Oracle Financials is an all-inclusive set of integrated apps created to improve organizational decision-making and expedite financial procedures. Oracle Financials offers a consolidated platform for managing financial data and operations, with modules for accounting, procurement, project management, and other areas. It gives organizations the ability to better understand their financial performance, allocate resources more efficiently, and maintain regulatory compliance thanks to its extensive reporting and analytics features.

1. What is Oracle Financials and what are its core components?

Ans:

A complete financial management package is called Oracle Financials. Applications. Its core components include the General Ledger for consolidating financial data, Accounts Payable for managing payments, Accounts Receivable for tracking receivables, and Cash Management for monitoring cash flow. Additionally, it features Fixed Assets for managing asset lifecycle and project accounting, enhancing overall financial visibility and control.

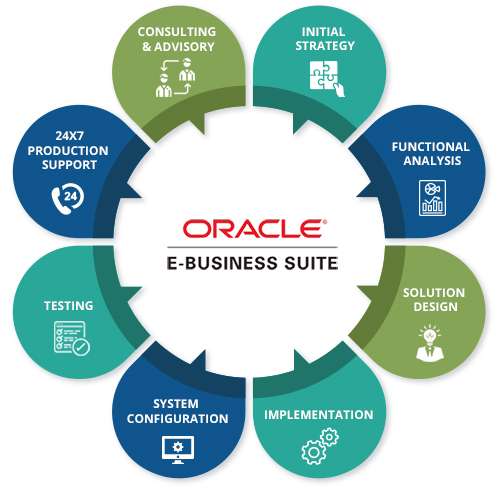

2. How do Oracle Financials fit into the overall Oracle E-Business Suite?

Ans:

Oracle Financials is a module within the Oracle E-Business Suite, focusing on financial management tasks like general ledger, accounts payable, receivable, and asset management. It integrates with other EBS modules like Supply Chain Management and Human Capital Management to provide comprehensive enterprise resource planning (ERP) capabilities.

3. What versions of Oracle Financials exist?

Ans:

- Extensive experience with Oracle Financials versions, including R12 and Fusion Cloud.

- This experience spans configuration, customization, and integration to fulfill diverse business requirements.

- Proficiency extends to areas such as module setup, reporting, and ensuring regulatory compliance.

4. What experience exists with Oracle General Ledger (GL)?

Ans:

- Experience with Oracle General Ledger (GL) involves configuring a chart of accounts, defining accounting rules, managing journal entries, and generating financial reports.

- Handled tasks such as period close processes, reconciliations, and troubleshooting general ledger (GL) issues to ensure accurate financial data for decision-making.

5. What are Oracle’s salient features of Accounts Payable (AP)?

Ans:

Key features of Oracle Accounts Payable (AP) include invoice processing, payment automation, vendor management, expense management, reporting, and integration with other financial systems. It streamlines the entire accounts payable process, enhancing efficiency and accuracy in financial transactions. Additionally, it offers robust compliance and audit capabilities, ensuring adherence to regulatory standards. The solution also supports advanced analytics, providing valuable insights for strategic decision-making and optimizing cash flow management.

6. How are vendor payments managed in Oracle Financials?

Ans:

In Oracle Financials, manage vendor payments by creating payment batches, selecting invoices for payment, specifying payment methods, and executing payments. Monitor payment statuses and reconcile transactions to ensure accurate vendor payment management. Collaborate with cross-functional teams to resolve any discrepancies and improve the efficiency of payment processes. Regularly review and update vendor records to maintain data integrity and compliance with financial policies.

7. What is the process for invoice validation in Oracle AP?

Ans:

- Invoice validation in Oracle AP involves verifying invoices against purchase orders, contracts, and business rules.

- It includes matching invoice details with PO data, checking for duplicates, validating against accounting rules, and ensuring compliance.

- Additional checks may involve verifying tax calculations and payment terms to ensure accurate financial reporting. Once validated, invoices are approved for payment processing.

8. What experience exists with Oracle Accounts Receivable (AR)?

Ans:

- Experience with Oracle Accounts Receivable (AR) involves managing customer invoices, payments, and collections efficiently.

- AR functionalities have been utilized for accurate tracking of receivables, resolving discrepancies, and ensuring timely cash flow.

- Additionally, generated financial reports and analytics to provide insights into customer payment trends and enhance decision-making processes.

9. What is the difference between functional and technical roles in Oracle Financials?

Ans:

| Aspect | Functional Roles | Technical Roles |

|---|---|---|

| Responsibilities | Analyze business requirements, configure modules | Develop and customize applications, maintain infrastructure |

| Tasks | Gather requirements, conduct gap analysis, design solutions | Software development, data migration, customization |

| Skills | Financial processes, business analysis, communication | Oracle technologies (PL/SQL, Oracle Application Framework), programming languages |

| Focus | Business alignment, process optimization | Software development, technical infrastructure management |

10. Explain the concept of Multi-Org in Oracle Financials.

Ans:

Multi-Org in Oracle Financials enables managing multiple business units or organizations within a single instance. It allows the sharing of data and resources while maintaining separate accounting, security, and reporting structures for each entity. This streamlines operations reduces duplication and ensures compliance with regulatory requirements across diverse organizational hierarchies.

11. What is the role of Oracle Cash Management in financial operations?

Ans:

- Oracle Cash Management plays a crucial role in financial operations by managing cash flow, bank transactions, and liquidity.

- It helps optimize cash positions, streamline reconciliation processes, and ensure compliance with banking regulations, enhancing overall financial visibility and control.

- Additionally, it provides real-time insights into cash positions and forecasts, allowing organizations to make proactive financial decisions and better manage their working capital.

12. How does Oracle Fixed Assets help in asset management?

Ans:

- Oracle Fixed Assets streamlines asset management by tracking acquisitions, depreciations, and retirements.

- It maintains detailed records, calculates depreciation, and ensures compliance with accounting standards.

- This aids in optimizing asset lifecycle, financial reporting, and regulatory adherence.

13. What are the critical functionalities of Oracle Purchasing?

Ans:

Oracle Purchasing streamlines procurement processes by automating requisitions, purchase orders, and supplier management. It facilitates efficient purchasing, ensures compliance with policies, tracks supplier performance, and integrates seamlessly with other Oracle applications for end-to-end procurement management. Collaborate with cross-functional teams to resolve any discrepancies and improve the efficiency of payment processes.

14. How are bank statements managed and reconciled in Oracle Cash Management?

Ans:

In Oracle Cash Management, reconcile bank statements by importing bank statements, matching transactions with system records, resolving discrepancies, and reconciling balances. Utilize features like Bank Statement Loader and Bank Statement Reconciliation to streamline the process, ensuring accuracy and compliance. Generate reports to provide insights into cash flow and account balances, facilitating informed decision-making.

15. Explain the process of period closing in Oracle Financials.

Ans:

- Reviewing transactions to ensure accuracy.

- Reconciling accounts and resolving discrepancies.

- Running period-end processes like depreciation.

- Closing the period to prevent further entries.

- Generating financial reports.

- Optionally, opening the next period for new transactions.

16. What is the role of Oracle Financials in compliance and auditing?

Ans:

Oracle Financials facilitates compliance and auditing by enforcing financial controls, ensuring regulatory adherence, and providing robust reporting capabilities. It tracks transactions, maintains accurate records, and enables audit trails, promoting transparency and accountability within financial operations. Additionally, it supports risk management by identifying potential compliance issues before they escalate. The system’s automated processes streamline workflows, enhancing efficiency and accuracy in financial reporting.

17. How is Oracle Financials configured for a new company?

Ans:

To configure Oracle Financials for a new company, first define the company structure, including legal entities, operating units, and accounting calendars. Set up the chart of accounts and define accounting periods. Configure primary and secondary ledgers and establish currency settings. Define financial reporting structures, configure payable and receivable modules, and set up tax rules and compliance requirements. Test configurations thoroughly before going live.

18. Describe the process of setting up a chart of accounts in Oracle GL.

Ans:

- Define the value sets for each segment of the chart of accounts.

- Create the accounting flexfield structure by combining these segments.

- Define segment values for each segment.

- Set up account combinations, including valid and cross-validation rules.

- Assign the chart of accounts to a ledger.

- Verify and test the setup to ensure accuracy.

19. How are intercompany transactions handled in Oracle Financials?

Ans:

- In Oracle Financials, intercompany transactions are managed using the Intercompany feature.

- This involves setting up intercompany accounts, defining intercompany balancing rules, and ensuring that transactions between different legal entities are recorded accurately.

- Automated processes handle the creation and reconciliation of intercompany invoices and payments, ensuring compliance with accounting standards and efficient financial consolidation.

20. What is the concept of sub-ledger accounting in Oracle Financials?

Ans:

Subledger accounting in Oracle Financials involves recording financial transactions at a detailed level before they’re summarized into the general ledger. Tracking transactions at their source allows for better control and visibility. Each sub-ledger, like accounts payable or receivable, maintains its detailed records, providing more granular insights into financial activities. This approach enhances accuracy, compliance, and reporting capabilities within the organization’s financial ecosystem.

21. How are reports customized in Oracle Financials?

Ans:

To customize reports in Oracle Financials, access the report template, modify parameters like data fields or layout, and then save changes. Alternatively, use Oracle’s report customization tools to adjust formatting, add filters, or incorporate additional data sources. Testing the modified report ensures accuracy before deploying it for regular use. Regularly review and update reports as business needs evolve to maintain their relevance.

22. What is FSG (Financial Statement Generator) in Oracle GL?

Ans:

- FSG (Financial Statement Generator) in Oracle GL is a tool used for generating financial statements.

- It allows users to create customized reports by defining rows, columns, and content based on specific accounting requirements.

- FSG facilitates the extraction of data from the General Ledger module to produce balance sheets, income statements, and other financial reports tailored to the organization’s needs.

23. What is the use of flexfields in Oracle Financials?

Ans:

FSG (Financial Statement Generator) in Oracle GL is a tool used for generating financial statements. It allows users to create customized reports by defining rows, columns, and content based on specific accounting requirements. FSG facilitates the extraction of data from the General Ledger module to produce balance sheets, income statements, and other financial reports tailored to the organization’s needs.

24. How are data issues managed and troubleshot in Oracle Financials?

Ans:

- The nature of the issue is thoroughly analyzed, identifying its root cause through data examination and querying.

- Corrective measures are implemented, which may involve adjusting configurations, applying patches, or restoring backups. Throughout this process, clear documentation and communication are maintained to ensure transparency and facilitate future troubleshooting efforts.

- Oracle’s support resources, forums, and knowledge base are leveraged to stay updated on best practices and emerging solutions. This approach ensures the effective resolution of data issues while minimizing disruption to operations.

25. Describe the process of integrating Oracle Financials with other systems.

Ans:

- First, identify the systems needing integration and their data requirements.

- Then, assess compatibility and establish communication protocols.

- Next, develop custom interfaces or leverage middleware solutions for seamless data exchange.

- Test the integration thoroughly to ensure accuracy and reliability.

- Finally, deploy the integration and monitor performance for ongoing optimization.

26. What are the different types of flexfields in Oracle Financials?

Ans:

In Oracle Financials, flexfields are customizable fields designed to capture additional data beyond the standard system fields. The two main types are Key Flexfields and Descriptive Flexfields. Key Flexfields serve as unique identifiers, such as account numbers or asset IDs, facilitating detailed categorization and analysis. In contrast, Descriptive Flexfields offer additional descriptive information tailored to business needs, such as attributes for customers or vendors.

27. How is Oracle Workflow used in financial processes?

Ans:

Oracle Workflow streamlines financial processes by automating tasks, such as invoice approvals, purchase requisitions, and expense report submissions. It ensures efficient routing of documents for review and approval, reducing manual intervention and speeding up processing times. Workflow notifications keep stakeholders informed about pending actions, enhancing transparency and accountability.

28. What is the concept of SLA (Subledger Accounting) in Oracle Financials?

Ans:

- SLA (Subledger Accounting) in Oracle Financials is a framework for managing accounting data.

- It allows for detailed tracking and recording of financial transactions within sub-ledgers before they are transferred to the general ledger.

- SLA provides rules-based accounting setups to customize how transactions are accounted for, ensuring accuracy and compliance.

- It enhances transparency, enabling organizations to analyze transaction details and create reports tailored to specific requirements.

29. How are journal entries created and managed in Oracle GL?

Ans:

To create and manage journal entries in Oracle GL, navigate to the Journal Entry page and input relevant details like journal date, currency, and description. Also utilize features like journal inquiry to review or modify entries. Journal entries are efficiently managed by adhering to accounting principles and company policies. Regularly reconcile entries to ensure accuracy and completeness, and utilize reporting tools for insights into financial performance.

30. How is customer billing and collections handled in Oracle AR?

Ans:

In Oracle AR, handle customer billing by setting up invoicing rules, generating invoices, and tracking payments. Use AR collections to manage overdue payments, send reminders, and escalate if necessary. Automated workflows streamline the process for efficient billing and collections. Collaborated with cross-functional teams to resolve billing discrepancies and ensure timely payment processing. Implemented reporting tools to analyze collection trends and improve cash flow management.

31. How is security and user access configured in Oracle Financials?

Ans:

To configure security and user access in Oracle Financials, roles and responsibilities are typically utilized. Roles define the access privileges a user has, while responsibilities determine the specific functions and da they can access within Oracle Financials modules. Access controls are set based on job roles and tasks, ensuring users only have access to the necessary functions and realities for their job duties.

32. Explain the process of data migration in Oracle Financials.

Ans:

- Data Extraction: Extracting data from the source system, ensuring completeness and accuracy.

- Data Transformation: converting data into a format compatible with Oracle Financials, including mapping data fields and addressing any discrepancies.

- Data Loading: Loading transformed data into Oracle Financials using tools like Data Loader o Oracle Integration Cloud.

- Data Verification: Validating the migrated data to ensure accuracy and integrity, often through reconciliation and comparison with the source data.

- Testing: Conduct thorough testing to verify that the migrated data functions correctly within Racle Financials and meets business requirements.

33. How is Oracle BI Publisher used for financial reporting?

Ans:

- Establish data connections to extract relevant financial information.

- Design report templates using BI Publisher’s intuitive interface, incorporating necessary fields such as balance sheets, income statements, and cash flow statements.

- Customize report layouts and formats to meet specific organizational requirements, ensuring clarity and compliance with regulatory standards.

34. What is the role of Oracle Forms and Reports in Oracle Financials?

Ans:

Oracle Forms and Reports play a crucial role in Oracle Financials by enabling the creation of customized data entry forms and reports. These tools allow users to input financial data accurately and efficiently, generate various financial reports, and analyze financial performance. They streamline processes, enhance data accuracy, and facilitate informed decision-making within the economic domain.

35. How is concurrent processing handled in Oracle Financials?

Ans:

Concurrent processing in Oracle Financials is managed through Concurrent Manager. It handles multiple tasks simultaneously, optimizing system performance. Users submit concurrent requests, which are processed based on defined priorities and resources. Monitoring tools help track and manage concurrent jobs to ensure efficient processing and resource utilization.

36. What is the concept of Oracle Payables Open Interface Import?

Ans:

Oracle Payables Open Interface Import is a feature allowing the bulk import of supplier invoices into Oracle Payables. Users prepare invoice data in a specified format and uplo d it into the system. The import process validates and processes the invoices, creating payable transactions. It streamlines invoice entry, improves accuracy, and reduces manual effort.

37 . How are approval workflows configured in Oracle Purchasing?

Ans:

- Configuring app oval workflows in Oracle Purchasing involves defining approval rules and hierarchies based on business requirements.

- Users specify conditions triggering approval, assign approvers, and establish routing paths.

- Configuration options include document types, approval groups, and escalation rules.

- Once set up, the system automates approval routing, improving efficiency and control over procurement processes.

38. Describe the process of automating financial transactions in Oracle Financials.

Ans:

- Automating financial transactions in Oracle Financials involves setting up rules and workflows to streamline repetitive tasks such as invoicing, payments, and reconciliations.

- Users configure automation features like recurring invoices, payment batches, and bank reconciliations.

- Automation reduces manual errors, accelerates processing times, and enhances financial management efficiency.

39. How is financial data reconciliation managed in Oracle Financials?

Ans:

Financial data reconciliation in Oracle Financials involves ensuring accuracy and consistency and comparing and contrasting financial records. Users reconcile transactions across modules like Accounts Payable, Accounts Receivable, and General Ledger. Reconciliation processes include verifying balances, investigating discrepancies, and resolving discrepancies through adjustments or corrections.

40. What are the best practices for maintaining Oracle Financials databases?

Ans:

Best practices for maintaining Oracle Financials databases include regular backups, performance tuning, and applying patches and updates. Database administrators monitor system health, optimize configurations, and put security measures in place to safeguard private financial information. Documented procedures and disaster recovery plans ensure continuity of operations and data integrity.

41. What situation required troubleshooting in Oracle AP?

Ans:

- When troubleshooting an issue in Oracle AP, a systematic approach is followed.

- Error messages are analyzed, configuration settings are reviewed, and transaction flows are traced to identify root causes.

- Collaborating with technical support and leveraging online resources, troubleshooting steps such as testing scenarios, applying patches, and reviewing log files are applied until the issue is resolved.

42. How was a complex financial consolidation project handled in Oracle Financials?

Ans:

- Handling a complex financial consolidation project in Oracle Financials involved meticulous planning and coordination.

- Led a cross-functional team to define requirements, configure consolidation rules, and test scenarios.

- Through iterative testing and communication with stakeholders, challenges such as data mapping discrepancies and system integration issues were addressed.

- Ultimately, the consolidation solution was successfully implemented, ensuring accuracy and compliance with reporting standards.

43. What improvements were made to a financial process using Oracle Financials?

Ans:

Improving a financial process using Oracle Financials involved identifying inefficiencies and implementing system enhancements. For example, Automated invoice approval workflows reduced processing times and enhanced control over expenses. Leveraging Oracle’s customization capabilities, reports and dashboards were tailored to provide insights into financial performance, enabling informed decision-making.

44. What challenges were faced during an Oracle Financials implementation project?

Ans:

A challenging Oracle Financials implementation project involved overcoming complexities in data migration and system integration. Extensive data cleansing and transformation were conducted to ensure accuracy and consistency. Collaboration with technical experts and business users addressed customization requirements and resolved issues through rigorous testing and troubleshooting. Despite challenges, the system was successfully launched on schedule, meeting stakeholder expectations.

45. How are year-end closing activities managed in Oracle GL?

Ans:

Managing year-end closing activities in Oracle GL involves preparing financial statements, reconciling accounts, and performing adjustments. Users close accounting periods, view balances, and generate financial reports. Tasks include accruals, depreciation calculations, and intercompany reconciliations. Additionally, ensuring compliance with regulatory requirements and internal policies is crucial. Effective communication with stakeholders helps facilitate a smooth closing process and timely reporting.

46. How was a customization request handled in Oracle AR?

Ans:

- H ndling a customization request in Oracle AR required understanding user require ents and assessing system capabilities.

- Collaborated with stakeholders to define specifications, develop customizations, and test functionalities.

- Utilizing Oracle’s extensibility features, such as user exits and APIs, the customization was implemented while ensuring compatibility with future system upgrades.

- Post-implementation, user training and support were provided to ensure seamless integration and adoption.

47. What methods optimized the performance of Oracle Financials applications?

Ans:

- Oracle Financial applications were optimized by conducting a comprehensive performance analysis.

- Identified bottlenecks and inefficiencies, then implemented solutions such as optimizing SQL queries, tuning server configurations, and enhancing indexing strategies.

- These efforts significantly improved system response times and user experience.

48. How was data migration from a legacy system to Oracle Financials managed?

Ans:

Managing data migration from a legacy system to Oracle Financials involved meticulous planning and execution. Thorough data cleansing and validation were conducted to ensure accuracy. Utilizing tools like Oracle Data Integrator, data fields were mapped between systems, and multiple test migrations were performed before executing the final migration. Post-migration, data reconciliation was conducted to verify the integrity of migrated data.

49. What scenario involved using Oracle Financials for regulatory compliance?

Ans:

In a scenario requiring regulatory compliance, Oracle Financial’s robust features were utilized to enforce compliance standards. This included configuring security settings to restrict access, implementing audit trails to track changes, and generating compliance reports to demonstrate adherence to regulations such as Sarbanes-Oxley (SOX) or GDPR. Additionally, user training was conducted to ensure staff understood compliance protocols, and regular system reviews were performed to identify and address potential vulnerabilities proactively.

50. What integration challenges arose with Oracle Financials and other ERP systems?

Ans:

- Integrating Oracle Financials with other ERP systems involved understanding data structures, developing custom interfaces, or utilizing middleware solutions like Oracle Fusion Middleware.

- Collaborated with IT teams and vendors to establish data mapping, ensure data consistency, and stream new business processes across systems.

51. How was a significant upgrade of Oracle Financials handled?

Ans:

- Handling a significant upgrade of Oracle Financials involved meticulous planning, testing, and communication.

- A thorough impact analysis was conducted to identify potential risks, and a phased upgrade plan was developed.

- Throughout the process, communication with stakeholders occurred, training was provided, and post-upgrade testing was conducted to ensure a smooth transition and minimal disruption to operations.

52. What critical issue was resolved in Oracle Cash Management?

Ans:

Resolving a critical issue in Oracle Cash Management required swift action and troubleshooting skills. Performed root cause analysis, collaborated with Oracle support when required, and implemented solutions, including applying patches, adjusting configurations, or executing data fixes. Communicated with affected users to provide updates and promptly addressed their needs.

53. How was financial reporting improved using Oracle Financials?

Ans:

To improve financial reporting in Oracle Financials, report templates were enhanced, custom reports were developed using tools such as Oracle BI Publisher, and data extraction processes were optimized. By streamlining reporting workflows and providing actionable insights, stakeholders were empowered to make informed decisions, driving business growth.

54. How was a complex multi-currency setup managed in Oracle Financials?

Ans:

- Managing a complex multi-currency setup in Oracle Financials involved configuring currency conversion rates, defining accounting rules, and ensuring compliance with international accounting standards.

- Implemented features such as Multiple Organization Support and Multi-Currency Accounting to handle transactions seamlessly across different currencies.

55. What automation occurred for a manual financial process using Oracle Financials?

Ans:

- Automating a manual financial process using Oracle Financials involved identifying repetitive tasks, analyzing workflows, and designing automated solutions.

- Utilized Oracle Workflow Builder or Oracle Integration Cloud to create workflow processes integrated with the Oracle Financials module, automating tasks such as invoice processing, reconciliation, and expense approvals.

56. How was Oracle Financials customized to meet specific business needs?

Ans:

Customizing Oracle Financials to meet specific business needs required understanding user requirements and leveraging customization tools like Oracle Application Framework or Oracle Forms. Conducted user interviews, developed custom forms, reports, and workflows, and performed rigorous testing to ensure functionality and usability.

57. How is data accuracy and integrity ensured in Oracle Financials?

Ans:

Ensuring data accuracy and integrity in Oracle Financials involved implementing data validation rules, setting up data governance policies, and conducting regular audits. Utilized features such as Data Integrity Constraints and Data Security Controls to enforce data quality standards and prevent unauthorized access or modifications. Additionally, collaborated with cross-functional teams to identify data discrepancies and establish corrective action plans.

58. How was a large volume of transactions managed in Oracle Financials?

Ans:

- Managing a large volume of transactions in Oracle Financials required optimizing performance and scalability.

- Optimized database configurations, batch processing jobs, and concurrent request settings to efficiently handle high transaction loads.

- Also monitored system performance and implemented tuning strategies as needed.

59. What challenges were faced with complex tax configuration in Oracle Financials?

Ans:

- Handling a complex tax configuration in Oracle Financials involved configuring tax codes, rules, and rates to comply with regional tax laws and regulations.

- Collaborated with tax experts and IT teams to ensure accurate tax calculations, timely filings, and compliance with tax reporting requirements.

60. How was a project involving extensive use of Oracle BI Publisher managed?

Ans:

Managed a project involving extensive use of Oracle BI Publisher, which included defining reporting requirements, designing report templates, and integrating BI Publisher with Oracle Financials modules. Developed data models, scheduled report generation jobs, and provided user training on accessing and interpreting reports to support informed decision-making.

61. How is Oracle Advanced Collections used in AR?

Ans:

Oracle Advanced Collections in Accounts Receivable (AR) automates and streamlines tasks including dispute settlement, promises to pay, and dunning letters to improve the collections process. Customer segmentation, automated workflows, and extensive reporting and analytics are just a few of its features. Efficiency is further increased by interface friendliness and integration with other Oracle modules. With the use of this technology, businesses may enhance cash flow, lower delinquency rates, and preserve stronger client ties.

62. What functionality does Oracle Treasury provide?

Ans:

- Oracle Treasury is a module within Oracle Financials that manages treasury operations, including cash management, liquidity management, risk management, and financial instrument trading.

- It helps organizations optimize their cash positions, mitigate financial risks, and comply with regulatory requirements.

- Additionally, it provides robust reporting and analytics tools that enable organizations to make informed financial decisions and enhance overall treasury visibility.

63. What is Oracle Le se and Finance Management, and how is it used?

Ans:

- Oracle Lease and Finance Management is a module designed to manage lease agreements and financial contracts throughout their lifecycle.

- It facilitates lease origination, contract management, billing, and accounting, providing visibility and control over lease portfolios.

- Additionally, it integrates with other Oracle applications, enabling seamless data flow and enhancing overall financial management and reporting capabilities.

64. How is Oracle Receivables AutoInvoice configured and used?

Ans:

Receivables from Oracle With the help of a strong feature called AutoInvoice, transactional data from external sources such as other Oracle modules and outside systems can be automatically imported into Oracle Receivables. It expedites the procedure inside the system for transforming unprocessed data into verified and correctly formatted invoices. AutoInvoice speeds up the invoicing process, minimizes errors caused by human data entry, and assures data consistency and integrity.

65. Describe the functional ty of Oracle Financials for India Localization.

Ans:

Oracle Financials for India Localization provides functionalities tailored to the specific requirements of financial operations in India, including support for statutory reporting, taxation, compliance with local regulations such as GST, TDS, and Excise Duty, and localization of financial processes. Additionally, it streamlines financial workflows to enhance efficiency and accuracy, ensuring timely submissions and adherence to regulatory changes.

66. How are foreign exchange gains and losses managed in Oracle Financials?

Ans:

- Oracle Financials uses the currency revaluation method to handle profits and losses on foreign exchange.

- This entails adjusting balances and transactions in foreign currencies in accordance with the most recent exchange rates.

- In order to provide accurate financial reporting, the revaluation modifies the value of these transactions to reflect current exchange rate movements.

- This procedure aids in recognizing and documenting any profits or losses brought about by shifts in currency prices.

67. What is the concept of Oracle E-Business Tax?

Ans:

- Oracle E-Business Tax is a centralized tax engine that manages tax configuration, calculation, and reporting across Oracle E-Business Suite modules.

- It enables organizations to define and maintain tax rules, rates, and jurisdictions to ensure accurate tax compliance and reporting.

- Moreover, it integrates seamlessly with various business processes, providing real-time tax calculations that enhance decision-making and reduce the risk of errors in tax management.

68. How is project accounting handled in Oracle Financials?

Ans:

Project accounting in Oracle Financials involves tracking and managing financial transactions and resources associated with projects, including budgeting, billing, revenue recognition, and cost allocation. It provides insights into project profitability and performance. This functionality enables organizations to maintain compliance with financial regulations and improve overall project management efficiency.

69. What is the use of Oracle Subledger Accounting (SLA) rules?

Ans:

Accounting guidelines and mappings for transactions from modules like Payables, Receivables, and Projects are managed by Oracle Subledger Accounting (SLA). It promotes accuracy and consistency by guaranteeing consolidated and consistent accounting procedures across multiple modules. Organizations may design intricate accounting logic and easily adjust to shifting business needs thanks to SLA. It simplifies financial reporting and compliance operations by offering a uniform framework.

70. How is Oracle Payments set up and used?

Ans:

- Oracle Payments is a module that manages payment processing and disbursement activities within Oracle E-Business Suite.

- It supports various payment methods, currencies, and payment formats, enabling organizations to streamline payment processes and improve cash management.

- Furthermore, it enhances security and compliance by providing robust controls and audit trails for all payment transactions.

71. Explain the process of budgetary control in Oracle Financials.

Ans:

- Budgetary control in Oracle Financials involves setting up controls to monitor and enforce budgetary limits for expenses and commitments.

- It ensures that expenditures are within approved budgets and provides real-time visibility into budget utilization and variances.

- Furthermore, it enables proactive management of financial resources, allowing organizations to make timely adjustments to budgets based on changing business conditions and financial performance.

72. How is Oracle Fixed Assets configured for asset tracking and depreciation?

Ans:

Oracle Fixed Assets is configured to track and oversee the lifecycle of fixed assets, including purchase, depreciation, revaluation, and retirement. It enables organizations to maintain accurate asset records, calculate depreciation expenses, and comply with accounting standards. Additionally, the system streamlines asset management processes, enhancing operational efficiency and facilitating informed financial planning.

73. What are the key features of Oracle Project Costing?

Ans:

Oracle Project Costing includes capabilities such as tracking, forecasting, budgeting, and reporting to provide complete project cost management. It helps firms assess the profitability of projects by providing visibility into project expenses and performance. It facilitates well-informed decision-making about the distribution of resources and project management techniques with its comprehensive insights. In order to maximize project results and financial performance, this module is essential.

74. Describe the functionality of Oracle Grants Accounting.

Ans:

- Oracle Grants Accounting manages grant funds and compliance requirements for grant-funded projects.

- It supports grant proposal creation, award management, budgeting, expenditure tracking, and reporting to ensure proper stewardship of grant funds.

- Additionally, it facilitates collaboration among stakeholders by providing tools for monitoring project progress and ensuring adherence to grant terms and conditions.

75. How is financial consolidation managed and reported in Oracle Financials?

Ans:

- Financial consolidation in Oracle Financials involves aggregating financial data from multiple entities or business units to produce consolidated financial statements.

- It includes processes such as intercompany eliminations, currency translation, and reconciliation to present a consolidated view of economic performance.

76. What is Oracle Advanced Global Intercompany System (AGIS)?

Ans:

Oracle Advanced Global Intercompany System (AGIS) simplifies intercompany transactions and reconciliations across corporate entities. By automating processes and enhancing accuracy, AGIS promotes compliance with transfer pricing regulations. It enables seamless coordination and transparency within the corporate group, facilitating efficient financial management. AGIS streamlines intercompany activities, minimizing errors and optimizing resource utilization for enhanced operational efficiency.

77. How is compliance with IFRS handled using Oracle Financials?

Ans:

Application of International Financial Reporting Standards (IFRS) in compliance with Oracle Financials involves configuring accounting policies, reporting structures, and financial processes to adhere to IFRS requirements. It includes features for IFRS-compliant financial reporting, disclosure management, and audit trails. Additionally, it supports the integration of financial data across various departments to enhance transparency and consistency.

78. Describe the process of setting up Oracle iExpense.

Ans:

- Setting up Oracle expenses involves configuring expense policies, approval workflows, and expense categories to manage employee expenses efficiently.

- It includes features for expense report creation, submission, approval, reimbursement, and integration with financial systems.

- Furthermore, it provides analytics and reporting capabilities to monitor spending patterns and compliance with company policies, aiding in strategic financial decision-making.

79. How is Oracle Financial Analytics used for decision-making?

Ans:

For financial analysis, Oracle Financial Analytics provides pre-built dashboards, reports, and analytics tools. These tools are useful for evaluating financial performance, identifying patterns, and assisting with strategic decision-making. Organizations are enabled to maximize economic outcomes and propel profitability through the provision of insights into critical financial metrics and trends. Oracle Financial Analytics makes data-driven decision-making processes more efficient with its intuitive interface.

80. Explain the concept of Oracle Financial Services Analytical Applications (OF AA).

Ans:

Oracle Financial Services Analytical Applications (OFSAA) is a suite of analytical applications tailored for the financial services industry. It includes modules for risk management, regulatory compliance, profitability analysis, and financial reporting to help financial institutions manage risks and improve performance. The suite leverages advanced analytics and machine learning capabilities to provide insights into customer behavior and operational efficiency.

81. How is Oracle Financials configured for the manufacturing industry?

Ans:

- Configuring Oracle Financials for the manufacturing industry involves setting up modules tailored to manufacturing processes.

- This includes defining inventory structures, cost components, and manufacturing overheads.

- Additionally, configuring supply chain management modules for procurement, production scheduling, and inventory management is vital.

- Integration with production planning systems and shop floor control for real-time tracking of manufacturing activities is essential for efficient operations.

82. Describe the use of Oracle Financials in the healthcare sector.

Ans:

- In the healthcare sector, Oracle Financials streamlines financial operations by managing revenue cycles, billing processes, and expense tracking.

- Electronic health record (EHR) systems are integrated with it to facilitate billing and coding compliance.

- Additionally, it handles accounts receivable, payable, and general ledger functions while ensuring regulatory compliance, such as HIPAA.

83. How are Oracle Financials tailored for the retail industry?

Ans:

Oracle Financials for the retail industry offers features tailored to retail operations, including point-of-sale integration, inventory management, and merchandising. It facilitates sales tracking, customer relationship management, and loyalty program management. Retail-specific financial reporting capabilities enable analysis of sales performance, inventory turnover, and profit margins across various product categories and store locations.

84. Explain the use of Or cle Financials in the banking and financial services industry.

Ans:

In the banking and financial services industry, Oracle Financials manages complex financial transactions, compliance requirements, and risk management. It supports core banking functions such as deposit and loan management, treasury management, and asset-liability management. Regulatory reporting capabilities ensure compliance with banking regulations such as Basel III and Dodd-Frank.

85. How is Oracle Financials configured for government and public sector entities?

Ans:

- Configuring Oracle Financials for government and public-sector entities involves adhering to governmental accounting standards and regulations.

- This includes setting up fund accounting structures, budgetary controls, and grant management functionalities.

- Additionally, it supports procurement processes, contract management, and project accounting for government-funded initiatives.

86. Describe the role of Oracle Financials in the telecommunications industry.

Ans:

- Oracle Financials play a crucial role in the telecommunications industry by managing revenue assurance, billing processes, and subscriber management.

- It supports complex billing structures, including usage-based billing and subscription plans.

- Oracle Financials integrates with customer relationship management (CRM) systems to track customer interactions and resolve billing inquiries.

- Additionally, it facilitates financial planning, budgeting, and cost allocation for telecommunications companies.

87. How are financial processes managed for the construction industry using Oracle Financials?

Ans:

Managing financial processes for the construction industry using Oracle Finan also involves project accounting, cost tracking, and contract management functionalities. It supports job cost ng, progress billing, and revenue recognition for construction projects. Integration with project management systems enables re l-time monitoring of project expenses, resource utilization, and project profitability.

88. Explain the application of Oracle Financials in the education sector.

Ans:

Oracle Financials in the education sector streamlines financial operations for educational institutions, including universities, schools, and colleges. Manages tuition fee billing, student financial aid, and grants management. Integration with student information systems (SIS) ensures accurate billing and enrollment tracking. Oracle Financials also supports budget planning, fund accounting, and endowment management for educational institutions.

89. How is Oracle Financials used in the energy and utilities sector?

Ans:

Oracle Financials handles complex financial processes in the energy and utilities sector, such as revenue recognition, cost allocation, and regulatory reporting. It supports energy trading and risk management (ETRM) functionalities for commodity trading companies. Additionally, it facilitates asset management, maintenance planning, and capital project accounting for utilities.

90. Describe the use of Oracle Financials in the transportation and logistics industry.

Ans:

- In the transportation and logistics industry, Oracle Financials manages financial transactions, costing, and revenue recognition for transportation companies.

- It supports freight billing, carrier settlement, and logistics cost management.

- Oracle Financials integrates with transportation management systems ( MS) to streamline shipment tracking and invoicing processes.

- Additionally, it facilitates financial planning, budgeting, and performance measurement for transportation and logistics companies.