- Introduction to Investment Banking

- Day in the Life of an Investment Banker

- Academic and Skill Requirements

- Career Progression Path

- Long Working Hours Explained

- Common Challenges Faced

- Job Satisfaction and Growth

- Salary Expectations

Introduction to Investment Banking

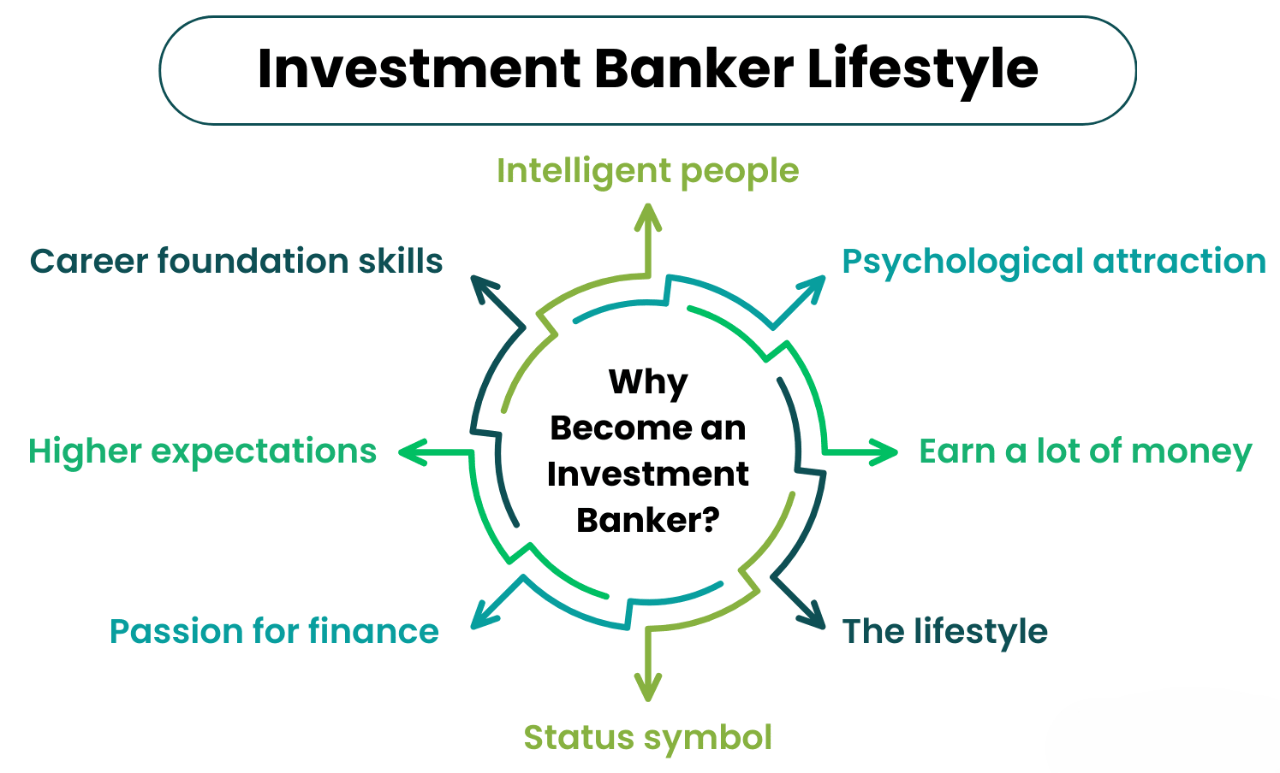

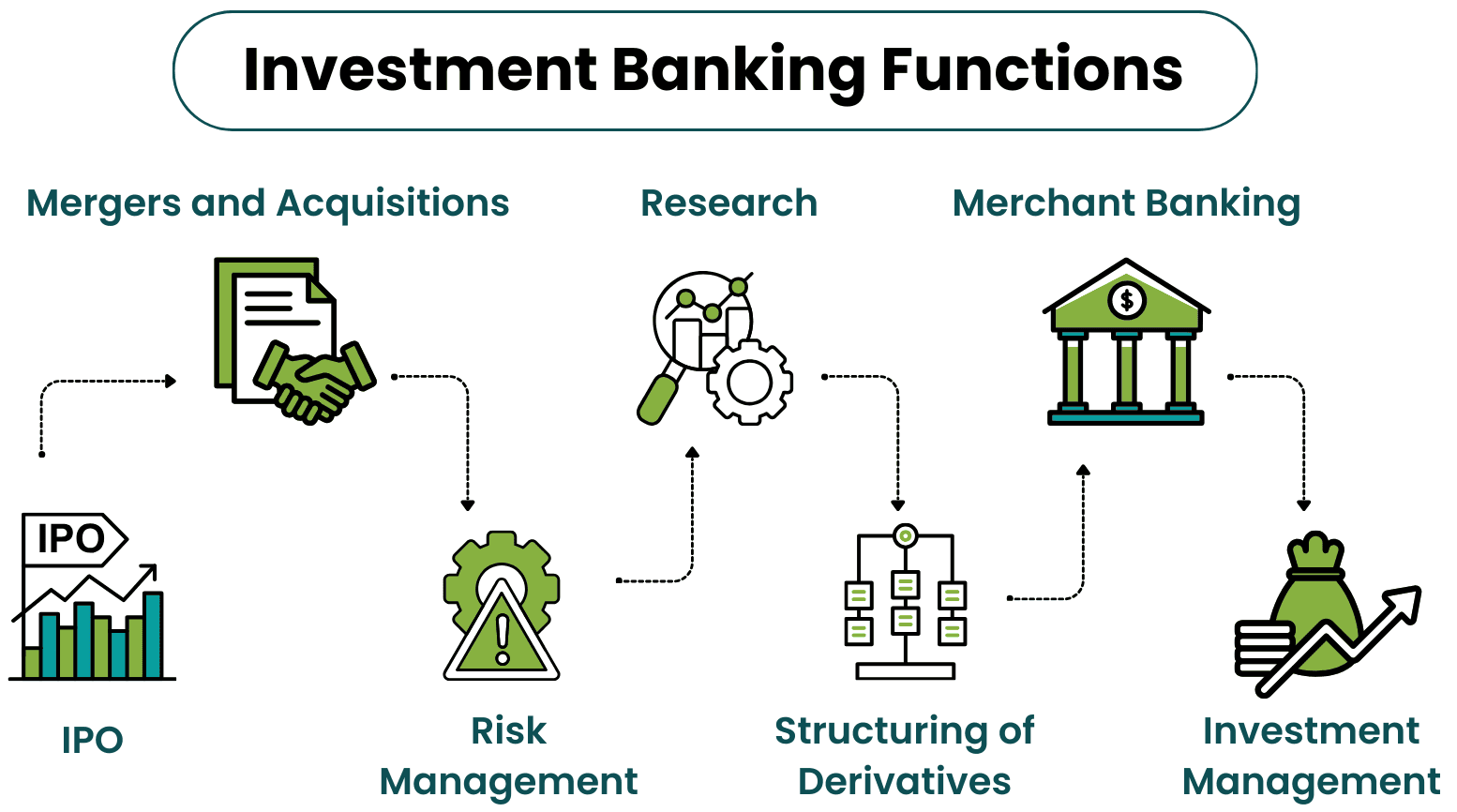

Investment banking is a dynamic and highly competitive field that plays a crucial role in the global financial system. It primarily involves helping corporations, governments, and institutions raise capital, offer strategic advisory for mergers and acquisitions, and manage financial assets. Many aspiring professionals often ask, “Is investment banking hard?” and the answer is yes, due to its demanding work hours, intense pressure, and the need for deep financial knowledge. Investment bankers work on high-stakes deals that require precision, speed, and strong analytical skills. Major global players like Credit Suisse Bank have long been at the forefront of large-scale investment banking operations, although recent market shifts and challenges have reshaped the landscape. Alongside these giants, boutique investment banks are gaining attention for offering specialized services and personalized client focus, often in niche markets. These smaller firms provide unique opportunities for professionals who want hands-on experience without the overwhelming scale of larger institutions. Whether you’re considering a career in the field or just trying to understand its functions, investment banking offers both prestige and complexity. While the path is tough, the rewards both financial and professional make it a compelling choice for those willing to commit.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Day in the Life of an Investment Banker

- Early Morning Market Review: The day often begins before sunrise, scanning global markets and reviewing financial news. Bankers keep a close eye on term deposits rates, bond yields, and stock performance to advise clients accurately.

- Team Briefings & Strategy Planning: Mornings include quick meetings to align with teams on live deals, pitchbooks, or new opportunities sometimes involving instruments like short term CDs and other low-risk capital solutions.

- Client Presentations: Bankers frequently pitch investment strategies or financing options, including CDs investment and fixed term deposits, tailored to client risk appetites and time horizons.

A day in the life of an investment banker is fast-paced, intense, and highly structured. These professionals are constantly juggling meetings, financial modeling, and client calls often under strict deadlines. Working at one of the top investment banks means high pressure, but also high rewards. Here’s a look at what their typical day might include:

- Financial Modeling & Valuation: A large part of the day is spent building Excel models to value companies, analyze mergers, or structure financing especially when advising corporate clients or wealthy investors.

- Due Diligence & Research: Bankers conduct rigorous research and vetting, whether it’s for a startup acquisition or a shift in fixed term deposits returns, ensuring all risks are accounted for.

- Late-Night Review Sessions: Evenings are often spent refining presentations or responding to urgent client queries. In top investment banks, long hours are the norm, and attention to detail is critical.

Academic and Skill Requirements

Pursuing a career in investment banking requires a strong academic foundation and a specific set of skills to thrive in this demanding field. Most professionals in this domain hold degrees in finance, economics, business, or mathematics from top-tier institutions, with many also pursuing an MBA or CFA for advanced roles. The ability to work under pressure, think analytically, and manage time efficiently is crucial, especially since investment banking hard is a phrase commonly used to describe the intense workload and long hours. Technical proficiency in Excel, financial modeling, and valuation methods is essential, as is strong communication for client interactions and deal negotiations. Firms like Credit Suisse Bank often seek candidates with a mix of academic excellence and real-world experience through internships or finance-related roles. Additionally, boutique investment banks which offer more specialized and hands-on services also look for professionals who are adaptable and able to work in lean teams. These smaller firms provide a different kind of learning curve but still require a solid base in finance and strategy. Ultimately, whether at a global institution or a niche firm, investment banking demands dedication, discipline, and a well-rounded skill set to succeed in this high-stakes environment.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Career Progression Path

The career progression path in investment banking is well-defined but highly competitive, demanding both persistence and performance. Most professionals start as analysts, where they build financial models, create pitchbooks, and support senior bankers in deal execution. After 2-3 years, high-performing analysts are promoted to associates, taking on more client-facing responsibilities and leading junior teams. With continued success, one can advance to vice president, director, and ultimately managing director, where the focus shifts to deal origination and maintaining client relationships. This journey isn’t easy investment banking hard is a common sentiment among insiders, given the long hours and intense pressure. Global firms like Credit Suisse Bank offer structured training and mentorship that help guide professionals through each stage, although expectations are equally high.

On the other hand, boutique investment banks provide faster exposure to deals and senior leadership but may lack the same level of formal development programs. However, they often reward initiative and hands-on involvement, which can accelerate career growth for ambitious individuals. Regardless of the firm size, career progression in investment banking hinges on technical expertise, leadership skills, and the ability to deliver results under pressure in a fast-paced, deal-driven environment.

Long Working Hours Explained

- Client Expectations Across Time Zones: Investment bankers serve clients worldwide. Whether advising on term deposits or IPOs, meetings and updates often take place late at night or early morning to match global time zones.

- Deal-Driven Pressure: During mergers, acquisitions, or debt financing, timelines are aggressive. Preparing models and proposals, including those involving short term CDs or capital structuring, requires extended work hours.

- Endless Revisions: Pitchbooks and financial models undergo numerous revisions. Even minor changes like tweaking details in a CDs investment strategy can take hours to update and polish.

- Last-Minute Demands: Clients may suddenly request changes or new insights related to fixed term deposits, forcing bankers to work overnight to deliver.

- High Volume of Tasks: Juggling multiple projects from evaluating term deposits to handling live M&A deals means tasks pile up quickly, demanding long hours.

- Culture of Over-Delivery: At top investment banks, there’s an unspoken expectation to go above and beyond often sacrificing personal time to prove commitment and reliability.

Working in investment banking is known for its intense pace and long working hours, often stretching well beyond the standard 9-to-5. The demanding schedule stems from high-stakes deals, tight deadlines, and constant client demands. Professionals at top investment banks are expected to be available around the clock, especially during active transactions. Here’s why the hours are so long:

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Common Challenges Faced

A career in investment banking is often perceived as prestigious, but it comes with its own set of challenges that make many wonder is investment banking hard? The answer lies in the intense demands professionals face daily. Long working hours, high-pressure deal-making, and the constant need to stay ahead in a highly competitive market create a stressful environment. One of the major challenges is maintaining a work-life balance, especially when working on tight deadlines across different time zones. Additionally, breaking into top-tier firms like Credit Suisse Bank or other elite institutions requires not only strong academic credentials but also robust networking and internship experience. Another hurdle is the steep learning curve for junior analysts who must quickly master financial modeling, valuation techniques, and client handling. Moreover, boutique investment banks, while offering more hands-on experience, often lack the extensive resources and global reach of larger firms, posing limitations in deal size and exposure. Navigating volatile market conditions, regulatory pressures, and shifting client demands adds further complexity to the role. These challenges highlight why investment banking remains one of the most demanding yet rewarding careers in finance, testing both mental resilience and strategic thinking at every level.

Job Satisfaction and Growth

Job satisfaction and growth in the financial sector, particularly within roles tied to term-based investment products, depend heavily on the nature of responsibilities and the scope for advancement. Professionals handling term deposits, short term CDs, CDs investment, and fixed term deposits often experience a stable and predictable workflow, which can contribute to a sense of control and consistency in their roles. While these positions might lack the adrenaline of high-stakes trading, they offer strong analytical engagement and opportunities to build long-term client relationships. Employees in such roles within top investment banks benefit from structured career paths, continuous training, and global exposure, which significantly enhances job satisfaction. Moreover, as fixed-income and deposit-based products become increasingly relevant during market volatility, experts in this area gain strategic importance, leading to faster career progression. Growth opportunities also expand through cross-functional moves into product development, risk management, or portfolio advisory roles. Though the pace might be slower compared to equity or M&A divisions, the long-term outlook remains strong, especially with growing investor interest in low-risk instruments. Ultimately, professionals find fulfillment in the trust placed in them to manage secure financial products, paired with the potential to move upward in a competitive yet rewarding environment.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Salary Expectations

Salary expectations in investment banking are often high, driven by the demanding nature of the role and the prestige associated with the industry. For those entering the field, especially at analyst or associate levels, the compensation packages can be highly attractive, including base salaries, performance bonuses, and other financial incentives. However, these high rewards come at a cost, as many professionals quickly realize that investment banking is hard, involving long hours, intense pressure, and constant performance evaluation. Entry-level salaries at top-tier firms such as Credit Suisse Bank can range significantly based on location and experience, often exceeding six figures annually in major financial hubs. In contrast, boutique investment banks may offer slightly lower base pay but can make up for it with larger bonuses and faster promotion tracks, given their leaner team structures and more personalized client interaction. As one progresses to vice president or managing director roles, the compensation scales dramatically, reflecting the value brought to high-stakes deals and client relationships. Ultimately, while the financial upside is substantial, professionals must weigh it against the high expectations, competitive environment, and personal sacrifices often required to succeed and grow in this rigorous career path.