- What are Options?

- Call vs Put Options

- The Concept of Strike Price and Expiry

- Basic Strategies: Buy Call/Put

- Covered Calls and Protective Puts

- Spreads: Vertical, Horizontal, and Diagonal

- Straddles and Strangles

- Iron Condor and Butterfly Spreads

What are Options?

Options in Options Trading Strategies are financial contracts that give traders the right, but not the obligation, to buy or sell an underlying asset at a specific price within a set timeframe. These instruments are highly versatile and form the foundation of various strategic approaches in the options market. Traders use options to hedge risks, generate income, or speculate on price movements, depending on their market outlook and risk tolerance. For example, Index Option Trading involves options based on market indices like the Nifty or S&P 500, allowing traders to gain exposure to a broad market segment rather than individual stocks. This approach is favored for its liquidity and lower volatility. Among the many tactics available, the Most Profitable Options Strategy often includes methods like selling covered calls or using vertical spreads, which balance risk and reward while maximizing returns under specific conditions. Options strategies can be tailored for bullish, bearish, or neutral market views, making them ideal for active traders seeking flexibility. Mastery of these tools enables investors to manage portfolios more effectively and respond to market changes with precision. Ultimately, understanding what options are and how they function is critical for leveraging the full potential of modern Options Trading Strategies.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Call vs Put Options

- Call Options give the buyer the right, but not the obligation, to purchase an asset at a fixed price before the expiration date. Traders typically use call options when they anticipate a bullish trend, and these are often combined in strategies like call debit spreads to manage cost and exposure efficiently.

- Put Options allow the buyer to sell an underlying asset at a predetermined price, ideal for bearish market expectations. A put spread strategy where one put is bought and another is sold at a lower strike helps limit losses while maintaining downside profit potential.

- A Call Debit Spread is a bullish vertical spread that lowers the entry cost compared to buying a single call, though it caps the maximum profit. This strategy works well in moderately bullish markets where a large move isn’t expected.

- A Put Spread (or bear put spread) can be a cost-effective way to profit from a modest decline in the price of a stock, especially useful in downtrending or weak markets where risk control is important.

In option trading, the comparison between call and put options forms the cornerstone of many effective Options Trading Strategies. These instruments allow traders to take positions on the future movement of asset prices with a defined risk. Understanding how and when to use each is key to building reliable and profitable setups.

- Iron Condor Options strategies combine both a bear call spread and a bull put spread. This neutral strategy profits when the underlying asset trades within a certain range, collecting premiums while minimizing risk. It’s highly popular in stable, low-volatility markets.

- In contrast to corporate bond spreads, which reflect differences in yields due to credit quality, maturity, or liquidity, option spreads focus on price movement and volatility, not interest rates.

Ultimately, choosing between call and put options or combining them in strategic spreads depends on the trader’s market view, risk appetite, and return expectations. With the right knowledge and approach, these tools can be powerful in crafting Options Trading Strategies tailored for every market condition.

The Concept of Strike Price and Expiry

The concept of strike price and expiry is fundamental to understanding how options work within various Options Trading Strategies. The strike price is the predetermined price at which the holder of an option can buy (in the case of a call) or sell (in the case of a put) the underlying asset. The expiry date is the last date on which the option can be exercised. Together, these two elements determine the value and profitability of an option. For instance, a call option becomes profitable when the market price of the asset exceeds the strike price before or at expiry, while a put option gains value when the asset price falls below the strike price. In Index Option Trading, where options are based on market indices like the Nifty or S&P 500, traders use strike prices and expiry dates strategically to target specific outcomes within a time frame. Many consider selecting the right strike and timing as part of the most profitable options strategy, as it directly affects risk, reward, and the premium paid or received. Whether employing conservative spreads or advanced strategies, a solid grasp of strike price and expiry is essential to succeeding in modern Options Trading Strategies.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Basic Strategies: Buy Call/Put

- Buy Call Option: Ideal when you expect the price of the underlying asset to rise. It gives you the right to buy at a set strike price, offering unlimited upside and limited downside (just the premium paid).

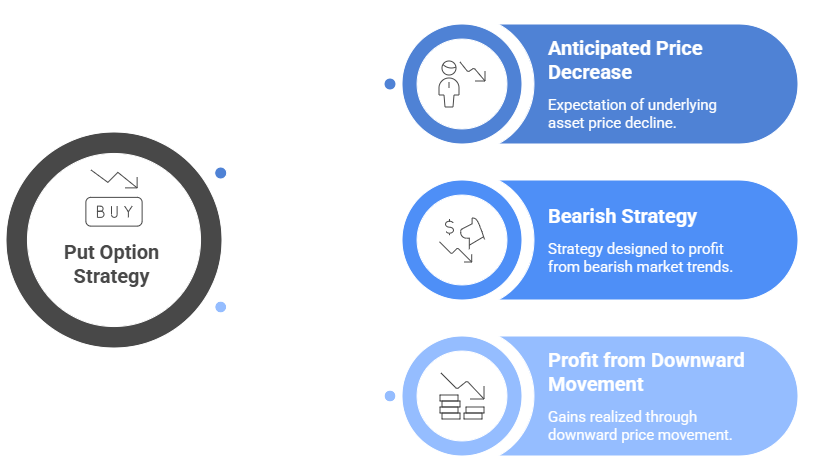

- Buy Put Option: Suitable when anticipating a drop in asset prices. It gives you the right to sell at the strike price, providing a high-reward opportunity if the market falls sharply.

- Put Spread Alternative: Instead of buying a single put, some traders use a put spread to limit risk and reduce the premium cost by selling another put at a lower strike.

In option trading, one of the simplest and most commonly used strategies is buying call or put options. These straightforward approaches are ideal for beginners looking to profit from directional market moves with limited risk. Here’s a breakdown of how these basic strategies work and how they relate to broader techniques like put spreads, call debit spreads, and Iron Condor options.

- Call Debit Spread Alternative: Similar to buying a call but includes selling another call at a higher strike. This call debit spread caps profit but lowers the cost of entry.

- Iron Condor Options Evolution: For more advanced neutral strategies, traders progress from simple buys to complex combinations like Iron Condor options, which use both calls and puts to profit in stable markets.

- Comparison to Corporate Bond Spreads: Unlike corporate bond spreads that reflect interest rate differentials, these options strategies rely on price movements and volatility, offering more dynamic trading opportunities.

- Vertical Spreads: These involve the same option type (call or put), same expiration date, but different strike prices. Popular forms include the put spread and call debit spread, ideal for traders expecting directional moves with limited risk.

- Horizontal Spreads: Also called calendar spreads, they use options with the same strike price but different expiration dates. These are effective in neutral markets, benefiting from time decay and implied volatility shifts.

- Diagonal Spreads: A flexible combination of different strike prices and expiries. Diagonal spreads allow traders to profit from directional moves and changing market conditions over time.

- Put Spread Example: Buying a higher-strike put and selling a lower-strike put creates a bearish setup with capped losses and reduced premium cost.

- Call Debit Spread Example: Involves buying a call at a lower strike and selling another at a higher strike this bullish strategy limits risk while lowering entry cost.

- Difference from Corporate Bond Spreads: Unlike corporate bond spreads, which measure credit risk and yield differences, option spreads rely on price movement and volatility as key profit drivers.

Covered Calls and Protective Puts

Covered calls and protective puts are two widely used Options Trading Strategies that help investors manage risk and generate income. A covered call involves owning the underlying stock and selling a call option against it, allowing the investor to earn a premium while potentially selling the stock at the strike price if exercised. This strategy is particularly effective in neutral to mildly bullish markets and is often considered one of the most profitable options strategies for income generation. On the other hand, a protective put involves purchasing a put option while holding the underlying stock, serving as an insurance policy against a decline in the asset’s value. This approach limits downside risk while maintaining upside potential, making it ideal during uncertain or bearish market conditions. In Index Option Trading, similar strategies can be applied to index-based instruments like the Nifty or S&P 500, where traders sell calls or buy puts on index options to manage portfolio risk or capture gains. Both covered calls and protective puts are favored by conservative traders and long-term investors who seek to enhance returns or reduce volatility without making radical changes to their holdings. Mastering these techniques can significantly strengthen a trader’s overall Options Trading Strategies framework.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Spreads: Vertical, Horizontal, and Diagonal

In option trading, spread strategies involve buying and selling options simultaneously to manage risk and optimize returns. The three primary types vertical, horizontal, and diagonal spreads form the backbone of many advanced strategies like Iron Condor options. These methods help traders profit in various market conditions with controlled exposure. Here’s a breakdown:

Mastering these spreads enhances a trader’s ability to build smarter Options Trading Strategies for both simple and complex market environments.

Straddles and Strangles

Straddles and strangles are popular non-directional strategies in option trading used to capitalize on significant price movements, regardless of direction. Both strategies involve buying both call and put options but differ slightly in their structure. A straddle involves buying a call and a put at the same strike price and expiry, typically used when a trader expects high volatility but is unsure of the direction. A strangle, on the other hand, involves buying out-of-the-money calls and puts with the same expiration, offering a lower cost than a straddle but requiring a larger move to become profitable. While these strategies focus on volatility, they contrast with directional strategies like the put spread and call debit spread, which aim to profit from specific upward or downward movements with limited risk and reward. In comparison, Iron Condor options are neutral strategies designed to profit from low volatility, collecting premiums within a defined price range. Unlike corporate bond spreads, which assess interest rate differentials and credit risk in fixed-income markets, straddles and strangles derive value from market uncertainty and rapid price swings. Traders often use these strategies during earnings announcements or major economic events, making them vital tools in advanced option trading playbooks.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Iron Condor and Butterfly Spreads

Iron Condor and Butterfly Spreads are advanced Options Trading Strategies designed to profit in low-volatility markets with limited risk and reward. An Iron Condor involves selling a lower-strike put and a higher-strike call while simultaneously buying a further out-of-the-money put and call. This creates two credit spreads one bullish and one bearish allowing traders to collect premiums when the underlying asset stays within a specific range. It’s especially popular in Index Option Trading, where broad indices like the Nifty or S&P 500 tend to move within predictable zones. Similarly, the Butterfly Spread uses three strike prices, combining either calls or puts to create a symmetrical profit zone around a central strike. This strategy profits most when the underlying asset expires exactly at the middle strike price, with maximum loss and gain both predefined. Both strategies are favored for their risk management and reward-to-risk balance, making them contenders for the most profitable options strategy when market conditions are stable and predictable. Their structured payoff profiles appeal to traders who seek consistency over high-risk bets, especially in sideways or low-volatility markets. Mastering these tools adds depth to a trader’s arsenal and reinforces a disciplined approach to Options Trading Strategies.