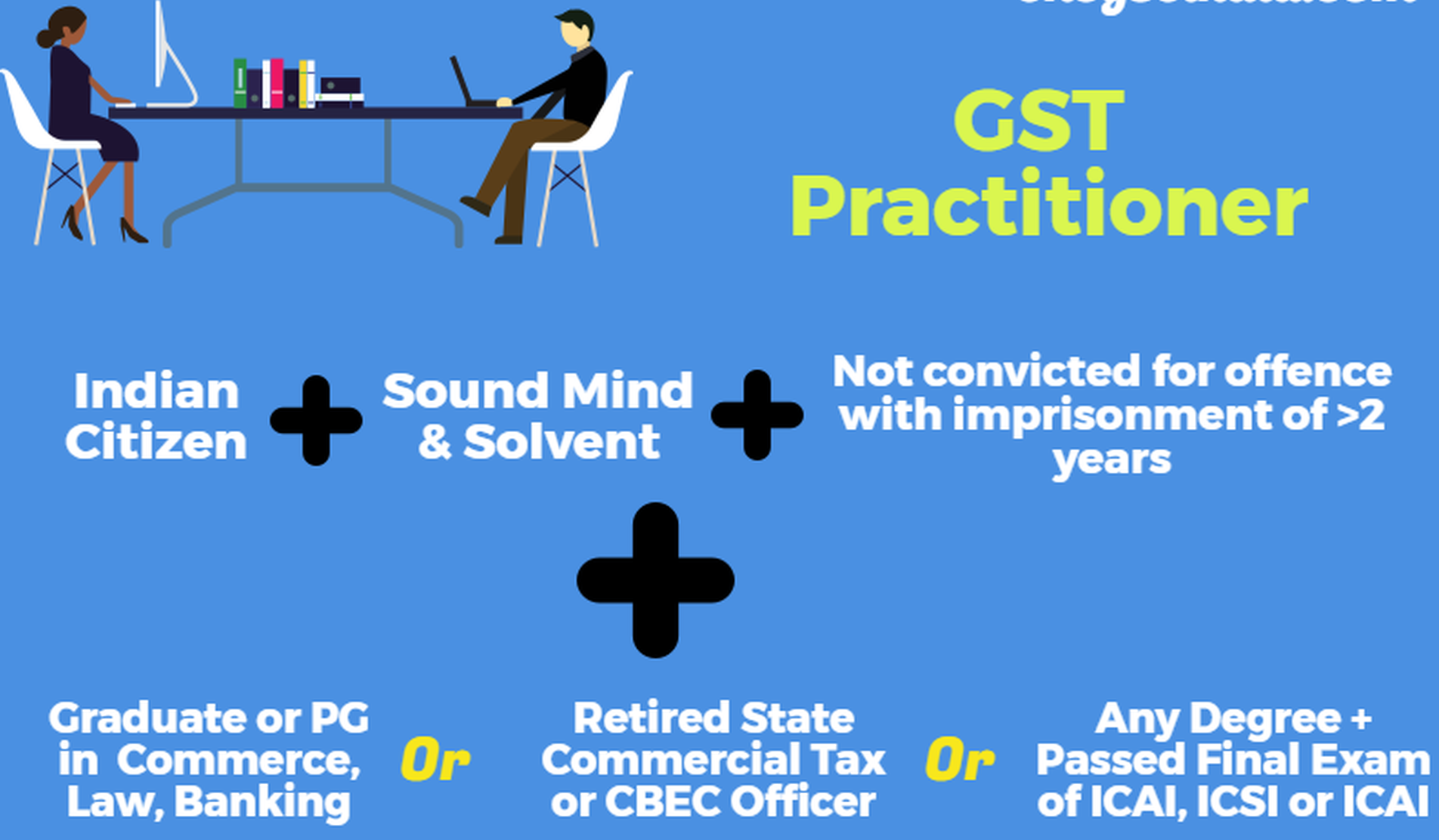

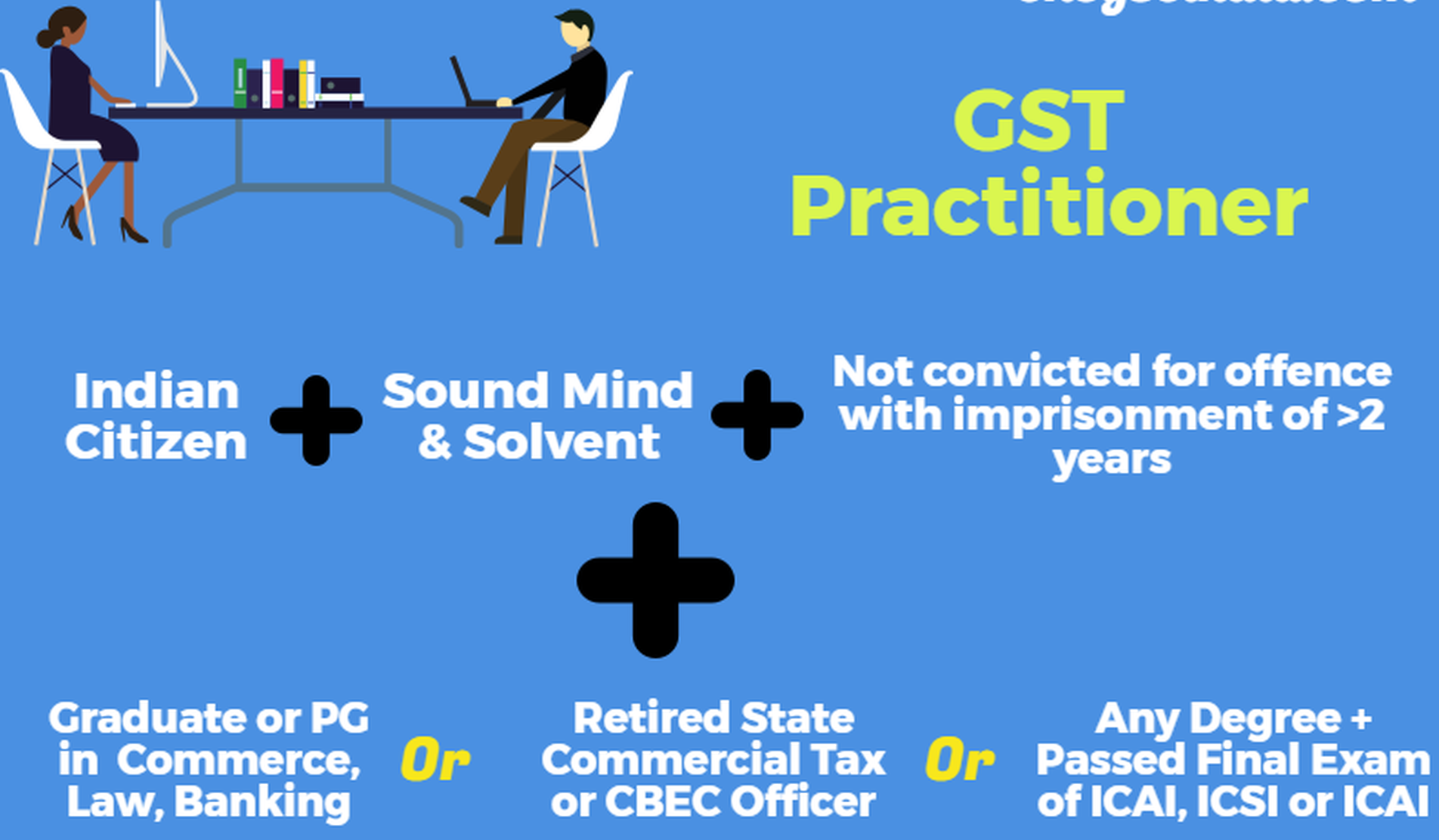

GST Practitioners will be an exciting career for commerce graduates and finance professionals. This article will help you get a clear picture on the procedure for a person to become a certified GST Practitioner

Who is a GST Practitioner?

GST Practitioner is a consultant who provides services to other taxpayers through online mode. A GST Practitioner must be registered on GSTN Portal and must have gained a certificate by going through an application procedure before he can start his or her practice.

Duties performed by a GST Practitioner

He can assist in making application for GST registration on behalf of the taxpayer or make amendment/cancellation of GST returns.

GST practitioner can assist in filing monthly/quarterly/annual GST returns such as Form GSTR – 3B, Form GSTR – 1 & Form GSTR – 9.

GST practitioner can file refund claims or pay taxes on behalf of the registered persons.

- Authorised representative

GST practitioner would be allowed to appear as an authorised representative before any officer of the GST Department, Appellate authority and the Tribunal.

Responsibilities of a GST Practitioner

- He can furnish details of inward and outward supplies

- He can furnish the monthly, quarterly, and annual return on behalf of his taxpayer client

- He can make a deposit for credit into the electronic cash ledger

- He can view complete list of taxpayers who are engaged in your account.

- He can file an application for his claim for refund

- He can file an application for amendments or cancellation of his registration

- He can help his client to generate an e-waybill for various movement of his goods

- He is enabled to accept or reject the application as a consultant from fellow taxpayer

- He is also enabled to make changes in the profile of his taxpayer client like place of his business, his contact details,and his other business information. However, a GST practitioner can only save such information and cannot submit it. He must tell his client to submit the information as he has furnished it.

In short, A GST practitioner or GSTP is a person approved by the Central and State Governments to perform any or all of the following activities, on behalf of a taxable person:

- File an application for fresh registration

- File an application for amendment or cancellation of registration

- Furnish details of outward and inward supplies

- Furnish monthly, quarterly, annual or final GST returns

- Make payments for credit into the electronic cash ledger, i.e. payments for tax, interest, penalty, fees or any other amount

- File a claim for refund

- Appear as an authorised representative before any officer of department, appellate authority or appellate tribunal

Benefits of being a GST Practitioner:

Below are mentioned GST Practitioner Benefits. Once certified, a GST Practitioners can perform below mentioned activities on GSTN Portal-

- He can view complete list of taxpayers who are engaged in your account.

- He can furnish details of inward and outward supplies.

- He can furnish the monthly, quarterly, and annual return on behalf his taxpayer client.

- He can make a deposit for credit into the electronic cash ledger.

- He can file an application for his claim for refund.

- He can even file an application for amendments or cancellation of his registration.

- He is also enabled to make changes in the profile of his taxpayer client like place of his business, his contact details, his other business information. However, a GST practitioner can only save such information and cannot submit it. He must tell his client to submit the information as he has furnished it.

- He can also help his client to generate an e-waybill for various movement of his goods.

- He is also able to help his client in issuance of tax invoices, delivery challan, a procedure for GST registration, cancellation, and any GST Updates.

- He is enabled to accept or reject the application as a consultant from fellow taxpayer.