Rated #1 Recoginized as the No.1 Institute for GST Training in Hyderabad

Take your career forward with GST Training in Hyderabad, where experienced instructors will provide you with comprehensive knowledge and practical training in GST law, filing returns, and compliance.

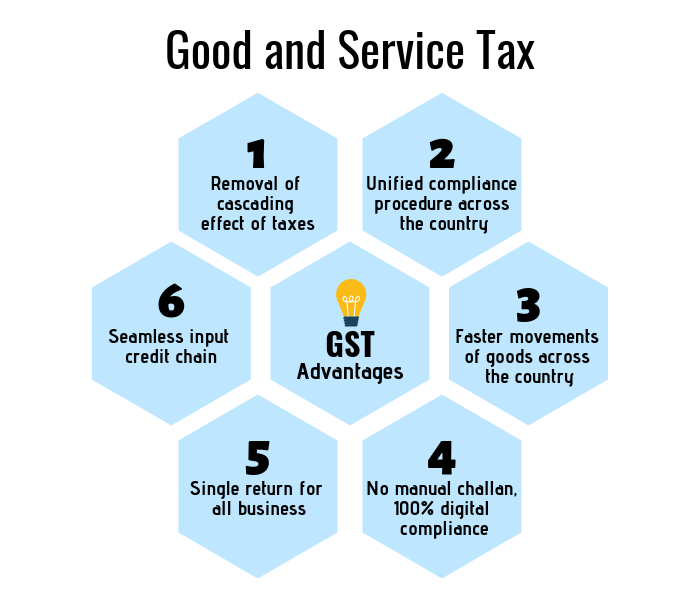

Gain expertise in accounting, taxation, and finance with our GST Course. Master GST principles, including return filing, tax rates, and industry-specific compliance, to excel in the field and stay ahead in the ever-evolving world of taxation and finance.

- Connect with 400+ companies and 15,648+ trained professionals.

- Master GST concepts to advance your career in taxation and compliance.

- Join the GST Training in Hyderabad to fast-track your professional growth.

- Access affordable, industry-recognized training with placement assistance.

- Unlock career opportunities in accounting, taxation, and financial services.

- Gain practical experience in filing GST returns and understanding regulations.