- Introduction to Company Valuation

- Why Valuation is Important

- Book Value vs Market Value

- Intrinsic vs Extrinsic Valuation

- Asset-Based Valuation Method

- Market Capitalization Method

- Discounted Cash Flow (DCF) Method

- Comparable Company Analysis

Introduction to Company Valuation

Company valuation is a fundamental process in understanding the true worth of a business, whether for investment, acquisition, or strategic planning. It involves assessing various aspects of a company’s financial and operational health to determine its market value. One of the most common methods used is company valuation based on revenue, which considers the income-generating capacity of the business as a key indicator of its value. However, accurate valuation requires a comprehensive approach that looks beyond just revenue figures it includes analyzing assets, liabilities, market position, and future growth potential. Engaging a business valuation expert ensures that the process is grounded in sound financial principles and real-world market data. These experts apply industry-specific knowledge and valuation models to deliver reliable results. Similarly, working with a business valuation consultant provides companies with tailored insights and strategic recommendations that align with their goals, whether it’s raising capital, selling the business, or planning an exit strategy. A proper introduction to company valuation helps stakeholders appreciate its importance and the role it plays in informed decision-making, financial reporting, and long-term business success. Whether for startups or established firms, understanding valuation is key to navigating the dynamic world of business finance.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Why Valuation is Important

- Informed Investment Decisions: Valuation helps investors determine whether a business is worth investing in. Tools like the Discounted Cash Flow (DCF) method offer insights into future cash flows and profitability.

- Business Planning and Strategy: Knowing the value of a company supports better planning and resource allocation. With data from DCF calculation and market metrics, businesses can set realistic goals.

- Fundraising and Capital Acquisition: Startups and growing companies often rely on valuation to attract investors. A solid DCF model example can demonstrate growth potential and justify funding needs.

Valuation plays a critical role in business strategy, investment decisions, and financial planning. It provides a clear picture of a company’s worth, helping stakeholders make informed choices. Whether it’s attracting investors, negotiating deals, or preparing for an exit, accurate valuation is essential. Here are six reasons why valuation is important:

- Mergers and Acquisitions: Accurate valuation is crucial during mergers or acquisitions. It involves analyzing financial data and assessing risks to ensure fair pricing.

- Benchmarking Against Competitors: Valuation allows companies to compare themselves with comparable companies in the industry, offering insights into market positioning.

- Regulatory and Tax Purposes: Authorities may require valuation for compliance or tax calculations, making it vital to have precise financial documentation and valuation methods in place.

Book Value vs Market Value

Book value vs market value is a key concept in understanding the financial health and true worth of a business. Book value refers to a company’s net asset value as recorded on its balance sheet essentially, total assets minus total liabilities. Market value, on the other hand, is the current price at which the company would trade in the open market, often influenced by investor sentiment, future growth expectations, and overall market conditions. While book value gives a historical perspective based on accounting records, market value reflects what investors are willing to pay, often making it more dynamic and forward-looking. In the context of company valuation based on revenue, market value typically plays a greater role, especially in industries where earnings potential and growth prospects matter more than physical assets. To accurately interpret both values and their significance, it’s advisable to consult a business valuation expert, who can break down the financials and provide insights based on industry standards. A business valuation consultant can further guide stakeholders in understanding how book value and market value align or diverge within the broader framework of valuation methods, helping businesses make informed strategic, financial, or investment decisions.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

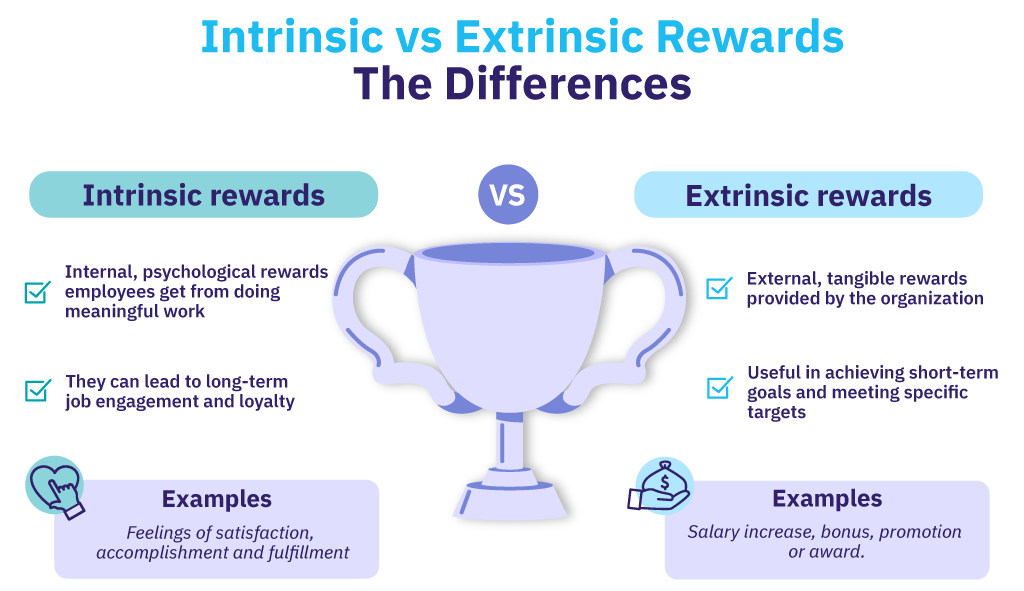

Intrinsic vs Extrinsic Valuation

- Definition and Core Approach: Intrinsic valuation determines a company’s value based on its fundamentals, often using Discounted Cash Flow (DCF) methods, whereas extrinsic valuation is driven by market perception and external benchmarks.

- Focus on Financial Data: Intrinsic methods rely heavily on analyzing financial data such as revenue, profit margins, and cash flows to estimate value. Extrinsic methods, on the other hand, may overlook internal performance details.

- DCF as a Valuation Tool: A DCF model example projects future cash flows and discounts them to present value, offering a detailed intrinsic view of a company’s financial strength.

Understanding the difference between intrinsic and extrinsic valuation is essential for accurately assessing a company’s true worth. Intrinsic valuation focuses on the internal financial fundamentals of a business, while extrinsic valuation considers external market factors and comparisons. Both approaches offer valuable insights depending on the context of the analysis. Here are six key points that highlight their differences:

- Market Comparisons: Extrinsic valuation often involves comparing the business with comparable companies in the same industry to estimate its value based on similar metrics.

- Calculation Complexity: DCF calculation requires assumptions about growth rates, discount rates, and cash flow forecasts, making intrinsic valuation more technical but precise.

- Use in Decision-Making: Investors seeking long-term value typically prefer intrinsic methods, while traders or analysts reacting to market trends may lean toward extrinsic approaches.

- Easy to Calculate: Market capitalization is straightforward share price outstanding shares making it a preferred choice for initial valuation assessments.

- Reflects Market Sentiment: Unlike company valuation based on revenue, this method reflects how investors perceive the company, which may be influenced by trends, news, or speculation.

- Useful for Public Companies: This method is most effective for publicly listed companies where share prices are readily available and regularly updated.

- Not Always Accurate: It can misrepresent a company’s real value, which is why a business valuation expert may recommend supplementary methods like DCF or asset-based valuation.

- Doesn’t Consider Financials Deeply: Unlike approaches involving deep financial analysis, market cap ignores profitability and revenue streams.

- Often Combined with Other Methods: A business valuation consultant may use market capitalization alongside revenue-based and intrinsic valuation methods to provide a more comprehensive analysis.

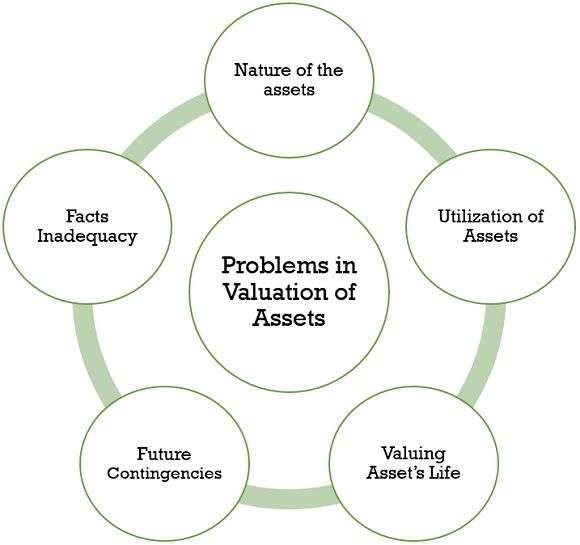

Asset-Based Valuation Method

The Asset-Based Valuation Method is a fundamental approach to determining a company’s worth by assessing the value of its individual assets minus its liabilities. This method is particularly useful for businesses with substantial tangible assets, such as real estate, machinery, or inventory. It provides a snapshot of a company’s net asset value and is commonly used during liquidation, mergers, or when valuing capital-intensive businesses. While it offers a clear, balance sheet-focused perspective, it may not fully capture future earning potential, which is where methods like the Discounted Cash Flow (DCF) come into play. Unlike asset-based valuation, DCF considers projected cash flows and discounts them to present value, requiring accurate DCF calculation and deep analyzing of financial data. A DCF model example can highlight the contrast between static asset values and dynamic income-based valuation. In practice, the asset-based method may be combined with income or market-based approaches to get a well-rounded picture, especially when comparing with comparable companies in the same sector. This holistic approach ensures more informed decisions, especially when assessing undervalued or distressed assets. While asset-based valuation offers a grounded view, integrating it with DCF techniques can enhance accuracy and strategic insight.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Market Capitalization Method

The Market Capitalization Method is one of the simplest and most widely used approaches to determine a company’s value, especially for publicly traded firms. It is calculated by multiplying the company’s current share price by its total number of outstanding shares. While this method provides a quick snapshot of a company’s market value, it does not always reflect its true financial health or growth potential. Below are six key points explaining the Market Capitalization Method:

Discounted Cash Flow (DCF) Method

The Discounted Cash Flow (DCF) method is a widely respected valuation approach that estimates the present value of a company based on its expected future cash flows. This technique involves projecting the company’s cash flows over a specific period and then discounting them back to their present value using an appropriate discount rate, which reflects the risk and time value of money. The discounted cash flow method is especially valuable for businesses with predictable income streams and is rooted in deep analyzing of financial data to ensure accuracy. A clear DCF model example typically includes revenue forecasts, operating costs, taxes, and reinvestment assumptions, all feeding into the final value estimate. Precise DCF calculation is critical, as even small changes in assumptions can lead to significant differences in valuation outcomes. Unlike market-based methods that rely on the performance of comparable companies, DCF offers an intrinsic view of a business’s worth based on its own financial fundamentals. This makes it a preferred choice for investors and analysts aiming to uncover a company’s true value, especially when market sentiment may distort stock prices. By focusing on actual performance and future potential, the DCF method remains a cornerstone of modern financial valuation.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Comparable Company Analysis

Comparable Company Analysis (CCA) is a popular relative valuation method that involves evaluating a company’s value by comparing it with similar businesses in the same industry. This approach assumes that companies with similar characteristics such as size, growth rate, and operational model should have similar valuation multiples like price-to-earnings (P/E), EV/EBITDA, or price-to-sales. It is often used as a benchmark to assess fair market value, especially in M&A deals or investment decisions. One of the key advantages of CCA is its simplicity and reliance on real-time market data, making it an effective tool for company valuation based on revenue when applied correctly. However, selecting truly comparable companies is crucial for accuracy, and this is where a business valuation expert plays a vital role. They ensure that the peer group used in the analysis closely reflects the subject company’s financial structure, industry focus, and growth prospects. Additionally, a business valuation consultant may use CCA alongside other valuation methods such as Discounted Cash Flow (DCF) or asset-based models to provide a well-rounded and defensible valuation. Overall, Comparable Company Analysis offers practical insights into market trends and helps businesses understand how they stack up against competitors in terms of value and performance.