- Introduction

- Definition of Financial Accounting

- Definition of Management Accounting

- Key Objectives

- Audience and Users

- Reporting Frequency

- Legal Requirements

- Types of Reports Generated

- Time Orientation (Historical vs Future)

- Tools and Techniques Used

- Integration in Business Strategy

- Summary of Differences

Introduction

Financial accounting vs Management accounting are two essential branches of accounting that serve different purposes but are both integral to the overall financial health and decision-making processes of an organization. While financial accounting focuses on recording and reporting past financial activities, management accounting is more concerned with providing information for internal management decisions that affect the future of the organization. In this comprehensive guide, we will delve into the definitions, objectives, users, reporting mechanisms, legal requirements, types of reports, time orientation, tools and techniques, and the integration of these two branches of accounting within business strategy. We will also provide a clear summary of the differences between Financial accounting vs Management accounting to help distinguish their unique roles within an organization.

Definition of Financial Accounting

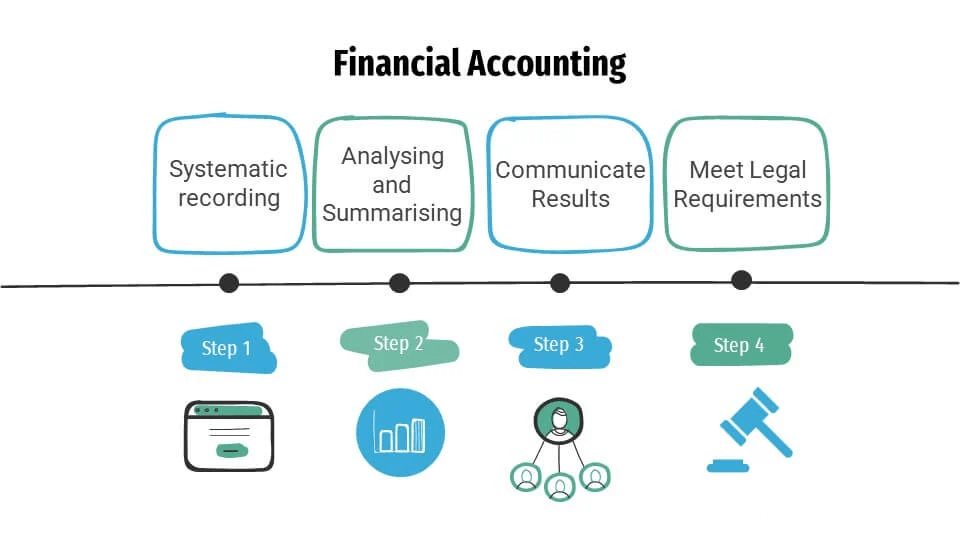

Financial accounting refers to the process of recording, classifying, and summarizing financial transactions to prepare reports that provide an overview of a company’s financial status. These reports, typically financial statements such as the balance sheet, income statement, and cash flow statement, are primarily intended for external stakeholders such as investors, creditors, regulators, and tax authorities. The primary focus is on the historical performance and financial position of an organization.

The key feature of financial accounting is its adherence to established accounting standards, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), which ensure consistency, reliability, and comparability in the financial reports across different companies and industries.

Definition of Management Accounting

Management accounting, on the other hand, is the process of preparing financial and non-financial information to help internal management make decisions aimed at achieving the organization’s goals. Unlike financial accounting, management accounting is not bound by external regulations or standards and is focused on providing detailed, forward-looking information to guide decision-making. It includes both financial data and operational data, such as performance metrics, cost analysis, and budget forecasts. Management accounting tools are used by managers at all levels to assess the efficiency and effectiveness of different functions within the organization. These reports are usually confidential and are not shared with external parties.

Key Objectives

The key objectives of financial accounting and management accounting reflect the differences in their purposes:

Financial Accounting:

- To provide a clear and accurate overview of a company’s financial performance and position.

- To ensure compliance with regulatory requirements and accounting standards.

- To provide external stakeholders with reliable information for investment, lending, and regulatory purposes.

Management Accounting:

- To provide actionable insights to internal management for making strategic decisions.

- To facilitate performance evaluation, cost control, budgeting, and forecasting.

- To assist in achieving operational efficiency and business profitability.

Audience and Users

The users of financial accounting and management accounting reports differ significantly:

-

Financial Accounting:

- External Stakeholders: Financial accounting is primarily aimed at external users such as investors, creditors, financial analysts, regulators, and tax authorities. These stakeholders rely on financial statements to assess the financial health of an organization and make informed decisions regarding investment, credit, and regulatory compliance. Management Accounting:

- Internal Management: Management accounting is intended for internal stakeholders such as company executives, managers, department heads, and operational teams. These users rely on management accounting data to make day-to-day operational decisions, set budgets, and plan for the future.

Reporting Frequency

One of the main differences between management accounting and financial accounting is how often reports are created. Financial accounting typically produces reports on a quarterly or yearly schedule. These reports aim to meet legal requirements and provide information to outside parties, such as creditors, regulators, and investors. Annual financial statements are often audited to ensure accuracy, consistency, and transparency. In contrast, management accounting is much more flexible and responsive to internal needs. Reports are generated more frequently, sometimes monthly, weekly, or even daily, depending on what management requires for decision-making. These reports are constantly updated to provide real-time or near-real-time insights, helping businesses stay agile and make informed operational choices.

Legal Requirements

The legal and regulatory framework that controls management accounting and financial accounting is a key difference between the two fields. Financial accounting is governed by strict laws. These laws require that companies follow accepted standards like GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards). Companies must record and report transactions according to these frameworks. Additionally, publicly traded firms must follow these standards when submitting their financial statements. This oversight ensures transparency, accountability, and comparability in financial reports for external stakeholders. On the other hand, management accounting has no mandatory legal or regulatory rules. Organizations can develop their own internal reporting systems tailored to their specific operational and strategic needs. There are no global guidelines that govern the preparation of management accounting reports. The primary aim is to provide timely, accurate, and relevant information to support internal decision-making, rather than to meet external regulatory requirements.

Types of Reports Generated

Both financial and management accounting generate distinct types of reports to serve their respective purposes:

-

Financial Accounting:

- Income Statement (Profit and Loss Statement): Summarizes the company’s revenues, expenses, and profits over a specific period.

- Balance Sheet: Provides a snapshot of the company’s assets, liabilities, and equity at a given point in time.

- Cash Flow Statement: Shows the movement of cash into and out of the business, highlighting the company’s ability to generate cash and manage its liquidity. Management Accounting:

- Budgets: Detailed financial plans that outline expected revenues and expenditures for a specific period.

- Variance Analysis: Compares actual performance with budgeted figures to identify deviations and their causes.

- Cost Analysis Reports: Breakdowns of costs incurred by the business, such as variable, fixed, and semi-variable costs, to assess efficiency and profitability.

- Break-even Analysis: Calculates the point at which total revenues equal total costs, indicating the level of sales needed to cover all costs.

Time Orientation (Historical vs Future)

The time orientation of financial accounting and management accounting is another key difference:

Financial Accounting: Financial accounting focuses on the past. It involves recording historical transactions and preparing reports that reflect the company’s financial performance and position as of a specific date or over a defined period. The emphasis is on accurately capturing data related to past activities to ensure compliance and provide a clear financial history. Management Accounting: Management accounting is forward-looking and future-oriented. It provides insights and predictions that help managers make decisions that will affect the company’s future performance. While it may include historical data for comparison, the primary goal is to support planning, budgeting, and forecasting.

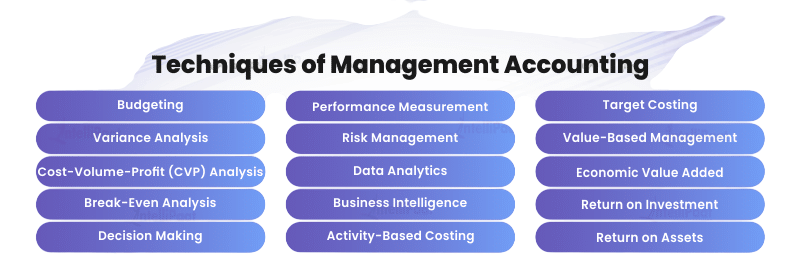

Tools and Techniques Used

Both financial and management accounting rely on a range of tools and techniques, but they differ in their approach:

-

Financial Accounting:

- Double-entry Bookkeeping: The fundamental method for recording financial transactions, ensuring that the accounting equation (Assets = Liabilities + Equity) remains balanced.

- Accounting Software: Tools such as QuickBooks, SAP, and Oracle Financials are commonly used to manage financial data and generate reports.

- Auditing: Independent verification of financial statements by external auditors to ensure compliance and accuracy. Management Accounting:

- Costing Methods: Techniques such as activity-based costing (ABC), marginal costing, and standard costing are used to allocate costs and evaluate profitability.

- Budgeting Tools: Various budgeting models, such as zero-based budgeting (ZBB) or incremental budgeting, are used for planning.

- Performance Metrics: KPIs, dashboards, and other metrics are used to measure and track performance against objectives.

Integration in Business Strategy

While management accounting and financial accounting have different functions and audiences, both play an important role in shaping and supporting company strategy. Financial accounting provides standardized financial data to outside parties like investors, creditors, and regulators. This enhances transparency and accountability. Such openness can impact a company’s ability to raise capital, which in turn affects investor trust. The financial statements also offer a snapshot of the company’s financial health. This information is vital for long-term strategic planning, as it reveals the organization’s resources and overall financial stability. In contrast, management accounting focuses on internal needs and is closely linked to executing the business strategy. It supplies managers with the tools they need to control costs, improve operations, and ensure business activities support strategic goals. By delivering real-time insights on factors like performance, profitability, and efficiency, management accounting aids decision-making and directs both strategic and tactical efforts across departments.

Summary of Differences

To summarize, here is a comparison of the key differences between Financial accounting vs Management accounting

| Aspect | Financial Accounting | Management Accounting |

|---|---|---|

| Objective | To provide historical financial information to external users. | To provide information for internal decision-making. |

| Audience | External stakeholders (investors, creditors, regulators) | Internal management and staff. |

| Reporting Frequency | Periodic (quarterly, annually). | Frequent (monthly, weekly, daily). |

| Legal Requirements | Governed by laws and accounting standards (GAAP, IFRS). | No legal requirements; company-specific. |

| Types of Reports | Income statement, balance sheet, cash flow statement. | Budgets, cost reports, variance analysis, and break-even analysis. |

| Time Orientation | Past-oriented (historical data). | Future-oriented (planning and forecasting). |

| Tools & Techniques | Double-entry bookkeeping, auditing, and accounting software. | Costing methods, performance metrics, and budgeting tools. |

| Integration with Strategy | Provides transparency for external stakeholders. | Directly supports operational and strategic decisions. |

In conclusion, while both Financial accounting vs Management accounting are essential for an organization’s success, they serve different purposes and audiences. Financial accounting is focused on providing an accurate representation of past financial performance for external stakeholders, while management accounting is geared towards helping internal managers make informed decisions that shape the organization’s future.