Looking for the top bitcoin interview questions to prepare for your interview. Go through some of the best bitcoin interview questions with detailed answers before you get ahead. Bitcoin is the first cryptocurrency that arrived in the market with promising implications of blockchain as its underlying technology. Over the years, it has served as the foundation for the development of many other cryptocurrency alternatives. Therefore, enterprise blockchain professionals need to encounter interview questions on Bitcoin for different enterprise blockchain job roles. The following discussion offers an overview of different categories of interview questions related to Bitcoin to help aspiring enterprise blockchain professionals.

1. What is Bitcoin?

Ans:

Bitcoin is a decentralized digital currency, a form of electronic cash. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

Bitcoin can be used for peer-to-peer transactions without the need for intermediaries like banks. The total supply of Bitcoin is capped at 21 million, making it deflationary. It has gained attention as both a digital currency and a store of value.

2. Who created Bitcoin?

Ans:

Bitcoin was created by an unknown person or group using the pseudonym Satoshi Nakamoto. The identity of Bitcoin’s creator, Satoshi Nakamoto, remains unknown. Nakamoto introduced the concept in a 2008 whitepaper and released the software in 2009 before disappearing from public view.

3. How does Bitcoin work?

Ans:

- Bitcoin operates on a peer-to-peer network, using blockchain technology to record and verify transactions.

- Bitcoin operates on a decentralized peer-to-peer network using blockchain technology.

- Transactions are verified by network nodes through cryptography, recorded in a public ledger (the blockchain), and added to the ledger through a process called mining.

- Miners solve complex mathematical problems to validate transactions, and in return, they are rewarded with newly created bitcoins.

- This process ensures transparency, security, and a limited supply of bitcoins (21 million).

- Users can send and receive bitcoins via cryptographic keys, providing a secure and pseudonymous way of transferring value.

4. What is blockchain?

Ans:

Blockchain is a distributed ledger technology that records all transactions across a network of computers securely and transparently. Blockchain is a decentralized and distributed ledger technology that records transactions across a network of computers in a secure, transparent, and tamper-resistant manner. Each transaction, or block, contains a cryptographic hash of the previous block, creating a chain of blocks, hence the name “blockchain.” This structure ensures the integrity of the data because altering one block would require changing all subsequent blocks, which is computationally infeasible.

5. What is mining in the context of Bitcoin?

Ans:

Mining is the process by which transactions are verified and added to the blockchain, and new bitcoins are created by solving complex mathematical problems. Mining serves a dual purpose: it ensures the security and integrity of the Bitcoin network by preventing double-spending and fraud, and it introduces new bitcoins into circulation. Miners are rewarded with freshly created bitcoins and transaction fees for their efforts. This process is crucial for the decentralized and trustless nature of the Bitcoin system.

6. What is a Bitcoin wallet?

Ans:

A Bitcoin wallet is a digital tool that allows users to store and manage their Bitcoin. A Bitcoin wallet is a digital tool that allows users to store, send, and receive bitcoins. It contains private keys, which are crucial for accessing and managing one’s Bitcoin holdings. Wallets come in various forms, such as software, hardware, or paper wallets, providing different levels of security and accessibility.

7. How is the total supply of bitcoins limited?

Ans:

- The total supply of bitcoins is capped at 21 million to control inflation and mimic the scarcity of precious metals.

- A built-in protocol in the Bitcoin network limits the total supply of bitcoins. There will only ever be 21 million bitcoins in existence.

- This scarcity is maintained through a process called halving, which occurs approximately every four years, reducing the rate at which new bitcoins are created and added to the circulating supply.

- This controlled supply is designed to mimic the scarcity and value proposition of precious metals like gold.

8. What is a public key in Bitcoin?

Ans:

A public key is a cryptographic address that others can use to send bitcoins to a specific user. In Bitcoin, a public key is a cryptographic key that is used to receive bitcoins. It is derived from a private key through a mathematical process. The public key is then transformed into a Bitcoin address, which is what users share to receive funds. While the public key is part of the key pair used in the cryptographic process, it’s important to note that the address derived from the public key is commonly used for practical transactions. The private key, which corresponds to the public key, is kept secret and is crucial for authorizing outgoing transactions.

9. What is a private key?

Ans:

A private key is a secret code known only to the owner that allows them to access and control their bitcoins. A private key in Bitcoin is a secret, cryptographic key that is used to sign transactions and control the spending of bitcoins associated with a specific public key or Bitcoin address.

It is essential for the security of a Bitcoin wallet, as anyone possessing the private key has control over the associated funds. Users must keep their private keys secure and confidential to prevent unauthorized access and transactions.

10. Explain the concept of a Bitcoin transaction.

Ans:

- A transaction involves the transfer of bitcoins from one user’s wallet to another, recorded on the blockchain. A Bitcoin transaction is the transfer of value between Bitcoin wallets.

- It involves a sender initiating the transfer by creating a transaction message, specifying the recipient’s address, and signing it with their private key.

- This transaction is broadcast to the decentralized Bitcoin network, where miners validate and include it in a block through a process called mining.

- Once confirmed, the transaction becomes part of the immutable blockchain, ensuring transparency and security. Bitcoin transactions are pseudonymous, as addresses, not personal information

11. How is transaction validation achieved in Bitcoin?

Ans:

Transactions are validated through a process called mining, where network nodes compete to solve complex mathematical problems. Transaction validation in Bitcoin is achieved through a process called mining. When a user initiates a transaction, it is broadcast to the network. Miners then compete to solve a cryptographic puzzle, and the first one to solve it gets the right to add a new block to the blockchain. This block contains a record of the new transaction, and the solution to the puzzle serves as proof of work.

12. What is a block reward in Bitcoin?

Ans:

A block reward is the number of bitcoins given to the miner who successfully validates a new block of transactions. A block reward in Bitcoin refers to the cryptocurrency reward that miners receive for successfully adding a new block to the blockchain through the mining process.

Initially, when Bitcoin was introduced, the block reward was set at 50 bitcoins per block. However, to control the overall supply of bitcoins and mimic the scarcity of precious metals, the protocol incorporates a mechanism called the “halving.

13. What is the purpose of the Bitcoin whitepaper?

Ans:

- The Bitcoin whitepaper, written by Satoshi Nakamoto, outlines the principles and workings of the cryptocurrency.

- The Bitcoin whitepaper, titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” was authored by the pseudonymous Satoshi Nakamoto and published in 2008.

- Its primary purpose is to introduce the concept and principles of Bitcoin. The whitepaper outlines the design, technical details, and the underlying philosophy of Bitcoin as a decentralized digital currency.

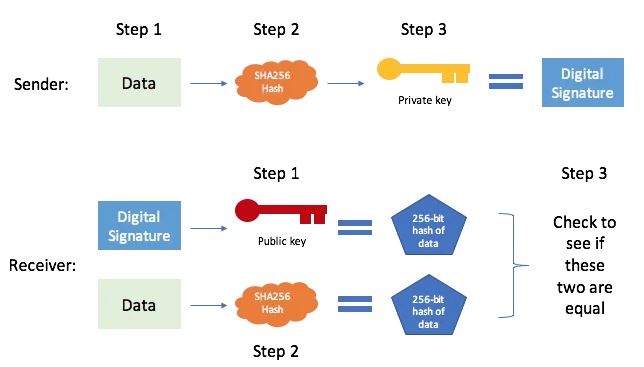

14. How does Bitcoin ensure security in transactions?

Ans:

Security is maintained through cryptographic techniques and the decentralized nature of the blockchain. Bitcoin ensures security in transactions through a decentralized network of nodes that validate and record transactions in a public ledger called the blockchain.

Cryptography, specifically SHA-256 hashing, is used to secure transaction data and link each block to the previous one, making it tamper-resistant. Additionally, the proof-of-work consensus mechanism requires miners to solve complex mathematical puzzles to add new blocks, making it computationally expensive to alter past transactions.

15. What is the role of nodes in the Bitcoin network?

Ans:

Nodes are computers that participate in the Bitcoin network, validating transactions and maintaining the blockchain. Nodes in the Bitcoin network play a crucial role in maintaining the decentralized nature of the system. They validate transactions, relay them to other nodes, and ensure consensus on the state of the blockchain.

There are different types of nodes, including full nodes that store the entire blockchain and validate all transactions and lightweight nodes that rely on full nodes for transaction verification. Nodes collectively contribute to the security and integrity of the Bitcoin network.

16. Explain the term “double-spending” in the context of Bitcoin.

Ans:

- Double-spending refers to the risk of spending the same bitcoin more than once, which is mitigated by the blockchain’s consensus mechanism.

- Double-spending refers to the risk of spending the same Bitcoin amount more than once.

- In traditional digital transactions, a central authority prevents this by keeping a record of account balances.

- However, Bitcoin operates on a decentralized system, and preventing double-spending is achieved through consensus on a single transaction history in the blockchain.

- The decentralized network of nodes ensures that once a transaction is confirmed and added to the blockchain, it becomes extremely difficult for someone to spend the same bitcoins again, ensuring the integrity of the cryptocurrency system.

17. What is a Bitcoin block size limit?

Ans:

The block size limit is the maximum amount of data that can be included in a single block, affecting the number of transactions processed per block. The Bitcoin block size limit refers to the maximum size a block can have on the Bitcoin blockchain. This limit is set at 1 megabyte (MB). This restriction helps manage the network’s scalability and ensures the efficiency and security of Bitcoin transactions.

18. What is the Lightning Network?

Ans:

The Lightning Network is a layer-2 scaling solution for Bitcoin, enabling faster and cheaper transactions by conducting some off-chain transactions. The Lightning Network is a second-layer scaling solution for blockchain networks, such as Bitcoin.

It aims to enable faster and cheaper transactions by creating off-chain payment channels. These channels allow participants to conduct multiple transactions without every transaction being recorded on the main blockchain, reducing congestion and increasing efficiency.

19. What is the significance of the halving event in Bitcoin?

Ans:

- The halving event occurs approximately every four years, reducing the reward miners receive for validating blocks and impacting the rate of new Bitcoin creation.

- The Bitcoin halving is a programmed event that occurs approximately every four years, reducing the reward miners receive for validating transactions by half.

- The significance lies in its impact on the Bitcoin supply and inflation rate. Halving events help control the issuance of new bitcoins, making the cryptocurrency more scarce and often contributing to upward price pressure.

- It also serves as a mechanism to align with Bitcoin’s deflationary nature, ultimately affecting its long-term economic model.

20. How does Bitcoin handle privacy and anonymity?

Ans:

| Aspect | Bitcoin’s Approach |

|---|---|

| Pseudonymous Transactions | Cryptographic addresses instead of real identities; some privacy but not complete. |

| Public Blockchain | Transparent transactions on a public ledger; compromises user privacy. |

| Address Reuse | Reusing addresses can compromise privacy; potential linkage of transactions. |

21. What is a fork in the context of Bitcoin?

Ans:

A fork occurs when there is a change in the protocol rules, leading to the creation of a new version of the blockchain. In the context of Bitcoin, a fork refers to a divergence in the blockchain’s protocol, resulting in two separate versions of the blockchain. There are two main types: soft forks and hard forks. Soft forks are backwards-compatible changes, while hard forks are not and can lead to a split in the community if not universally adopted. Forks can occur for various reasons, such as protocol upgrades or disagreements among the network participants.

22. What is the difference between a soft fork and a hard fork?

Ans:

A soft fork is a backwards-compatible upgrade, while a hard fork requires all nodes to upgrade to avoid a split in the blockchain. A soft fork and a hard fork are both updates to a blockchain, but they differ in terms of compatibility.

A soft fork is backwards-compatible, meaning older nodes can still accept new blocks, while a hard fork is not backwards-compatible, requiring all nodes to upgrade to the latest version for consensus. Soft forks typically tighten rules, while hard forks introduce new rules, potentially leading to a split in the blockchain if not all nodes adopt the changes.

23. Explain the concept of a Bitcoin hash.

Ans:

A hash is a cryptographic function that converts input data into a fixed-size string of characters, used in various aspects of Bitcoin’s security. In Bitcoin, a hash is a cryptographic function that takes an input (data) and produces a fixed-size string of characters, which is a unique representation of the input. The most commonly used hashing algorithm in Bitcoin is SHA-256 (Secure Hash Algorithm 256-bit).

24. What is the role of miners in the Bitcoin network?

Ans:

- Miners validate transactions, add them to blocks, and compete to solve mathematical problems to earn block rewards.

- Miners play a crucial role in the Bitcoin network by validating transactions and adding them to the blockchain.

- They use powerful computers to solve complex mathematical puzzles, and the first miner to solve the puzzle gets the chance to add a new block of transactions to the blockchain.

- This process, known as proof-of-work, ensures the security and decentralization of the network. Miners are also rewarded with newly created bitcoins and transaction fees for their efforts.

25. How does Bitcoin address scalability issues?

Ans:

Various solutions, such as Segregated Witness (SegWit) and the Lightning Network, aim to address scalability challenges in the Bitcoin network. Bitcoin addresses scalability issues through various mechanisms.

One key approach is the implementation of the Lightning Network, a second-layer solution that enables faster and cheaper transactions by conducting them off-chain. This reduces the load on the main Bitcoin blockchain.

26. What is the significance of the Genesis Block in Bitcoin?

Ans:

The Genesis Block is the first block in the Bitcoin blockchain, mined by Satoshi Nakamoto and containing a special message. The Genesis Block, also known as Block 0 or Block 1, is the first block in the Bitcoin blockchain. It was mined by Bitcoin’s creator, Satoshi Nakamoto, in January 2009.

The significance of the Genesis Block lies in its unique coinbase parameter, which includes the message “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” This text is considered a timestamp and a commentary on the flaws of the traditional financial system.

27. How does Bitcoin mitigate the risk of 51% attacks?

Ans:

A 51% attack is prevented by the decentralized nature of the network, requiring an attacker to control over half of the total mining power. Bitcoin mitigates the risk of 51% attacks through its proof-of-work consensus mechanism. In a 51% attack, an entity gains control of more than half of the network’s mining hash rate, potentially allowing it to manipulate transactions, double-spend coins, or prevent new transactions from being confirmed.

28. What is the role of consensus mechanisms in Bitcoin?

Ans:

Consensus mechanisms ensure agreement among network nodes on the validity of transactions, maintaining the integrity of the blockchain. Consensus mechanisms in Bitcoin play a crucial role in achieving agreement among participants about the state of the blockchain. The primary mechanism is Proof of Work (PoW), where miners solve complex mathematical problems to validate transactions and add blocks to the chain. This process ensures decentralized consensus, security, and immutability in the Bitcoin network.

29. How are transaction fees determined in Bitcoin?

Ans:

- Transaction fees are determined by users who choose to include them in their transactions to incentivize miners.

- Market forces determine transaction fees in Bitcoin and depend on the current demand for block space.

- Users can choose their transaction fees when sending bitcoins, typically measured in satoshis per byte. Miners prioritize transactions with higher fees, aiming to maximize their earnings.

- During times of high network activity, transaction fees may increase due to increased competition for limited block space, while lower demand can result in lower fees.

30. What is the importance of public and private key encryption in Bitcoin?

Ans:

Public and private key encryption ensures the security and authenticity of transactions by allowing users to sign and verify messages. Public and private key encryption is fundamental to the security and functionality of Bitcoin. Public keys serve as addresses, allowing others to send bitcoins to a user. However, it’s the corresponding private key that grants access to control and spend those bitcoins. This asymmetric cryptography ensures secure and verifiable transactions. The private key must be kept secret, while the public key is shared openly. This cryptographic pairing ensures ownership, confidentiality, and integrity of transactions in the Bitcoin network.

31. How does Bitcoin handle divisibility?

Ans:

- Bitcoin is divisible into smaller units, with the smallest unit being a Satoshi, named after the pseudonymous creator.

- Bitcoin handles divisibility through its smallest unit, called a satoshi.

- One bitcoin is divisible into 100,000,000 satoshis, allowing for fine-grained transactions and flexibility in dealing with various amounts.

32. What is the role of the mempool in Bitcoin transactions?

Ans:

The mempool is a waiting area for unconfirmed transactions, and miners select transactions from it to include in the next block. The mempool (short for memory pool) in Bitcoin is a temporary storage area for unconfirmed transactions. It acts as a waiting area where transactions wait to be included in the next block by miners. Miners prioritize transactions based on fees, and those with higher fees generally get processed first. The mempool helps maintain the order and validity of transactions before they are added to the blockchain.33. Explain the concept of multi-signature (multisig) wallets in Bitcoin

Ans:

Multisig wallets require multiple private keys to authorize a Bitcoin transaction, enhancing security and enabling more complex spending conditions. Multi-signature (multi-sig) wallets in Bitcoin involve multiple private keys to authorize a transaction, adding an extra layer of security. Instead of a single private key controlling access to funds, a multi-sig wallet requires a predefined number of signatures from a set of private keys. For example, a 2-of-3 multi-sig wallet would require two out of three possible private keys to authorize a transaction. This enhances security by distributing control among multiple parties, reducing the risk associated with a single point of failure.

34. How does the timestamp server concept apply to Bitcoin’s blockchain?

Ans:

Bitcoin’s blockchain serves as a decentralized timestamp server, providing an immutable record of when transactions occur. The timestamp server concept is fundamental to Bitcoin’s blockchain, ensuring the chronological order of transactions.

In the context of Bitcoin, the network’s decentralized nodes reach a consensus on the order of transactions by timestamping them. Each block contains a timestamp representing when it was mined, creating a chain of blocks with a chronological sequence.

35. What is the significance of the 10-minute block time in Bitcoin?

Ans:

The 10-minute block time helps maintain consistency and allows for adjustments in mining difficulty to regulate the rate of block creation. The 10-minute block time in Bitcoin serves multiple purposes. Firstly, it helps maintain a consistent rate at which new blocks are added to the blockchain, ensuring a controlled issuance of new bitcoins. This is part of the protocol’s design to limit the total supply over time.

Secondly, the 10-minute block time contributes to the security of the network. It provides a sufficient window for miners to solve the cryptographic puzzle required to add a new block, reducing the likelihood of multiple miners solving it simultaneously.

36. How does Bitcoin address environmental concerns related to mining?

Ans:

- While mining consumes energy, some argue that the environmental impact is offset by the decentralized nature of Bitcoin, reducing reliance on centralized systems.

- Bitcoin’s environmental impact, primarily associated with mining, has been a subject of debate.

- The protocol relies on Proof-of-Work (PoW), which requires miners to solve complex mathematical puzzles to validate transactions and add blocks to the blockchain. This process, while secure, consumes significant computational power and energy.

37. What is the role of the UTXO model in Bitcoin?

Ans:

Unspent Transaction Outputs (UTXOs) track the amount of bitcoin associated with a user’s address, preventing double-spending. The Unspent Transaction Output (UTXO) model in Bitcoin helps track the ownership of bitcoins. Each transaction creates new UTXOs, representing the amount sent and remaining. This model enhances security and enables efficient verification of transactions by validating the unspent outputs, preventing double-spending.

38. What is the difference between a hot wallet and a cold wallet in Bitcoin?

Ans:

- A hot wallet is connected to the internet for easy access, while a cold wallet is offline and considered more secure for long-term storage.

- A hot wallet is connected to the internet and used for frequent transactions, making it more susceptible to hacking.

- In contrast, a cold wallet is offline and provides enhanced security by keeping private keys offline, making it less vulnerable to online threats.

39. How does Bitcoin address the issue of lost private keys?

Ans:

Lost private keys can result in the permanent loss of bitcoins, emphasizing the importance of secure key management. Bitcoin doesn’t have a built-in mechanism to recover lost private keys. If a user loses access to their private key, they lose control of the associated bitcoins. It highlights the importance of securely storing and backing up private keys. Some users turn to hardware wallets or other secure methods to reduce the risk of losing access to their funds.

40. What is the role of the Merkle Tree in Bitcoin’s block structure?

Ans:

- The Merkle Tree efficiently summarizes all transactions in a block, allowing for quick verification and reducing the amount of data stored.

- The Merkle Tree in Bitcoin’s block structure plays a crucial role in ensuring the integrity of transactions within a block.

- It efficiently summarizes all transactions by creating a tree structure of hash values. The root of this tree, known as the Merkle Root, is then included in the block header.

41. How does the Bitcoin network achieve decentralization?

Ans:

Decentralization is maintained through a distributed network of nodes and miners, preventing a single point of control. Bitcoin achieves decentralization through its peer-to-peer network, where nodes communicate and validate transactions without a central authority.This distributed network ensures no single entity controls the entire system, enhancing security and resilience against censorship or manipulation. Additionally, the proof-of-work consensus mechanism prevents any single participant from dominating the creation of new blocks, further promoting decentralization.

42. What is the role of the Difficulty Adjustment in Bitcoin?

Ans:

The Difficulty Adjustment ensures that blocks are mined approximately every 10 minutes, even as mining power fluctuates. The Difficulty Adjustment in Bitcoin is a mechanism designed to maintain a consistent block time of approximately 10 minutes. It dynamically adjusts the difficulty level for mining based on the total computational power of the network. If more miners join, making the network more powerful, the difficulty increases; if miners leave, the difficulty decreases. This ensures that blocks are mined at a predictable rate, promoting stability in the Bitcoin network and preventing rapid fluctuations in block generation times.

43. What is a Bitcoin Improvement Proposal (BIP)?

Ans:

BIPs are documents outlining new features, processes, or improvements for the Bitcoin protocol, providing a structured way for the community to propose changes. A Bitcoin Improvement Proposal (BIP) is a design document outlining new features, improvements, or processes for the Bitcoin network.

Proposed by developers or community members, BIPs undergo a review and consensus process. BIPs cover a wide range of topics, including protocol upgrades, technical standards, and best practices. Accepted BIPs contribute to the evolution and enhancement of the Bitcoin protocol, ensuring a transparent and collaborative approach to its development.

44. Explain the concept of fungibility in Bitcoin.

Ans:

Fungibility refers to the interchangeability of bitcoins, meaning that each unit is indistinguishable from another, promoting equal value. Fungibility in Bitcoin refers to the property of interchangeable and indistinguishable units of the cryptocurrency.

It means that each bitcoin is considered equal in value to every other bitcoin. Unlike unique items or assets with distinct histories, bitcoins are mutually interchangeable.

This characteristic is crucial for a currency because it ensures that each unit is accepted and valued equally, promoting uniformity and simplicity in transactions.

Fungibility is essential for the proper functioning of money, as it allows for seamless and fair exchange in the Bitcoin network.

45. How does Bitcoin address the issue of scalability?

Ans:

Bitcoin aims to address scalability through both on-chain solutions (e.g., SegWit) and off-chain solutions (e.g., Lightning Network). Bitcoin addresses scalability through various strategies. One key approach is the implementation of the Lightning Network, a layer-2 scaling solution. It enables faster and more cost-effective transactions by conducting off-chain transactions, reducing the load on the main blockchain.

46. What is the role of full nodes in the Bitcoin network?

Ans:

Full nodes store and validate the entire blockchain, contributing to the network’s security and decentralization. Full nodes in the Bitcoin network play a crucial role in maintaining the decentralized and trustless nature of the system. They independently validate and enforce all rules of the Bitcoin protocol, including transaction and block validity. Full nodes store the entire blockchain and relay transactions to other nodes.

47. How does Bitcoin handle network forks and chain reorganizations?

Ans:

- Forks and reorganizations are natural occurrences in the network, with the longest valid chain eventually becoming the accepted one. Bitcoin handles network forks and chain reorganizations through its consensus mechanisms.

- When multiple miners discover a valid block simultaneously, it can lead to a temporary fork. However, the longest valid chain is considered the valid one. Miners and nodes converge on the longest chain, abandoning shorter branches.

48. What is the role of Bitcoin halving in its economic model?

Ans:

The halving reduces the rate of new bitcoin creation, affecting the overall supply and potentially influencing its value. The Bitcoin halving is a programmed event that occurs approximately every four years, reducing the rate at which new bitcoins are created by half. This event is designed to control the supply of bitcoins and follows a predetermined schedule, ultimately leading to a maximum supply of 21 million bitcoins.

49. Explain the concept of dust transactions in Bitcoin.

Ans:

- Dust transactions refer to very small amounts of bitcoin that may be uneconomical to spend due to transaction fees.

- Dust transactions can be problematic because they contribute to blockchain bloat and can clog up the network.

- To address this, Bitcoin users and wallets often set a minimum transaction amount to avoid dealing with such small and uneconomical outputs.

- Additionally, some wallets use coin selection algorithms that aggregate dust outputs into larger, more usable amounts, reducing the impact of these tiny transactions on the network.

50. How does Bitcoin contribute to financial inclusion globally?

Ans:

Bitcoin provides financial services to those without access to traditional banking, allowing participation in the global economy. Bitcoin contributes to financial inclusion globally by providing access to financial services for the unbanked and underbanked populations. Its decentralized nature allows people without traditional banking infrastructure to participate in the global economy, enabling cross-border transactions and financial empowerment.

51. What is the role of Schnorr signatures in Bitcoin?

Ans:

Schnorr signatures, when implemented, can enhance privacy, efficiency, and scalability by combining multiple signatures into one.

Schnorr signatures are a cryptographic signature scheme that offers several advantages for Bitcoin.

They enhance privacy, reduce transaction size, and enable advanced smart contract functionalities by allowing multiple signatures to be aggregated into a single one.

This can lead to more efficient and flexible transaction verification on the Bitcoin network.

52. How does the concept of “not your keys, not your Bitcoin” emphasize security?

Ans:

This phrase highlights the importance of controlling your private keys to maintain ownership and security of your bitcoins. The phrase “not your keys, not your Bitcoin” underscores the importance of holding and controlling the private keys associated with your Bitcoin wallet.

Private keys are crucial for accessing and managing your Bitcoin holdings. If you rely on a third party or an exchange to control your keys, you’re vulnerable to potential security breaches, fraud, or loss of funds.

53. What is the role of the CoinJoin protocol in Bitcoin privacy?

Ans:

CoinJoin allows multiple users to combine their transactions, making it more challenging to trace individual transactions and enhancing privacy.CoinJoin is a privacy protocol in Bitcoin designed to enhance transaction privacy by combining multiple transactions into a single, larger transaction. In a CoinJoin transaction, multiple participants pool their Bitcoin inputs and outputs, making it difficult to determine which inputs correspond to which outputs.

54. How does Bitcoin handle the issue of transaction malleability?

Ans:

Segregated Witness (SegWit) addresses transaction malleability by separating witness data from transaction data. Bitcoin addresses this by implementing a process called Segregated Witness (SegWit).

SegWit separates the transaction witness (the scriptSig) from the transaction data, including the signature. By doing so, it ensures that the witness data, which includes the signatures, doesn’t impact the transaction ID. This helps prevent transaction malleability and enhances the security and reliability of the Bitcoin network.

55. Explain the concept of coloured coins in Bitcoin.

Ans:

Coloured coins are a method of tagging specific bitcoins to represent ownership of real-world assets, enabling tokenization on the Bitcoin blockchain. While the concept of coloured coins has been explored, it hasn’t gained widespread adoption due to some technical and regulatory challenges. However, it showcases the potential for extending the functionality of the Bitcoin blockchain beyond simple currency transactions to include a broader range of digital assets and ownership representations.

56. How does the Bitcoin scripting language enable smart contracts?

Ans:

- Bitcoin’s scripting language allows for the creation of simple, smart contracts, enabling programmable conditions for spending bitcoins. Bitcoin Script supports various opcodes, allowing for conditional statements, cryptographic operations, and time-based restrictions.

- While less feature-rich than more advanced smart contract platforms, Bitcoin’s scripting language provides a foundation for creating basic programmable conditions within transactions, enhancing the functionality of the Bitcoin network.

57. What is the role of the Coin Days Destroyed metric in Bitcoin analysis?

Ans:

- Coin Days Destroyed measures the cumulative age and quantity of bitcoins spent in a transaction, providing insights into the movement of long-held coins.

- Analyzing Coin Days Destroyed can offer insights into market dynamics, investor sentiment, and the timing of significant movements of bitcoins.

- However, it’s important to note that interpreting this metric requires consideration of various factors, and it is just one of many tools used in the broader analysis of Bitcoin transactions and market behavior.

58. How does Bitcoin contribute to censorship resistance?

Ans:

Bitcoin transactions are resistant to censorship as the network operates without a central authority, making it difficult to control or restrict. Bitcoin contributes to censorship resistance through its decentralized nature. The distributed blockchain ensures that no single entity or government can control or censor transactions. This decentralized network makes it challenging for authorities to restrict or manipulate financial activities, promoting censorship resistance in the realm of digital currency.

59. Explain the role of the Bitcoin Core software in the network.

Ans:

- Bitcoin Core is the reference implementation of the Bitcoin protocol, serving as the backbone software for the entire network. Bitcoin Core is the reference implementation of the Bitcoin protocol, serving as the official software for participating in the Bitcoin network.

- It includes a full node, allowing users to validate and relay transactions while maintaining a complete copy of the blockchain.

- Bitcoin Core plays a crucial role in consensus, enforcing the rules of the network and helping to secure the decentralized nature of Bitcoin by preventing fraudulent transactions and maintaining the integrity of the blockchain.

60. What is the Lightning Torch experiment in Bitcoin?

Ans:

- The Lightning Torch was a symbolic transaction passed around the Lightning Network, showcasing the technology’s capabilities and community involvement.

- The Lightning Torch was a symbolic experiment in the Bitcoin community to showcase the capabilities of the Lightning Network, a second-layer scaling solution for Bitcoin. Starting in early 2019, the Lightning Torch involved sending a small amount of bitcoin (the torch) from one user to another through the Lightning Network.

- Each participant added a small amount before passing it on, creating a chain of transactions.

- This experiment demonstrated the speed, efficiency, and potential of the Lightning Network for micropayments and instant transactions in the Bitcoin ecosystem.

61. How does Bitcoin address the issue of scalability through the Segregated Witness (SegWit) upgrade?

Ans:

SegWit separates witness data from transaction data, increasing the effective block size and reducing transaction malleability. Segregated Witness (SegWit) is a Bitcoin protocol upgrade designed to address scalability issues by separating transaction signature data from transaction data. This separation removes the signature data, also known as the witness, from the main block, allowing more transaction data to fit within a block.

62. What is the significance of the BIP-148 UASF (User Activated Soft Fork) in Bitcoin’s history?

Ans:

BIP-148 was a proposal to activate SegWit through a user-activated soft fork, demonstrating the influence of the community in protocol upgrades.BIP-148 involved nodes enforcing the SegWit rules, potentially leading to a split in the Bitcoin blockchain if a majority of miners did not adopt SegWit.

While the actual UASF activation didn’t occur due to the “New York Agreement” and the subsequent adoption of SegWit through BIP-91, the UASF movement demonstrated the power of users and node operators in steering the direction of the Bitcoin network. It highlighted the importance of community-driven initiatives in shaping the protocol’s development.

63. How does Bitcoin’s decentralized nature contribute to censorship resistance?

Ans:

Decentralization means there is no central authority that can be pressured or coerced to censor transactions or users. Bitcoin’s decentralized nature means there’s no central authority controlling it. This decentralization makes it resistant to censorship because no single entity can control or shut down the entire network. Transactions are distributed across a global network of nodes, making it harder for any government or organization to censor or manipulate the system.

64. Explain the significance of the first recorded Bitcoin transaction involving pizza.

Ans:

- The purchase of pizza for 10,000 bitcoins marked one of the first real-world transactions using Bitcoin, illustrating its use as a medium of exchange.

- The first recorded Bitcoin transaction for pizza, which took place in May 2010, is significant because it marked one of the earliest real-world use cases for the cryptocurrency.

- Laszlo Hanyecz paid 10,000 bitcoins for two pizzas, demonstrating that Bitcoin could be used for actual goods and services.

- This event is now celebrated annually as “Bitcoin Pizza Day.” It highlights the early adoption phase of Bitcoin and underscores the significant value appreciation of the cryptocurrency over time.

65. What is the purpose of the Bitcoin Investment Trust (GBTC)?

Ans:

GBTC is a publicly traded investment vehicle that allows investors to gain exposure to Bitcoin’s price movements without directly holding the cryptocurrency.GBTC provides a way for investors to invest in Bitcoin through the stock market, making it more accessible to those who may not want to navigate cryptocurrency exchanges or store Bitcoin directly. However, it’s important to note that GBTC doesn’t perfectly track the price of Bitcoin, and its value can be influenced by factors like demand and premium/discount to the actual Bitcoin holdings.

66. How does Bitcoin’s fixed supply contribute to its store of value characteristics?

Ans:

- The capped supply of 21 million bitcoins creates scarcity, making it potentially attractive as a store of value similar to precious metals.

- Bitcoin’s fixed supply, capped at 21 million coins, contributes to its store of value characteristics by introducing scarcity.

- In contrast to fiat currencies that can be printed in unlimited quantities, the limited supply of Bitcoin creates a deflationary aspect.

- This scarcity is designed to mimic precious metals like gold, where limited availability can contribute to the preservation of value over time.

67. What is the role of the Bitcoin network’s mempool in transaction processing?

Ans:

The mempool stores unconfirmed transactions, and miners select transactions from it to include in the next block. The mempool, short for “memory pool,” is a crucial component of the Bitcoin network.

It serves as a temporary storage area for unconfirmed transactions that are waiting to be added to a block by miners. When a user initiates a Bitcoin transaction, it enters the mempool, and miners select transactions from this pool to include in the next block they mine.

68. How does the “difficulty adjustment” algorithm maintain a consistent block time in Bitcoin?

Ans:

The difficulty adjustment algorithm regulates the mining difficulty based on the network’s hash rate, aiming for an average block time of 10 minutes. If miners collectively find blocks faster than the target 10-minute interval, the difficulty increases. Conversely, if blocks are being mined more slowly, the difficulty decreases. This adjustment mechanism ensures that, on average, a new block is added to the blockchain every 10 minutes, helping to regulate the rate at which new bitcoins are created and maintaining the overall security and stability of the network.

69. What is the significance of the concept of “verifiability without trust” in Bitcoin?

Ans:

- Bitcoin allows users to verify transactions and the overall state of the network independently without relying on a trusted third party.

- Through cryptographic techniques like digital signatures and the consensus mechanism of mining, participants can verify the authenticity of transactions and the validity of the entire blockchain.

- Each participant can independently confirm that transactions are valid and that no double-spending has occurred without relying on a trusted third party.

70. How does the Lightning Network address Bitcoin’s scalability challenges?

Ans:

The Lightning Network enables faster and cheaper transactions by conducting some off-chain transactions and settling them on the main blockchain later. The Lightning Network addresses Bitcoin’s scalability challenges by introducing off-chain payment channels. On the main Bitcoin blockchain, each transaction needs to be recorded, verified, and confirmed by miners, which can result in slower transaction times and higher fees as the network becomes congested.

71. Explain the concept of “replace-by-fee” (RBF) in Bitcoin transactions.

Ans:

- RBF allows users to replace an unconfirmed transaction with a new one that includes a higher fee, providing flexibility in transaction management.

- Replace-By-Fee” (RBF) is a feature in Bitcoin that allows a user to replace an unconfirmed transaction with a new one that includes a higher transaction fee.

- This can be useful in situations where a user wants to expedite the confirmation of a transaction that’s taking too long due to a low fee.

- By creating a new transaction with a higher fee, miners are more likely to prioritize it, increasing the chances of quicker confirmation.

- It provides users with greater flexibility and control over their transactions in a dynamic fee market.

72. What is the role of the Bitcoin halving in controlling inflation?

Ans:

The halving reduces the rate at which new bitcoins are created, effectively slowing down inflation and contributing to the scarcity of the cryptocurrency. The Bitcoin halving is an event that occurs approximately every four years, reducing the reward miners receive for validating transactions by half. This mechanism is designed to control inflation in the Bitcoin supply. By decreasing the rate at which new bitcoins are created, the total supply of bitcoins grows at a decreasing and predictable pace.

This controlled and diminishing issuance aligns with the principles of scarcity, making Bitcoin a deflationary asset. The halving events are programmed to continue until the maximum supply of 21 million bitcoins is reached, providing a built-in mechanism to manage inflation and create a more predictable supply schedule.

73. How does the concept of “censorship-resistant money” apply to Bitcoin?

Ans:

Bitcoin’s decentralized nature makes it resistant to censorship, ensuring that transactions cannot be easily blocked or manipulated by external entities. Censorship-resistant money” refers to the idea that transactions and the use of a currency are not easily controlled, restricted, or censored by any central authority. In the context of Bitcoin, this means that individuals can transact without the fear of censorship or interference from governments, financial institutions, or any other third party.

74. Explain the concept of the “free market” in Bitcoin transactions.

Ans:

The free market refers to the supply and demand dynamics of transaction fees, where users compete to have their transactions included in the next block. The “fee market” in Bitcoin transactions refers to the supply and demand dynamics of transaction fees within the network. Users attach fees to their transactions to incentivize miners to include them in the next block. As block space is limited, users compete by offering higher fees to have their transactions prioritized.

75. What is the role of the “difficulty bomb” in Ethereum, and how does it differ from Bitcoin’s difficulty adjustment?

Ans:

- Ethereum’s difficulty bomb is a mechanism to encourage network upgrades by gradually increasing mining difficulty.

- Bitcoin’s adjustment is based on hash rate changes. As the difficulty bomb progresses, mining becomes progressively more challenging, slowing down the creation of new blocks.

- This was intended to act as a mechanism to encourage network participants, including miners and developers, to make the switch to Ethereum 2.0 – Ethereum’s planned upgrade to a proof-of-stake consensus mechanism.

76. How does the concept of “sound money” apply to Bitcoin?

Ans:

Sound money principles include characteristics like scarcity, durability, portability, divisibility, and fungibility—all of which Bitcoin exhibits. The concept of “sound money” generally refers to a stable and reliable form of currency.

In the context of Bitcoin, proponents argue that its fixed supply (21 million coins) and decentralized nature make it a sound form of money, resistant to inflation and government manipulation. Critics, however, point to its volatility and potential regulatory uncertainties as challenges to its soundness.

77. Explain the concept of “Proof of Keys” in the Bitcoin community.

Ans:

- Proof of Keys is an annual event where users are encouraged to withdraw their bitcoins from exchanges to promote self-custody and verify solvency.

- Proof of Keys” is an annual event in the Bitcoin community on January 3rd, initiated by Trace Mayer.

- It encourages users to withdraw their bitcoins from third-party exchanges and wallets to ensure they have control over their private keys.

- This practice aims to promote self-custody of funds, emphasizing the importance of not relying on centralized services and enhancing individual sovereignty in managing one’s cryptocurrency assets.

78. How does the concept of “staking” in other cryptocurrencies differ from Bitcoin’s Proof of Work (PoW) consensus mechanism?

Ans:

Staking involves participants locking up coins to support network operations, whereas Bitcoin uses PoW, requiring miners to solve complex mathematical problems. Staking in other cryptocurrencies often involves participants locking up a certain amount of their coins as collateral to support the network’s operations and validate transactions.

This contrasts with Bitcoin’s Proof of Work, where miners solve complex mathematical puzzles to validate transactions and create new blocks. Staking generally requires less computational power and energy, making it a more energy-efficient alternative to PoW.

79. What is the role of the “Genesis Block” in Bitcoin’s history, and why is it significant?

Ans:

The Genesis Block is the first block in the Bitcoin blockchain, containing a unique message and marking the beginning of the cryptocurrency’s existence. The Genesis Block is the first block in the Bitcoin blockchain, mined by Satoshi Nakamoto in January 2009. It serves as the foundation of the entire blockchain and has unique characteristics, including a hard coded message referencing a newspaper headline from that date. The significance lies in its role as the starting point of the decentralized ledger. The inclusion of the coinbase transaction in the Genesis Block marked the creation of the first 50 bitcoins, establishing the initial supply. This block’s existence symbolizes the birth of Bitcoin and the beginning of a new era in digital decentralized currency.

80. Explain the concept of “Satoshi’s Vision” in the context of Bitcoin’s development.

Ans:

- Satoshi’s Vision refers to different interpretations of Nakamoto’s Vision for Bitcoin, often associated with specific scaling strategies and principles.

- “Satoshi’s Vision” refers to the original Vision and principles set forth by Bitcoin’s pseudonymous creator, Satoshi Nakamoto.

- It encompasses the core ideas and design choices embedded in the early development of Bitcoin.

- These include concepts like decentralization, peer-to-peer transactions, cryptographic security, and the use of proof-of-work for consensus.

81. How does the concept of “digital gold” apply to Bitcoin’s value proposition?

Ans:

Bitcoin is often likened to gold due to its scarcity, durability, and potential as a store of value in the digital realm. The concept of “digital gold” refers to Bitcoin’s value proposition as a store of value and a hedge against inflation, similar to how traditional gold has been used throughout history. Like gold, Bitcoin is decentralized, limited in supply (with a capped maximum of 21 million coins), and durable. These qualities contribute to the idea that Bitcoin can serve as a form of “digital gold.”

82. What is the role of the “Bitcoin Pizza Day” in Bitcoin’s history?

Ans:

Bitcoin Pizza Day commemorates the first real-world purchase with bitcoins, where 10,000 BTC was exchanged for two pizzas in 2010. Bitcoin Pizza Day, celebrated on May 22nd, commemorates the first documented commercial transaction using Bitcoin.

On this day in 2010, a programmer named Laszlo Hanyecz paid 10,000 bitcoins for two pizzas. At that time, Bitcoin had very little established value, and this transaction is now famously known for highlighting the early days of Bitcoin adoption.

83. Explain the concept of “privacy coins” and how they differ from Bitcoin.

Ans:

- Privacy coins like Monero and Zcash aim to enhance transaction privacy by implementing advanced cryptographic techniques, offering greater anonymity compared to Bitcoin.

- Privacy coins are cryptocurrencies specifically designed to enhance the privacy and anonymity of transactions.

- Unlike Bitcoin, where transaction details are publicly recorded on the blockchain, privacy coins incorporate various cryptographic techniques to obfuscate or conceal transaction data, sender identities, and recipient addresses.

84. How does the concept of “quantitative hardening” relate to Bitcoin’s scarcity?

Ans:

Quantitative hardening emphasizes Bitcoin’s fixed supply and diminishing block rewards, contributing to its scarcity over time. Quantitative hardening” refers to the reduction of the rate at which new units of a cryptocurrency are created, essentially making the supply more scarce over time.

In the context of Bitcoin, this concept is linked to its built-in mechanism called the “halving.” Approximately every four years, the reward that miners receive for validating transactions is halved, decreasing the rate at which new bitcoins are generated. This gradual reduction in the creation of new bitcoins contributes to the overall scarcity of the cryptocurrency, aligning with the principles of quantitative hardening and enhancing Bitcoin’s value proposition as a limited and deflationary asset.

85. Explain the role of the “Stock-to-Flow” model in predicting Bitcoin’s value.

Ans:

The Stock-to-Flow model relates the existing supply of an asset to its newly produced supply, and it has been used to forecast Bitcoin’s future value. The S2F model gained popularity for predicting Bitcoin’s value because, historically, there has been a correlation between the increasing scarcity (higher Stock-to-Flow ratio) and the rise in Bitcoin’s price. The model suggests that as the rate of new bitcoin production decreases (due to halvings), the scarcity of Bitcoin increases, potentially driving up its value.

86. What is the significance of the “Lightning Torch” experiment in showcasing Bitcoin’s capabilities?

Ans:

- The Lightning Torch demonstrated the Lightning Network’s ability to facilitate small, rapid transactions across the globe, promoting awareness and adoption.

- The “Lightning Torch” experiment was a symbolic initiative within the Bitcoin community to demonstrate the capabilities of the Lightning Network, a second-layer scaling solution for Bitcoin.

- It showcased the network’s ability to facilitate fast and low-cost transactions by passing a small amount of Bitcoin (the torch) through participants.

- This experiment highlighted the potential for microtransactions and scalability improvements in the Bitcoin ecosystem.

87. How does Bitcoin’s consensus mechanism differ from that of other cryptocurrencies like Proof of Stake (PoS)?

Ans:

Bitcoin uses Proof of Work (PoW), requiring miners to solve complex mathematical problems. PoS relies on participants holding coins to validate transactions. Bitcoin primarily relies on a Proof of Work (PoW) consensus mechanism, where miners solve complex mathematical puzzles to validate transactions and secure the network. In contrast, Proof of Stake (PoS) cryptocurrencies assign the right to create new blocks and validate transactions to participants who hold a certain amount of the cryptocurrency.

PoS doesn’t require the extensive computational work seen in PoW, making it more energy-efficient. Each consensus mechanism has its advantages and trade-offs, influencing factors like security, decentralization, and energy consumption in different ways.

88. What is the role of the “UASF” (User Activated Soft Fork) movement in Bitcoin’s history?

Ans:

The UASF movement aimed to activate Segregated Witness (SegWit) through user support, reflecting the community’s influence on protocol upgrades. The User Activated Soft Fork (UASF) movement in Bitcoin’s history was a push by the user community to implement a soft fork through a coordinated upgrade. Specifically, it aimed to activate the segregated witness (SegWit) upgrade to address scalability issues and enable additional features. UASF gained attention in 2017, and its significance lies in the attempt by users to influence protocol changes directly, demonstrating the decentralized nature of Bitcoin governance. Ultimately, the activation of SegWit occurred through a different process, but UASF played a role in highlighting community-driven efforts to shape the protocol’s evolution.

89. Explain the concept of “Bitcoin maximalism” and its implications.

Ans:

- Bitcoin maximalism advocates for the idea that Bitcoin is the only truly decentralized and secure cryptocurrency, often downplaying the value of other digital assets.

- Bitcoin maximalism is the belief that Bitcoin (BTC) is the only legitimate and significant cryptocurrency, advocating for its supremacy over all other digital assets.

- Proponents argue that Bitcoin’s decentralized nature, security, and scarcity make it the ideal store of value and medium of exchange.

- Implications include scepticism toward alternative cryptocurrencies, potential resistance to technological advancements, and a focus on Bitcoin as the primary driver of the decentralized finance (DeFi) ecosystem. Critics argue that this mindset might hinder innovation in the broader blockchain space.

90. How does the concept of “cross-validation” apply to the decentralized nature of Bitcoin?

Ans:

Cross-validation refers to multiple nodes independently validating transactions, contributing to the security and truthfulness of the Bitcoin network.

In the context of Bitcoin, the concept of “cross-validation” doesn’t directly apply as it does in traditional machine learning. However, Bitcoin’s decentralized nature involves a consensus mechanism known as proof-of-work (PoW). In this system, miners compete to solve complex mathematical problems to validate transactions and secure the network.

91. Explain the concept of “second-layer solutions” in addressing Bitcoin scalability issues.

Ans:

Second-layer solutions, like the Lightning Network, are built on top of the Bitcoin blockchain to enable faster and more scalable transactions. Second-layer solutions in Bitcoin scalability refer to protocols or mechanisms built on top of the main Bitcoin blockchain to enhance transaction throughput and reduce fees.

Examples include the Lightning Network, where off-chain channels allow users to conduct faster and cheaper transactions without burdening the main blockchain with every transaction detail. These solutions aim to alleviate congestion and enhance scalability while maintaining the security and decentralization of the underlying blockchain.

92. What is the role of the “Bitcoin network hash rate” in determining the security of the network?

Ans:

A higher hash rate indicates more computational power securing the network, making it more resistant to potential attacks. The Bitcoin network hash rate reflects the total computational power miners contribute to the network. A higher hash rate indicates increased competition among miners to solve complex mathematical problems and validate transactions. This high level of competition makes it extremely difficult for any single entity to control or manipulate the network.