- Understanding NFTs: Definition and Basics

- How NFTs Differ from Cryptocurrencies

- Blockchain Technology Behind NFTs

- Popular NFT Standards and Protocols

- Real-World Use Cases of NFTs

- How to Create, Buy, and Sell NFTs

- Challenges and Criticisms of NFTs

- The Future of NFTs and Their Potential Impact

Understanding NFTs: Definition and Basics

Understanding NFTs Definition and Basics involves exploring one of the most transformative concepts in the digital economy. What is an NFT? A Non-Fungible Token (NFT) is a unique digital asset stored on a blockchain that certifies ownership of a specific item, such as digital art, music, videos, or even virtual real estate. Unlike cryptocurrencies like Bitcoin or Ethereum, NFTs are not interchangeable due to their distinct metadata and ownership records, a concept often emphasized in Blockchain Training programs. Built on blockchain technology, NFTs leverage the secure, transparent, and decentralized nature of this system to ensure the authenticity and traceability of digital assets. With the rise of Blockchain Development Services, businesses and creators can now tokenize and monetize their content in new ways, paving the path for decentralized marketplaces and intellectual property protection. Beyond the world of collectibles and gaming, Blockchain Technology in Healthcare is also exploring the use of NFTs for securely managing patient data and medical records, offering improved data integrity and personalized access control. As NFTs continue to evolve, they are shaping digital identity, ownership, and value in unprecedented ways, making them a crucial component of the growing blockchain ecosystem.

Are You Interested in Learning More About Blockchain Certification? Sign Up For Our Blockchain Training Course Today!

How NFTs Differ from Cryptocurrencies

- Fungibility: Cryptocurrencies are fungible, meaning each unit is identical and interchangeable (e.g., one Bitcoin is equal to another). In contrast, NFT crypto assets are non-fungible, meaning each one is unique and cannot be exchanged on a one-to-one basis.

- Use Case: Cryptocurrencies are primarily used for investment, crypto trading, and purchasing goods and services. NFTs are used to prove ownership of digital items like art, music, and collectibles, concepts often explored in a Blockchain Tutorial for better understanding.

- Value Representation: A cryptocurrency’s value is determined by market demand and supply. NFTs derive value from their uniqueness, creator reputation, and utility.

While both NFTs and cryptocurrencies operate on blockchain technology, they serve very different purposes in the digital world. NFTs (Non-Fungible Tokens) represent ownership of unique digital assets, while cryptocurrencies like Bitcoin and Ethereum are interchangeable and used mainly for crypto trading and transactions. Below are the key differences:

- Divisibility: Cryptocurrencies can be divided into smaller units (like satoshis for Bitcoin). NFTs, on the other hand, are indivisible; you can’t own a fraction of an NFT (unless fractionalized intentionally).

- Smart Contract Integration: NFTs often contain metadata and are governed by smart contracts, enabling features like royalty payments. Many blockchain certificate systems use this capability for verifying credentials.

- Ownership and Provenance: NFTs offer traceable ownership history, making them ideal for collectibles. This is not typical in crypto trading, where the focus is on liquidity and speed.

In summary, while both are part of the blockchain revolution, NFTs and cryptocurrencies serve vastly different roles and functions.

Blockchain Technology Behind NFTs

The blockchain technology behind NFTs is the core engine that ensures their uniqueness, security, and transparency across digital platforms. To understand the concept, it’s essential to first ask, What is an NFT? A Non-Fungible Token (NFT) is a unique digital asset that represents ownership of a specific item whether it’s digital art, music, virtual goods, or documents recorded immutably on a blockchain. This uniqueness is guaranteed through smart contracts, which are self-executing codes deployed by Blockchain Development Services on decentralized networks like Ethereum or Solana. Each NFT has distinct metadata and ownership history, making it non-interchangeable with other tokens. The underlying blockchain technology ensures that these tokens are verifiable, tamper-proof, and easily transferable across platforms, allowing creators and users to securely engage in digital commerce a foundational concept when exploring What is Ethereum and its role in powering decentralized applications. Moreover, the utility of blockchain extends beyond NFTs and into critical sectors such as Blockchain Technology in Healthcare, where similar principles are applied to securely manage patient records, verify identities, and enable transparent data sharing without compromising privacy. As NFTs continue to gain traction, the foundational role of blockchain becomes increasingly vital, not just in entertainment or gaming, but across various industries seeking decentralized and trusted digital solutions.

Are You Interested in Learning More About Blockchain Certification? Sign Up For Our Blockchain Training Course Today!

Popular NFT Standards and Protocols

- ERC-721 (Ethereum) The original and most widely adopted standard for NFTs, ERC-721 defines a set of rules for creating unique tokens on the Ethereum blockchain. Each token is distinguishable and owns individual metadata.

- ERC-1155 (Multi-Token Standard)This standard allows for the creation of both fungible and non-fungible tokens in one smart contract, optimizing storage and efficiency. It is widely used in gaming and collectible platforms and is commonly covered in a BlockChain Developer Tutorial for hands-on implementation.

- BEP-721 (Binance Smart Chain) Similar to Ethereum’s ERC-721, BEP-721 supports the creation of NFTs on Binance Smart Chain, providing a faster and cheaper alternative for crypto trading and NFT deployment.

- BEP-1155 This standard brings the multi-token capability of ERC-1155 to Binance Smart Chain, enhancing flexibility and scalability for NFT crypto applications and marketplaces.

- Flow by Dapper Labs Designed for scalability and ease of use, Flow supports NFTs for platforms like NBA Top Shot. It’s tailored for mass consumer applications with low transaction fees and developer-friendly tools.

- Tezos FA2 Standard Tezos uses the FA2 standard to support multiple token types including NFTs. With an eco-friendly proof-of-stake consensus, it’s favored for blockchain certificates and green cryptocurrencies.

- Choose a Blockchain: Select a blockchain platform like Ethereum, Binance Smart Chain, or Flow. Ethereum is the most common for NFT creation due to its robust ecosystem and widespread adoption.

- Set Up a Digital Wallet: Create a wallet (e.g., MetaMask or Trust Wallet) that supports the chosen blockchain. This wallet will store your NFTs and cryptocurrencies needed for transactions, a process often explained in Blockchain Mining & Tutorial guides for beginners.

- Pick an NFT Marketplace: Platforms like OpenSea, Rarible, and Mintable allow users to mint, list, and trade NFTs. Some platforms specialize in specific asset types, such as art or music.

- Create Your NFT: Upload your digital file (image, music, video, etc.) to the marketplace and fill in details like name, description, and properties. Mint it using blockchain development services.

- List for Sale or Auction: Set a fixed price or choose to auction your NFT. Confirm the transaction via your digital wallet.

- Buy or Trade NFTs: Explore listed NFTs, place bids, or buy directly. In future applications, even blockchain technology in healthcare may allow patients to trade health-related data through NFTs.

NFTs operate based on specific standards and protocols that ensure their uniqueness, interoperability, and compatibility across platforms. These technical frameworks allow creators and developers to build NFT-based assets that can seamlessly function within blockchain ecosystems. As the demand for NFT crypto assets grows in markets like crypto trading, it’s essential to understand these foundational standards that support everything from digital art to blockchain certificates and tokenized game assets. Below are the most widely used NFT standards:

These NFT protocols form the foundation for innovation in crypto trading and digital asset management, ensuring interoperability and expanding possibilities across blockchain ecosystems.

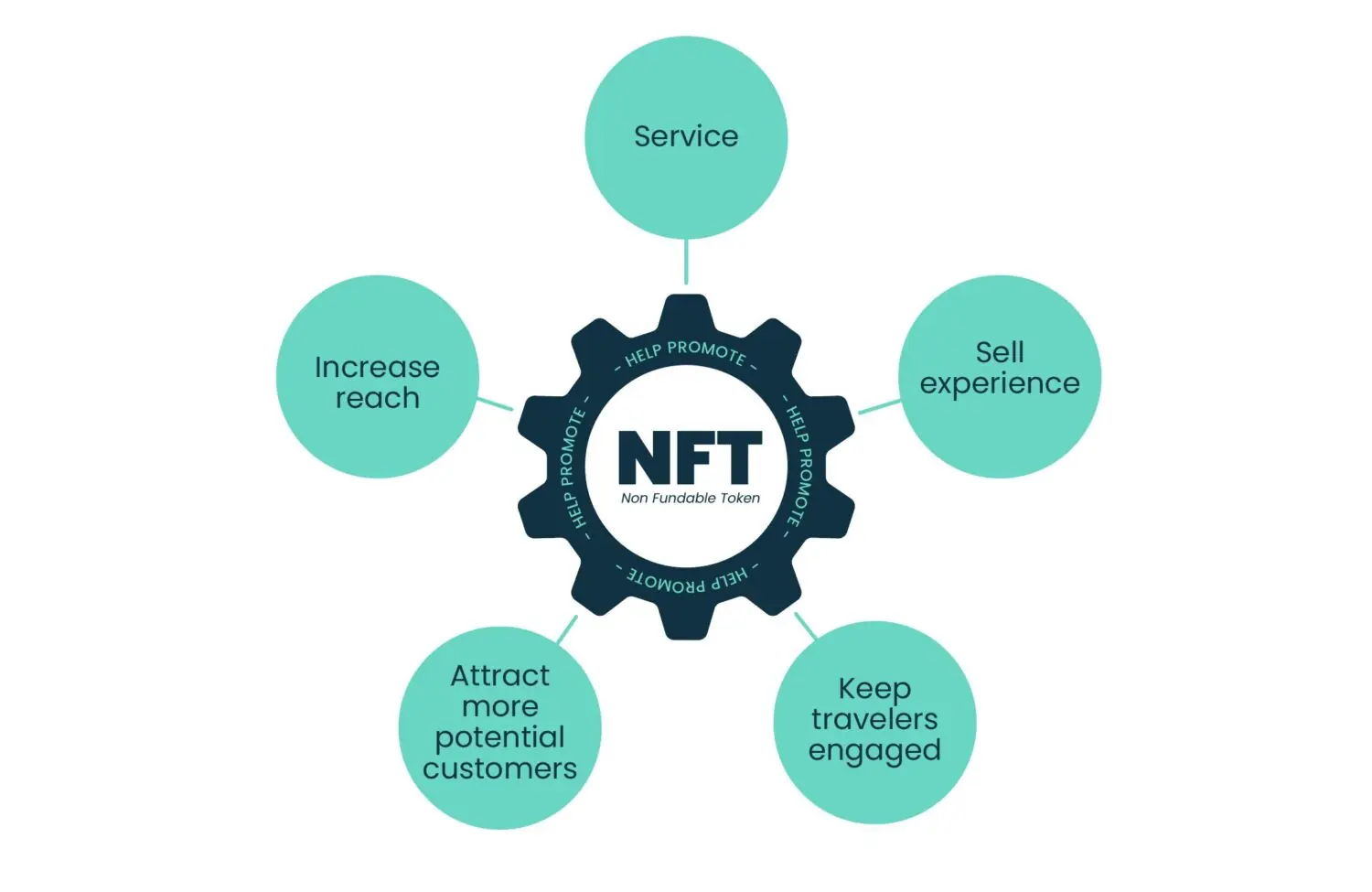

Real-World Use Cases of NFTs

Real-World Use Cases of NFTs are rapidly expanding beyond digital art, showing their potential in transforming industries through secure, verifiable ownership and smart contracts. One of the most prominent areas is crypto trading, where NFT crypto assets are now being used as tradeable commodities on decentralized marketplaces, adding a new layer of value and liquidity to digital investments. In education and professional development, NFTs serve as blockchain certificates, offering tamper-proof proof of credentials and skills that can be verified globally, reducing fraud and streamlining the hiring process through Blockchain Training adoption and awareness. The gaming industry is also leveraging NFTs to represent in-game items, skins, and characters, allowing players to trade and monetize assets independently from the games themselves. In the music and entertainment sectors, artists release limited-edition NFT albums and collectibles, giving fans exclusive access while maintaining intellectual property rights. Even in real estate, NFTs are being tested for tokenizing property deeds, enabling quicker, more transparent ownership transfers. Furthermore, healthcare organizations explore NFTs to manage patient data securely. As adoption grows, NFTs are proving to be more than a trend, becoming a critical tool for cryptocurrencies and blockchain applications, and redefining ownership, identity, and value in real-world scenarios across multiple sectors.

How to Create, Buy, and Sell NFTs

Understanding what is an NFT is the first step before diving into the process of creating, buying, or selling these digital assets. NFTs (Non-Fungible Tokens) are unique digital items verified using blockchain technology. They represent ownership of digital or physical assets and are now widely used in sectors like gaming, art, and even blockchain technology in healthcare for secure data handling. Thanks to evolving blockchain development services, anyone can now easily engage in the NFT marketplace. Here’s a step-by-step guide:

Challenges and Criticisms of NFTs

Challenges and Criticisms of NFTs are becoming more prominent as the market matures, with various concerns arising around sustainability, speculation, and utility. One of the major issues is the environmental impact of NFTs, especially those built on proof-of-work blockchains, which consume vast amounts of energy during transactions raising questions about their long-term sustainability. Another criticism is the speculative nature of the NFT crypto market, where prices often surge based on hype rather than intrinsic value, creating volatility similar to crypto trading a concern frequently examined in Hyperledger Tutorial sessions focused on building more stable blockchain ecosystems. This has led to concerns about market manipulation, scams, and pump-and-dump schemes. In terms of practical use, critics argue that many NFTs lack real-world utility beyond digital collectibles, limiting their broader adoption. Additionally, while blockchain certificate systems offer tamper-proof verification, there’s still uncertainty about legal recognition and interoperability across different regions and platforms. Intellectual property rights are another grey area, as owning an NFT doesn’t always grant copyright, leading to confusion and legal disputes. Moreover, because NFTs are often bought using cryptocurrencies, price fluctuations in tokens like Ethereum can significantly affect NFT pricing and accessibility. Despite these challenges, the NFT space continues to evolve, but it must address these criticisms to ensure long-term credibility and mainstream acceptance.

Are You Preparing for Blockchain Developer Jobs? Check Out ACTE’s Blockchain Interview Questions and Answers to Boost Your Preparation!

The Future of NFTs and Their Potential Impact

The Future of NFTs and Their Potential Impact lies in their ability to revolutionize digital ownership and redefine how assets are created, exchanged, and authenticated. While NFTs initially gained fame through digital art and collectibles, their real potential stretches far beyond, with industries exploring more functional and scalable use cases. In the world of Crypto Trading, NFT crypto assets are being leveraged as unique, high-value instruments that introduce scarcity and proof of ownership into decentralized marketplaces. As cryptocurrencies become more integrated into everyday transactions, NFTs are expected to bridge the gap between tangible assets and digital representation. Sectors like education and recruitment are adopting NFTs as blockchain certificates to issue tamper-proof credentials and achievements, streamlining verification processes globally through Blockchain Training initiatives and applications. Gaming platforms are also evolving, allowing players to truly own in-game assets and transfer them across ecosystems. Even supply chain and real estate sectors are experimenting with NFT-based documentation for secure, traceable ownership records. As scalability improves and environmental concerns are addressed through eco-friendly blockchains, the adoption curve is set to rise sharply. The fusion of NFTs with DeFi and smart contracts will unlock new financial tools, making crypto trading more dynamic. Ultimately, NFTs are poised to be a cornerstone of the Web3 digital economy.