- Definition and Purpose of Golden Parachutes

- Historical Background and Evolution

- Components and Terms in Golden Parachutes

- Benefits to Executives

- Legal and Regulatory Framework

- Criticism and Controversies

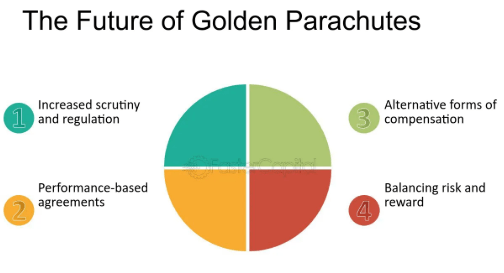

- Future Outlook and Recommendations

- Trends and Changes in Usage

- Conclusion

Definition and Purpose of Golden Parachutes

A Golden Parachutes In Executive Pay is a contractual agreement between a corporation and its top executives that provides substantial financial benefits if the executive is terminated, especially Continuity of Leadership, a merger, stakeholders , acquisition, or change in control of the company. These benefits often include severance pay, stock options, bonuses, and other perks designed to soften the financial impact of job loss.The primary purpose of a golden parachute is to protect executives from the uncertainties and risks associated with corporate restructuring. It aims to incentivize executives to act in the best interests of the company during potentially disruptive events like takeovers without fear of personal financial loss. In theory, this aligns executive behavior with shareholder value maximization, reducing resistance to mergers or acquisitions that could ultimately benefit the company.Golden Parachutes are contractual agreements that provide substantial financial Components and Terms in Golden Parachutes and benefits to top executives if they are terminated as a result of a merger, stakeholders , acquisition, or takeover. Typically, these benefits include severance pay, bonuses, stock options, or continued health and retirement benefits. The main goal is to protect executives from the financial and career instability that can arise when a company undergoes major structural changes.The purpose of golden parachutes extends beyond individual security. For companies, these agreements can serve as a strategic tool to attract and retain high-level executives, Transparency offering them assurance in times of uncertainty. They also help facilitate smoother mergers or acquisitions by reducing executive resistance, as leaders are less likely to oppose a deal that could end their tenure if they’re financially protected.However, Golden Parachutes In Executive Pay can be controversial. Critics argue they may reward failure, especially when underperforming executives receive large payouts. Supporters, on the other hand, view them as essential for ensuring leadership stability and reducing conflict during corporate transitions.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Historical Background and Evolution

The concept of Golden Parachutes In Executive Pay originated in the 1960s and gained prominence during the 1980s’ wave of hostile takeovers in the United States. As corporate raiders targeted undervalued companies, top executives sought protection against abrupt dismissal.Initially, golden parachutes were modest severance packages. However, with growing corporate consolidation and increased merger activity, these packages ballooned into lucrative financial arrangements that sometimes amounted to tens of millions of dollars.Over time, golden parachutes have evolved from simple severance agreements to complex contracts including multiple forms of compensation cash, stock options, bonuses, and accelerated vesting of retirement benefits. The practice expanded globally, but it remains most prevalent in the U.S. corporate environment.Golden parachutes first emerged in the early 1980s during a wave of corporate takeovers and mergers in the United States. As hostile takeovers became more common, top executives faced the risk of abrupt dismissal or significant changes to their roles. In response, companies began offering financial protection packages later known as golden parachutes to attract and retain executive talent in an increasingly volatile environment.

One of the earliest and most publicized uses was by TWA (Trans World Airlines) in 1983, where a generous executive severance package highlighted the concept and sparked public and shareholder attention. Throughout the 1980s and 1990s, golden parachutes became more widespread, often seen as a necessary tool to stabilize leadership during mergers and acquisitions. Over time, these agreements evolved. Initially limited to top CEOs, they began extending to other Components and Terms in Golden Parachutes. The size and complexity of the benefits also grew, including stock options, pension enhancements, and extended healthcare coverage. In the 2000s and beyond, growing criticism from shareholders, regulators, and the public led to increased scrutiny. Reforms were introduced to ensure transparency and tie severance more closely to performance. Today, while still controversial, golden parachutes remain a Continuity of Leadership feature in executive compensation across many major corporations.

Components and Terms in Golden Parachutes

- Severance Pay: A lump sum or salary continuation paid to executives upon termination.

- Accelerated Vesting of Stock Options: Immediate vesting of stock options or equity awards that would otherwise vest over time.

- Bonuses and Incentive Compensation: Payment of outstanding or prorated bonuses.

- Benefits Continuation: Continued health insurance, retirement benefits, or other perquisites.

- Tax Gross-Ups: Payments made to cover taxes related to parachute benefits, particularly excise taxes imposed under tax regulations.

- Non-Compete or Consulting Agreements: Sometimes included to restrict executives from competing with the company after departure.

The specific terms depend on negotiations, company policies, and regulatory constraints.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Benefits to Executives

- Financial Security: Provides a substantial severance package in the event of termination due to a merger, stakeholders , acquisition, or takeover.

- Career Risk Mitigation: Reduces the Continuity of Leadership and professional risk executives face during corporate restructuring or leadership changes.

- Incentive for Cooperation: Encourages executives to support mergers or acquisitions without fear of personal financial loss.

- Peace of Mind: Offers reassurance that their efforts and service to the company are recognized and protected, even if employment ends.

- Negotiation Leverage: Strengthens executives’ position in employment contract negotiations.

- Retention Tool: Helps companies retain top talent in uncertain or competitive environments.

- Continuity of Leadership: Ensures executives remain committed and focused during transitions, reducing disruption.

- Legal Protection: Often includes clauses that provide legal support or compensation in case of disputes related to termination.

Legal and Regulatory Framework

- U.S. Securities and Exchange Commission (SEC) Disclosure Rules: Public companies must disclose golden parachute arrangements in merger proxy statements.

- Internal Revenue Code Section 280G: Imposes excise taxes on “excess parachute payments” exceeding three times an executive’s base compensation.

- Sarbanes-Oxley Act and Dodd-Frank Act: These laws include provisions on executive compensation transparency and shareholder voting on golden parachutes.

- State Corporate Laws: May impact enforceability and governance related to parachute agreements.

Globally, regulatory frameworks vary, with some countries imposing stricter limits or disclosure requirements.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Criticism and Controversies

- Excessive Executive Compensation: Especially when large payouts occur despite poor company performance or layoffs of rank-and-file employees.

- Rewarding Failure: Executives can receive millions even if their leadership led to decline or takeover.

- Public Backlash and Media Scrutiny: Highlighted during financial crises and high-profile mergers.

- Conflicts of Interest: Executives may prioritize personal gains over shareholder or company health.

- Double Dipping: Receiving parachutes while moving to other lucrative roles.

These controversies have prompted shareholder activism and calls for reform.

Future Outlook and Recommendations

- Balancing Act: Companies must balance executive protection with shareholder interests.

- Increased Scrutiny: Expect more regulation and activism around parachutes.

- Innovative Contract Design: Using clawbacks, performance hurdles, and deferred payments.

- Alignment with ESG Goals: Integrating environmental, social, and governance considerations. Education and Transparency: Engaging shareholders and the public to maintain trust.

Trends and Changes in Usage

- Increased Shareholder Activism: More say-on-pay votes influencing executive contracts.

- Greater Transparency: Stricter disclosure requirements.

- Tighter Regulation: Legislative pressure to limit excessive payouts.

- Shift to Performance-Based Packages: Linking payouts to company success metrics.

- International Variations: Some countries discourage or cap parachutes.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Conclusion

Golden Parachutes In Executive Pay are a critical but controversial tool in executive compensation. They provide essential protections for leaders during corporate upheavals but can raise concerns over fairness and corporate governance. Understanding their structure, benefits, and implications helps stakeholders make informed decisions and shape policies that balance risk, reward, and accountability. Golden parachutes Continuity of Leadership play a pivotal role in modern executive compensation strategies. By offering financial security, legal protection, and peace of mind, they help executives navigate the uncertainties that come with corporate mergers and acquisitions. These agreements not only encourage cooperation during transitions but also serve as powerful tools for retention and negotiation, ensuring leadership continuity and Components and Terms in Golden Parachutes. While sometimes debated, their strategic value in maintaining executive focus and reducing disruption during high-stakes changes is widely recognized across industries.