- Introduction

- Economic and Analytical Nature

- Dynamic and Evolving Field

- Goal-Oriented Approach

- Integrative in Nature

- Forward-Looking

- Continuous Process

- Quantitative and Qualitative Aspects

- Decision-Making Focused

- Value Maximization Objective

- Ethical and Legal Considerations

- Conclusion

Introduction

Financial management plays a crucial role in the success and sustainability of any business organization. It is the strategic planning, organizing, directing, and controlling of financial undertakings in an organization or an institute. It also includes applying management principles to the financial assets of an organization, while also playing an important part in fiscal management. This field of management is not only essential for the smooth functioning of companies but also for ensuring long-term growth and profitability. In the contemporary business environment, where competition is intense and resources are limited, the significance of effective financial management cannot be overstated. The scope of financial management extends beyond simple bookkeeping and accounting. It is a multifaceted discipline that involves evaluating investment opportunities, managing capital structure, ensuring optimal utilization of funds, and mitigating financial risks. The objective is to maximize the value of the firm for its stakeholders, particularly the shareholders. Financial management blends economic principles, quantitative tools, strategic insights, and ethical frameworks to guide decision-making. It is dynamic, continuously evolving in response to changes in market conditions, technological advancements, regulatory frameworks, and global economic trends.

Economic and Analytical Nature

At its core, financial management is rooted in economic theory. It applies the principles of economics, particularly microeconomics and macroeconomics, to the financial decisions of a firm. Concepts such as supply and demand, cost-benefit analysis, marginal analysis, financial risks and opportunity cost play a central role in financial decision-making. The economic nature of financial management implies that decisions are made after careful analysis of economic conditions and the potential impacts on the organization.Analytical rigor is also a defining characteristic. Financial managers must analyze data, interpret financial statements, forecast revenues and expenditures, and assess the viability of investment projects. Tools such as ratio analysis, break-even analysis, cash flow analysis, shareholders and financial modeling are used extensively. This analytical approach enables organizations to make informed decisions, identify financial strengths and weaknesses, and plan for future growth.

Dynamic and Evolving Field

- Financial management is not a static field. It is highly dynamic, influenced by a variety of internal and external factors.

- Technological advancements, such as the rise of financial technologies (fintech), artificial intelligence, and big data analytics, are reshaping how financial information is processed and decisions are made.

- Moreover, changes in regulatory policies, global economic shifts, and evolving investor expectations necessitate continuous adaptation.

- The dynamic nature of financial management means that professionals in the field must engage in lifelong learning.

- They must stay updated with new tools, frameworks, and best practices. For instance, the increasing importance of environmental, social, and governance (ESG) factors in investment decisions reflects a broader shift towards sustainable finance.

- Financial managers must be agile, innovative, and responsive to change in order to steer their organizations through uncertainty and complexity.

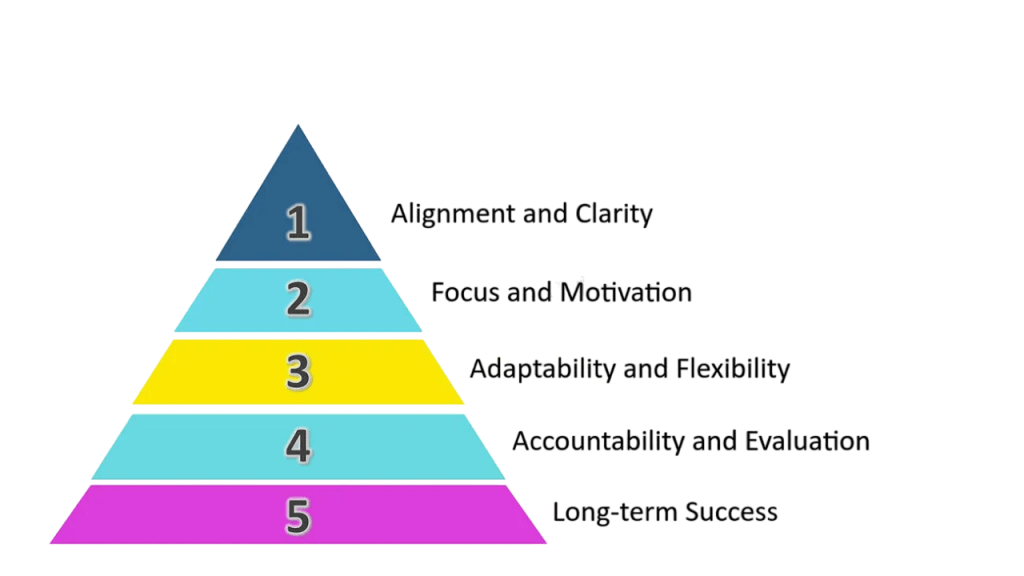

Goal-Oriented Approach

Financial management is inherently goal-oriented. It seeks to achieve specific financial objectives that align with the overall mission and vision of the organization. These goals may include maximizing shareholder wealth, ensuring liquidity, maintaining financial stability, achieving profitability, and enhancing market share. A clear set of financial goals provides direction and focus. It helps organizations prioritize activities, allocate resources effectively, and measure performance. Financial managers play a key role in setting these goals, developing strategies to achieve them, and monitoring progress. This goal-oriented approach fosters accountability, transparency, financial risks and strategic alignment across the organization.

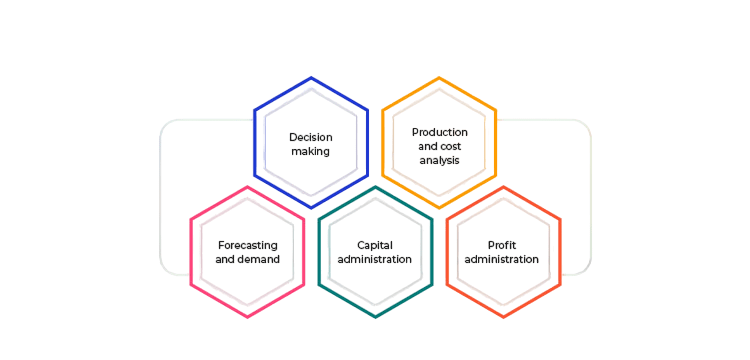

Integrative in Nature

- One of the unique features of financial management is its integrative nature. It does not operate in isolation but is deeply interconnected with other functions of the organization such as marketing, operations, human resources, and strategic management.

- Financial decisions impact and are impacted by decisions in these other areas. For example, a marketing campaign requires financial investment and should generate returns that justify the cost. Similarly, decisions related to hiring or training staff have financial implications in terms of salaries, benefits, and productivity.

- Financial managers must therefore work collaboratively with other departments to ensure that financial considerations are embedded in organizational planning and decision-making.

- This integrative approach enhances coordination and coherence across the organization.

- It ensures that financial resources are aligned with strategic priorities and that all departments contribute to the overall financial health of the enterprise.

Forward-Looking

Financial management is inherently forward-looking. It involves forecasting future financial conditions, anticipating challenges, and preparing for opportunities. Budgeting, financial risks, financial planning, shareholders and investment analysis are key activities that require a forward-looking mindset. Forecasting enables organizations to allocate resources efficiently, plan for contingencies, and set realistic goals. It also helps in identifying emerging trends, assessing potential risks, and making proactive decisions. The forward-looking aspect of financial management fosters resilience and agility, enabling organizations to navigate uncertainty and adapt to change. Strategic financial planning, in particular, plays a critical role in long-term success. It involves setting financial objectives, developing plans to achieve them, and monitoring progress over time. By looking ahead, financial managers can position their organizations to seize growth opportunities and mitigate potential threats.

Continuous Process

- Financial management is not a one-time activity but a continuous process. It involves ongoing monitoring, evaluation, and adjustment of financial strategies and plans.

- This continuous nature ensures that financial decisions remain relevant and responsive to changing circumstances.

- The financial environment is constantly evolving due to factors such as market fluctuations, competitive dynamics, technological changes, and regulatory developments.

- A continuous approach allows organizations to stay agile and adapt their financial strategies accordingly.

- Regular financial reviews, audits, and performance evaluations are essential components of this process.

- Continuous financial management also supports organizational learning and improvement.

- By analyzing past performance and identifying lessons learned, organizations can refine their financial practices and enhance their decision-making capabilities.

- This iterative process contributes to long-term sustainability and success.

Quantitative and Qualitative Aspects

Financial management involves both quantitative and qualitative aspects. The quantitative side includes the use of numerical data, financial metrics, statistical models, and mathematical techniques to support decision-making. Financial ratios, net present value (NPV), internal rate of return (IRR), and other metrics are commonly used to evaluate financial performance and investment opportunities. However, financial decisions cannot be based solely on numbers. Qualitative factors such as management quality, brand reputation, customer satisfaction, employee morale, and market conditions also play a critical role. For example, a project may appear financially viable based on quantitative analysis but may pose reputational or operational risks that warrant caution.Effective financial management requires a balanced approach that considers both quantitative data and qualitative insights. This holistic perspective enables more comprehensive and informed decision-making, reducing the likelihood of unforeseen problems and enhancing organizational performance.

Decision-Making Focused

- At its heart, financial management is focused on decision-making. It provides the information, tools, and frameworks necessary to make sound financial decisions.

- These decisions may relate to investment choices, capital structure, dividend policy, risk management, and resource allocation.

- Good financial decisions are those that contribute to the overall goals of the organization, particularly value maximization.

- Financial managers must evaluate alternatives, assess risks and returns, and choose the option that offers the best outcome.

- Decision-making in financial management is supported by a range of analytical tools, financial models, and strategic frameworks.

- Moreover, decision-making in financial management is not limited to top executives.

- Managers at all levels need to make financial decisions within their areas of responsibility.

- Providing them with the necessary knowledge and tools enhances overall organizational effectiveness and accountability.

Value Maximization Objective

The ultimate objective of financial management is to maximize the value of the firm. This means increasing the wealth of shareholders and ensuring sustainable growth over the long term. Value maximization serves as a guiding principle for all financial decisions and strategies. Value is created when the firm earns returns greater than the cost of capital. This requires effective investment, efficient operations, prudent risk management, and sound financial planning. features of financial management , Financial managers play a crucial role in identifying value-creating opportunities, optimizing capital allocation, and monitoring performance. Value maximization also implies a long-term perspective. It requires balancing short-term profitability with long-term sustainability. Decisions should not only generate immediate gains but also strengthen the organization’s competitive position and future potential.

Ethical and Legal Considerations

- Financial management must be conducted within a framework of ethical standards and legal compliance.

- Ethical and Legal considerations include honesty, transparency, integrity, and fairness in financial reporting and decision-making.

- Unethical practices such as fraud, insider trading, and manipulation of financial statements can lead to legal consequences and damage the reputation of the organization.

- Legal compliance involves adhering to laws and regulations related to financial reporting, taxation, corporate governance, and securities markets.

- Regulatory bodies such as the Securities and Exchange Commission (SEC) in the United States, or the Financial Conduct Authority (FCA) in the UK, enforce these rules to protect investors and ensure market integrity.

- Financial managers have a fiduciary duty to act in the best interest of the organization and its stakeholders.

- Upholding ethical and legal standards fosters trust, credibility, and long-term success.

- It also contributes to a positive organizational culture and corporate social responsibility.

Conclusion

In conclusion, features of financial management is a vital function that encompasses a wide range of activities and responsibilities. It is economic and analytical in nature, dynamic and evolving, goal-oriented, integrative, forward-looking, and continuous. It involves both quantitative and qualitative analysis and is fundamentally focused on decision-making with the objective of maximizing value. Moreover, it must be grounded in ethical and legal principles to ensure responsible and sustainable financial practices.