- Introduction to Monte Carlo Analysis

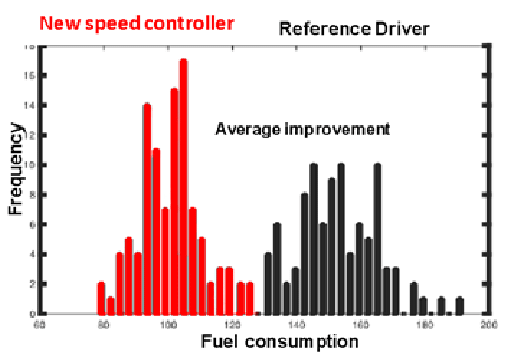

- The outcomes would look something like this

- Advantages of Monte Carlo investigation in project the executives

- Key Takeaways

- Who Uses Multivariate Models

- Typical Distribution and Standard Deviation

- Who Uses the Method

- Extraordinary Considerations

- How Monte Carlo Simulation Works

- Normal likelihood circulations include

- Conclusion

- Monte Carlo Analysis is a danger the executive’s procedure used to direct a quantitative examination of dangers. This numerical method was created in 1940 by a nuclear atomic researcher named Stanislaw Ulam and is utilized to break down the effect of dangers on your task – all in all, on the off chance that this hazard happens, what will it mean for the timetable or the expense of the venture? Monte Carlo provides you with a scope of potential results and probabilities to permit you to think about the probability of various situations.

- For instance, suppose you don’t have the foggiest idea what amount of time your task will require. You have a best guess of the span of each undertaking task. Utilizing this, you foster a most ideal situation (hopeful) and most dire outcome imaginable (skeptical) span for each assignment. You can then utilize Monte Carlo to break down every one of the likely blends and give you probabilities of when the task will finish.

- 2% possibility finishing the undertaking in a year (assuming each assignment wrapped up by the hopeful timetable)

- 15% possibility of finish inside 13 months

- 55% possibility of consummation inside 14 months

- 95% possibility of consummation inside 15 months

- 100 percent chance of culmination inside 16 months (If everything takes as long as the negative assessments)

- Utilizing this data, you can now better gauge your course of events and plan your task.

- Gives early inducation of the fact that you are so prone to comply with project achievements and time constraints

- Can be utilized to make a more sensible spending plan and timetable

- Predicts the probability of timetable and cost overwhelms

- Evaluates dangers to survey impacts

- Gives objective information to navigation

- Impediments of Monte Carlo investigation in project the executives

- You should give three evaluations to each movement or element being examined

- The investigation is just pretty much as great as the assessments gave

- The Monte Carlo reenactment shows the general likelihood for the whole task or a huge subset (like a stage). It can’t be utilized to examine individual exercises or dangers.

- Remember These 10 Project Management Best Practices (Infographic)

- Conquering its Top Challenges Project Management

- Project Risk Management Tools (Ultimate Guide to Project Risk, Part 2)

- Project Management Methodologies Review (Part 1)

- The Monte Carlo model makes it workable for analysts from all various types of callings to run numerous preliminaries, and consequently to characterize every one of the possible results of an occasion or a choice.

- While utilizing the Monte Carlo model, a client changes the worth of different factors to discover their likely effect on the choice that is being assessed.

- In the money business, the choice is regularly connected with a venture.

- The likelihood disseminations delivered by a Monte Carlo model make an image of hazard.

- Multivariate models-like the Monte Carlo model-are famous factual instruments that utilization various factors to gauge potential results. While utilizing a multivariate model, a client changes the worth of different factors to learn their expected effect on the choice that is being assessed.

- A wide range of sorts of callings utilize multivariate models. Monetary examiners might utilize multivariate models to gauge incomes and new item thoughts. Portfolio chiefs and monetary consultants use them to decide the effect of ventures on portfolio execution and hazard. Insurance agencies use them to assess the potential for claims and to value approaches.

- The Monte Carlo model is named after the geographic area, Monte Carlo (in fact an authoritative region of the Principality of Monaco), that has been made popular by its expansion of casinos.

- With tosses of the dice like those that are played at club every one of the potential results and probabilities are known. Notwithstanding, with most speculations the arrangement of future results is obscure.

- It’s dependent upon the investigator to decide the results as well as the likelihood that they will happen. In Monte Carlo displaying, the examiner runs different preliminaries (here and there even a great many them) to decide every one of the potential results and the likelihood that they will happen.

- Monte Carlo examination is valuable on the grounds that numerous venture and business choices are made based on one result. As such, numerous examiners infer one potential situation and afterward contrast that result with the different obstructions to that result to choose whether to continue.

- Most expert forma gauges start with a base case. By contributing the most elevated likelihood presumption for each component, an examiner can infer the most elevated likelihood result. Nonetheless, settling on any choices based on a base case is risky, and making an estimate with just a single result is deficient in light of the fact that it says nothing regarding whatever other potential qualities that could happen.

- It additionally says nothing regarding the genuine opportunity that the real future worth will be some different option from the base case expectation. It is difficult to support against a negative event assuming the drivers and probabilities of these occasions are not determined ahead of time.

- Once planned, executing a Monte Carlo model requires an instrument that will arbitrarily choose factor esteems that are limited by specific foreordained conditions. By running various preliminaries with factors compelled by their own autonomous probabilities of event, an expert makes a circulation that incorporates every one of the potential results and the probabilities that they will happen.

- There are numerous irregular number generators in the commercial center. The two most normal devices for planning and executing Monte Carlo models are @Risk and Crystal Ball. Both of these can be utilized as add-ins for bookkeeping pages and permit irregular inspecting to be consolidated into laid out accounting page models.

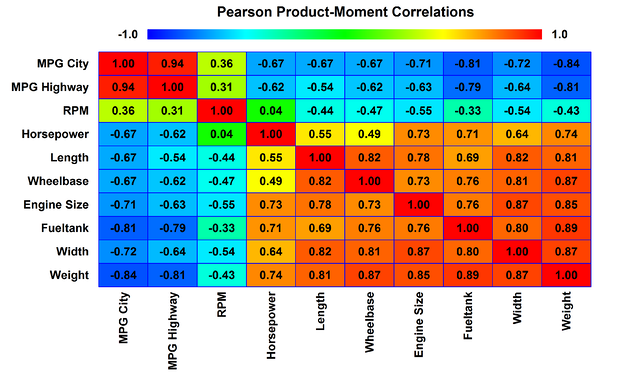

- The workmanship in fostering a fitting Monte Carlo model is to decide the right requirements for every factor and the right connection between factors. For instance, since portfolio broadening depends on the relationship between’s resources, any model created to make expected portfolio values should incorporate the connection between’s speculations.

- To pick the right conveyance for a variable, one should see every one of the potential dispersions accessible. For instance, the most well-known one is an ordinary conveyance, otherwise called a chime bend.

- In a typical dissemination, every one of the events are similarly conveyed around the mean. The mean is the most plausible occasion. Regular peculiarities, individuals’ statures, and expansion are a few instances of information sources that are typically appropriated.

- In the Monte Carlo examination, an arbitrary number generator picks an irregular incentive for every factor inside the imperatives set by the model. It then, at that point, delivers a likelihood conveyance for every conceivable result.

- The standard deviation of that likelihood is a measurement that signifies the probability that the genuine result being assessed will be some different option from the mean or most plausible occasion. Expecting a likelihood dispersion is regularly conveyed, roughly 68% of the qualities will fall inside one standard deviation of the mean, around 95% of the qualities will fall inside two standard deviations, and around 99.7% will exist in three standard deviations of the mean. This is known as the “68-95-99.7 rule” or the “exact rule.”

- Monte Carlo examinations are directed by finance experts as well as by numerous different organizations. It is a dynamic device that expects that each choice will somely affect generally speaking danger.

- Each person and foundation has an alternate danger resilience. That makes it vital to compute the danger of any venture and contrast it with the singular’s danger resistance.

- The likelihood disseminations delivered by a Monte Carlo model make an image of hazard. That image is a powerful method for passing the outcomes on to other people, like bosses or forthcoming financial backers. Today, extremely complex Monte Carlo models can be planned and executed by anybody with admittance to a PC.

- Monte Carlo reenactments are utilized to show the likelihood of various results in an interaction that can only with significant effort be anticipated because of the intercession of arbitrary factors. It is a method used to comprehend the effect of hazard and vulnerability in expectation and estimating models.

- A Monte Carlo reenactment can be utilized to handle a scope of issues in for all intents and purposes each field, for example, finance, designing, store network, and science. It is additionally alluded to as a different likelihood reproduction.

- When confronted with huge vulnerability during the time spent making a conjecture or assessment, rather than simply supplanting the questionable variable with a solitary normal number, the Monte Carlo Simulation may end up being a superior arrangement by utilizing different qualities.

- Since business and money are tormented by irregular factors, Monte Carlo reproductions have a huge range of possible applications in these fields. They are utilized to assess the likelihood of cost overwhelms in enormous activities and the probability that a resource cost will move with a specific goal in mind.

- Telecoms use them to survey network execution in various situations, assisting them with improving the organization. Investigators use them to evaluate the danger that a substance will default, and to break down subordinates like choices.

- Safety net providers and oil well drillers additionally use them. Monte Carlo recreations have incalculable applications outside of business and money, for example, in meteorology, stargazing, and molecule physical science.

- Monte Carlo recreations are named after the famous betting objective in Monaco, since possibility and irregular results are integral to the displaying strategy, much as they are to games like roulette, dice, and gaming machines.

- The strategy was first evolved by Stanislaw Ulam, a mathematician who chipped away at the Manhattan Project. After the conflict, while recuperating from mind a medical procedure, Ulam engaged himself by playing innumerable rounds of solitaire. He became keen on plotting the result of every one of these games to notice their appropriation and decide the likelihood of winning. After he imparted his plan to John Von Neumann, the two worked together to foster the Monte Carlo recreation.

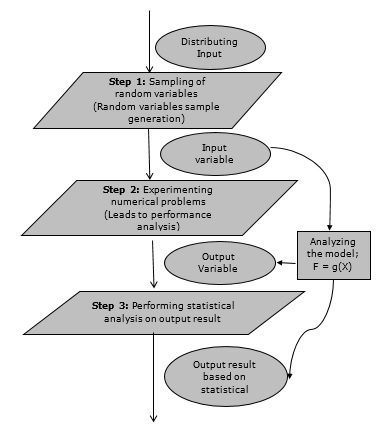

- The premise of a Monte Carlo recreation is that the likelihood of changing results can’t be resolved in view of irregular variable impedance. Subsequently, a Monte Carlo recreation centers around continually rehashing irregular examples to accomplish specific outcomes.

- A Monte Carlo recreation takes the variable that has vulnerability and relegates it an irregular worth. The model is then run and an outcome is given. This interaction is rehashed and again while allocating the variable being referred to with various qualities. When the reenactment is finished, the outcomes are found the middle value of together to give a gauge.

- One method for utilizing a Monte Carlo reenactment is to display potential developments of resource costs utilizing Excel or a comparable program. There are two parts to a resource’s value development: float, which is a consistent directional development, and an irregular info, which addresses market instability. By dissecting chronicled value information, you can decide the float, standard deviation, change, and normal value development of a security. These are the structure squares of a Monte Carlo recreation.

- To project one potential value direction, utilize the recorded value information of the resource for produce a progression of intermittent every day restores utilizing the regular logarithm (note that this condition varies from the standard rate change recipe):

- \begin{aligned} &\text{Periodic Daily Return} = ln \left ( \frac{ \text{Day’s Price} }{ \text{Previous Day’s Price} } \right ) \\ \end{aligned}

- Intermittent Daily Return=ln(

- Earlier Day’s Price

- Day’s Price

- )

- The frequencies of various results produced by this recreation will shape a typical conveyance, that is, a ringer bend. The most probable return is in the bend, importance there is an equivalent opportunity that the real return will be higher or lower than that worth.

- The likelihood that the genuine return will be inside one standard deviation of the most plausible (“expected”) rate is 68%, while the likelihood that it will be inside two standard deviations is 95%, and that it will be inside three standard deviations 99.7%. In any case, there is no assurance that the most expected result will happen, or that genuine developments won’t surpass the most out of control projections.

- Significantly, Monte Carlo reproductions overlook all that isn’t incorporated into the value development (large scale patterns, organization initiative, publicity, recurrent elements); as such, they accept entirely proficient business sectors.

- Monte Carlo reenactment is a mechanized numerical procedure that permits individuals to represent hazard in quantitative investigation and independent direction. The method is utilized by experts in such broadly unique fields as money, project the board, energy, producing, designing, innovative work, protection, oil and gas, transportation, and the climate.

- Monte Carlo reproduction outfits the leader with a scope of potential results and the probabilities they will happen for any decision of activity. It shows the outrageous conceivable outcomes the results of putting it all on the line and for the most safe choice alongside all potential ramifications for widely appealing choices.

- The strategy was first utilized by researchers chipping away at the nuclear bomb; it was named for Monte Carlo, the Monaco resort town eminent for its gambling clubs. Since its presentation in World War II, Monte Carlo reproduction has been utilized to display an assortment of physical and calculated frameworks.

- Monte Carlo recreation performs hazard investigation by building models of potential outcomes by subbing a scope of values-a likelihood appropriation for any variable that has innate vulnerability. It then, at that point, ascertains results again and again, each time utilizing an alternate arrangement of arbitrary qualities from the likelihood capacities.

- Contingent on the quantity of vulnerabilities and the reaches determined for them, a Monte Carlo reenactment could include thousands or a huge number of recalculations before it is finished. Monte Carlo reproduction produces conveyances of conceivable result values. By utilizing likelihood conveyances, factors can have various probabilities of various results happening. Likelihood disseminations are a substantially more sensible approach to depicting vulnerability in factors of a danger investigation.

- The client characterizes the base, no doubt, and greatest qualities, very much like the three-sided dissemination. Values around the most probable are bound to happen. Anyway esteems between the most probable and limits are bound to happen than the three-sided; that is, the limits are not as underscored. An illustration of the utilization of a PERT dissemination is to depict the term of an assignment in an undertaking the board model.

- The client characterizes explicit qualities that might happen and the probability of each. A model may be the aftereffects of a claim: 20% possibility of positive decision, 30% difference in bad decision, 40% possibility of settlement, and 10% possibility of legal blunder.

- During a Monte Carlo reenactment, values are tested aimlessly from the info likelihood appropriations. Each set of tests is called an emphasis, and the subsequent result from that example is recorded. Monte Carlo reenactment does this hundreds or thousands of times, and the outcome is a likelihood dispersion of potential results. Thusly, Monte Carlo reenactment gives a considerably more complete perspective on what might occur. It lets you know what could occur, yet that it is so liable to occur.

Introduction to Monte Carlo Analysis

The outcomes would look something like this:

Advantages of Monte Carlo investigation in project the executives

The essential advantages of utilizing Monte Carlo examination on your undertakings are:

There are a few difficulties to utilizing the Monte Carlo investigation. These include:

Further perusing

4 Tips for an Effective Project Management Plan

The Monte Carlo model makes it feasible for scientists from all various types of callings to run different preliminaries, and accordingly to characterize every one of the likely results of an occasion or a choice. In the money business, the choice is regularly connected with a speculation. Whenever joined, every one of the different preliminaries make a likelihood appropriation or hazard appraisal for a given venture or occasion.

Monte Carlo examination is a sort of multivariate demonstrating procedure. Everything multivariate models can be considered complex outlines of “imagine a scenario in which?” situations. The absolute most popular multivariate models are those used to esteem investment opportunities. Research investigators use them to estimate venture results, to comprehend the conceivable outcomes encompassing their speculation openings, and to all the more likely moderate their dangers.

Whenever financial backers utilize the Monte Carlo technique, the outcomes are contrasted with different degrees of hazard resilience. This can assist partners with choosing whether or not to continue with a speculation.

Key Takeaways

Who Uses Multivariate Models

Results and Probabilities

Expert Forma Estimates

Making the Model

Right Constraints

Typical Distribution and Standard Deviation

Who Uses the Method

Understanding Monte Carlo Simulations

Monte Carlo Simulation History

Monte Carlo Simulation Method

Computing a Monte Carlo Simulation in Excel

To take e to a given power x in Excel, utilize the EXP work: EXP(x). Rehash this computation the ideal number of times (every redundancy addresses one day) to acquire a reenactment of future value development. By producing a self-assertive number of recreations, you can survey the likelihood that a security’s cost will follow a given direction.

Extraordinary Considerations

How Monte Carlo Simulation Works

Normal likelihood circulations include:

Typical

Or on the other hand “chime bend.” The client just characterizes the mean or anticipated that worth and a standard deviation should depict the variety about the mean. Values in the center close to the mean are probably going to happen. It is symmetric and depicts numerous normal peculiarities like individuals’ statures. Instances of factors portrayed by typical appropriations incorporate expansion rates and energy costs.

Lognormal

Values are decidedly slanted, not symmetric like a typical dissemination. Used to address values don’t go under nothing however have limitless positive potential. Instances of factors portrayed by lognormal conveyances incorporate land property estimations, stock costs, and oil saves.

Uniform

All values have an equivalent possibility happening, and the client essentially characterizes the base and most extreme. Instances of factors that could be consistently dispersed incorporate assembling expenses or future deals incomes for another item.

Three-sided

The client characterizes the base, no doubt, and most extreme qualities. Values around the most probable are bound to happen. Factors that could be depicted by a three-sided dispersion incorporate past deals history per unit of time and stock levels.

Energetic

Monte Carlo recreation gives various benefits over deterministic, or “single-point gauge” investigation:

Probabilistic Results: Results show what could occur, yet the way in which likely every result is.

Graphical Results: In light of the information a Monte Carlo reproduction produces, it’s not difficult to make charts of various results and their possibilities of event. This is significant for conveying discoveries to different partners.

wareness Analysis: With only a couple of cases, deterministic examination makes it hard to see which factors sway the result the most. In Monte Carlo reenactment, it’s not difficult to see which data sources had the greatest impact on main concern results.

Situation Analysis: In deterministic models, it’s truly challenging to demonstrate various mixes of values so that various sources of info might be able to see the impacts of really various situations. Utilizing Monte Carlo reenactment, experts can see precisely which sources of info had which esteems together when certain results happened. This is important for seeking after additional investigation.

Connection of Inputs: In Monte Carlo reproduction, it’s feasible to demonstrate reliant connections between input factors. Precision must address how, in all actuality, when a few elements goes up, others go up or down in like manner.

An upgrade to Monte Carlo recreation is the utilization of Latin Hypercube testing, which tests all the more precisely from the whole scope of dispersion capacities.

Conclusion:

Monte Carlo reenactment is a strategy for assessing meaningful speculations and measurable assessors by fostering a PC calculation to mimic a populace, drawing numerous examples from this pseudo-populace, and assessing gauges got from these examples.