- Introduction to Financial Advisor Roles

- Average Salary of Financial Advisors in India

- Global Salary Comparison (US, UK, Canada, etc.)

- Factors Affecting Salary (Experience, Location, Certification)

- Salary Differences Across Industries (Banking, Insurance, Investment Firms)

- Impact of Educational Background and Certifications (CFP, CFA)

- Commission-Based vs Fixed Salary Compensation

- Salary Growth Over the Career Span

- Conclusion

Introduction to Financial Advisor Roles

A financial advisor salary is a professional who offers strategic guidance to clients on managing their finances, investments, insurance, retirement planning, tax optimization, and wealth accumulation. They can work independently, be affiliated with financial institutions, or operate within corporate environments. Their role involves analyzing client goals, assessing financial health, creating investment plans, and consistently monitoring progress. There are multiple types of financial advisors, such as certified financial planners (CFPs), investment advisors, Financial Analyst, wealth managers, and retirement specialists. Regardless of specialization, strong interpersonal skills, analytical thinking, and financial literacy are crucial. As the demand for professional financial planning continues to grow, the compensation of financial advisors has become a key area of interest among aspiring professionals and industry analysts alike.Afinancial advisor salary is a professional who helps individuals and businesses make informed decisions about their money to achieve specific financial goals. Their role involves evaluating a client’s financial situation, including income, expenses, assets, and liabilities, and then developing a personalized financial plan. This plan may include strategies for budgeting, saving, investments, retirement planning, tax optimization, insurance coverage, and estate planning. Financial advisors may specialize in certain areas such as investments, wealth management, or retirement solutions, and can work independently or as part of a firm. They must possess strong analytical skills, a solid understanding of financial products and regulations, and the ability to communicate complex financial concepts clearly to clients. Often holding certifications like Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA), they are trusted to act in their clients’ best interests. Ultimately, a financial advisor’s goal is to help clients grow and protect their wealth while making sound Salary of Financial Advisors in India choices throughout different stages of life.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Average Salary of Financial Advisors in India

In India, the average salary of a financial advisor salary varies significantly depending on experience, qualifications, geographic location, and the employing organization. On average:

- Entry-level financial advisors: (0–2 years of experience) earn between ₹2.5 to ₹4.5 lakhs per annum.

- Mid-level advisors: (3–7 years) typically earn between ₹5 to ₹10 lakhs per annum.

- Senior-level professionals: (10+ years) can command ₹12 to ₹25 lakhs per annum, with some earning even more based on performance and clientele.

Advisors working in metro cities such as Mumbai, Bengaluru, and Delhi tend to earn higher salaries compared to those in Tier-II or Tier-III cities due to the concentration of high-net-worth individuals (HNIs) and financial institutions.

Global Salary Comparison (US, UK, Canada, etc.)

Internationally, Salary of Financial Advisors in India enjoy competitive salaries, often exceeding those in India. Here’s a quick comparison:

- United States: Financial advisors earn a median annual salary of $94,000, with top earners crossing $200,000.

- United Kingdom: The average salary is around £45,000 to £60,000, with bonuses and commissions significantly boosting earnings.

- Canada: Financial advisors earn an average of CAD $55,000 to $100,000, depending on the province and experience.

- Australia: Salaries range between AUD $70,000 to $120,000.

- Singapore: Annual pay ranges from SGD $50,000 to $120,000, especially high in private banking sectors.

- Experience: As with most professions, experience is directly proportional to salary. Advisors with a proven track record in portfolio management and client retention are better compensated.

- Location: Urban centers offer better pay due to a larger client base and more affluent customers.

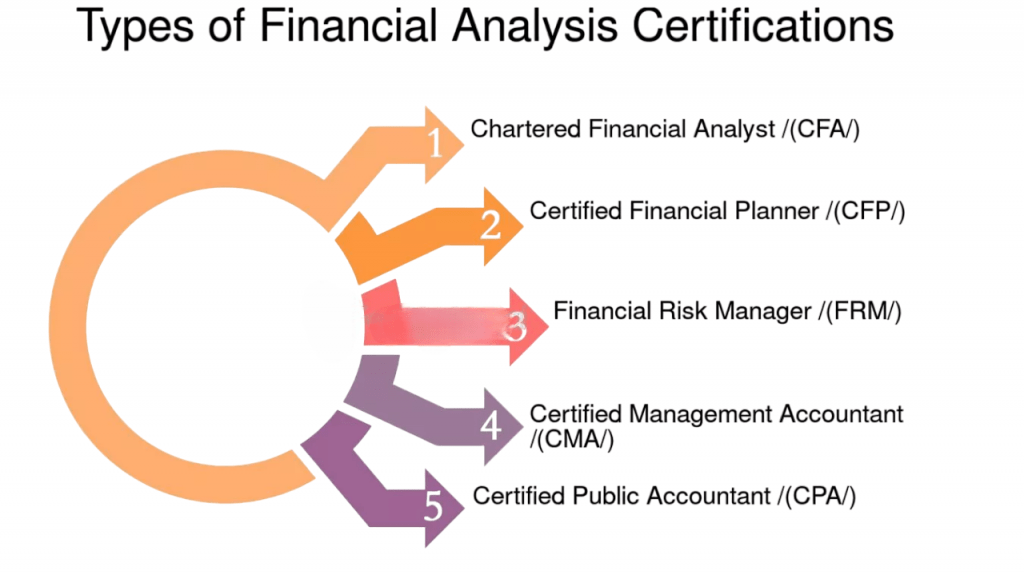

- Certifications: Holding industry-recognized credentials like CFP (Certified Financial Planner), CFA (Chartered Financial Analyst), or CPA (Certified Public Accountant) can lead to substantial salary hikes.

- Clientele Type: Advisors catering to institutional or high-net-worth clients typically earn more than those serving the retail segment.

- Firm Type: Advisors in multinational banks or investment firms often earn more than those working in local or regional banks.

- Banking Sector: Typically provides stable base salaries and periodic performance bonuses. Advisors in private and investment banking earn the most.

- Insurance Companies: Often rely on a commission-based compensation model. High-performing advisors can out-earn their investment banking counterparts if they close large-volume insurance deals.

- Mutual Fund Houses & AMCs: These institutions offer decent fixed pay with strong incentives tied to investment banking sales and SIP enrollments.

- Independent Advisory Firms: Salaries can vary significantly based on business development capabilities and personal branding.

- CFP (Certified Financial Planner): Globally recognized, CFPs can command 20–30% higher salaries due to their specialized training in personal finance and wealth management.

- CFA (Chartered Financial Analyst): Preferred for roles involving deep investment analysis. CFAs can shift into higher-paying asset management or advisory roles.

- MBA in Finance: Equips professionals with leadership and analytical skills, often leading to faster promotions.

- NISM Certifications: Mandatory in India for investment and mutual fund advisory roles. They help increase credibility and job opportunities.

- Stable monthly income

- Performance bonuses

- Health and retirement benefits

- This structure rewards advisors based on:

- Products sold (insurance, mutual funds, retirement plans)

- Assets under management (AUM)

- Client acquisition and retention

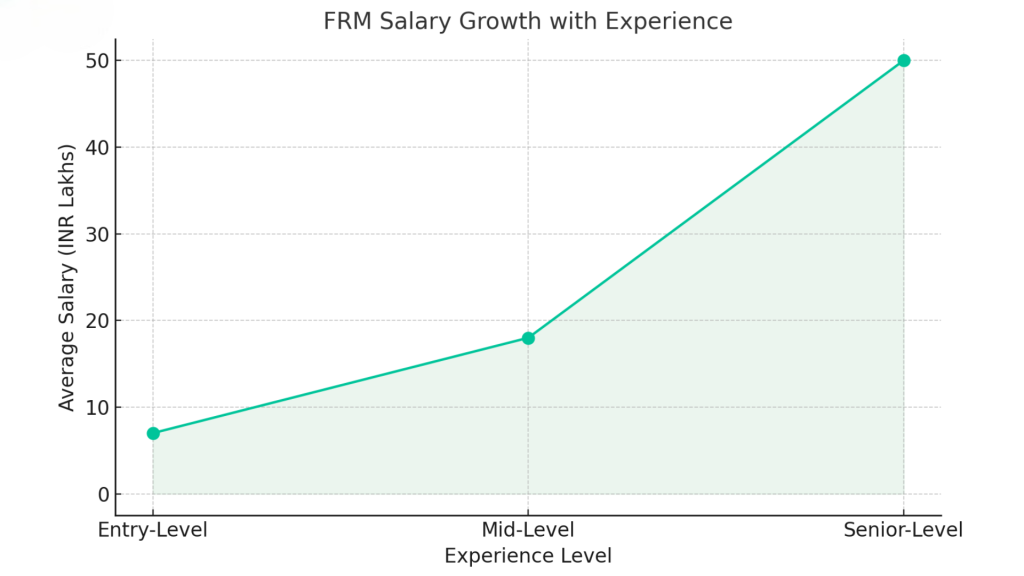

- 0–2 Years: Entry-level roles with a focus on learning, building client lists, and clearing certifications

- 3–5 Years: Advisors establish a client base and gain the ability to negotiate for better pay or shift to higher-paying firms.

- 6–10 Years: With experience and trust, advisors start earning from long-term client investment banking, cross-selling, and portfolio management fees.

- 10+ Years: Senior advisors, wealth managers, or partners in firms enjoy a steady stream of income from AUM-based fees, high-value clients, and team management bonuses.

Factors such as cost of living, regulatory requirements, and taxation heavily influence these salary levels across different countries.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Factors Affecting Salary (Experience, Location, Certification)

Several variables play a role in determining a financial advisor’s earnings:

Salary Differences Across Industries (Banking, Insurance, Investment Firms)

Compensation of financial advisors work across several industries, each offering unique compensation structures:

Investment firms, wealth management especially global ones, generally offer the highest compensation, often structured with stock options and profit-sharing bonuses.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Impact of Educational Background and Certifications (CFP, CFA)

Educational qualifications play a vital role in determining salary potential. A bachelor’s degree in finance, commerce, wealth management, compensation of financial advisors or economics is often the minimum requirement. However, advanced degrees and certifications offer a competitive edge:

Certifications signal to employers and clients a commitment to professional standards, making them a powerful tool for salary growth.

Commission-Based vs Fixed Salary Compensation

The Compensation of financial advisors structure for financial advisors typically falls into two categories:

Fixed Salary Model

This structure is common in banks and large institutions. It provides:

While secure, income growth may be slower compared to commission-based models.

Commission-Based Model

High-performing advisors can earn 2x–5x their fixed-salary counterparts. However, income can fluctuate, and pressure to perform may be intense. Some hybrid models offer a base salary + commission setup, balancing stability and performance incentives.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Salary Growth Over the Career Span

A financial advisor’s salary grows substantially over time:

Over a 10–15 year career, advisors can see a 5–10x increase in their base salary, with additional income from commissions and perks.

Conclusion

In conclusion, Salary of Financial Advisors in India play a crucial role in helping individuals and businesses navigate the complexities of financial planning. By offering expert guidance on saving, investing, and managing risk, they empower clients to make informed decisions that align with their long-term goals. With their knowledge, experience, and commitment to ethical financial practices, Financial Planner, financial advisors serve as trusted partners in building and securing a stable financial future.The salary of a financial advisor is influenced by multiple factors including experience, certifications, location, industry, wealth management and compensation of financial advisors structure. While entry-level roles may offer modest pay, the career offers high long-term earning potential through bonuses, investment banking, commissions, Financial Analyst and client-based rewards. With increasing demand for personalized financial advice, and the rise in wealth across emerging economies like India, the role of financial advisor salary is becoming more lucrative than ever.By continuously learning, building client trust, and leveraging certifications, financial advisors can unlock significant financial rewards and long-term career satisfaction.