- Introduction to Poison Pill in Corporate Defense

- Types of Poison Pills

- How Poison Pills Work to Deter Takeovers

- Legal Considerations and Regulations

- Implementation Process

- Effects on Shareholders and Management

- Advantages And Disadvantage of Using Poison Pills

- Conclusion

Introduction to Poison Pill in Corporate Defense

A Poison Pill in Corporate Defense strategy mechanism used by a target company to prevent or discourage hostile takeovers. Officially known as a “shareholder rights plan,” the poison pill strategy makes the target company less attractive or more expensive for the acquiring company. It is triggered when a hostile entity acquires a certain percentage of the company’s shares without board approval.Developed in the 1980s by law firm Wachtell, Lipton, Rosen & Katz during a wave of corporate raiding, the poison pill has evolved into one of the most debated tools in corporate governance. It reflects the tension between shareholder rights and managerial control.The poison pill, officially known as a shareholder rights plan, is a defensive strategy used by corporations to prevent or discourage hostile takeovers. Introduced in the early 1980s, the poison pill was developed as a legal mechanism to protect companies from unsolicited acquisition attempts that could undermine shareholder value or disrupt business operations.The basic concept involves making the target company’s Stock Price attractive or more difficult to acquire by the would-be acquirer. This is typically achieved by allowing existing shareholders (except the acquiring party) to purchase additional shares at a significant discount once a certain ownership threshold is crossed. As a result, the potential acquirer’s stake becomes diluted, making the takeover more expensive and less appealing.Poison pills serve several purposes: they give the board more time to evaluate offers, triggered ,negotiate better terms, Stock Price or seek alternative bids. They also strengthen the company’s bargaining position and can deter opportunistic takeovers that may not align with long-term shareholder interests.While effective as a defense tactic, Advantages of Using Poison Pills are controversial. Critics argue they can entrench management and limit shareholder rights. Nonetheless, they remain a widely used and legally upheld tool in corporate Effects on Shareholders and Management and defense strategy.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

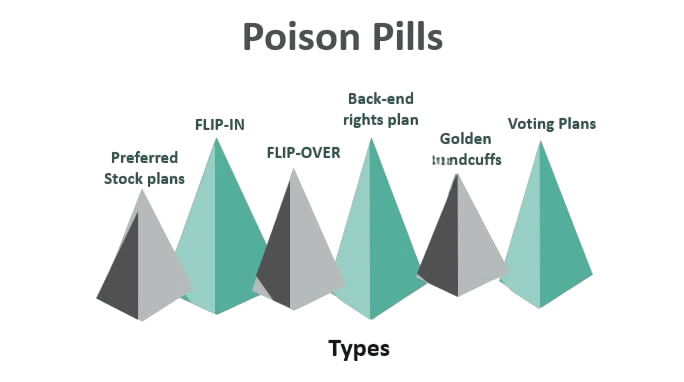

Types of Poison Pills

- Flip-In Poison Pill: This allows existing shareholders (except the hostile bidder) to buy additional shares at a discount when the acquirer crosses a certain ownership threshold. This dilutes the acquirer’s stake and makes the takeover more costly.

- Flip-Over Poison Pill: In this variation, shareholders of the target company can purchase the acquirer’s shares at a discounted price after the merger. This significantly dilutes the value of the acquiring company’s stock.

- Preferred Stock Plan: A company issues preferred shares with special rights that activate upon a takeover attempt. These rights may include huge voting powers or redemption clauses that complicate control for the acquirer.

- Back-End Rights Plans: These promise a premium price to shareholders after a takeover, making it more expensive for the bidder.

- Voting Plans: These issue new shares with superior voting rights to friendly shareholders, helping maintain control in the face of a takeover.

How Poison Pills Work to Deter Takeovers

Poison Pill in Corporate Defense operate on a trigger mechanism. Once a hostile entity buys a threshold amount (typically 10–20%) of the company’s stock, the plan is activated. Existing shareholders other than the triggered,defense strategy acquirer are given rights to purchase additional shares at a discounted rate.

- Dilution of the hostile party’s ownership.

- Increase in the cost of acquisition.

- Slowing down or completely deterring the takeover.

This strategy buys time for the board to evaluate offers, seek white knight alternatives, or negotiate better terms.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Legal Considerations and Regulations

- U.S. Legal Framework: In the U.S., poison pills are generally upheld as legal, especially after the 1985 Delaware Supreme Court ruling in Moran v. Household International, which validated their use. However, courts have also emphasized that boards must show that the threat is real and that the poison pill is a proportionate response.

- Shareholder Rights and Fiduciary Duty: Board members must balance their duty to maximize shareholder value with their discretion to implement triggered defensive measures. Shareholders often challenge poison pills if they perceive misuse or entrenchment motives.

- Disclosure Requirements: Public companies must disclose Advantages of Using Poison Pills arrangements through SEC filings, and in some jurisdictions, they require shareholder approval or sunset clauses.

- Global Perspective: In countries like the UK, poison pills are largely banned under the City Code on Takeovers and Mergers. In Canada, defense strategy poison pills are allowed temporarily but must be removed after a certain period unless the board gains shareholder approval.

Implementation Process

Step 1: Board Approval

The board of directors typically initiates a poison pill without requiring shareholder approval.

Step 2: Drafting the Plan

Legal counsel prepares a plan detailing thresholds, share rights, triggering events, and expiry dates.

Step 3: Public Announcement

The plan is disclosed to the market to deter hostile interest and inform shareholders.

Step 4: Filing with Regulators

SEC and other regulatory bodies are notified through 8-K or similar filings.

Step 5: Shareholder Communication

Shareholders are informed about how the plan protects their interests and the company’s long-term value.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Effects on Shareholders and Management

On Shareholders- Short-Term Dilution: Non-hostile shareholders may see value dilution, though they are offered discounted shares.

- Protection from Undervalued Takeovers: Poison pills can prevent acquisitions at prices deemed too low.

- Limited Control: Shareholders may feel disempowered if the board uses the pill to avoid legitimate offers. On Management

- Increased Bargaining Power: Management gets time and leverage to seek alternatives.

- Risk of Entrenchment: Can be used to preserve management’s position even when change may be beneficial.

Advantages And Disadvantage of Using Poison Pills

Advantages- Deters Hostile Bidders: Makes takeovers economically unfeasible.

- Preserves Long-Term Value: Allows time for better deal evaluation.

- Encourages Negotiated Deals: Bidders often approach the board rather than going hostile.

- Protects Innovation: Prevents loss of control over strategic assets. Disadvantages

- Shareholder Opposition: Pills are sometimes seen as anti-democratic.

- Stock Price Drop: May negatively affect market confidence.

- Legal Challenges: Risk of lawsuits for breach of fiduciary duties.

- Management Entrenchment: Can be misused to protect underperforming executives.

- Complexity and Cost: Legal and financial costs of implementing and defending a poison pill can be high.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Conclusion

The Poison Pill in Corporate Defense remains a relevant and controversial component of corporate defense strategy. While it provides a legitimate method for safeguarding against opportunistic takeovers, its implementation must be thoughtful, balanced, Advantages of Using Poison Pills and transparent. Boards must walk a fine line between protecting the company’s long-term vision and respecting the rights of shareholders. As corporate governance continues to evolve, triggered ,Effects on Shareholders and Management Stock Price the poison pill’s role will likely become more nuanced, tailored, and performance-oriented.The poison pill remains one of the most prominent and effective strategies in corporate defense against hostile takeovers. By diluting an acquirer’s potential ownership and increasing the cost of acquisition, it allows companies to protect themselves from aggressive bids that may not serve the best interests of shareholders. While it offers valuable leverage for corporate boards, Stock Price the use of poison pills must be balanced with transparency and accountability to avoid misuse. When implemented responsibly, poison pills can provide the Effects on Shareholders and Management time and flexibility for companies to explore better alternatives and preserve long-term value.