- Introduction to CAPM

- Theoretical Foundations: Risk and Return

- Role of Beta in CAPM

- Assumptions Underlying the Model

- Security Market Line (SML)

- Interpreting Expected Return vs Required Return

- Strengths and Limitations of CAPM

- CAPM vs Other Asset Pricing Models (APT, FF Model)

- Conclusion

Introduction to CAPM

The Capital Asset Pricing Model (CAPM) is a foundational framework in modern finance that defines the relationship between risk and expected return. Developed during the 1960s by financial economic William Sharpe, John Lintner, and Jan Mossin, CAPM builds on the concepts of Modern Portfolio Theory (MPT) and offers investors a method to determine a theoretically appropriate required rate of return of an asset. CAPM is widely used in corporate finance, investment analysis, and risk management to estimate the cost of equity and to assess whether a security is fairly valued.It answers a fundamental question: how should investors be compensated for the risks they take? Through its structure, CAPM provides a simple linear model that estimates the expected return on an asset based on its systematic risk. Its clarity and ease of use have made it a staple in financial analysts decision-making processes across industries.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Theoretical Foundations: Risk and Return

CAPM’s theoretical roots stem from MPT, which posits that diversification allows investors to optimize the risk-return trade-off. CAPM narrows this concept by establishing that the return on an asset is directly proportional to its exposure to systematic risk, the risk inherent to the entire market as opposed to unsystematic, asset-specific risks which can be diversified away. The idea is that only systematic risk, measured by beta, financial economic, investment analysis, should be rewarded with additional return. The model presumes that rational investors will construct efficient portfolios on the capital market line (CML) and expect higher returns only for bearing higher systematic risks.The core argument is that markets are efficient and investors should not expect to earn returns beyond what is justified by the risk they undertake. The linear relationship between risk and return makes CAPM a vital model for pricing risky securities and estimating capital costs.

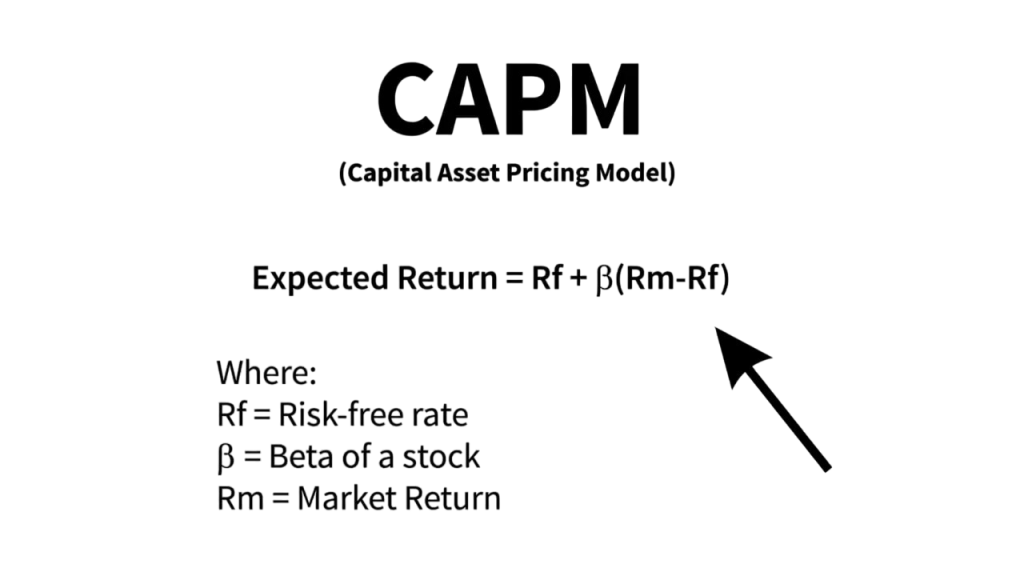

CAPM Formula and Breakdown of Components

The fundamental formula for CAPM is:

Expected Return (E[R]) = Rf + β × (Rm – Rf)

The model suggests that the expected return of a security is the sum of the risk-free rate and a risk premium. The risk premium is determined by how sensitive the security is to market risk (beta) and the excess return expected from the market above the risk-free rate.This equation provides a baseline for assessing whether a security is worth investment analysis in, based on its relative risk compared to the market.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Role of Beta in CAPM

Beta (β) measures an asset’s volatility in relation to the overall market. A beta of 1 indicates that the asset’s price moves in sync with the market. Betas greater than 1 suggest more volatility, and less than 1 imply less volatility.

β > 1: Aggressive investment, higher risk and return.

β < 1: Defensive investment, lower risk and return.

β = 0: Uncorrelated to market (e.g., cash)

Understanding beta helps investors determine how a stock contributes to financial analysts risk and aids in pricing securities within a diversified portfolio. CAPM uses beta as the central measure of market-related risk, financial economics and choosing assets with the right beta can help investors align with their risk tolerance.

Assumptions Underlying the Model

CAPM is built on several simplifying assumptions:

- All investors are rational and risk-averse.

- Investors have homogeneous expectations.

- Markets are frictionless with no taxes or transaction costs.

- Investors can borrow and lend at the risk-free rate.

- Assets are infinitely divisible and traded in perfect markets.

- Single-period investment horizon.

- No inflation or changes in interest rates.

These assumptions allow Capital Asset Pricing Model CAPM to function as a theoretical ideal, though their realism is often debated. Still, they offer a benchmark for understanding asset pricing. Critics argue that the model’s reliance on these idealized conditions limits its application in real-world markets.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

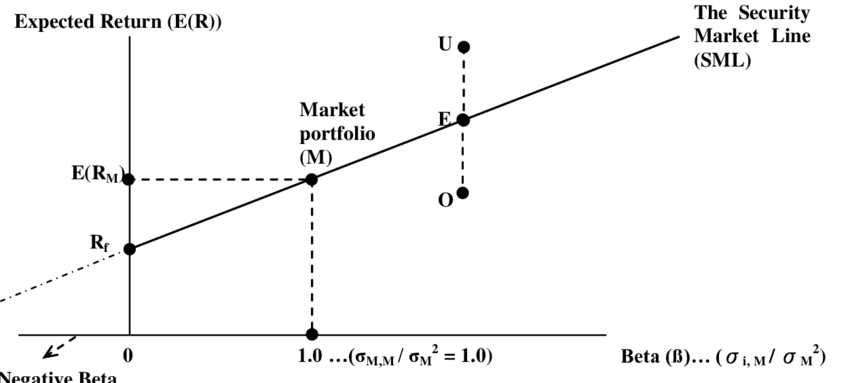

Security Market Line (SML)

The Security Market Line (SML) is the graphical representation of the CAPM. It depicts the expected return of assets as a function of their beta:

X-axis: Beta

Y-axis: Expected return

Intercept: Risk-free rate

Slope: Market risk premium

The Security Market Line SML is a benchmark for evaluating the financial analysts of an asset’s expected return. An asset above the line is undervalued (higher return than required), financial economic and an asset below is overvalued (lower return than required). It helps visualize the compensation for risk and identify arbitrage opportunities in the market.

Interpreting Expected Return vs Required Return

CAPM helps investors distinguish between a stock’s expected return and the return they require for the risk undertaken:

- If Expected Return > Required Return: The asset may be undervalued and attractive.

- If Expected Return < Required Return: The asset may be overvalued and should be avoided.

Such analysis is integral to security valuation, cost of capital calculations, and decision-making in corporate financial analysts. Investment analysis managers often use this framework when building and rebalancing portfolios.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Strengths and Limitations of CAPM

Strengths:

- Provides a simple and intuitive measure of risk-adjusted return.

- Aids in estimating the cost of equity.

- Offers a standardized way to compare investment opportunities.

- Based on sound economic theory.

Limitations:

- Relies on unrealistic assumptions (e.g., borrowing at the risk-free rate).

- Market return and beta estimates may be unstable or imprecise.

- Ignores other risk factors (e.g., liquidity, momentum).

- Assumes returns are normally distributed.

Despite its limitations, Capital Asset Pricing Model CAPM is still a powerful tool in financial modeling and capital budgeting.

CAPM vs Other Asset Pricing Models (APT, FF Model)

CAPM is often compared to more complex asset pricing models:

- Arbitrage Pricing Theory (APT): APT allows for multiple risk factors, offering more flexibility. It does not rely on a market portfolio but identifies relevant macroeconomic variables.

- Fama-French Three-Factor Model: Enhances CAPM by adding size (small minus big, SMB) and value (high book-to-market minus low, HML) factors to explain returns better.

- Fama-French Five-Factor Model: Further includes profitability and investment factors. These models tend to have higher explanatory power but require more data and complexity.

- Carhart Four-Factor Model: Adds momentum factor to improve predictive accuracy.

CAPM’s simplicity makes it attractive for practical applications, even if more advanced models often yield better empirical results. These newer models provide refined insights but at the cost of increased data requirements and complexity.

Conclusion

The Capital Asset Pricing Model stands as a cornerstone of modern financial theory. While it has its limitations and is based on idealized assumptions, CAPM provides a useful framework for understanding the relationship between risk and return. It helps investors, corporations, financial economic and financial analysts make informed decisions regarding asset pricing, investment analysis, portfolio construction, and capital budgeting. As financial markets grow in complexity, Capital Asset Pricing Model CAPM, Security Market Line will continue to serve as both a practical tool and a theoretical baseline in the evolving world of finance. It may not be the final word on asset pricing, but it remains the first word in most financial discussions.