- Banker of Investments

- Manager of Key Accounts

- An accountant for costs

- Benefits of a career in computer science

- Secretary of the Company (CS)

- Entrepreneur

- A certified public accountant

- Manager of Credits

- Officer of Insurance

- CPA, or certified public accountant

- Conclusion

Banker of Investments

For graduates in commerce, investment banking career continues to be one of the most prominent and lucrative professions. As a financial advisor, an investment banker assists governments, business management careers, and organizations in raising money for strategic initiatives and corporate expansion. In order to finance analyst roles major initiatives or mergers and acquisitions, they help businesses issue shares, bonds, and other instruments. Investment bankers counsel clients on market trends, valuation, and business restructuring in addition to financial transactions. Strong analytical abilities, a thorough understanding of economics, and the capacity to function under pressure are requirements for the position.

- high earning potential and bonuses based on success.

- chances to collaborate with large clientele and multinational corporations.

- exposure to global markets and intricate financial transactions.

- robust career advancement in fields like as private equity, M&A, and corporate finance. For students of commerce who are interested in corporate strategy, economics, and finance, investment banking CFA career provides a demanding but rewarding professional path that can lead to a global career.

- high prominence inside the organization as a result of working with exclusive clients.

- prospects for professional advancement in company development and sales leadership.

- improvement of problem-solving, negotiating, and strategic thinking abilities.

- a fulfilling position for people who like interacting with clients and forming relationships.

- The need for qualified account managers is increasing as a result of digital transformation altering business management careers, particularly in the consulting, technology, and financial sectors.

- crucial function in many kinds of business management careers, from start-ups to global corporations.

- chances to focus on cost control, internal auditing, or financial planning.

- strong job security as a result of the ongoing need for cost-effectiveness.

- route to more senior positions like finance director or chief financial officer (CFO).

- Cost accounting provides a stable and expanding job path for commerce career options students with excellent analytical and numerical skills.

- important part of maintaining moral corporate governance.

- chances to collaborate with regulatory agencies, boards, and top management.

- high regard and CFA career stability in the business world.

- Possibility of independent practice as a corporate consultant.

- Commerce students who enjoy law, policy, and strategic planning will find this investment banking career both intellectually stimulating and impactful. Global employment prospects in corporate finance analyst roles departments, hedge funds, and investment businesses are made possible by a CFA designation.

- highly employable diploma that is recognized worldwide.

- profound knowledge of investing strategies and financial markets.

- great income potential and access to prestigious financial institutions.

- Outstanding basis for positions like financial consultant, research analyst, or portfolio manager.

- For commerce students interested in international markets, investments, and complex financial ideas, the CFA career is ideal.

- important part of maintaining moral corporate governance.

- chances to collaborate with regulatory agencies, boards, and top management.

- high regard and investment banking career stability in the business world.

- Possibility of independent practice as a corporate consultant.

- Commerce students who enjoy law, policy, and strategic planning will find this career both intellectually stimulating and impactful.

- Unlimited creative flexibility and income opportunity.

- the capacity to turn concepts into profitable ventures.

- growth in resilience, strategic thinking, and leadership.

- chance to support social advancement and innovation.

- Nowadays, a lot of prosperous businesspeople, particularly in the fintech and IT industries, have backgrounds in commerce and combine their entrepreneurial vision with financial knowledge.

- Being a chartered accountant course has several advantages.

- high compensation packages and status in the workplace.

- worldwide prospects for advising, tax, and auditing services.

- the freedom to work for prestigious accounting firms or on your own.

- a crucial part in determining the financial strategy of the firm.

- chances to work in corporate finance teams, NBFCs, and banks.

- a healthy ratio of decision-making duties to risk analysis.

- Possibility of leadership positions in lending strategy and credit risk.

- significant background in customer relationship management and financial forecasting.

- For commerce students who like financial decision-making and analytical challenges, credit management is perfect.

- several investment banking career paths in the corporate insurance, health, and life insurance sectors.

- prospects in sales, claims administration, and underwriting.

- employment stability and consistent market expansion in the insurance officer career sector.

- Career advancement is facilitated by strong analytical and communication abilities.

- For individuals studying commerce who wish to work in a field that combines problem-solving, financial, and customer service, insurance is an excellent option.

- mobility and recognition on a global scale.

- Competitive salaries and strong demand worldwide.

- Expertise in U.S. GAAP and global financial reporting.

- Opportunities in corporate finance, consulting, and auditing.

- A CPA credential can be a gateway to a high-profile international career, particularly for commerce career options graduates aiming for cross-border financial roles.

Advantages of working in investment banking:

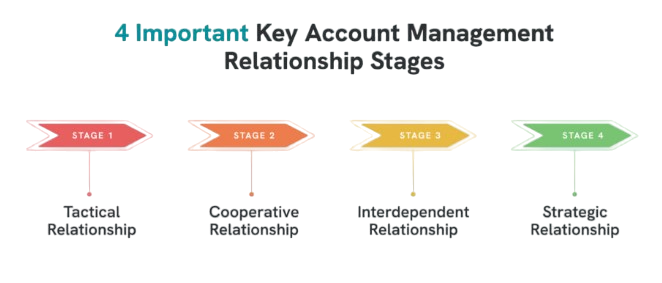

Manager of Key Accounts

In order to effectively manage an organization’s most significant clients, a Key Account Manager (KAM) is essential. They serve as a liaison between the business and its most important clients, guaranteeing both client pleasure and business expansion. To keep customers loyal and increase sales, KAMs determine their needs, establish enduring connections, and create unique solutions. Because they already have a strong understanding of business management careers principles, negotiation strategies, and customer relationship management, commerce career options majors make outstanding KAMs. This position is perfect for persons who like balancing people and numbers management because it combines analytical thinking with interpersonal abilities.

Being a Key Account Manager has several benefits:

To Explore Soft Skill in Depth, Check Out Our Comprehensive Soft Skill Certification Training To Gain Insights From Our Experts!

An accountant for costs

Understanding and controlling the expenses associated with running a firm is the main goal of a cost accountant. Analyzing, monitoring, and reporting on different spending categories—labor, materials, overheads, logistics, and production costs—is their main duty. They assist business management careers in determining product price, securing profitability, and locating areas for cost reduction. Cost accountants are vital to strategic decision-making in the industrial, logistics, and service sectors. Their observations inform financial forecasting, resource allocation, and budget planning.

The advantages of studying cost accounting include:

Are You Interested in Learning More About Soft Skill ? Sign Up For Our Soft Skill Certification Training Today!

Benefits of a career in computer science

One of the most prestigious degrees in the finance analyst roles and investment management industries is the Chartered Financial Analyst (CFA) program. CFAs are specialists in asset management, portfolio optimization, financial modeling, and investment analysis. Passing three difficult exam levels encompassing economics, accounting, quantitative finance, and ethics is required for the course.

Reasons to Become a CFA:

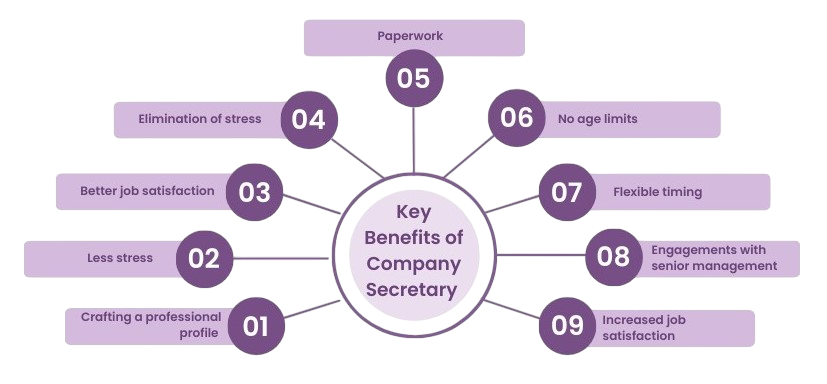

Secretary of the Company (CS)

corporation’s compliance with legal and regulatory obligations is monitored by a company secretary (CS). They are authorities in governance, securities laws, and corporate law. A CS is in charge of planning board meetings, writing reports, filing taxes, and counseling directors on strategic and legal issues. Company secretaries are in great demand as corporate transparency and compliance gain more attention.

Benefits of a career in computer science:

Entrepreneur

An entrepreneur is a person who launches and runs a firm, taking measured chances to realize creative concepts. Business savvy, financial literacy, and a grasp of market trends are all innate traits of commerce students that are critical for entrepreneurship. By launching new goods, challenging established company models, and risk management jobs, entrepreneurs propel economic progress. With modern tools like digital marketing, e-commerce, and cloud finance, starting a business has never been more accessible.

Why graduates of commerce find entrepreneurship exciting:

Are You Considering Pursuing a Master’s Degree in Soft Skill? Enroll in the Soft Skill Masters Program Training Course Today!

A certified public accountant (CA)

A chartered accountant (CA), one of the most well-liked and esteemed occupations in business, manages accounting systems, tax filings, financial audits, and financial planning. Certified public accountants (CAs) make sure businesses follow financial regulations and keep their financial statements transparent.

They may be employed as independent consultants, by private companies, or by public accounting firms. The CA qualification offers a broad foundation in business, finance, and taxation, making it versatile across industries.

Because of its blend of professional respect and intellectual rigor, CA is frequently seen by commerce students as a demanding but incredibly rewarding career choice.

Are You Preparing for Soft Skill Jobs? Check Out ACTE’s Soft Skill Interview Questions & Answer to Boost Your Preparation!

Manager of Credits

To make sure that a business has appropriate lending and credit procedures, a credit manager is essential. They handle accounts receivable, assess client creditworthiness, and reduce bad debts. This position requires a thorough comprehension of financial facts, analytical accuracy, and risk assessment abilities. Credit management positions are a good fit for recent commerce graduates with expertise in accounting, finance, or economics. They can eventually advance to senior roles in corporate treasury departments or financial institutions.

Benefits of credit management for careers:

Officer of Insurance

An insurance assists customers with risk management jobs assessment, policy selection, and claim handling. They are essential in helping clients understand financial protection and making sure their enterprises, assets, or health are adequately covered by insurance. Graduates in commerce contribute a wealth of analytical and financial expertise that enables them to assess client profiles and suggest suitable coverage choices. insurance officer career continues to be a safe and reputable vocation due to the rising demand for risk management jobs and financial planning.

Benefits of being an insurance officer career at work:

CPA, or certified public accountant

The international counterpart of the Certified Public Accountant (CA) credential is the Certified Public Accountant (CPA) credential, which is especially accepted in nations like the US, Canada, and Australia. CPAs specialize in auditing, taxation, and financial consulting, often working with multinational corporations or global accounting firms. For commerce career options students with worldwide job goals, the CPA chartered accountant course is a great option because it deepens their awareness of international accounting standards.

A CPA’s benefits include:

Conclusion

A wide range of job commerce career options outside standard accounting positions are available in the commerce stream. Every job route offers a different combination of analytical thinking, financial savvy, and strategic decision-making, from investment banking and chartered accountant course to entrepreneurship and insurance. Graduates in modern commerce are not limited to a single area; they are influencing the direction of company management, technology, and finance. You may establish a fulfilling career in any of these disciplines with the correct combination of training, credentials, and real-world experience. There are plenty of chances to innovate, lead, and prosper in the business sector, regardless of your career goals be they financial analysis, investment banking, chartered accounting, or entrepreneurship.