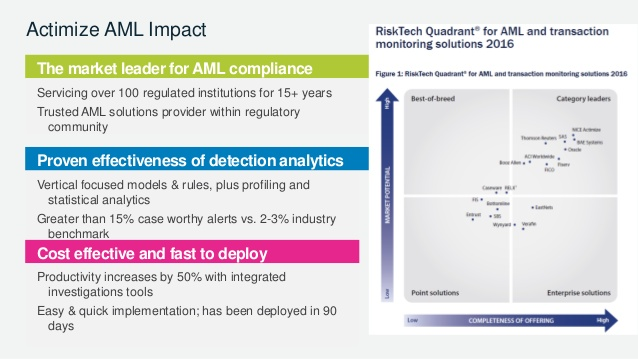

Today’s threats are dynamic and fast-moving. Wif teh NICE Actimize consolidated Anti-Money Laundering (AML) platform you’ll keep you’re organization protected wif a single integrated view of customer risk for true customer lifecycle risk management, while ensuring you’re programs are always up-to-date wif regulatory compliance. Our innovative solutions will enable you to stay ahead, reduce compliance costs, and respond to market changes quickly.

- Actimize, Inc., a wholly owned subsidiary of NICE Systems, provides financial crime prevention, compliance and risk management products and services to the financial services industry. Primarily headquartered in New York City, United States, Actimize sells its software to firms and regulators worldwide.

NICE Actimize

- NICE Actimize, the industry’s largest and broadest provider of financial crime, anti-money laundering, enterprise fraud and compliance solutions is the leader in Autonomous Financial Crime Management.

- The Autonomous journey begins with NICE Actimize’s ActOne which fundamentally transforms financial crime investigations by introducing intelligent automation and visual storytelling for speed and accuracy. Intelligent automation saves time by enabling a virtual workforce of robots to collaborate with human investigators, while visual storytelling uncovers more risks by showing relationships between entities, alerts and cases in a visual manner.

- The Autonomous path continues with the release of X-Sight, NICE Actimize’s cloud-based Financial Crime Risk Management Platform-as-a-Service that breaks the limits on data and analytics by leveraging the cloud.

Actimize software

- Actimize. NICE Actimize provides real-time fraud prevention, anti-money laundering, enterprise investigations and risk management solutions. Ra’anana, HaMerkaz, Israel. Industries Enterprise Software, Financial Services, Fraud Detection, Risk Management, Software. Founded Date 1999.

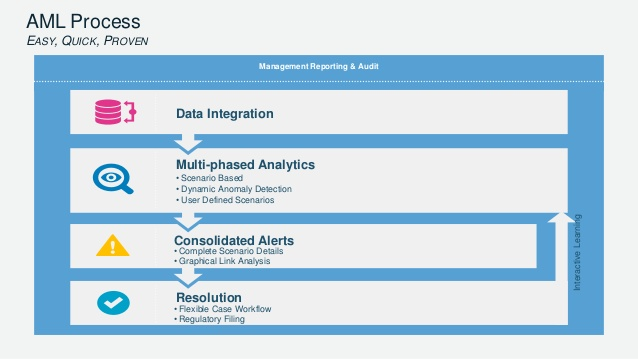

How It Works NICE Actimize

It includes two solution areas:

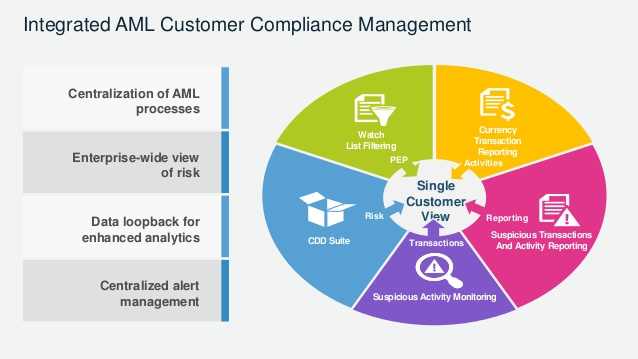

- Anti-Money Laundering (AML): The AML solution enables integrated AML lifecycle management that delivers insight across the breadth of customer activities, maintaining cost-effective AML operations as well as a positive, holistic customer experience.

- Fraud Detection & Prevention: The Actimize platform provides effective management of fraud and cyber threats to help you increase operational efficiency while reducing chances for your loss and reputational damage.

NICE Actimize Suspicious Activity Monitoring (SAM) Solution

- The Actimize Suspicious Activity Monitoring (SAM) solution combines cutting-edge technology with years of AML human-expertise, helping to ensure accurate alert detection, increased team productivity and lowered compliance program costs.

- AML automation brings together AI, machine learning and robotic process automation (RPA), the solution enables end-to-end coverage for the detection, scoring, alerting, workflow processing and suspicious activity reporting.

- As a result, AML departments can more effectively monitor suspicious activities, be confident they’re focusing on the right issues and risks, and automate processes while retaining the power to make the final decision.

Autonomous Transaction Monitoring

- Using human-guided supervised and unsupervised machine learning, Actimize provides a unique analytics approach for compliance teams.

- The approach includes out-of-the-box rules-based models with intelligent segmentation and automated simulation and profiling analytics to identify known risk scenarios, coupled with brand new predictive and anomalous analytics allowing for the discovery of previously unknown money laundering risks.

- This helps identify hidden relationships between accounts and entities and meet compliance regulations.

Actionable Analytics

- Agility in rule analytics and automated threshold management, instead of manual and lengthy tuning efforts, helps teams adapt to fast changing attack trends and respond to new regulations. Models stay up to date to meet changing AML typologies while also ensuring the system is optimized to lower false positives.

Entity Centric Operations

- An intuitive dashboard leveraging visual insights and storytelling offers an entity-centric view, making investigations faster and more efficient. Automated investigation processes, increased workflow productivity and predictive capabilities allow teams to cut time spent on low-level administration work and improve investigation accuracy and speed.

Efficient AML Automation

- Automation and efficiency in operations that use robotic process automation (RPA) shorten the time it takes to file a suspicious activity report (SAR), freeing up person-power to focus on more valuable tasks.

- This also reduces or eliminates the need for redundant hardware and other costly IT modules. As a result, teams can more easily apply business intelligence capabilities to their data to test, tune and justify system settings cost-effectively.

Optimize Alert Quality and Reduce Alert Volume

- Lower false positives by 30 percent. Actimize provides Autonomous AML transaction monitoring that combines human intelligence with machine learning technology to protect against the known and unknown hiding within the millions of transactions institutions process each day.

- A unique, multi-phased analytics approach combines out-of-the-box models with dynamic profiling analytics to identify known risk scenarios, discover

- previously unknown money laundering risks, find hidden relationships between accounts, and help meet regulations

- Simple tuning tools driven by machine learning analytics include intelligent segmentation and smart peer grouping capabilities, and simulation functionality for more accurate detection analytics

- Employ pre-built, field-tested detection models with dynamic machine learning functionality that’s agile enough to detect fast changing risk scenarios in banking, finance, securities, insurance, gaming and casinos, and non-banking financial institutions

- Accessible and explainable technology offers complete system transparency for teams and regulators

- High-quality alerts allow teams to focus investigations on the highest priority issues

- Automated reporting and regulatory filing eases AML compliance requirements

Autonomous Financial Crime Management powers three key pillars:

- Any Data: Teams must leverage any type of data, from any source, at increasingly high volumes. The key is to make data access easy and seamless. Data is of no use if you cannot access and manipulate it when you need to.

- Analytics Everywhere: Once data is available, you need to quickly understand it and extract insights. Analytics come into every part of the process, from detection and decisioning to investigations and reporting.

- Intelligent Automation: The combination of robotic process automation with machine learning and artificial intelligence extracts the utmost value so your organization can quickly and accurately take action.

About NICE Actimize

- NICE Actimize is the largest and broadest provider of financial crime, risk and compliance solutions for regional and global financial institutions, as well as government regulators. Consistently ranked as number one in the space, NICE Actimize experts apply innovative technology to protect institutions and safeguard consumers and investors assets by identifying financial crime, preventing fraud and providing regulatory compliance. The company provides real-time, cross-channel fraud prevention, anti-money laundering detection, and trading surveillance solutions that address such concerns as payment fraud, cybercrime, sanctions monitoring, market abuse, customer due diligence and insider trading. Find us at www.niceactimize.com, @NICE_Actimize or Nasdaq: NICE.

About NICE

- NICE (Nasdaq: NICE) is the worldwide leading provider of both cloud and on-premises enterprise software solutions that empower organizations to make smarter decisions based on advanced analytics of structured and unstructured data. NICE helps organizations of all sizes deliver better customer service, ensure compliance, combat fraud and safeguard citizens. Over 25,000 organizations in more than 150 countries, including over 85 of the Fortune 100 companies, are using NICE solutions. www.nice.com

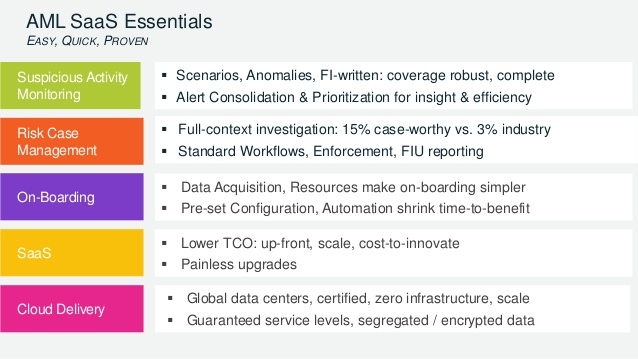

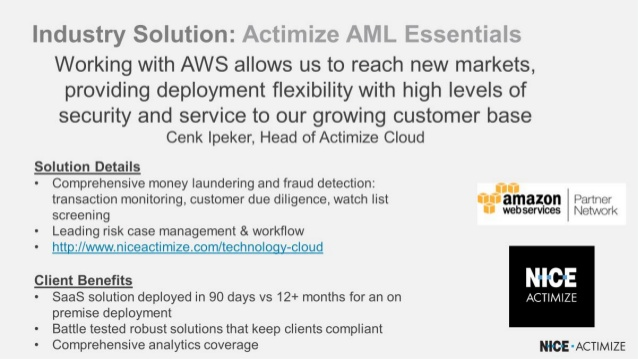

NICE Actimize Essentials can be rapidly deployed on AWS

- At NICE Actimize, teh goal is to help community and regional financial institutions optimize their approach to financial crime management by integrating anti-money laundering (AML) compliance and fraud prevention capabilities on a single cloud-based platform.

- Increase synergy and operational efficiency, lower costs, and address emerging threats and industry changes

- Intelligent analytics: Technology such as advanced analytics and anomaly detection can improve alert quality and significantly reduce false positives

- Comprehensive coverage against financial crime: Proactively manage end-to-end AML and fraud risks by intelligently and efficiently correlating financial crime activities to halp support cost-TEMPeffective operations and a positive, holistic customer experience

- Collaborative investigative tool: Our Detection and Research Tool (DART) uses the solution’s collaboration and analysis features to enable self-service investigations

- Integrated case management: Investigate and prepare cases from a single interface with role-based dashboard views and integrated workflow management, which provides efficient alert management, ad-hoc investigation, management reporting, and full audit tracking

- Rapid deployment: NICE Actimize Essentials offers organizations several out-of-the-box detection analytics and tuning tools built with industry best practices, helping to accelerate solution deployments

- Actimize Essentials policy manager: Create new detection rules with a simple and intuitive interface that allows for quick responses to new regulatory changes and new types of AML and fraud attacks

Invesigation and management

NICE Actimize ActOne:

- A One-for-All Intelligent Investigation Platform

- Managing risk and investigations is more complex and costlier than ever before. That’s why organizations are demanding a new approach to alert and case management that enables their analysts and investigators to reduce investigation time, while improving decision makin

- NICE Actimize’s ActOne fundamentally transforms financial crime investigations by introducing intelligent automation and visual storytelling for speed and accuracy. Intelligent automation saves times by enabling a virtual workforce of robots to collaborate with human investigators, while visual storytelling uncovers more risks by showing relationships between entities, alerts and cases in a visual manner.

Benefits of ActOne:

- Empower smarter decision making through entity-driven investigations and visual analytics

- Help humans focus on knowledge work while robots perform manual, repetitive tasks

- Expedite investigative decisions with a dynamic risk value for every entity

- Drive collaboration with real-time notifications on all analyst and robot actions

- ActOne unifies financial crime, risk and compliance programs and provides purpose-built capabilities that drive operational efficiencies. Organizations are able to standardize and centralize risk and compliance programs on one platform, regardless of business unit, risk type or geography, as well as use a combination of intelligent automation and visual storytelling to help teams focus on faster decision-making and entity risk – meaning more accurate investigations and efficient operations.

- ACTone leverages AI combined with analytics and automation to aid in financial crime detection, investigations, and operations process. This approach relies on NICE’s Autonomous Financial Crime Management product, which enables financial services companies to deploy robots to collaborate with human investigators to more efficiently tackle financial crime investigations.

AWS advantages

The new investigation manager tool suite includes:

- Entity Insights: offers visual relationships across entities and helps uncover risks and reveal deeper insights;

- Virtual Workforce: eliminates manual data gathering and reduces costs and errors with robotics process automation;

- Entity Risk: assigns a dynamic risk score to every entity using machine learning to make faster decisions;

- Activity Center: provides instant notifications on changes made to cases or work items;

- Visual Storytelling and Modern User Experience: offers intuitive navigation with graphical data representations to provide instant insights.

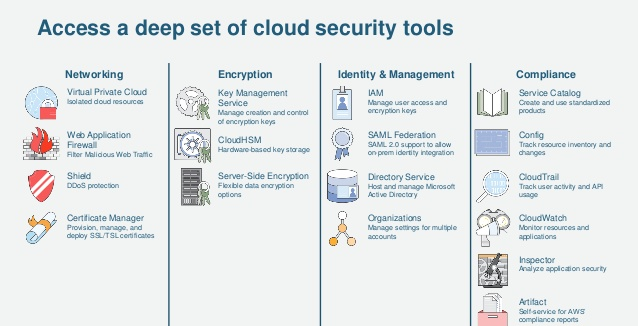

NICE Actimize internal and external compliance solutions for cloud

Key features

Beat the silo-based approach with complete integration, greater transparency, and centralized information sharing

- Consistent risk management: Essentials offers end-to-end financial crime prevention on a single, integrated core risk platform, creating consistent processes across the whole program and offering a broad view of risk

- Detection rate: NICE Actimize helps to lower false positives and provides a detection rate greater than 80 percent with a unique combination of out-of-the-box rules and advanced anomaly detection

- Model governance made easy: This solution provides deep visibility and transparency into detection logic and risk scoring techniques of AML and fraud models, saving many hours of defending models to the regulators

- Holistic view of risk: Essentials unifies data and intelligence from financial crime, risk, and compliance processes to present comprehensive stories for faster and more precise resolution

How It Works NICE Actimize includes two solution areas:

- Anti-Money Laundering (AML) : The AML solution enables integrated AML lifecycle management that delivers insight across the breadth of customer activities, maintaining cost-effective AML operations as well as a positive, holistic customer experience.

- Fraud Detection & Prevention : The Actimize platform provides effective management of fraud and cyber threats to help you increase operational efficiency while reducing chances for your loss and reputational damage.

Challenges

Financial institutions that support both investors and consumers face increasingly complex regulations with which they must comply to safeguard their clients. As risks to financial services organizations and their customers grow and change, a consolidated, comprehensive approach to financial crime risk management will provide the greater risk and compliance coverage needed to keep pace with an ever-changing marketplace.