- Introduction

- The Basics of Balanced Scorecard

- Highlights of Balanced Scorecard

- A Tool of Strategic Management

- The Need for a Balanced Scorecard

- Clients of Balanced Scorecard

- Monetary MEASUREMENT AND ITS LIMITATIONS

- Fiscal reports in associations are regularly ready by practical region

- The Balanced Scorecard Scope

- Conclusion

- Convey what they are attempting to achieve

- Adjust the everyday work that everybody is doing with technique

- Focus on activities, items, and administrations

- Measure and screen progress towards key targets

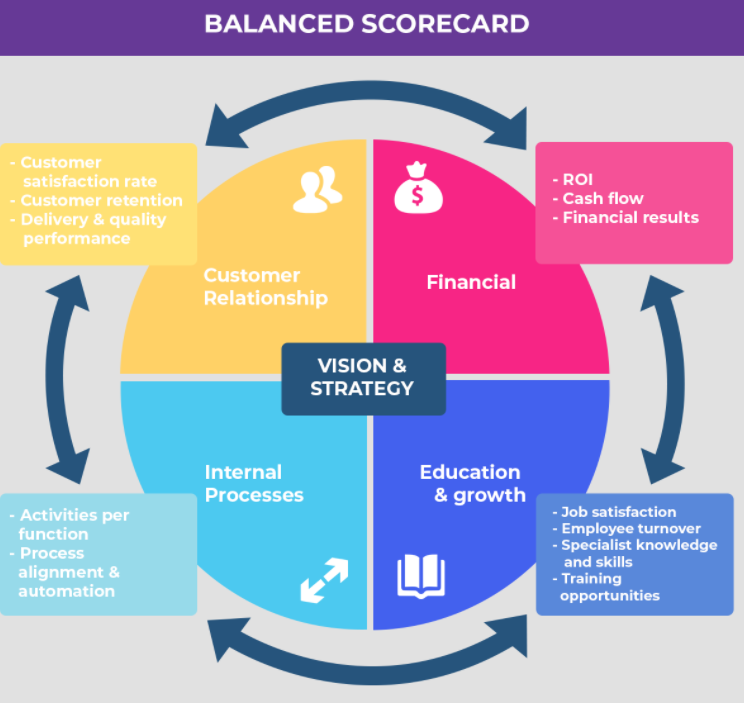

- Monetary Perspective – This comprises of expenses or estimation required, as far as pace of return on capital (ROI) utilized and working pay of the association.

- Client Perspective – Measures the degree of consumer loyalty, client maintenance and piece of the pie held by the association.

- Business Process Perspective – This comprises of measures, for example, cost and quality connected with the business processes.

- Learning and Growth Perspective – Consists of measures like representative fulfillment, worker maintenance and information the board.

- Builds the emphasis on the business system and its results.

- Prompts ad libbed hierarchical execution through estimations.

- Adjust the labor force to meet the association’s procedure on an everyday premise.

- Focusing on the vital determinants or drivers of future execution.

- Works fair and square of correspondence comparable to the association’s procedure and vision.

- Assists with focusing on projects as per the time span and other need factors.

- Compelling authoritative execution estimation, the ascent of immaterial resources, and the test of carrying out methodology.

- We start by examining execution estimation and, explicitly, our dependence on monetary proportions of execution notwithstanding their intrinsic constraints.

- Next we inspect the ascent of theoretical resources in current associations and their effect on our capacity to gauge corporate execution precisely.

- From that point we move to the system story and survey various hindrances to effective procedure execution.

- With the issues obviously on the table, we present the Balanced Scorecard and how this apparatus can defeat the boundaries connected with monetary measures, the development of theoretical resources, and methodology execution.

- Our Balanced Scorecard outline starts with a glance back at how and when the Scorecard was initially imagined.

- Next we offer the conversation starter, “What is a Balanced Scorecard?” and expound on the points of interest of the device as correspondence framework (with specific accentuation on the idea of Strategy Maps), estimation framework, and key administration framework.

- Here you will be acquainted with the hypothesis fundamental the Balanced Scorecard and the four points of view of execution examined utilizing this cycle.

- The section closes with a survey of the basic undertaking of connecting Balanced Scorecard goals and measures through a progression of circumstances and logical results connections, where you will find how recounting a strong vital story will be an extraordinary partner in your Balanced Scorecard execution.

- Additional proof of the pervasiveness of the Balanced Scorecard is given by The Hackett Group, which found in 2002 that 96 percent of the almost 2,000 worldwide organizations it studied had either executed or wanted to carry out the tool.

- Before we talk about the idea of the Balanced Scorecard, we should look at its starting points and endeavor to decide exactly why it has become such an all around acknowledged approach.

- Regardless of whether it’s the spot confronted kid excitedly hawking lemonade on a boiling midsummer’s day, the CEO of a worldwide combination thinking about a significant choice, or a harried public area chief endeavoring to accomplish more with less, the shared factor among everything is the mind-boggling drive to succeed.

- And keeping in mind that difficult work want actually go quite far, business, obviously, has changed drastically lately, delivering achievement more troublesome than any other time in recent memory to accomplish.

- The present authoritative value creating exercises are not caught in the substantial, fixed resources of the firm.

- All things being equal, esteem rests in the thoughts of individuals dissipated all through the firm, in client and provider connections, in data sets of key data, and in societies equipped for advancement and quality.

- Customary monetary measures were intended to look at past periods in view of inner guidelines of execution.

- These measurements are of little help with giving early signs of client, quality, or worker issues or open doors. We’ll look at the ascent of immaterial resources in the following part of this section.

- Monetary measures give a great survey of past execution and occasions in the association.

- They address a reasonable verbalization and rundown of exercises of the firm in earlier periods.

- In any case, this nitty gritty monetary view has no prescient power for what’s to come.

- Obviously, and as experience has shown, incredible monetary outcomes in a single month, quarter, or even year are not the slightest bit demonstrative of future monetary execution.

- All things considered called incredible organizations those that once graced the fronts of business magazines and were the jealousy of their friend bunches can succumb to this awful situation.

- The Balanced Scorecard is the device that answers this perplexing set of three of difficulties. In the rest of this part we will start our investigation of the Balanced Scorecard by examining its beginnings, auditing its applied model, and taking into account which isolates the Balanced Scorecard from different frameworks.

- Beginnings of the Balanced Scorecard The Balanced Scorecard was created by two men, Robert Kaplan, a bookkeeping teacher at Harvard University, and David Norton, a specialist additionally from the Boston region. In 1990 Kaplan and Norton drove an exploration investigation of twelve organizations investigating new strategies for execution estimation. The catalyst for the review was a developing conviction that monetary proportions of execution were ineffectual for the cutting edge business venture.

- The review organizations, alongside Kaplan and Norton, were persuaded that a dependence on monetary proportions of execution was influencing their capacity to make esteem. Inward Process Perspective In the Internal Process point of view of the Scorecard, we distinguish the key cycles the firm should dominate at to keep adding an incentive for clients and eventually investors.

- Item advancement, creation, assembling, conveyance, and postsale administration might be addressed in this point of view. Numerous associations depend vigorously on provider connections and other outsider courses of action to serve clients actually.

- Such associations ought to think about creating measures in the Internal Process viewpoint to address the basic components of those connections. We will inspect the improvement of execution destinations and measures for Internal Processes in more noteworthy profundity in Chapters Four and Five.

- When you distinguish destinations, gauges, and related drives in your Customer and Internal Process points of view, you can be sure of finding a few holes between your present authoritative foundation of worker abilities (human resources), data frameworks (instructive capital), and the climate expected to keep up with progress (hierarchical capital). The targets and measures you plan in this viewpoint will assist you with shutting that hole and guarantee practical execution for what’s to come.

- Maybe the groups are mentally depleted from their prior endeavors of growing new essential measures, or they basically think about this point of view “delicate stuff ” best left to the Human Resources bunch. Regardless of how legitimate the reasoning appears, this point of view can’t be disregarded in the improvement cycle. As I referenced, the actions you create in this viewpoint are the empowering agents of any remaining means on your Scorecard.

- Consider them the foundations of a tree that will at last lead through the storage compartment of inner cycles to the parts of client results lastly to the leaves of monetary returns. Monetary Perspective Financial measures are a basic part of the Balanced Scorecard, particularly so in the revenue driven world.

- The goals and measures in this viewpoint let us know whether our technique execution-which is point by point through targets and measures picked in different viewpoints is prompting further developed primary concern results. We could concentrate the entirety of our energy and capacities on further developing consumer loyalty, quality, on-time conveyance, or quite a few things, however without a sign of their impact on the association’s monetary returns, they are of restricted worth.

Introduction :-

The equilibrium scorecard is utilized as an essential preparation and an administration method. This is generally utilized in numerous associations, no matter what their scale, to adjust the association’s exhibition to its vision and destinations.

The scorecard is additionally utilized as a device, which works on the correspondence and input process between the representatives and the executives and to screen execution of the hierarchical goals.As the name portrays, the fair scorecard idea was created not exclusively to assess the monetary exhibition of a business association, yet additionally to address client concerns, business process advancement, and improvement of learning apparatuses and instruments.

The goal of the reasonable scorecard was to make a framework, which could gauge the exhibition of an association and to further develop any lacks that happen. One of the fundamental explanations behind numerous associations to be ineffective is that they neglect to comprehend and stick to the targets that have been set for the association.The fair scorecard gives an answer for this by separating destinations and making it more straightforward for the executives and representatives to comprehend.

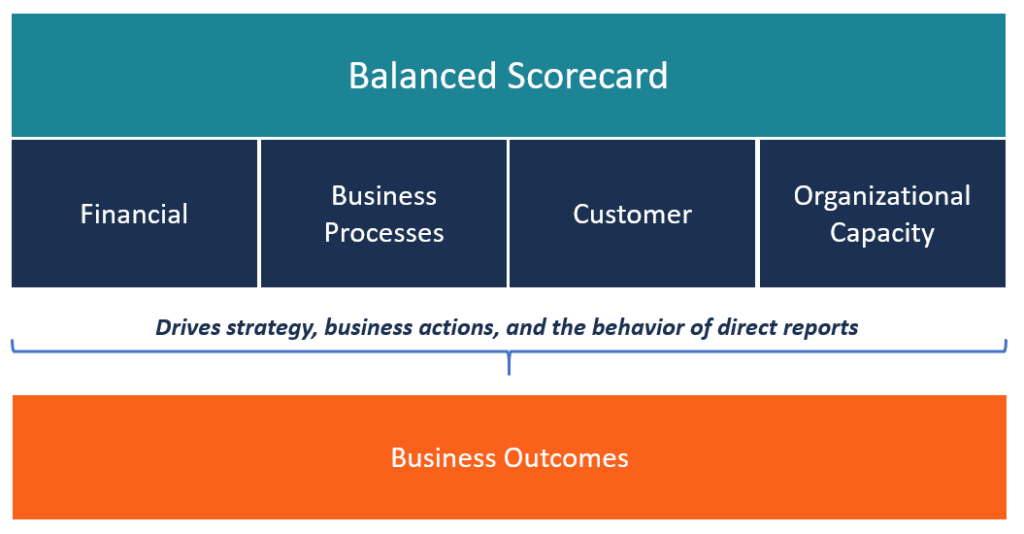

The decent scorecard (BSC) is an essential preparation and the board framework that associations use to:

The Basics of Balanced Scorecard :-

Following is the least difficult outline of the idea of adjusted scorecard. The four boxes address the principle areas of thought under adjusted scorecard. Every one of the four primary areas of thought are limited by the business association’s vision and procedure.

The decent scorecard is separated into four primary regions and a fruitful association is one that tracks down the right harmony between these areas.Every region (point of view) addresses an alternate part of the business association to work at ideal limit.

The four points of view are interrelated. In this way, they don’t work autonomously. In true circumstances, associations need at least one points of view consolidated together to accomplish its business targets. For instance, Customer Perspective is expected to decide the Financial Perspective, which thusly can be utilized to work on the Learning and Growth Perspective.

Highlights of Balanced Scorecard :-

From the above graph, you will see that there are four viewpoints on a decent scorecard. Every one of these four viewpoints ought to be considered as for the accompanying elements.With regards to characterizing and evaluating the four viewpoints, following elements are utilized:

Goals – This mirrors the association’s destinations, for example, productivity or piece of the pie.

Measures – Based on the targets, measures will be set up to check the advancement of accomplishing destinations.

Targets – This could be office based or in general as an organization. There will be explicit focuses on that have been set to accomplish the actions.

Drives – These could be delegated moves that are made to meet the destinations.

A Tool of Strategic Management :-

The target of the reasonable scorecard was to make a framework, which could gauge the exhibition of an association and to further develop any back slacks that happen.The prevalence of the decent scorecard expanded over the long haul because of its coherent cycle and strategies. Subsequently, it turned into an administration system, which could be utilized across different capacities inside an association.

The decent scorecard assisted the administration with understanding its targets and jobs in the master plan. It likewise assists the executives with joining to gauge the exhibition as far as amount.The decent scorecard likewise assumes an essential part with regards to correspondence of vital goals.

One of the principle purposes behind numerous associations to be fruitless is that they neglect to comprehend and stick to the destinations that have been set for the association. The fair scorecard gives an answer for this by separating destinations and making it simpler for the executives and workers to comprehend.

Arranging, setting targets and adjusting procedure are two of the key regions where the fair scorecard can contribute. Targets are set out for every one of the four viewpoints as far as long haul goals.Nonetheless, these objectives are for the most part attainable even in the short run. Measures are taken in line up with accomplishing the objectives.

Key input and learning is the following region, where the decent scorecard assumes a part. In essential input and learning, the administration gets cutting-edge surveys with respect to the accomplishment of the arrangement and the exhibition of the methodology.

The Need for a Balanced Scorecard :-

Following are a portion of the focuses that depict the requirement for carrying out a reasonable scorecard:

Clients of Balanced Scorecard (BSC) :-

BSCs are utilized broadly in business and industry, government, and charitable associations around the world.The greater part of significant organizations in the US, Europe, and Asia are utilizing the BSC, with utilize filling in those areas as well as in the Middle East and Africa.

A new worldwide concentrate by Bain and Co recorded adjusted scorecard fifth on its best ten most broadly utilized administration instruments all over the planet.BSC has likewise been chosen by the editors of Harvard Business Review as perhaps the most powerful business thoughts of the beyond long term.The Balanced Scorecard helps associations in beating three central questions:

Monetary MEASUREMENT AND ITS LIMITATIONS :-

However long business associations have existed, the customary strategy for estimation has been monetary. Accounting records used to work with 2 Performance Measurement and the Need for a Balanced Scorecard c01.qxd 07/06/06 02:02 PM Page 2 monetary exchanges can be followed back in a real sense millennia.

At the turn of the 20th century, monetary estimation developments were basic to the achievement of the early modern goliaths, like General Motors. That ought not come as a shock since the monetary measurements of the time were the ideal supplement to the machinelike idea of the corporate elements and the executives reasoning of the day.

Rivalry was controlled by extension and economies of scale with monetary measures giving the measuring sticks of achievement.Monetary proportions of execution have developed, and today ideas, for example, financial worth added (EVA) are very pervasive.

EVA proposes that except if an association’s benefit surpasses its expense of capital, it truly isn’t making an incentive for its investors.Involving EVA as a focal point, it is feasible to discover that regardless of an expansion in profit, a firm might be obliterating investor esteem assuming the expense of capital related with new ventures is adequately high.

Crafted by monetary experts is to be complimented. As we move into the twenty-first century, be that as it may, many are scrutinizing our practically select dependence on monetary proportions of execution.Maybe these actions served better for of giving an account of the stewardship of assets shared with the board’s consideration rather than as a method for diagramming the future bearing of the association.

We should investigate a portion of the reactions collected against the overabundant utilization of monetary measures:

Not steady with the present business real factors.

Driving by rearview reflect.

Fiscal reports in associations are regularly ready by practical region:-

Individual division articulations are ready and moved up into the specialty unit’s numbers, which eventually are assembled as a feature of the by and large authoritative picture. This approach is conflicting with the present association, wherein a large part of the work is cross-practical in nature.Today we see groups contained numerous useful regions meeting up to tackle squeezing issues and make esteem in never-envisioned ways.

Despite industry or association type, collaboration has arisen as an absolute necessity have normal for winning ventures in the present business climate.For instance, think about these three fields of try: heart medical procedure, Wall Street research examination, and b-ball as played by the very much remunerated geniuses of the National Basketball Association (NBA).

From the outset they seem to share literally nothing practically speaking; notwithstanding, studies uncover that achievement in every one of the three is extraordinarily worked on using cooperation:The communications of specialists with other clinical experts (anesthesiologists, medical caretakers, and professionals) are the most grounded mark of patient accomplishment on the surgical table.

With regards to Wall Street “stars,” it’s not the singular expert and scholarly estimations that spell achievement, however the joining of examiner and firm.Indeed, even in the NBA, specialists have observed that groups where players stay together longer win more games.Our conventional monetary estimation frameworks have no real way to ascertain the genuine worth or cost of these connectionsThe Vision Barrier by far most of workers don’t comprehend the association’s system.

The present circumstance was satisfactory at the turn of the 20th century, when worth was gotten from the most productive utilization of actual resources and representatives were in a real sense gear-teeth in the incredible modern wheel. Notwithstanding, in the data or information age in which we at present exist, esteem is made from the theoretical resources the skill, connections, and societies existing inside the association.Most organizations are as yet coordinated for the modern period, using order and control directions that are insufficient for the present climate.

The Balanced Scorecard Scope :-

As the former conversation shows, associations face many obstacles in creating execution estimation situation that genuinely screen the right things.

Conclusion :-

As the name means, adjusted scorecard makes a right harmony between the parts of association’s goals and vision. It’s an instrument that assists the administration with finding the presentation of the association and can be utilized as an administration system. It gives a broad outline of an organization’s targets rather than restricting itself just to monetary qualities. This makes a solid brand name among its current and possible clients and a standing among the association’s labor force.