- Defining a Recession

- Causes and Economic Triggers

- Identifying Recession Indicators

- The Business Cycle and Recessions

- Impact on Employment and Businesses

- Government and Central Bank Responses

- Differences Between Recession and Depression

- Historical Examples of Major Recessions

Defining a Recession

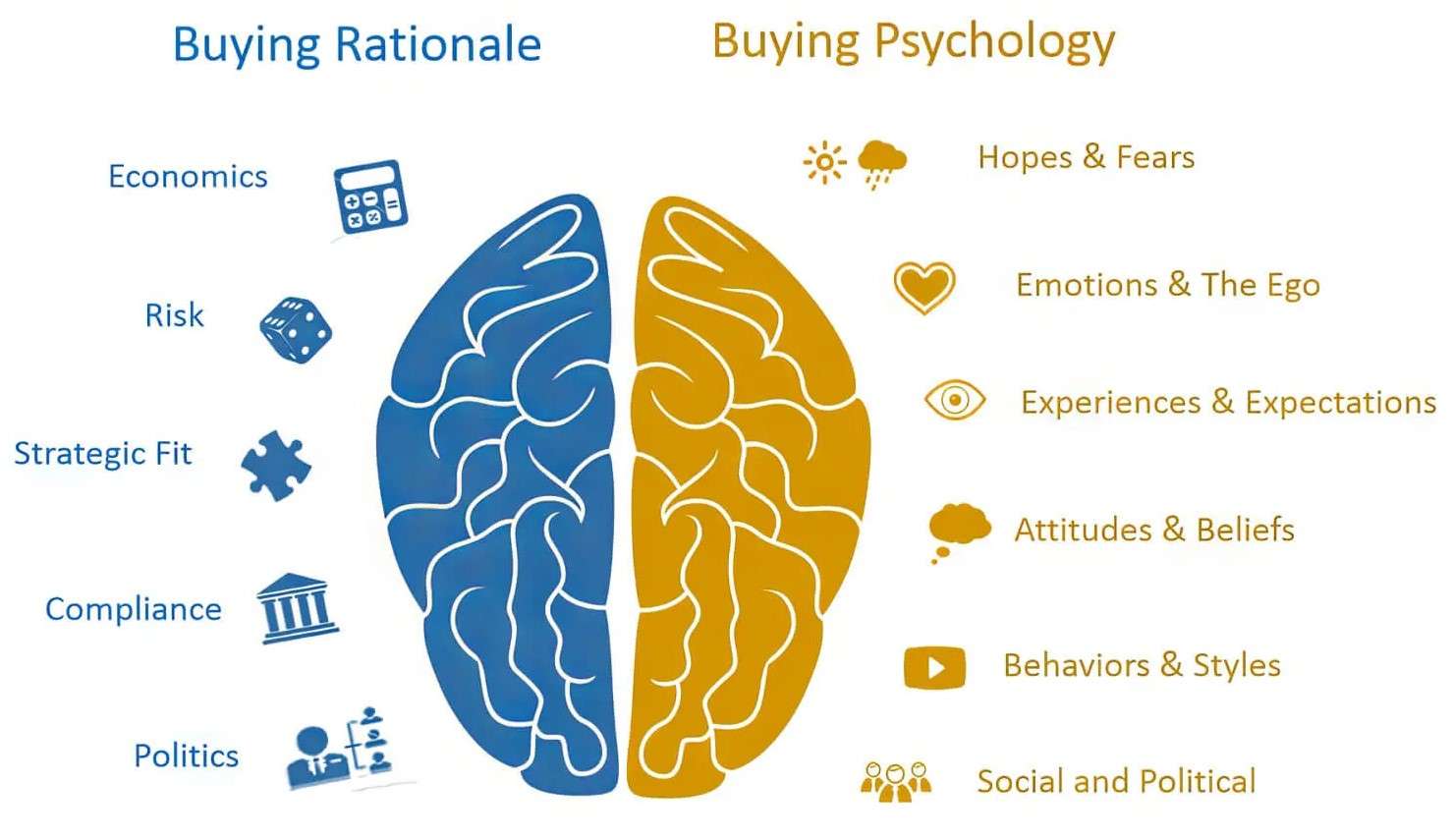

Defining a recession involves recognizing a significant decline in economic activity across the economy, lasting more than a few months. It’s typically marked by falling GDP, rising unemployment, reduced consumer spending, and declining industrial production. Recessions can be triggered by various factors such as financial crises, high inflation, or global disruptions. While they bring economic uncertainty, they also present opportunities for strategic financial planning. Understanding the best investments during a recession can help preserve and grow wealth; these often include government bonds, dividend-paying stocks, and essential commodities. Meanwhile, recession proof investments focus on assets tied to sectors that maintain steady demand regardless of economic cycles. Likewise, recession proof businesses such as healthcare, utilities, and grocery retail tend to perform reliably during downturns due to their essential nature. By being informed and proactive, individuals and businesses can navigate recessions more confidently, safeguarding their financial health and even leveraging downturns for long-term gains. Recognizing the signs early and adapting with resilient strategies is key to weathering economic storms effectively.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Causes and Economic Triggers

- High Inflation: When prices rise too quickly, purchasing power drops, forcing central banks to raise interest rates often leading to reduced consumer spending and business investments.

- Excessive Interest Rate Hikes: While meant to curb inflation, aggressive rate hikes can slow economic growth, reduce borrowing, and trigger a recession.

- Stock Market Crashes: Sudden, sharp declines in stock markets can wipe out wealth, shake consumer confidence, and stall investment activity.

Understanding what causes a recession is essential for recognizing early warning signs and preparing accordingly. Recessions don’t happen randomly they’re often the result of specific economic triggers that disrupt normal market activity and lead to widespread financial downturns. Whether it’s a global recession or a localized economic slump, knowing the root causes can guide smarter financial choices, especially when it comes to investing in a recession or identifying reliable recession indicators. Below are six key causes and triggers of a world recession:

- Global Supply Chain Disruptions: Events like pandemics or wars can halt production and distribution, triggering a world recession.

- Debt Crises: High levels of public or private debt can spiral out of control, leading to defaults and economic instability.

- Geopolitical Tensions: Political instability, trade wars, or military conflicts can act as major economic triggers that tip markets into recession.

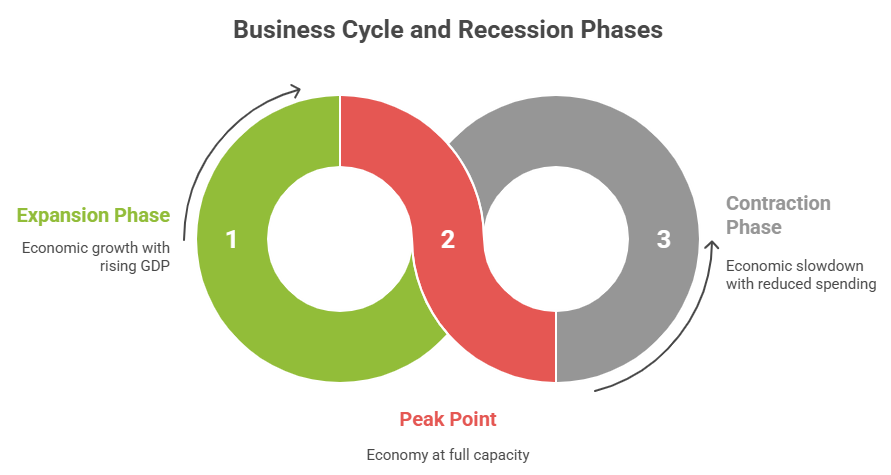

- Expansion Phase: This is a period of economic growth marked by rising GDP, low unemployment, and increased consumer confidence.

- Peak Point: At the cycle’s peak, the economy operates at full capacity. However, inflation pressures and asset bubbles may begin forming often early economic triggers for a downturn.

- Contraction Phase: A slowdown in economic activity begins, with reduced spending and investment. Monitoring recession indicators like declining output and rising layoffs becomes essential here.

- Trough Stage: This is the lowest point of the cycle where the recession bottoms out before recovery begins.

- Recovery Period: The economy slowly regains strength through job growth and renewed investment, signaling the end of the recession phase.

- Strategic Response: Understanding the cycle helps in investing in a recession wisely and identifying recession proof investments that perform well even in downturns, especially during a global recession scenario.

- Monetary Policy Easing: Central banks often lower interest rates to make borrowing cheaper, encouraging businesses and consumers to spend and invest more.

- Quantitative Easing (QE): In severe downturns, central banks may inject liquidity into the economy by purchasing government securities, increasing money supply and boosting market activity.

- Fiscal Stimulus: Governments launch stimulus packages that include tax cuts, unemployment benefits, and direct cash transfers to support individuals and businesses.

- Infrastructure Spending: Investment in public infrastructure creates jobs and stimulates demand, providing an immediate boost to the economy.

- Support for Key Industries: Governments may offer bailouts or subsidies to industries hit hardest by recession, helping prevent mass layoffs and stabilizing essential services.

- Monitoring Recession Indicators: Ongoing analysis of key recession indicators allows policymakers to fine-tune responses. These actions also influence how people approach investing in a recession, as policy stability often determines market confidence during a global recession.

By understanding these causes, individuals can make more informed decisions about investing in a recession and tracking relevant recession indicators for timely action.

Identifying Recession Indicators

Identifying recession indicators is crucial for preparing ahead of economic downturns and making informed financial decisions. These indicators serve as warning signs that the economy may be contracting. Key recession indicators include a decline in GDP over two consecutive quarters, rising unemployment rates, reduced consumer spending, falling manufacturing output, and an inverted yield curve in bond markets. Monitoring these trends can help individuals and businesses anticipate challenges and adjust their strategies accordingly. For example, during periods when these signs emerge, many investors begin shifting their portfolios toward recession proof investments, such as utilities, healthcare stocks, or government bonds, which tend to remain stable despite economic fluctuations. At the same time, recognizing the potential of recession proof businesses, like grocery stores, repair services, and discount retailers, can provide both employment and entrepreneurial opportunities. Furthermore, understanding these indicators helps individuals identify the best investments during a recession, focusing on assets with steady returns and lower risk. By staying alert to these economic signals, one can better navigate financial uncertainty, protect their wealth, and potentially find growth opportunities even in challenging times. Being proactive rather than reactive is the key to maintaining financial stability during downturns.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

The Business Cycle and Recessions

The business cycle refers to the natural rise and fall of economic activity over time, consisting of periods of expansion and contraction. Recessions are a normal, though challenging, part of this cycle. Understanding the relationship between the business cycle and recession phases can help individuals and businesses identify economic triggers, watch for recession indicators, and prepare for the potential of a global recession or even a broader world recession. Here are six key points explaining this connection:

Impact on Employment and Businesses

The impact of a recession on employment and businesses is often swift and severe, with widespread job losses, reduced hiring, and cost-cutting becoming the norm across industries. As consumer demand drops, companies experience shrinking revenues, forcing many to downsize, freeze wages, or even shut down. Small businesses, in particular, face the brunt of the downturn due to limited cash flow and reduced access to credit. However, not all sectors suffer equally. Recession proof businesses such as healthcare, utilities, and essential retail tend to maintain stability due to consistent demand, making them vital anchors during economic storms. For individuals concerned about job security and financial planning, understanding the landscape becomes essential. This is where knowledge of recession proof investments comes into play, as assets tied to stable industries or necessities offer safer returns during turbulent times. Moreover, identifying the best investments during a recession, such as dividend-paying stocks, gold, and government bonds, can help preserve and even grow wealth. By aligning employment strategies with resilient sectors and adopting a defensive investment approach, both individuals and business owners can better withstand economic shocks and position themselves for recovery once the downturn passes.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Government and Central Bank Responses

During times of economic slowdown or a global recession, swift and strategic action from governments and central banks is crucial to stabilizing the economy and restoring growth. These institutions respond by targeting key economic triggers and mitigating the effects of a potential world recession. Here are six common responses used to manage recessions:

Differences Between Recession and Depression

Understanding the differences between a recession and a depression is essential for grasping the severity and duration of economic downturns. A recession is a temporary period of economic decline, typically lasting a few months to a couple of years, characterized by shrinking GDP, rising unemployment, and decreased consumer spending. In contrast, a depression is a prolonged and more severe economic collapse, often lasting several years, with widespread business failures, soaring unemployment, and a deep loss of consumer and investor confidence. While recessions are part of the natural business cycle, depressions are rare and indicate systemic failures in the economy. During a recession, governments and central banks can often stabilize conditions with stimulus efforts and policy adjustments. Individuals can also protect themselves by turning to recession proof businesses and making strategic financial decisions. Choosing the best investments during a recession, such as bonds, defensive stocks, or gold, helps preserve capital. Likewise, focusing on recession proof investments like those in healthcare, utilities, or essential goods can offer consistent returns even as the broader market struggles. In a depression, these strategies become even more critical, as long-term survival depends on financial resilience, adaptability, and investments in sectors that continue to meet basic human needs.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Historical Examples of Major Recessions

Throughout history, several major recessions have shaped global economies and highlighted the importance of recognizing recession indicators and understanding economic triggers. One of the most severe was the Great Depression of the 1930s, which led to massive unemployment and widespread poverty worldwide. More recently, the global recession triggered by the 2008 financial crisis was fueled by the collapse of the housing market and widespread failures in financial institutions. It revealed how interconnected global economies are and how quickly a crisis in one sector can escalate into a full-blown world recession. The COVID-19 pandemic in 2020 also caused a sudden and deep global downturn, as lockdowns disrupted supply chains and halted economic activity across industries. In each case, governments and central banks intervened with stimulus packages, monetary policy easing, and financial support to limit the damage. These historical examples stress the value of monitoring recession indicators, such as declining GDP and rising unemployment, to act early. They also underscore the importance of strategic financial planning, particularly when investing in a recession, where safe-haven assets and diversified portfolios help mitigate risk. Understanding the patterns behind these past downturns provides valuable insights into navigating future economic challenges and potential economic triggers.