- What is Financial Leverage?

- Understanding Operating vs Financial Leverage

- The Formula for Degree of Financial Leverage (DFL)

- Interpreting DFL Values

- DFL in Different Industries

- How Debt Affects DFL

- Example Calculations

- Risks of High Financial Leverage

What is Financial Leverage?

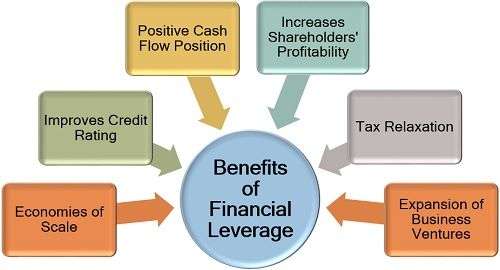

Financial leverage refers to the use of borrowed funds to increase the potential return on investment, allowing businesses to amplify gains or losses depending on performance. The concept of financial leverage is rooted in how companies utilize debt to finance operations and growth while aiming to boost shareholder value. By strategically taking on debt, firms can pursue expansion without diluting ownership, but this comes with the risk of higher interest obligations. It’s essential to differentiate financial leverage vs operating leverage: while financial leverage deals with debt and interest costs, operating leverage focuses on the proportion of fixed to variable costs in a company’s operations. Both influence a firm’s risk and profitability, but in different ways. Financial leverage intensifies the effects of changes in earnings before interest and taxes (EBIT) on net income, making it a powerful yet risky financial tool. A key metric used to assess this impact is the Degree of Financial Leverage (DFL), which measures the sensitivity of earnings per share (EPS) to fluctuations in operating income. A higher DFL indicates greater financial risk, especially in volatile markets. Therefore, understanding and managing financial leverage is crucial for long-term financial health and informed decision-making in corporate finance.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Understanding Operating vs Financial Leverage

- Definition and Focus: Operating leverage measures the impact of fixed operating costs on a company’s earnings, while financial leverage assesses the effect of debt financing on profitability and risk.

- Cost Structure Impact: High operating leverage means a firm has more fixed costs, which can magnify profits during good times but increase losses during downturns. Financial leverage, on the other hand, reflects the use of borrowed funds, increasing financial leverage risk if income is insufficient to cover interest payments.

- Sources of Leverage: Operating leverage comes from internal operations (like fixed salaries and rent), whereas capital leverage arises from debt and equity choices in financing.

Operating and financial leverage are two critical tools that businesses use to influence profitability and manage financial structure. Both play a key role in shaping a company’s earnings and risk profile. While operating leverage focuses on cost structure, financial leverage relates to capital structure. Below are six key points to help you understand the differences and strategic importance of each:

- Risk Management: Both forms of leverage raise business risk, but financial leverage particularly raises credit and bankruptcy risk if poorly managed.

- Asset Utilization: Asset leverage refers to the extent to which a company uses its assets to drive revenue linking operational efficiency with leverage strategy.

- Strategic Application: Some institutions, especially pension funds, adopt LDI pension strategy (Liability-Driven Investment), which uses financial and asset leverage to match assets with long-term liabilities, effectively balancing risk and return.

The Formula for Degree of Financial Leverage (DFL)

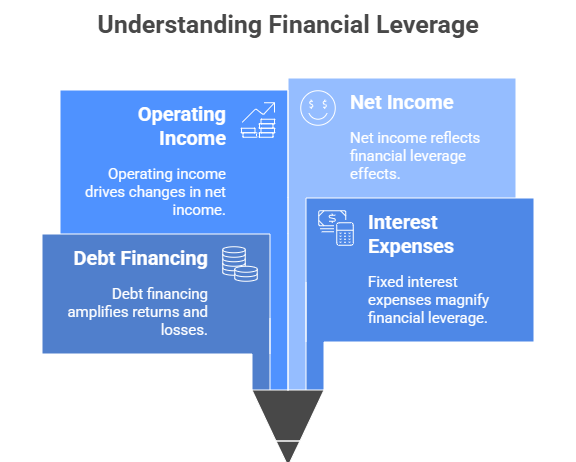

The Degree of Financial Leverage (DFL) is a key financial metric that measures the sensitivity of a company’s earnings per share (EPS) to changes in its operating income or earnings before interest and taxes (EBIT). It highlights how debt influences a firm’s profitability and financial risk. The formula for Degree of Financial Leverage is typically expressed as: DFL = EBIT / (EBIT – Interest Expense). This formula indicates how a small percentage change in EBIT can lead to a larger percentage change in net income due to fixed financial costs like interest. Understanding the concept of financial leverage is essential here, as it centers on the use of debt to enhance returns, which can amplify gains in good times but also magnify losses during downturns. This is where the distinction between financial leverage vs operating leverage becomes important. While operating leverage deals with fixed operational costs impacting EBIT, financial leverage comes into play after EBIT, affecting net earnings. A high DFL suggests a company is more exposed to financial risk, as it relies heavily on borrowed funds. Therefore, analyzing the Degree of Financial Leverage helps investors and managers assess how responsibly a company uses debt to finance growth and drive profitability.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Interpreting DFL Values

- Low DFL (Close to 1): Indicates minimal use of debt; earnings are stable and not highly affected by interest expenses. Companies with low financial leverage tend to be more conservative and financially secure.

- Moderate DFL: Suggests a balanced approach to financing, combining debt and equity in a way that moderately boosts earnings without significantly increasing risk. This is often a mark of healthy capital leverage.

- High DFL: Signifies high financial leverage, meaning the company relies heavily on debt. While this can increase returns during growth periods, it also magnifies losses and can lead to financial instability.

Understanding and interpreting Degree of Financial Leverage (DFL) values is crucial for assessing how sensitive a company’s earnings are to changes in operating income. A higher DFL indicates that a small change in earnings before interest and taxes (EBIT) will cause a larger change in net income, revealing the company’s exposure to financial leverage risk. Here’s how to interpret DFL values in a strategic context:

- Risk Assessment: A high DFL increases financial leverage risk, especially in economic downturns when consistent cash flow is uncertain.

- Impact on Asset Utilization: When combined with asset leverage, high DFL could indicate over-reliance on both debt and fixed assets, which may reduce flexibility in challenging markets.

- Strategic Use in Pension Planning: In an LDI pension strategy, understanding DFL helps align investment approaches with long-term liabilities, ensuring that leveraged assets generate predictable income to match future payouts.

- Increased Fixed Costs: Higher debt leads to more interest payments, which increases fixed financial costs directly impacting the Degree of Financial Leverage by making earnings more sensitive to changes in EBIT.

- Amplified Earnings Volatility: Even small fluctuations in operating income can result in large swings in net income when DFL is high, showing how debt magnifies financial outcomes.

- Leverage Comparison: In the context of financial leverage vs operating leverage, debt impacts financial leverage, while operating leverage relates to fixed operating costs both can combine to increase overall business risk.

- Profitability Boost During Growth: When EBIT is strong, a higher DFL can enhance returns on equity, making debt an effective tool under favorable conditions.

- Heightened Financial Risk: If earnings fall, high debt burdens increase financial vulnerability, reinforcing the importance of monitoring leverage carefully.

- Strategic Financial Planning: Understanding the concept of financial leverage and how debt affects DFL allows companies to strike a balance between risk and return in their capital structure.

DFL in Different Industries

The Degree of Financial Leverage (DFL) varies widely across industries based on their operating models, capital needs, and revenue stability. In capital-intensive sectors like utilities and telecommunications, companies often maintain high financial leverage due to steady cash flows that support regular debt repayments. These industries benefit from capital leverage by using long-term borrowing to fund infrastructure while keeping shareholder dilution low. In contrast, technology and service-based firms typically operate with lower DFL values, relying less on debt and more on equity financing to avoid excessive financial leverage risk. These businesses often prioritize agility over long-term liabilities, especially in fast-evolving markets. Retail and manufacturing industries may adopt moderate levels of both financial leverage and asset leverage, balancing borrowed capital with operational assets to enhance returns during growth periods. Financial institutions, such as banks and pension funds, strategically manage leverage within risk guidelines, especially under regulatory constraints. In the case of pension management, particularly under an LDI pension strategy (Liability-Driven Investment), financial leverage is used thoughtfully to match asset returns with long-term obligations, ensuring funding security. Understanding DFL across industries helps stakeholders assess not only profitability potential but also long-term sustainability and exposure to risk, depending on how aggressively leverage is employed in specific economic environments.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

How Debt Affects DFL

Debt plays a central role in influencing the Degree of Financial Leverage (DFL), which measures how sensitive a company’s net income is to changes in its operating income (EBIT). As debt increases, so do fixed financial costs like interest payments, which in turn heighten the volatility of earnings. Understanding the concept of financial leverage helps in recognizing how debt magnifies both profit and risk. Here’s how debt affects DFL in six key ways:

Example Calculations

Let’s explore example calculations to understand how financial leverage impacts a company’s earnings. Suppose a company has an EBIT (Earnings Before Interest and Taxes) of ₹1,000,000 and annual interest expenses of ₹200,000. The Degree of Financial Leverage (DFL) is calculated using the formula: DFL = EBIT / (EBIT – Interest). Here, DFL = ₹1,000,000 / (₹1,000,000 – ₹200,000) = 1.25. This means that a 10% change in EBIT would result in a 12.5% change in net income, reflecting the influence of debt. Now consider a company with higher debt and interest of ₹400,000; the DFL becomes ₹1,000,000 / ₹600,000 = 1.67, indicating greater earnings sensitivity and higher financial leverage risk. These examples demonstrate how debt increases the potential return but also the volatility. When paired with asset leverage, where a firm uses its assets efficiently to generate revenue, the impact can be more pronounced. In industries requiring large capital outlays, firms often use capital leverage to fund growth without diluting ownership. Similarly, in the LDI pension strategy, leverage is strategically used to match long-term assets with liabilities, ensuring consistent cash flow. These examples underline how proper financial planning and understanding of leverage ratios are crucial to maintaining a healthy risk-return balance.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Risks of High Financial Leverage

High financial leverage can significantly increase a company’s potential returns, but it also introduces considerable risk, especially during economic downturns or periods of unstable cash flow. The concept of financial leverage revolves around using debt to amplify earnings, but when debt levels become excessive, the burden of fixed interest payments can strain a company’s financial health. This becomes particularly evident when earnings before interest and taxes (EBIT) decline, leading to disproportionate drops in net income due to the high Degree of Financial Leverage (DFL). A company with a high DFL is extremely sensitive to even minor fluctuations in operating income, increasing its vulnerability to financial distress or insolvency. Comparing financial leverage vs operating leverage, the former deals with financing risk, while the latter relates to cost structure; when both are high, the combined effect can dramatically magnify losses. Additionally, over-leveraging can reduce a firm’s ability to access further credit, limit strategic flexibility, and lower investor confidence. It can also make a business more reactive to interest rate changes, further compounding risk. Therefore, while leveraging debt can be a powerful growth strategy, it must be carefully managed to avoid the severe downsides associated with high financial leverage.