- Introduction to Financial Manager Role

- Educational Qualifications

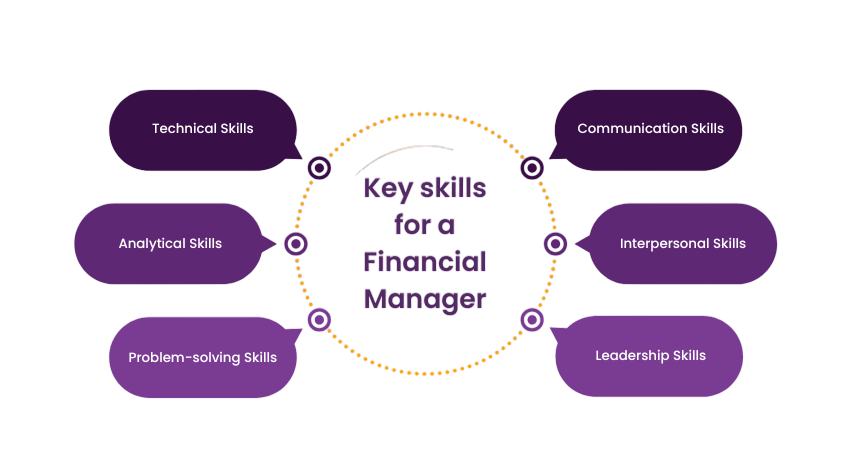

- Key Skills and Competencies

- Professional Certifications (e.g., CPA, CFA)

- Gaining Relevant Work Experience

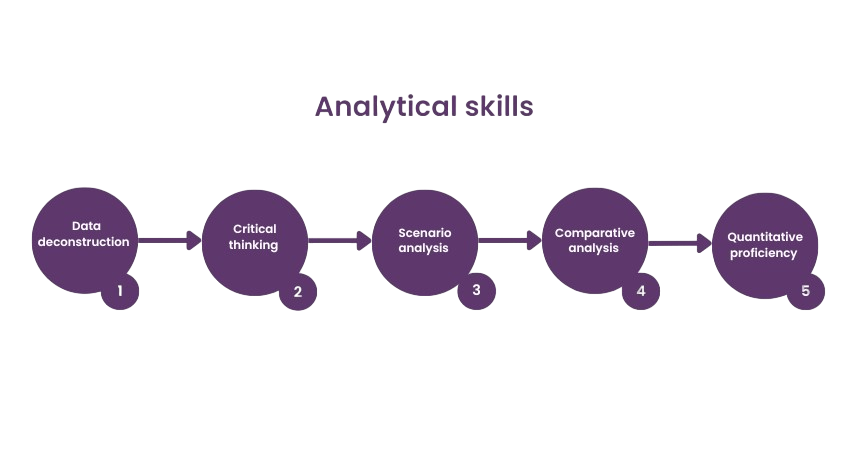

- Building Financial Analysis Skills

- Leadership and Management Development

- Networking in the Finance Industry

- Continuous Learning and Staying Updated

- Typical Career Path

- Salaries and Growth Prospects

- Conclusion

Introduction to Nash Equilibrium

Nash Equilibrium is a foundational concept in game theory and economics, introduced by the mathematician John Nash in 1950. It defines a situation in a non-cooperative game where no player can improve their outcome by changing their strategy alone, assuming the other players’ strategies remain fixed. In other words, each player’s chosen strategy is the best response to the strategies of all other players, creating a state of mutual best responses. This balance means that no one has an incentive to deviate from their current strategy, leading to a stable outcome in the game. The concept of Nash Equilibrium is essential for understanding strategic decision-making in a variety of fields including economics, politics, business, and social sciences. It is widely used to analyze competitive behavior, where multiple decision-makers interact, each trying to maximize their own payoff. For instance, in competitive markets, firms choose pricing or production levels considering the actions of their rivals. In auctions, bidders decide their bids based on what others might do, and in negotiations, parties settle on agreements based on mutual expectations. Nash Equilibrium helps explain how rational individuals or organizations make decisions when their outcomes depend on the choices of others. It shows that even in competitive and sometimes conflicting situations, stable and predictable outcomes can emerge without cooperation. This insight makes it a powerful tool for predicting behavior in strategic interactions and designing mechanisms, policies, or strategies that account for the interdependence of participants’ choices. Understanding this concept is crucial for anyone interested in strategic thinking and competitive analysis.

Introduction to Financial Manager Role

A Financial Manager plays a crucial role in overseeing and managing the financial health of an organization. They are responsible for ensuring the company’s financial resources are used efficiently and effectively to achieve business goals. The role involves creating financial reports, preparing budgets, managing investments, and offering financial guidance to senior management. They are integral to business decisions, often advising on financial strategies and risk management. Financial managers typically work in a variety of sectors including corporate finance, banking, investment, and insurance. The main goal of a financial manager is to ensure the financial stability and growth of the organization by implementing solid financial strategies, controlling expenditures, managing risks, and providing insight into investment decisions.

Educational Qualifications

To become a financial manager, it is essential to have a strong educational Qualifications, particularly in fields related to finance, accounting, or economics. Typically, a bachelor’s degree in finance, accounting, economics, or business administration is required. This degree provides a solid foundation in the principles of financial management, managing investments, corporate finance, accounting, and economics, which are essential for performing managerial tasks. While a bachelor’s degree is often the minimum requirement, many financial managers further their education with a master’s degree, such as a Master of Business Administration (MBA) with a focus on finance or a Master’s in Finance. Advanced studies offer deeper insights into financial modeling, risk management, and financial strategy, which are essential for higher-level management roles.

Key Skills and Competencies

Financial managers must possess a variety of technical and interpersonal skills to excel in their roles. Here are some of the key skills required:

- Analytical Skills: Financial managers must be able to analyze financial data, identify trends, and make informed decisions based on their findings.

- Attention to Detail: Given the complexity of financial data, attention to detail is crucial to ensure that all numbers are accurate and properly interpreted.

- Communication Skills: Financial managers need to be able to explain complex financial concepts to non-financial colleagues, which requires strong written and verbal communication skills.

- Problem-Solving Skills: They must be able to approach financial challenges with effective solutions, often under pressure.

- Leadership and Management Skills: As they may lead a team, financial managers must be effective leaders who can inspire, motivate, and manage their team’s performance.

- Technical Proficiency: A strong grasp of financial software and tools, such as Microsoft Excel, QuickBooks, and enterprise resource planning (ERP) systems, is crucial.

- Risk Management: Understanding how to mitigate risks and create financial strategies that can safeguard the company’s assets is essential.

- Certified Public Accountant (CPA): While traditionally associated with accounting, a CPA can also be beneficial for financial managers who wish to deepen their understanding of tax laws, auditing, and financial reporting.

- Chartered Financial Analyst (CFA): The CFA designation is widely recognized in the finance industry and focuses on investment analysis, portfolio management, and financial ethics. This certification is ideal for those aiming for senior financial management or investment-related roles.

- Certified Management Accountant (CMA): A CMA is focused on management accounting and corporate financial management. It is ideal for professionals working in managerial roles within financial departments.

- Financial Risk Manager (FRM): The FRM certification is suited for those specializing in risk management, which is critical for financial managers responsible for protecting the company’s financial interests.

- Financial Statement Analysis: Understanding the balance sheet, income statement, and cash flow statement allows managers to evaluate an organization’s financial health and performance.

- Budgeting and Forecasting: Financial managers work closely with other departments to create realistic financial projections and budgets based on historical data and market trends.

- Ratio Analysis: Ratios such as return on investment (ROI), current ratio, and debt-to-equity ratio are vital in assessing financial performance and ensuring the organization is on track with its goals.

- Cost Management: Analyzing costs to increase profitability and control operational expenses is essential for a financial manager’s role.

- Manage Teams: Financial managers often lead teams of accountants, analysts, and other financial professionals. Having the ability to manage and motivate teams is essential for meeting organizational goals.

- Strategic Thinking: Successful financial managers must understand the big picture, not just the numbers. They need to contribute to the company’s long-term strategy by advising on the most profitable and sustainable financial approaches.

- Decision Making: Being able to make fast and informed decisions, often under pressure, is a crucial skill for leadership in financial management.

- Attending Workshops and Seminars: Participate in finance-related workshops, webinars, and seminars to gain knowledge of the latest tools, regulations, Building Relationships and industry trends.

- Advanced Certifications and Courses: Obtaining advanced certifications and taking relevant courses can enhance your skills and help you specialize in niche areas like risk management, investments, or financial modeling.

- Staying Current with Financial News: Subscribing to financial publications, blogs, and podcasts can help you stay informed about the latest news in finance and economics.

- Entry-Level: Most financial managers start as junior analysts, accountants, or auditors, gaining experience in financial reporting and analysis.

- Mid-Level: With experience, individuals may be promoted to senior financial analyst or assistant finance manager roles, where they take on more responsibility in budgeting, forecasting, and decision-making.

- Senior-Level: At this stage, professionals may become finance managers or controllers, overseeing larger teams, managing more complex financial operations, and providing strategic advice to senior leadership.

- Executive Level: The final step is moving into executive positions such as Chief Financial Officer (CFO) or finance director. These roles involve overall financial strategy, policy-making, and direct involvement in business decisions at the highest level.

Professional Certifications (e.g., CPA, CFA)

To further their careers and demonstrate their expertise, many financial managers obtain professional certifications. Some of the most prominent certifications include:

Gaining Relevant Work Experience

Work experience is critical for advancing in the financial management career path. Typically, individuals begin their careers as financial analysts, Chartered Financial Analyst, accountants, or auditors. Gaining experience in financial reporting, forecasting, and budgeting lays a strong foundation for moving into management positions. Over time, financial analysts can be promoted to more senior positions such as senior financial analyst or finance manager. Hands-on experience in managing financial statements, preparing financial reports, managing investments and overseeing budgets helps to build practical expertise in handling the financial complexities of an organization. Internships and entry-level positions offer valuable exposure to the work environment and the financial tools used in the industry, providing the experience needed to take on more responsibility.

Building Financial Analysis Skills

Financial analysis is at the core of a financial manager’s role. Building strong financial analysis skills is necessary to interpret data, forecast financial trends, and make sound decisions. Some key aspects of financial analysis that financial managers focus on include:

Leadership and Management Development

As a financial manager, leadership skills are equally as important as technical financial knowledge. Developing leadership skills is crucial for those who wish to move into senior financial management positions. Effective leaders are able to:

Networking in the Finance Industry

Networking is an important component of career advancement in finance. Building relationships with other professionals in the field helps you stay informed about industry trends, new job opportunities, and best practices. Attend industry conferences, seminars, and financial networking events to stay connected with peers. Additionally, joining professional organizations such as the CFA Institute, AICPA (American Institute of Certified Public Accountants), and IMA (Institute of Management Accountants) can help you build a network of fellow professionals and access valuable resources.

Continuous Learning and Staying Updated

The finance industry is dynamic and constantly evolving. Financial regulations, market trends, and technological advancements are continually changing. To stay competitive and relevant in the industry,Chartered Financial Analyst financial managers must embrace continuous learning. Some ways to stay updated include:

Typical Career Path

The career path for how to become a financial manager typically progresses through several stages:

Salaries and Growth Prospects

The salary of a financial manager varies widely depending on location, education, experience, and industry. On average, financial managers in the United States earn between $90,000 and $140,000 annually, with the potential for bonuses and profit-sharing. In larger corporations or high-cost areas like New York or San Francisco, salaries and Growth Prospects can exceed $150,000 per year. The job outlook for financial managers is positive, with the U.S. Bureau of Labor Statistics projecting a growth rate of 15% from 2020 to 2030, much faster than the average for other occupations. This growth is driven by the need for organizations to manage their finances effectively, navigate complex regulations, and implement financial technologies.

Conclusion

The role of how to Become a financial manager is both challenging and rewarding, offering a broad scope for career growth and development. A combination of strong educational qualifications, relevant certifications, hands-on experience, salaries and Growth prospects and ongoing professional development is essential to succeed in this field. With the increasing complexity of global financial markets, the demand for skilled financial managers is expected to grow, offering both lucrative salaries and career advancement opportunities.