- Introduction to Algorithmic Trading

- Historical Evolution and Milestones

- Key Components of an Algo Trading System

- Common Trading Algorithms and Strategies

- Role of Programming Languages (Python, R, C++)

- Market Data Feeds and Real-Time Analytics

- Infrastructure Requirements and Latency

- Risk Management in Algorithmic Trading

- Advantages and Drawbacks of Algo Trading

- Future Trends: AI and Machine Learning in Trading

- Conclusion

Introduction to Algorithmic Trading platform

Algorithmic trading platform, often referred to as algo trading or automated trading, is the practice of using computer algorithms to automatically execute financial markets trades. These algorithms are designed based on predefined criteria such as timing, price, volume, and other mathematical models. The objective is to maximize trading efficiency,Risk Management minimize human error, and capitalize on market opportunities at lightning speed. Over the last few decades, algorithmic trading has revolutionized financial markets, Key Components of an Algo Trading System Contributing to enhanced liquidity, tighter spreads, and 24/7 trading cycles, effective risk management in algorithmic trading is essential to ensure stability, prevent large-scale losses, and maintain market integrity.

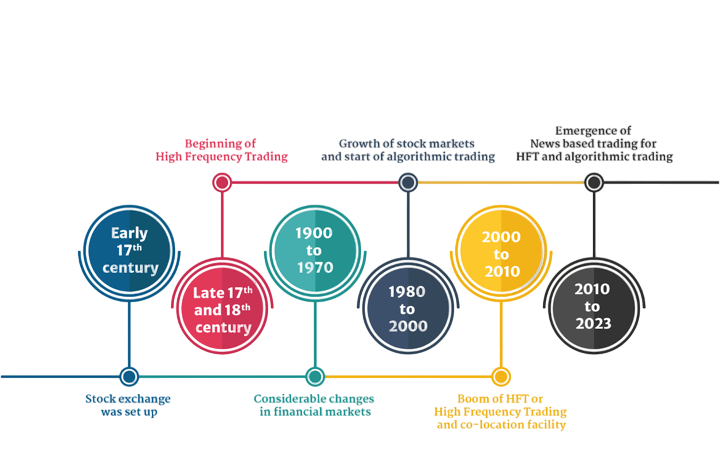

Historical Evolution and Milestones

The inception of algorithmic trading dates back to the early 1970s:

- 1971: The NASDAQ became the first electronic stock exchange.

- 1980s: Program trading became common on Wall Street.

- 1990s: Rise of Direct financial markets Access (DMA) and Electronic Communication Networks (ECNs).

- 2005: Regulation NMS in the U.S. promoted competition, accelerating algo adoption.

- 2010: The Flash Crash brought widespread attention to risks associated with high-frequency trading.

- 2020s: Adoption of artificial intelligence (AI), machine learning (ML), and natural language processing (NLP) in trading.

These advancements have progressively redefined the architecture and reliability of algorithmic Automated trading systems.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Key Components of an Algo Trading System

An effective algorithmic trading platform setup includes:

- Strategy Engine: Implements trade logic based on indicators, patterns, or AI models.

- Market Data Interface: Gather live and historical data for analysis and signal generation.

- Order Management System (OMS): Sends, modifies, and cancels orders in real-time.

- Execution Layer: Optimizes order execution for speed and cost.

- Risk Control Framework: Monitors and restricts undesired exposure or behavior.

- Backtesting and Simulation Tools: Allow historical validation of strategies.

Each component must be seamlessly integrated to ensure performance, reliability, and compliance.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Common Trading Algorithms and Strategies

Popular algorithmic trading platform strategies include:

- Trend Following: Uses indicators like moving averages to trade in the direction of price momentum.

- Statistical Arbitrage: Exploits price inefficiencies between correlated assets.

- Mean Reversion: Assumes prices will revert to their historical mean.

- Market Making: Places simultaneous buy and sell orders to profit from bid-ask spread.

- Event-Driven Strategies: Reacts to news, earnings announcements, or geopolitical events.

- Sentiment Analysis: Trades based on news or social media sentiment using NLP tools.

Traders often combine strategies to diversify and hedge risk.

Role of Programming Languages (Python, R, C++)

The backbone of algorithmic trading platform is coding. Key languages include:

- Python: Preferred for prototyping due to extensive libraries like NumPy, pandas, and TensorFlow.

- R: Ideal for data modeling, time-series forecasting, and statistical testing.

- C++: Offers ultra-low latency performance, ideal for high-frequency trading (HFT).

- Java: Used in enterprise trading systems for scalability and concurrency.

Most Automated trading platforms support these languages via SDKs and APIs for custom strategy deployment.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Market Data Feeds and Real-Time Analytics

High-quality data is critical in algo trading:

Market Data Types:

- Level I: Bid/ask prices and volumes

- Level II: Market depth

- Tick Data: Time-stamped trades and quotes

- Alternative Data: Satellite images, weather forecasts, Twitter sentiment

- Real-Time Analytics Tools: Apache Kafka, Flink, and Redis are used to process data in motion.

The accuracy and timeliness of data directly impact strategy success.

Example Calculations

Let’s explore example calculations to understand how financial leverage impacts a company’s earnings. Suppose a company has an EBIT (Earnings Before Interest and Taxes) of ₹1,000,000 and annual interest expenses of ₹200,000. The Degree of Financial Leverage (DFL) is calculated using the formula: DFL = EBIT / (EBIT – Interest). Here, DFL = ₹1,000,000 / (₹1,000,000 – ₹200,000) = 1.25. This means that a 10% change in EBIT would result in a 12.5% change in net income, reflecting the influence of debt. Now consider a company with higher debt and interest of ₹400,000; the DFL becomes ₹1,000,000 / ₹600,000 = 1.67, indicating greater earnings sensitivity and higher financial leverage risk. These examples demonstrate how debt increases the potential return but also the volatility. When paired with asset leverage, where a firm uses its assets efficiently to generate revenue, the impact can be more pronounced. In industries requiring large capital outlays, firms often use capital leverage to fund growth without diluting ownership. Similarly, in the LDI pension strategy, leverage is strategically used to match long-term assets with liabilities, ensuring consistent cash flow. These examples underline how proper financial planning and understanding of leverage ratios are crucial to maintaining a healthy risk-return balance.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Infrastructure Requirements and Latency

Low-latency infrastructure ensures minimal delays in execution:

- Co-location: Housing servers near exchange data centers.

- Direct Market Access (DMA): Direct links to exchanges without intermediary brokers.

- Optimized Networks: Use of fiber optics, microwave transmissions, and edge computing.

- Server Performance: High-throughput CPUs, GPUs, and solid-state drives.

Milliseconds or even microseconds can differentiate profits from losses in high-frequency strategies.

Risk Management in Algorithmic Trading

Key risk mitigation techniques include:

- Hard Limits: Restrictions on position size, order volume, and trade frequency.

- Stop-Loss & Take-Profit Orders: Prevents excessive losses or locks in gains.

- Real-Time Dashboards: Alerts for anomalies, latency spikes, or system errors.

- Fail-Safes: Automated halts or fallback strategies during volatile conditions.

A robust risk management in algorithmic trading system is mandatory to prevent cascading losses.

Advantages and Drawbacks of Algo Trading

Pros:

- Consistency in execution

- Speed and scalability

- Eliminates emotional bias

- Multi-market and multi-asset capability

- 24/7 market surveillance

Cons:

- High initial setup and maintenance costs

- Risk of overfitting in model design

- System bugs or flash crashes

- Requires continuous monitoring and updates

- Complex regulatory scrutiny

Proper governance, regular audits, robust infrastructure, and contingency planning are key components of an algo trading system that help mitigate most risks.

Future Trends: AI and Machine Learning in Trading

AI is redefining how algorithms function:

- Machine Learning (ML): Machine Learning Enables adaptive strategies that learn from new data.

- Deep Learning: Recognizes complex market patterns and behaviors.

- Natural Language Processing (NLP): Converts unstructured data (news, reports) into tradable signals.

- Reinforcement Learning: Builds self-optimizing agents that improve over time.

- Quantum Computing: Still nascent, but holds potential for exponential speed-ups.

These technologies are pushing the boundaries of predictive accuracy and execution intelligence.

Conclusion

Algorithmic trading is at the confluence of technology, finance, and innovation. It offers unmatched potential for financial markets , efficiency, precision, and profitability. Yet, it demands rigorous planning, Algo Trading , strong governance, and a deep understanding of market behavior. As AI and quantum computing evolve, the future of trading will likely become more autonomous, Risk Management in Algorithmic Trading , real-time, and data-centric.Automated trading is reshaping the financial landscape, and institutions that embrace this shift while maintaining ethical standards, regulatory compliance, and key components of an algo trading system such as robust infrastructure, risk controls, and real-time analytics are better positioned for long-term success. Automated trading and institutions that embrace this shift while maintaining ethical and regulatory standards will emerge as long-term winners in the financial markets.