- Introduction to Cost Accounting Formulas

- Importance of Formulas in Cost Accounting

- Break even Point Formula

- Contribution Margin Formul

- Overhead Rate Calculation

- Marginal Costing Formula

- Absorption Costing Formula

- Inventory Valuation Methods

- Activity Based Costing Formula

- Variance Analysis Formulas

- Cost Volume Profit Analysis

- Conclusion

Introduction to Cost Accounting Formulas

Cost accounting Formulas is a specialized branch of accounting that deals with the calculation, management, and control of costs incurred by a business. Unlike financial accounting, which focuses on external reporting, cost accounting is used internally to make informed decisions that can help improve the efficiency and profitability of a business. It provides valuable insights into cost behavior, cost structures, and profitability, enabling management to make strategic decisions such as pricing, budgeting, and financial forecasting. In today’s competitive business environment, effective cost control is crucial to maximizing profits. Cost accounting helps in determining the cost of production, the allocation of overheads, and the evaluation of cost efficiency across departments or product lines. By analyzing the costs, businesses can identify areas where wasteful expenditure can be minimized, thus improving overall financial performance. The discipline also plays a vital role in inventory management, budgeting, and decision-making processes, ensuring that resources are utilized optimally.

Importance of Formulas in Cost Accounting

- Formulas in cost accounting Formulas are essential because they provide structured ways to compute and analyze costs.

- They help accountants and managers evaluate cost-related data efficiently, making it easier to track expenditures, understand cost behaviors, and make informed decisions.

- These formulas play a crucial role in understanding how fixed, variable, and semi-variable costs affect business operations.

- By applying the correct formulas, businesses can calculate critical metrics that influence pricing strategies, profitability, Inventory valuation and cost control.

- In cost accounting, formulas are not just numbers; they are tools that reflect business realities.

- For instance, calculating the break-even point helps managers understand how much of a product must be sold to cover all fixed and variable costs.

- Similarly, knowing the contribution margin helps in analyzing the profitability of individual products, which is essential for making decisions about product lines and pricing.

- Therefore, cost accounting formulas are indispensable for managing costs and improving business decision making.

Break-even Point Formula

The break-even point (BEP) is the point at which total revenues equal total costs, resulting in neither profit nor loss. It is a critical concept in cost accounting, as it helps businesses understand the minimum sales level needed to avoid losing money. The break-even point is particularly useful for decision-making, particularly in pricing, cost management, improve profitability and profitability analysis. The formula to calculate the break-even point is: Break-even Point (units)=Fixed CostsSelling Price per Unit−Variable Cost per Unit\text{Break-even Point (units)} = \frac{\text{Fixed Costs}}{\text{Selling Price per Unit} – \text{Variable Cost per Unit}}

- Fixed Costs are the costs that do not change with the level of production or sales (e.g., rent, salaries).

- Selling Price per Unit is the amount at which a product is sold to customers.

- Variable Cost per Unit is the cost that varies with the production level (e.g., raw materials, labor). The break-even point tells businesses how many units need to be sold at a given price to cover all fixed and variable costs. Once sales exceed the break-even point, the business starts making a profit.

- Total Overhead Costs include expenses like rent, utilities, and salaries for staff who are not directly involved in production.

- Total Activity Base can be machine hours, labor hours, or any other base used to allocate overhead costs.

- FIFO (First-In, First-Out): Assumes that the first units purchased are the first ones sold. This method is commonly used in industries where inventory has a limited shelf life, such as food and pharmaceuticals.

- LIFO (Last-In, First-Out): Assumes that the most recently purchased units are the first ones sold. LIFO is often used in industries with rising costs, as it matches higher costs with current revenues.

- Weighted Average Cost: Calculates an average cost for all units in inventory, regardless of when they were purchased. This method is often used in industries where products are indistinguishable from one another. Each of these methods affects the calculation of COGS and, consequently, the gross profit, making it an important consideration for businesses.

- Material Variance: Material Variance=(Actual Price−Standard Price)×Actual Quantity\text{Material Price Variance} = (\text{Actual Price} – \text{Standard Price}) \times \text{Actual Quantity} Material Usage Variance =(Actual Quantity−Standard Quantity)×Standard Price\text{Material Usage Variance} = (\text{Actual Quantity} – \text{Standard Quantity}) \times \text{Standard Price}

- Labor Variance: Labor Rate Variance=(Actual Rate−Standard Rate)×Actual Hours\text{Labor Rate Variance} = (\text{Actual Rate} – \text{Standard Rate}) \times \text{Actual Hours} Labor Efficiency Variance =(Actual Hours−Standard Hours)×Standard Rate\text{Labor Efficiency Variance} = (\text{Actual Hours} – \text{Standard Hours}) \times \text{Standard Rate}

- Overhead Variance: Overhead Spending Variance=Actual Overhead−Budgeted Overhead\text{Overhead Spending Variance} = \text{Actual Overhead} – \text{Budgeted Overhead} Overhead Efficiency Variance =(Actual Hours−Standard Hours)×Standard Overhead Rate\text{Overhead Efficiency Variance} = (\text{Actual Hours} – \text{Standard Hours}) \times \text{Standard Overhead Rate}

- Contribution Margin: Contribution Margin=Sales−Variable Costs\text{Contribution Margin} = \text{Sales} – \text{Variable Costs}

- Break-even Point: Break-even Point (units)=Fixed CostsContribution Margin per Unit\text{Break-even Point (units)} = \frac{\text{Fixed Costs}}{\text{Contribution Margin per Unit}}

- Target Profit: Required Sales to Achieve Target Profit=Fixed Costs+Target ProfitContribution Margin per Unit\text{Required Sales to Achieve Target Profit} = \frac{\text{Fixed Costs} + \text{Target Profit}}{\text{Contribution Margin per Unit}}

Contribution Margin Formula

The contribution margin is a key financial metric that helps businesses assess the improve profitability of individual products or services. It represents the amount of revenue from each unit sold that is available to cover fixed costs and contribute to profit. The contribution margin formula helps in calculating how much money is generated after covering the variable costs.

The formula for calculating the contribution margin is:Contribution Margin=Selling Price per Unit−Variable Cost per Unit\text{Contribution Margin} = \text{Selling Price per Unit} – \text{Variable Cost per Unit}

The contribution margin can also be calculated on a total basis for all units sold:Total Contribution Margin=Total Sales−Total Variable Costs\text{Total Contribution Margin} = \text{Total Sales} – \text{Total Variable Costs}

The contribution margin is vital because it helps in determining the amount of sales needed to cover fixed costs and reach profitability. The higher the contribution margin, the more profitable the product is likely to be.

Overhead Rate Calculation

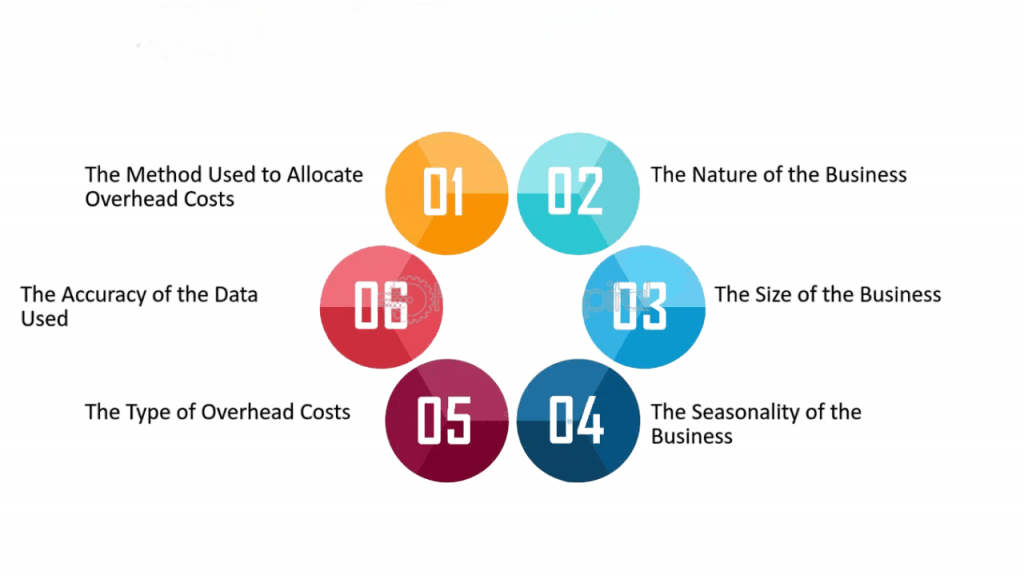

Overhead costs are those that are not directly attributable to a specific product or service but are necessary for running the business. These costs are allocated to products or services based on an overhead rate. The overhead rate calculation helps businesses determine the amount of overhead cost to allocate to each unit of production.

The formula for calculating the overhead rate is:Overhead Rate=Total Overhead CostsTotal Activity Base\text{Overhead Rate} = \frac{\text{Total Overhead Costs}}{\text{Total Activity Base}}

The overhead rate is essential for pricing products accurately, as it ensures that indirect costs are appropriately included in the cost of goods sold (COGS). It is particularly important in manufacturing businesses where overhead costs can be significant.

Marginal Costing Formula

Marginal costing Formula is a method of costing that focuses on the cost of producing one additional unit of output. It is used to analyze the impact of changes in production levels on overall costs and profitability. The marginal cost consists of variable costs only, as fixed costs remain constant regardless of the production level.

The formula for calculating marginal cost is:Marginal Cost=Total Variable Costs/Total Units Produced\text{Marginal Cost} = \text{Total Variable Costs} / \text{Total Units Produced}

Marginal costing Formula is used to make decisions about pricing, production volumes, and the profitability of different product lines. It is particularly useful in determining the impact of producing additional units and in assessing how changes in fixed and variable costs affect profitability.

Absorption Costing Formula

Absorption costing Formula is a method of accounting for all costs associated with manufacturing a product, including both variable and fixed costs. It is used to allocate overhead costs to products and determine the total cost of production. Unlike marginal costing, absorption costing includes fixed costs in the product cost, making it more suitable for external financial reporting. The formula for calculating absorption costing is:

Absorption Cost per Unit=Total Fixed Costs+Total Variable CostsTotal Units Produced\text{Absorption Cost per Unit} = \frac{\text{Total Fixed Costs} + \text{Total Variable Costs}}{\text{Total Units Produced}}

Absorption costing Formula is typically used in external reporting and financial statements because it aligns with generally accepted accounting principles (GAAP). However, for internal decision-making, businesses often use marginal costing, as it provides more flexibility in analyzing cost behavior.

Inventory Valuation Methods

Inventory valuation is an important aspect of cost accounting, as it determines the cost of goods sold (COGS) and ending inventory on the balance sheet. Several methods can be used to value inventory, each having an impact on the financial statements. Common inventory valuation methods include:

Activity-Based Costing Formula

Activity-based costing (ABC) is a method of allocating overhead costs based on the activities that drive those costs. It is more accurate than traditional costing methods, as it assigns overhead costs to specific products or services based on the activities that generate the costs. The formula for calculating ABC is:

Cost per Activity=Total Overhead Costs for ActivityTotal Activity Levels\text{Cost per Activity} = \frac{\text{Total Overhead Costs for Activity}}{\text{Total Activity Levels}}

Once the cost per activity is calculated, businesses can allocate these costs to products or services based on their consumption of each activity. ABC provides more accurate cost information, allowing businesses to make better pricing and product mix decisions.

Variance Analysis Formulas

Variance analysis is used to compare actual costs with budgeted or standard costs to identify discrepancies and evaluate performance. By analyzing the variance, businesses can determine whether they are operating efficiently or if corrective actions are needed. The most common formulas in variance analysis are:

Cost Volume Profit Analysis

Cost-Volume-Profit (CVP) analysis is a financial tool used to understand the relationship between costs, sales volume, and profits. It helps businesses determine how changes in the level of production or sales affect profitability. The basic concept of CVP analysis is to understand the impact of fixed costs, variable costs, and sales prices on a company’s profitability. The key formulas in CVP analysis include:

Conclusion

Cost accounting is an essential discipline that helps businesses manage costs, allocate resources efficiently, and improve profitability. The formulas used in cost accounting, such as the break-even point, contribution margin, Inventory valuation and overhead rate, are key tools for understanding cost behavior and making informed decisions. By employing various costing methods, such as marginal costing, absorption costing, and activity-based costing, businesses can gain a clearer understanding of their cost structures and profitability. Furthermore, Material Variance, variance analysis and cost-volume-profit analysis help businesses evaluate performance and make adjustments to achieve financial goals. Cost accounting is crucial not only for financial reporting but also for strategic decision-making, and mastering its formulas is essential for any business aiming for long-term success.