- What are Direct Mutual Funds?

- Direct vs Regular Mutual Funds

- Benefits of Investing Directly

- Choosing the Right Fund

- Steps to Invest in Direct Mutual Funds

- Online Platforms for Direct Investments

- SIP vs Lump Sum in Direct Funds

- Taxation in Direct Mutual Funds

What are Direct Mutual Funds?

Direct Mutual Funds are a type of mutual fund where investors can purchase units directly from the asset management company (AMC) without involving any intermediaries or brokers. This means there are no commission charges, which leads to lower expense ratios and potentially higher returns over the long term. When you invest in direct mutual funds, you’re taking a cost-efficient approach to wealth creation. These funds are ideal for financially aware investors who prefer to make informed decisions without paying extra fees. Many people now prefer using a direct mutual fund platform to easily research, compare, and invest in funds directly online. These platforms provide access to detailed fund information, past performance, risk metrics, and more, helping users make better choices. A reliable direct mutual fund investment platform also ensures transparency and convenience, often allowing investments to be tracked and managed in one place. With the rise of digital solutions and greater investor awareness, direct mutual funds are becoming a go-to option for those seeking better control over their investments and lower costs, without compromising on the quality of fund management. Whether you’re a beginner or an experienced investor, going direct can make a meaningful difference to your financial journey.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

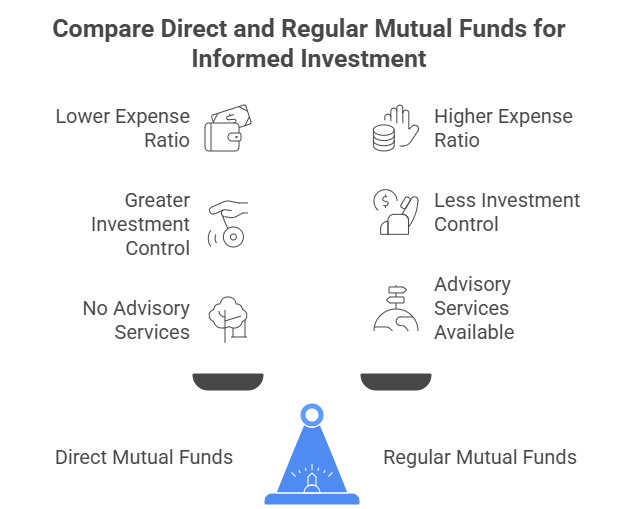

Direct vs Regular Mutual Funds

- Expense Ratio: Direct mutual fund plans have lower expense ratios since they eliminate distributor commissions, resulting in better long-term returns compared to regular plans.

- Returns: With no intermediaries involved, direct SIP investment generally yields higher returns than regular plans, especially over a long investment horizon.

- Investment Process: Direct plans require the investor to research and choose funds independently, often through a direct mutual fund investment platform, while regular plans involve assistance from an advisor.

When investing in mutual funds, one of the key decisions investors face is choosing between direct and regular plans. Both options offer access to the same underlying portfolio, but the way you invest and the associated costs can differ significantly. Understanding this difference is crucial, especially if you are planning a SIP direct plan or comparing SIP vs Lump Sum strategies. Here’s a breakdown of the key differences:

- Transparency: Direct plans offer more transparency as investors deal directly with the AMC, whereas regular plans may lack detailed insights into the commissions and recommendations.

- Cost Efficiency: Choosing a SIP direct plan is more cost-effective than a regular SIP, particularly for disciplined, long-term investors aiming for wealth accumulation.

- SIP vs Lump Sum: Whether you go for lump sum vs SIP, direct plans offer cost advantages in both methods, making them a preferred choice for financially savvy investors.

Benefits of Investing Directly

Investing directly in mutual funds offers a range of advantages, especially for investors who are informed and prefer taking control of their financial journey. One of the key benefits is the elimination of intermediary commissions, which leads to lower expense ratios and higher potential returns over time. When you invest in direct mutual funds, you’re choosing a more cost-effective route compared to regular plans. This means more of your money stays invested and works for you, enhancing compounding benefits in the long run. Direct investing also gives you access to a wide variety of funds directly from asset management companies, offering greater transparency and control. With the help of a direct mutual fund platform, investors can analyze fund performance, risk levels, and asset allocation in real time, making it easier to make informed decisions. Additionally, a direct mutual fund investment platform simplifies the entire process from selection and purchase to monitoring and redemption allowing you to manage your portfolio efficiently in one place. As digital awareness grows, more investors are shifting toward direct investments to maximize returns and maintain full control over their portfolios. Overall, going direct empowers investors with better clarity, reduced costs, and a smarter approach to wealth building.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

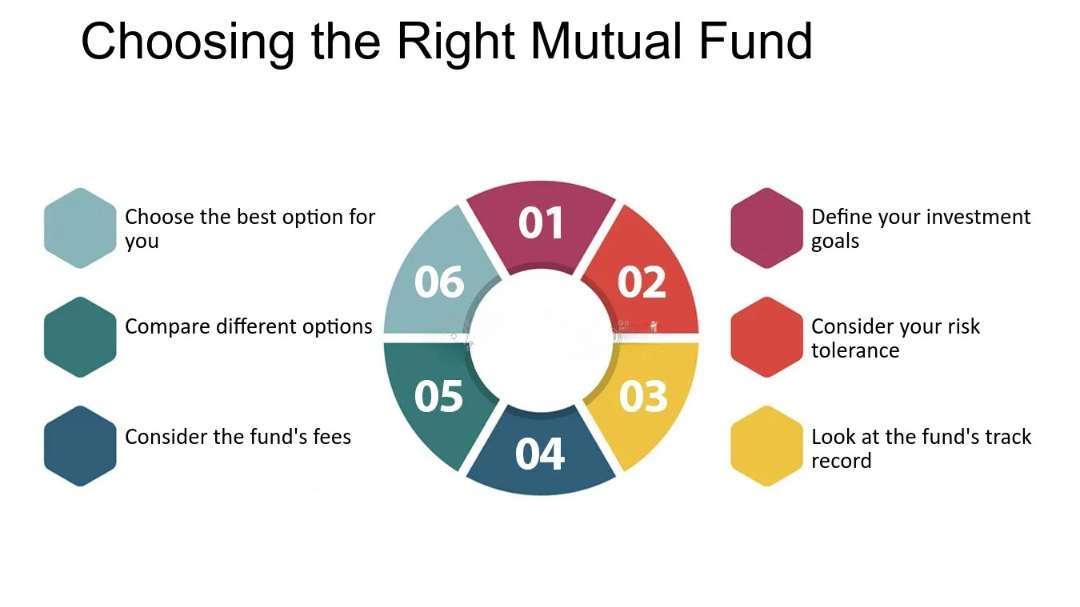

Choosing the Right Fund

- Identify Your Goals: Define your short-term and long-term financial goals clearly. Whether you aim to build wealth, save for retirement, or fund a child’s education, your goal will determine the type of direct mutual fund suitable for you.

- Assess Risk Tolerance: Evaluate how much risk you’re comfortable taking. Equity funds suit aggressive investors, while debt funds are ideal for conservative ones.

- Investment Horizon: If you have a longer time frame, equity-based direct SIP investments may be more beneficial. For shorter horizons, consider safer debt or hybrid funds.

Selecting the right mutual fund is essential for achieving your financial goals, especially if you’re planning to start a SIP direct plan or make a one-time investment. The decision becomes even more crucial when comparing strategies like SIP vs Lump Sum. With so many options available in the market, here are six key points to help you make the right choice:

- SIP vs Lump Sum: Understand the pros and cons of lump sum vs SIP. SIPs help in rupee cost averaging, while lump sum investments can be effective during market dips.

- Fund Performance and Ratings: Check historical returns, fund ratings, and performance consistency before making a decision.

- Use a Direct Platform: Opt for a reliable direct mutual fund investment platform to compare funds, track performance, and invest without distributor commissions.

- User-Friendly Interface: Most direct mutual fund investment platforms feature clean, intuitive dashboards that make it easy for beginners and experienced investors to navigate and invest with confidence.

- Zero Commission Investing: When you invest in direct mutual funds through these platforms, you avoid distributor commissions, reducing your overall costs and increasing potential returns.

- Wide Fund Selection: These platforms offer access to a variety of mutual funds from multiple AMCs, allowing you to compare and choose the best options based on your financial goals.

- Real-Time Tracking: Track your investments, view performance charts, and get updates in real time, making it easier to manage and rebalance your portfolio when needed.

- Goal-Based Investing: Some platforms offer tools to plan and invest based on specific life goals like retirement, education, or wealth creation.

- Secure and Paperless Process: With robust security features and a fully digital process, direct mutual fund platforms make investing simple, fast, and safe right from KYC to redemption.

Steps to Invest in Direct Mutual Funds

Investing in direct mutual funds is a straightforward process that allows investors to save on commissions and maximize returns. To invest in direct mutual funds, start by defining your financial goals and risk appetite. Once you know your investment objectives, the next step is to choose a trusted direct mutual fund platform that offers easy access to various schemes from different asset management companies. These platforms provide detailed fund information, comparisons, and performance analytics to help you make informed decisions. After selecting the appropriate fund, complete your KYC (Know Your Customer) process, which includes submitting identity and address proof. Once KYC is verified, you can proceed to create an account on your chosen direct mutual fund investment platform. From there, you can begin investing either through a one-time lump sum or a systematic investment plan (SIP), depending on your strategy. The platform will guide you through setting up auto-debits for SIPs, selecting fund categories, and tracking performance. Most platforms also offer mobile apps for real-time monitoring and portfolio management. By following these simple steps, investors can enjoy lower expense ratios, complete control over their investments, and better long-term returns all by choosing to invest directly without any intermediaries.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Online Platforms for Direct Investments

With the rise of digital finance, investing in mutual funds has become more convenient and cost-effective. Today, several online platforms are available to help investors invest in direct mutual funds without involving intermediaries or paying commissions. These platforms simplify the investment journey and offer powerful tools for analysis, tracking, and fund selection. Here are six key benefits of using a direct mutual fund platform:

SIP vs Lump Sum in Direct Funds

When choosing how to invest in direct mutual funds, one of the most common decisions investors face is between Systematic Investment Plans (SIPs) and lump sum investments. SIPs involve investing a fixed amount at regular intervals, helping investors develop a disciplined habit while benefiting from rupee cost averaging and market volatility. On the other hand, lump sum investments involve putting in a large amount at once, which can be more rewarding during market lows but carries higher risk if mistimed. The choice between SIP and lump sum often depends on your financial situation, market outlook, and risk appetite. For salaried individuals or those with steady cash flow, SIPs are often more practical and less emotionally taxing. If you have a large corpus available and a favorable market condition, lump sum may generate higher returns. With the help of a direct mutual fund platform, you can easily compare both approaches, analyze past performance, and make informed choices. A reliable direct mutual fund investment platform also allows you to automate SIPs or execute a one-time investment quickly, securely, and without any intermediary costs. Whether you prefer consistency through SIPs or seek opportunity with lump sum, both strategies have their place in direct mutual fund investing.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Taxation in Direct Mutual Funds

Taxation in direct mutual funds plays a crucial role in determining your post-return gains, making it important for investors to understand how it works. When you invest in direct mutual funds, the tax liability depends on the type of fund equity or debt and the duration for which you hold the investment. For equity mutual funds, if units are sold after one year, long-term capital gains (LTCG) above ₹1 lakh are taxed at 10% without indexation. If sold within one year, short-term capital gains (STCG) are taxed at 15%. For debt mutual funds, any gains made after three years are considered long-term and taxed at 20% with indexation benefits, while short-term gains (less than three years) are added to your income and taxed as per your applicable slab. These rules remain the same whether you choose a one-time investment or invest via SIPs, though each SIP installment is treated as a separate investment for tax purposes. A reliable direct mutual fund platform helps you track your investments along with capital gains and tax obligations in real-time. Using a robust direct mutual fund investment platform can make your tax filing easier, giving you clarity on returns, exit loads, and applicable taxes for smarter financial planning.