Looking for the top Oracle iExpense interview questions to prepare for your interview. Go through some of the best Oracle iExpense interview questions with detailed answers before you get ahead. iExpense is an Oracle module used to report and seek reimbursement of expenses paid by employees. Therefore, Oracle iExpense professionals need to encounter interview questions on iExpense for different enterprise Oracle job roles. The following discussion offers an overview of different categories of interview questions related to Oracle iExpense to help aspiring enterprise Oracle iExpense Professionals.

1. What is Oracle iExpense?

Ans:

Oracle iExpense is an Oracle E-Business Suite module that manages the entire expense report lifecycle, from submission to reimbursement.Oracle expense is an expense management application that helps organizations streamline and automate their expense reporting processes. It is part of the Oracle E-Business Suite, allowing employees to submit, track, and manage their expenses while providing administrators with tools to review, approve, and process reimbursement requests efficiently.

2. How does Oracle iExpense integrate with other modules in the E-Business Suite?

Ans:

iExpense seamlessly integrates with modules like Payables and General Ledger, ensuring accurate and efficient processing of expense reports. Oracle iExpense integrates with various modules in Oracle E-Business Suite to streamline expense management. It typically interfaces with Oracle Payables for expense reimbursements, Oracle General Ledger for accounting entries, and Oracle Human Resources for employee information. This integration ensures a cohesive flow of data, allowing seamless processing of expense reports, approvals, and reimbursement transactions within the E-Business Suite ecosystem.

3. Can you explain the key features of Oracle iExpense?

Ans:

Mobile Accessibility : Submit expenses on the go.

Policy Compliance : Validates against company policies.

Integration Capabilities : Seamless with Oracle apps.

Receipt Imaging : Attach digital receipts.

Automated Approval Workflow : Customizable, reduces delays.

Expense Analytics : Robust reporting tools.

Multi-Currency Support : Handles various currencies.

Audit Trail : Comprehensive activity tracking.

Policy Configuration : Adaptable expense policy setup.

4. What is the purpose of receipt imaging in Oracle iExpense?

Ans:

Receipt imaging allows users to attach digital images of receipts to expense reports, improving audit trails and compliance. The purpose of receipt imaging in Oracle expense is to allow users to attach digital receipts to their expense submissions. This feature helps in maintaining a clear and organized record of expenses, enhances transparency, and facilitates compliance with documentation requirements. It also streamlines the auditing process by providing a visual reference for each expense, improving accuracy and accountability in expense management.

5. How does Oracle iExpense enforce expense policies?

Ans:

iExpense uses configurable rules to enforce expense policies, ensuring that submitted reports comply with company guidelines. Oracle iExpense enforces expense policies through systematic validation of expense submissions. It checks each expense against predefined company policies, ensuring compliance. If a submitted expense violates any rules, the system can flag it for review or rejection, reducing the likelihood of non-compliant expenditures. This automated enforcement helps organizations maintain consistency, uphold regulatory standards, and prevent unauthorized or excessive spending.

6. What role does workflow play in Oracle iExpense?

Ans:

Workflow in expense facilitates the automated routing and approval of expense reports, streamlining the reimbursement process. In Oracle expense, workflow plays a crucial role in managing the approval and reimbursement processes for employee expenses. The workflow defines the sequence of steps and approvals that an expense report goes through, from submission to final reimbursement.

7. Can Oracle iExpense handle multiple currencies in expense reports?

Ans:

Yes, iExpense supports multiple currencies, enabling users to submit expense reports in the currency of their transactions. Oracle iExpense is designed to handle multiple currencies in expense reports. Employees can submit expense reports in different currencies based on the transactions they’ve incurred. The system allows for the conversion of expenses into the company’s default currency or any other designated reporting currency.

8. How does Oracle iExpense handle credit card transactions?

Ans:

expense can import credit card transactions, making it easier for users to reconcile expenses and attach receipts to transactions. Oracle iExpense manages credit card transactions by allowing users to import credit card statements into the system. Users can then allocate expenses to appropriate categories, attach receipts, and submit them for approval. The system streamlines the expense reporting process, ensuring accurate tracking and compliance with corporate policies. If you need more detailed information, refer to Oracle’s official documentation or contact their support.

9. Explain the concept of ‘Per Diem’ in Oracle iExpense.

Ans:

expense allows users to claim per diem expenses, specifying fixed daily allowances for meals, lodging, and incidental expenses. In Oracle expense, ‘Per Diem’ refers to a fixed daily allowance given to employees for expenses incurred during business travel. Instead of itemizing each expense, users can claim a per diem amount for meals, lodging, and incidental expenses. Oracle expense automates the calculation and reimbursement of per diem allowances based on predefined rates and policies, simplifying the expense reporting process for employees on business trips.

10. How can administrators troubleshoot issues related to Oracle expense?

Ans:

Administrators can use diagnostic tools and log files, review workflow statuses, and leverage Oracle support resources to troubleshoot expense issues. Administrators can troubleshoot Oracle expense issues by checking configuration settings, reviewing log files, and monitoring database performance. They should also verify user permissions, examine workflow setups, and utilize Oracle support resources for specific error messages or issues.

11. What is the role of the iExpense Setup Manager in Oracle iExpense?

Ans:

iExpense Setup Manager is used to configure and customize iExpense according to the organization’s policies, defining rules, templates, and approval hierarchies. The iExpense Setup Manager in Oracle iExpense facilitates the configuration and setup of the iExpense application. It allows administrators to define expense report templates, establish approval hierarchies, configure expense types, and set up policy rules. Essentially, it centralizes the administrative tasks related to tailoring expense to an organization’s specific needs.

12. How does Oracle iExpense handle mileage expenses?

Ans:

iExpense supports mileage expenses by allowing users to enter details like starting point, destination, and miles travelled, facilitating accurate reimbursement. Oracle iExpense handles mileage expenses by allowing users to enter details such as starting and ending locations, total miles traveled, and the purpose of the trip. Users can attach supporting documents like maps or receipts. Administrators can configure mileage expense types, rates, and validation rules to ensure compliance with company policies. Once submitted, the mileage expenses follow the approval workflow set up in the system.

13. Can users submit expense reports in Oracle iExpense through mobile devices?

Ans:

Yes, iExpense provides mobile accessibility, enabling users to submit and manage expense reports conveniently from their mobile devices. Oracle iExpense supports mobile expense report submission. Users can conveniently submit and manage their expense reports using mobile devices, providing flexibility and accessibility on the go. This functionality enhances the user experience and streamlines the expense reporting process.

14. Explain the difference between a hard stop and a soft stop in Oracle expense.

Ans:

| Aspect | Hard Stop | Soft Stop | |

| Definition |

An absolute block that prevents further processing until the issue is resolved. |

A warning or advisory message that allows users to proceed but highlights potential issues. | |

| Impact | Mandatory compliance; users cannot proceed without addressing the issue. | Advisory; users can proceed but are alerted to review and address potential concerns. | |

| Example | Missing mandatory receipt for a high-value expense. | Exceeding recommended spending limits, suggesting further review. |

15. How does Oracle iExpense ensure compliance with tax regulations for expense reporting?

Ans:

iExpense can be configured to enforce tax compliance by validating expenses against tax rules and regulations relevant to the organization’s jurisdiction. Oracle iexpense helps ensure compliance with tax regulations by allowing administrators to configure tax-related settings based on the organization’s requirements. This includes defining tax codes, rates, and rules. Additionally, users can input necessary tax information during the expense entry process.

16. Can Oracle iExpense automatically allocate expenses to different cost centers or projects?

Ans:

Yes, iExpense supports the automatic allocation of expenses to specific cost centres or projects based on predefined rules set up during configuration.Oracle iExpense provides the capability to automatically allocate expenses to different cost centers or projects through configuration settings and predefined rules. This helps organizations streamline the expense allocation process and ensures accurate accounting for various cost centres or projects.

17. What role does the Audit feature play in Oracle iExpense?

Ans:

The Audit feature in iExpense helps in monitoring and reviewing expense reports for compliance, ensuring accuracy and adherence to organizational policies. The Audit feature in Oracle iExpense plays a crucial role in ensuring compliance and accuracy in expense reports. It involves reviewing and validating expense submissions to detect any policy violations, errors, or inconsistencies. The Audit feature helps enforce company policies, ensures adherence to regulatory requirements, and identifies potential issues in expense reports. This enhances the overall integrity of the expense management process and promotes financial accountability within the organization.

18. How does Oracle iExpense handle recurring expenses, such as monthly subscriptions?

Ans:

iExpense supports recurring expenses by allowing users to create templates for repetitive expenses, simplifying the submission process for regular transactions. Oracle iExpense typically handles recurring expenses, such as monthly subscriptions, through a feature called “Recurring Expenses” or similar functionality. Users can set up recurring expense profiles where they define the details of the recurring expense, including the frequency, amount, and duration.

19. Can employees delegate the submission of their expense reports to someone else in Oracle iExpense?

Ans:

Yes, iExpense allows employees to delegate the submission of their expense reports to another person, useful in cases of extended absence.in Oracle iExpense, employees can often delegate the submission of their expense reports to someone else, such as an administrative assistant or a designated colleague. This delegation feature allows for flexibility in managing expense reporting responsibilities, especially in situations where the original submitter is unavailable.

20. What reporting tools are available in Oracle iExpense for tracking and analyzing expenses?

Ans:

iExpense provides reporting tools like Oracle Discoverer or Oracle Business Intelligence for creating customized reports and analyzing expense data. Oracle iExpense offers Expense Summary Reports, Expense Detail Reports, Audit Trail Reports, Policy Violation Reports, User Productivity Reports, and customizable dashboards for efficient expense tracking and analysis.

21. How does Oracle iExpense handle currency conversions for international transactions?

Ans:

iExpense uses predefined exchange rates or integrates with Oracle General Ledger to handle currency conversions accurately. Oracle iExpense handles currency conversions for international transactions by utilizing predefined exchange rates or integrating with external systems for real-time rates. It supports multiple currencies, allowing users to submit expenses in their preferred currency. The system automatically converts these expenses to the company’s base currency using the applicable exchange rates, ensuring accurate financial reporting and reimbursement.

22. Explain the role of the Payment Manager in Oracle iExpense.

Ans:

The Payment Manager in iExpense is responsible for generating payment instructions based on approved expense reports and sending them to Oracle Payables for disbursement. In Oracle iExpense, the Payment Manager plays a crucial role in managing the payment process for employee expenses. This role involves overseeing and authorizing expense reports for payment. The Payment Manager is responsible for verifying that submitted expenses comply with company policies and ensuring accurate reimbursement to employees. Additionally, they may handle tasks such as reconciling expenses, approving payment batches, and collaborating with finance teams to facilitate timely and accurate payments.

23. Can Oracle iExpense integrate with third-party travel and expense management systems?

Ans:

Yes, iExpense provides integration capabilities to seamlessly connect with third-party travel and expense management systems for a unified experience. Oracle iExpense is designed to integrate with third-party travel and expense management systems. This integration capability allows organizations to streamline their expense management processes by connecting Oracle iExpense with external systems. By doing so, companies can leverage existing tools or services for various aspects of travel and expense management while still benefiting from Oracle iExpense’s features for expense tracking, policy enforcement, and reimbursement within their overall financial ecosystem.

24. How does Oracle iExpense handle the taxation of employee reimbursements?

Ans:

iExpense allows the configuration of tax rules to determine whether reimbursements are taxable or non-taxable, ensuring compliance with tax regulations.Oracle iExpense includes features to handle the taxation of employee reimbursements. The system typically allows organizations to configure tax rules and policies based on local regulations and company policies. The taxation module within Oracle iExpense can automatically calculate applicable taxes on employee reimbursements, taking into account factors such as the nature of expenses, location-specific tax rates, and any exemptions.

25. What is the role of the Expense Report Template in Oracle iExpense?

Ans:

The Expense Report Template in iExpense allows users to create standardized templates for commonly incurred expenses, streamlining the reporting process. Oracle iExpense, the Expense Report Template serves as a predefined structure that guides users in submitting expense reports. It includes fields and formatting to capture necessary information, streamlining the process and ensuring consistency in reporting expenses within the organization.

26. Can Oracle iExpense automate the approval process for expense reports?

Ans:

Yes, iExpense supports workflow automation to route expense reports for approval based on predefined rules and hierarchies.Oracle iExpense can automate the approval process for expense reports. It allows organizations to set up predefined approval workflows based on criteria such as expense amount, project, or department. This automation helps streamline the approval process, reducing manual intervention and ensuring a more efficient expense management system.

27. How does iExpense handle advances or prepayments for employee expenses?

Ans:

iExpense enables users to request advances or prepayments for anticipated expenses, which can later be reconciled when the actual expenses are incurred.Oracle iExpense facilitates advances or prepayments for employee expenses by allowing users to create cash advances within the system. Employees can request advances, and once approved, the system tracks these advances separately. When the employee submits an expense report, the advanced amount is deducted from the reimbursable expenses, ensuring accurate reimbursement calculations.

28. Explain the purpose of the Expense Report Dashboard in Oracle iExpense.

Ans:

The Expense Report Dashboard provides a centralized view of submitted, pending, and approved expense reports, offering insights into the overall expense status.The Expense Report Dashboard in Oracle iExpense serves as a centralized hub for users to monitor and manage their expense reports. It provides a visual summary of key information, such as pending, approved, or rejected expense reports. Users can quickly track the status of their submissions, view any comments or notifications, and take necessary actions, enhancing transparency and efficiency in the expense reporting process.

29. Can Oracle iExpense enforce different approval hierarchies based on the type or amount of expenses?

Ans:

Yes, iExpense allows the definition of multiple approval hierarchies, which can be applied based on expense types, amounts, or other criteria. Oracle iExpense allows organizations to configure and enforce different approval hierarchies based on various criteria, such as the type or amount of expenses. This flexibility enables tailored approval workflows to match specific business rules. For example, higher-value expenses may require approval from different levels or departments than lower-value ones. This feature helps organizations customize their approval processes to align with their unique expense management requirements.

30. How does Oracle iExpense handle policy updates or changes in the organization?

Ans:

iExpense supports the dynamic updating of expense policies, ensuring that changes are reflected in the system without disrupting ongoing processes. Oracle iExpense accommodates policy updates or changes in the organization by providing administrators with the ability to modify and configure expense policies within the system. When policies change, administrators can update the relevant settings, rules, and approval workflows in iExpense to reflect the new guidelines. This ensures that employees’ expense submissions align with the latest organizational policies, maintaining compliance and consistency in expense management.

31. What role does the Oracle Internet Expenses (OIE) module play in Oracle iExpense?

Ans:

Oracle Internet Expenses is the underlying module for iExpense, providing a web-based interface for users to enter and manage their expenses. The Oracle Internet Expenses (OIE) module is the underlying component of Oracle iExpense. It provides the core functionality for capturing, submitting, and processing expense reports. Oracle iExpense is essentially an application built on top of the OIE module, offering a user-friendly interface and additional features for enhanced expense management. OIE serves as the foundation, handling the fundamental aspects of expense reporting, while iExpense provides a more tailored and user-focused experience.

32. How does Oracle iExpense handle per diem rates for different locations?

Ans:

iExpense supports the configuration of per diem rates based on geographic locations, ensuring accurate reimbursement according to local cost standards. Oracle iExpense allows organizations to manage per diem rates for different locations by enabling administrators to set up location-specific per diem rates within the system. Employees can then select the appropriate location when entering their expenses, and the system automatically applies the corresponding per diem rates based on the configured settings. This ensures accurate reimbursement calculations in accordance with the specified rates for each location, enhancing the system’s flexibility in handling diverse expense scenarios.

33. Can Oracle iExpense automatically validate receipts attached to expense reports?

Ans:

Yes, iExpense includes features for automatic receipt validation, helping ensure that receipts are complete and match submitted expenses. Oracle iExpense can be configured to validate receipts attached to expense reports automatically. The system can enforce rules and policies regarding receipt requirements, such as checking for missing receipts or validating against predefined criteria. This automation helps ensure compliance with expense policies and improves the accuracy of expense reporting by flagging any discrepancies or missing documentation during the validation process.

34. Explain the role of the Expense Auditor in Oracle iExpense.

Ans:

The Expense Auditor in iExpense is responsible for reviewing and auditing expense reports to ensure compliance with company policies and external regulations. In Oracle iExpense, the Expense Auditor plays a crucial role in reviewing and auditing expense reports submitted by employees. The Expense Auditor ensures that the submitted expenses comply with organizational policies and guidelines. They may validate receipts, check for policy violations, and verify that expenses align with approved budgets. The auditing process helps maintain accuracy and adherence to policies in expense reporting within the organization.

35. How does Oracle iExpense handle corporate credit card transactions and reconciliations?

Ans:

iExpense facilitates the reconciliation of corporate credit card transactions by allowing users to match them with corresponding expenses in the system. Oracle iExpense facilitates the handling of corporate credit card transactions and reconciliations by allowing users to link their corporate credit card to their expense reports. The system can automatically import credit card transactions, and users can match these transactions to corresponding expenses within the iExpense interface.

36. What is the purpose of the iExpense Request Group in Oracle E-Business Suite?

Ans:

The iExpense Request Group determines the access and permissions users have within iExpense, controlling their ability to submit, review, or approve expenses. The iExpense Request Group in Oracle E-Business Suite serves as a mechanism to control access to Oracle iExpense functionality for different sets of users within an organization. It allows administrators to define and manage user permissions by assigning them to specific request groups.

37. Can Oracle iExpense integrate with travel booking systems for seamless expense tracking?

Ans:

Yes, iExpense can integrate with travel booking systems, automatically importing travel-related expenses into the expense reporting workflow. Oracle iExpense can integrate with travel booking systems to achieve seamless expense tracking. This integration enables automatic data flow from travel bookings to expense reports, reducing manual data entry and ensuring accuracy. Users can import details of their travel expenses directly from the booking system into iExpense, streamlining the process and providing a comprehensive view of travel-related expenditures within the expense management system.

38. Explain the significance of the Oracle Payables Open Interface in relation to Oracle iExpense.

Ans:

The Oracle Payables Open Interface is used to transfer approved expense reports from iExpense to Oracle Payables for payment processing. The Oracle Payables Open Interface is significant in the context of Oracle iExpense as it serves as a bridge between iExpense and Oracle Payables. When expense reports are submitted and approved in iExpense, the Payables Open Interface facilitates the transfer of these expenses into Oracle Payables for further processing and payment.

39. How does iExpense handle multiple expense entry methods for users?

Ans:

iExpense supports various expense entry methods, including manual entry, credit card import, and integration with other systems, offering flexibility for users. Oracle iExpense accommodates multiple expense entry methods for users by providing flexibility in how they can submit their expenses. Users can choose from various entry methods, including manual entry, uploading spreadsheet templates, or leveraging integrations with corporate credit card transactions or travel booking systems.

40. What options are available for configuring expense report templates in Oracle iExpense?

Ans:

iExpense allows the configuration of templates based on expense categories, making it easier for users to select appropriate expenses when creating reports. In Oracle iExpense, you can configure expense report templates by defining expense categories, specifying default values, setting up rules for expense types, and configuring approval workflows. Additionally, you can customize layouts, define validation rules, and establish policies to control expense entry and approval processes. Detailed configuration steps can be found in Oracle iExpense documentation or user guides.

41. How does Oracle iExpense handle the reconciliation of expense reports with corporate policies?

Ans:

iExpense uses configurable policy rules to automatically check expense reports for compliance, ensuring adherence to corporate policies. Oracle iExpense automates the reconciliation of expense reports with corporate policies by enforcing predefined rules and policies during the submission and approval process. It validates expenses against company guidelines, ensuring compliance. Users receive notifications for policy violations, enabling them to make necessary adjustments. Approvers can also review and flag non-compliant expenses, facilitating efficient reconciliation with corporate policies.

42. Can Oracle iExpense integrate with external systems for data import/export purposes?

Ans:

Yes, iExpense provides integration capabilities through APIs, enabling seamless data exchange with external systems for various purposes. Oracle iExpense supports integration with external systems for data import/export. It provides various integration options, including APIs (Application Programming Interfaces) that allow seamless exchange of data with other systems. This facilitates the import of expense-related data into iExpense and the export of relevant information to external systems, ensuring consistency and efficiency in data management.

43. What role does the Oracle Workflow Business Event System play in Oracle iExpense

Ans:

The Workflow Business Event System in iExpense triggers events that initiate workflow processes, facilitating timely approval and processing of expense reports. In Oracle iExpense, the Oracle Workflow Business Event System plays a crucial role in managing and controlling the flow of events throughout the expense report processing lifecycle. It enables the definition and handling of events triggered by specific actions, such as expense submission or approval.

44. How does Oracle iExpense handle expense report audit trails for compliance purposes?

Ans:

iExpense maintains comprehensive audit trails, documenting changes made to expense reports and providing a transparent history for compliance audits. Oracle iExpense maintains comprehensive audit trails to ensure compliance with expense reporting requirements. It records a detailed history of actions taken on each expense report, including submission, approvals, rejections, and any modifications made.

45. Can Oracle iExpense support various reimbursement methods like direct deposit or paper checks?

Ans:

Yes, iExpense supports various reimbursement methods, allowing organizations to choose options like direct deposit or traditional paper checks. Oracle iExpense is designed to accommodate various reimbursement methods, including direct deposit and paper checks. Users can specify their preferred reimbursement method when configuring their expense profiles. The system allows organizations to define and manage multiple payment methods to cater to diverse employee preferences and company policies. This flexibility ensures that reimbursements can be processed efficiently according to the chosen payment method.

46.Explain the role of the Expense Workbench in Oracle iExpense.

Ans:

The Expense Workbench serves as a centralized interface for users to manage, review, and edit their expense reports throughout the submission process. The Expense Workbench in Oracle iExpense serves as a centralized interface where users can manage and monitor their expense reports. It provides a user-friendly platform for employees to create, edit, and submit their expense reports. The Expense Workbench also enables users to track the status of their reports and view detailed information about individual expenses.

47. How does Oracle iExpense handle tax recovery for eligible expenses?

Ans:

iExpense allows users to specify tax recovery details for eligible expenses, ensuring accurate accounting and compliance with tax regulations. Oracle iExpense facilitates tax recovery for eligible expenses by allowing users to associate tax-related information with their expenses. Users can specify relevant tax codes, rates, and details during the expense submission process. The system then calculates the applicable taxes based on the configured information.

48. Can Oracle iExpense accommodate complex approval hierarchies based on organizational structures?

Ans:

Yes, iExpense supports flexible approval hierarchies based on organizational structures, accommodating complex workflows for different departments or business units. Oracle iExpense is designed to accommodate complex approval hierarchies based on organizational structures. It allows organizations to define and configure intricate approval workflows that align with their specific hierarchy and business processes. The system supports multi-level approvals, ensuring that expense reports move through the appropriate channels within the organization.

49. What measures does Oracle iExpense have in place for ensuring data security and confidentiality?

Ans:

iExpense implements robust security measures, including user access controls, encryption, and audit trails, to ensure data security and confidentiality. Oracle iExpense employs various measures to ensure data security and confidentiality. These include robust encryption protocols for sensitive data, role-based access controls to restrict information access, audit trails to track user activities, and compliance with industry standards such as ISO/IEC 27001. Regular security assessments and updates are also conducted to address potential vulnerabilities and enhance overall system security.

50. How does Oracle iExpense handle non-cash expenses without receipts, like mileage or meals?

Ans:

iExpense allows users to claim non-cash expenses like mileage or per diem, providing options for reimbursement without requiring physical receipts. Oracle expense typically allows users to submit reimbursement requests for non-cash expenses, like mileage or meals, without receipts. However, the specific configuration and rules can be customized based on the organization’s policies. In such cases, users may need to provide additional details, such as the purpose of the expense and relevant supporting documentation, to justify the reimbursement. Administrators can set specific guidelines and approval workflows to ensure compliance with company policies and regulations while handling non-cash expense reimbursements.

51. How does Oracle iExpense handle the submission of expenses in different languages?

Ans:

iExpense supports multiple languages, allowing users to submit expenses and navigate the system in their preferred language. Oracle iExpense typically supports the submission of expenses in multiple languages. Users can input expense details, descriptions, and other relevant information in their preferred language during the submission process. The system often provides language localization features, allowing for a user-friendly experience in diverse linguistic settings. The availability of languages may depend on the specific configuration and version of Oracle iExpense implemented by the organization.

52. Can Oracle iExpense enforce spending limits for specific expense categories?

Ans:

Yes, iExpense allows administrators to set spending limits for different expense categories, ensuring compliance with budgetary constraints. Oracle iExpense often allows administrators to enforce spending limits for specific expense categories. Through configuration settings, administrators can define and set spending limits based on categories such as meals, transportation, or accommodations. This helps organizations control and manage expenses effectively, ensuring compliance with budgetary constraints and financial policies. Users submitting expense reports exceeding these predefined limits may trigger alerts or require additional approvals, providing a mechanism for oversight and adherence to spending guidelines.

53. Explain the role of the Expense Auditor in Oracle iExpense.

Ans:

The Expense Auditor in iExpense reviews and verifies expense reports to ensure compliance with policies and regulatory requirements before approval. In Oracle iExpense, the Expense Auditor plays a crucial role in reviewing and approving or rejecting expense reports submitted by employees. Their responsibilities include :

- Verifying that the expenses comply with company policies.

- Ensuring accurate documentation.

- Confirming that expenses are within approved limits.

54. How does Oracle iExpense handle the taxation of employee reimbursements?

Ans:

iExpense provides options to configure tax rules, allowing organizations to determine the tax treatment of different types of employee reimbursements. Oracle iExpense provides a flexible taxation setup to handle employee reimbursements. You can define tax rules based on reimbursement types, locations, and employee attributes. It supports various taxation methods, including flat amount or percentage-based taxes. The system calculates taxes during expense entry or reimbursement, ensuring compliance with tax regulations. Configuration and setup may vary based on specific organizational requirements and the Oracle version.

55. Can Oracle iExpense be customized to accommodate specific business rules or requirements?

Ans:

Yes, iExpense is highly customizable, allowing organizations to tailor the system to meet specific business rules and requirements. Oracle iExpense is designed to be customizable to accommodate specific business rules or requirements. It offers a range of configuration options to tailor the system to your organization’s needs. Customization can include adding fields, modifying workflows, defining approval hierarchies, and integrating with other systems. However, it’s crucial to follow Oracle’s guidelines and best practices to ensure the stability and maintainability of the system.

56. What role does the Subledger Accounting (SLA) play in Oracle iExpense?

Ans:

SLA in iExpense manages accounting information, ensuring accurate and compliant financial reporting for expense-related transactions. In Oracle iExpense, Subledger Accounting (SLA) plays a crucial role in managing and accounting for expense transactions. SLA is responsible for creating detailed accounting entries based on the expenses incurred by employees using expense. It ensures accurate and transparent financial reporting by capturing and processing accounting information related to expense transactions.

57. How does Oracle iExpense handle the reimbursement of expenses incurred during business trips?

Ans:

iExpense supports the inclusion of travel-related expenses in expense reports, allowing for easy reimbursement of expenses incurred during business trips. Oracle iExpense streamlines the expense reimbursement process by allowing users to submit and manage expense reports online. It typically involves capturing receipts, categorizing expenses, and providing details. The system then routes the report for approval, and once approved, it initiates the reimbursement process. The configuration and exact steps can vary based on the organization’s setup and customization of Oracle iExpense.

58. Can Oracle iExpense automate departmental expense allocation based on organizational structure?

Ans:

Yes, iExpense allows for the automation of expense allocation, ensuring that expenses are appropriately charged to the relevant departments or cost centers. Oracle iExpense can often automate the allocation of expenses to different departments based on organizational structures. This is typically achieved through the setup of predefined rules and configurations within the system. These rules may consider factors like project codes, cost centres, or other criteria to automatically allocate expenses to the appropriate departments during the reimbursement process. The specific implementation can vary based on the organization’s requirements and the configuration of their Oracle iExpense system. For detailed guidance, it’s advisable to consult Oracle’s official documentation or your organization’s system administrator.

59. Explain the role of the Expense Report Wizard in Oracle iExpense.

Ans:

The Expense Report Wizard in iExpense guides users through the process of creating expense reports, providing a user-friendly interface for efficient submission. The Expense Report Wizard in Oracle iExpense is a tool designed to guide users through the process of creating and submitting expense reports. It provides a step-by-step interface, helping users input necessary information such as expenses, receipts, and other relevant details. The Wizard ensures that users follow a structured approach, reducing errors and streamlining the expense report creation process.

60. How does Oracle iExpense handle the entry and approval of expenses for project-related activities?

Ans:

iExpense can be configured to integrate with project-related modules, allowing for the entry and approval of expenses associated with specific projects. Oracle iExpense allows users to enter and submit expenses related to project activities. The system typically integrates with Oracle Projects for project-related expenses. Users input expense details, attach receipts, and submit them for approval. Approvers can review and approve expenses based on configured rules. Integration with Oracle Projects ensures accurate tracking and allocation of expenses to the relevant projects, providing comprehensive financial control.

61. How does Oracle iExpense handle the validation of expense entries against corporate policies?

Ans:

iExpense uses a rules engine for real-time validation, ensuring that expense entries comply with predefined corporate policies. Oracle iExpense incorporates a robust validation system to ensure expense entries adhere to corporate policies. It utilizes predefined rules and configurations to check various parameters such as spending limits, allowed expense types, and policy compliance. These rules are customizable to align with specific corporate guidelines. When users submit expenses, the system automatically validates them against these rules, flagging any discrepancies for further review. Approvers can then assess compliance during the approval process. This helps organizations maintain control over expenses and ensures adherence to established corporate policies.

62. Can Oracle iExpense generate reports for analyzing expense trends and patterns over time?

Ans:

Yes, iExpense provides reporting capabilities to generate insightful reports for analyzing expense trends and patterns over different periods. Oracle iExpense can generate reports to analyze expense trends and patterns over time, providing valuable insights into spending behaviors and patterns within an organization.

63. What is the purpose of the Expense Report Template Library in Oracle iExpense?

Ans:

The Expense Report Template Library allows users to save and reuse templates, promoting consistency in expense reporting across the organization. The Expense Report Template Library in Oracle iExpense serves as a repository for predefined expense report templates. It allows users to quickly create expense reports based on these templates, streamlining the process and ensuring consistency in reporting formats across the organization.

64. How does Oracle iExpense handle the reimbursement of expenses incurred in multiple currencies?

Ans:

iExpense performs currency conversions based on predefined exchange rates, ensuring accurate reimbursement for expenses incurred in different currencies. Oracle iExpense is equipped to handle expenses incurred in multiple currencies. It supports the entry and tracking of expenses in different currencies, allowing users to submit reports with expenses in various monetary units. The system typically utilizes exchange rates to convert expenses into a common currency for reimbursement and reporting purposes.

65. Can Oracle iExpense integrate with Human Resources systems to retrieve employee information?

Ans:

Yes, iExpense can integrate with Human Resources systems, retrieving employee information to streamline the expense submission process. Oracle iExpense can integrate with Human Resources (HR) systems to retrieve employee information. This integration ensures that accurate and up-to-date employee data, such as names, positions, and cost centers, is available within the iExpense system, streamlining the expense management process and enhancing data accuracy.

66. Explain the role of the Submittal Alert in Oracle iExpense.

Ans:

The Submittal Alert in iExpense notifies users when their expense reports are due or pending approval, helping ensure timely submission and processing. The Submittal Alert in Oracle iExpense serves as a notification mechanism. It alerts users when they need to submit their expense reports, helping ensure timely submission. This feature enhances accountability and compliance with expense reporting deadlines within an organization using Oracle iExpense.

67. How does Oracle iExpense handle the reconciliation of expenses paid with personal funds?

Ans:

iExpense allows users to reconcile expenses paid with personal funds, facilitating reimbursement for out-of-pocket expenditures. Oracle iExpense facilitates the reconciliation of expenses paid with personal funds through a process called expense reimbursement. Users can submit expense reports detailing out-of-pocket expenses, and the system manages the reimbursement workflow. This typically involves approval processes, validation of receipts, and reimbursement of the incurred personal expenses.

68. Can Oracle iExpense enforce different policies for different employee roles or departments?

Ans:

Yes, iExpense supports role-based and department-specific policies, allowing for the enforcement of different expense policies based on organizational structure. Oracle iExpense allows for the enforcement of different expense policies based on employee roles or departments. The system can be configured to apply specific rules, limits, and approval workflows depending on the user’s role or the department to ensure compliance with the organization’s expense policies.

69. Explain the concept of ‘Expense Types’ in Oracle iExpense.

Ans:

Expense Types in iExpense categorize different types of expenses, facilitating accurate tracking and reporting of various expense categories. In Oracle iExpense, ‘Expense Types’ refers to predefined categories or classifications for various types of expenses that users can incur. These can include categories like meals, lodging, transportation, etc. Expense Types help standardize and categorize different expenses, making it easier for users to report their expenditures accurately and for the organization to analyze and manage expenses efficiently.

70. How does Oracle iExpense handle the integration of expense data with external financial systems?

Ans:

iExpense provides interfaces and APIs for seamless integration with external financial systems, ensuring the flow of accurate expense data for accounting purposes. Oracle iExpense supports integration with external financial systems through various methods such as Application Programming Interfaces (APIs) or direct integration connectors. This allows seamless transfer of expense data, including approved expenses and reimbursement information, between Oracle iExpense and external financial systems. The integration ensures accuracy, consistency, and efficient financial management across the organization.

71. How does Oracle iExpense handle duplicate expense submissions?

Ans:

iExpense includes mechanisms to detect and prevent duplicate expense submissions, ensuring data accuracy and preventing errors. Oracle iExpense typically includes mechanisms to detect and handle duplicate expense submissions. This can involve system checks during the submission process to identify duplicate entries based on various criteria such as date, amount, and description. If duplicates are detected, the system may provide alerts to users or prevent the submission, ensuring data accuracy and preventing unintentional or fraudulent duplicate submissions.

72. Can Oracle iExpense enforce different approval workflows for various business units?

Ans:

Yes, iExpense supports the configuration of multiple approval workflows, allowing organizations to tailor approval processes based on business units or departments. Oracle iExpense allows for the enforcement of different approval workflows based on business units within an organization. This flexibility enables customization of approval processes to align with the specific needs and structures of different units or departments, ensuring that expense reports go through the appropriate channels for approval based on the organizational hierarchy or business unit requirements.

73. What security measures does Oracle iExpense implement to protect sensitive financial data?

Ans:

iExpense employs robust security measures, including data encryption, user access controls, and audit trails, to protect sensitive financial information. Oracle iExpense incorporates various security measures to protect sensitive financial data. This may include role-based access controls, encryption of data in transit and at rest, secure authentication methods, and audit trails to track user actions. Additionally, the system often complies with industry standards and regulations to ensure robust security practices. Regular updates and patches are typically provided to address potential vulnerabilities, contributing to a secure environment for handling sensitive financial information within Oracle iexpense.

74. How does Oracle iExpense manage international expense taxation amid varying tax regulations?

Ans:

iExpense allows for the configuration of tax rules specific to different regions, accommodating international tax regulations for expense reimbursement. Oracle iExpense is designed to handle the taxation of international expenses by providing configurable tax rules and compliance features. The system can be set up to accommodate varying tax regulations in different regions or countries. It typically includes options to define tax codes, rates, and rules specific to each location, ensuring that the taxation of international expenses aligns with the applicable regulatory requirements for accurate reporting and compliance.

75. Can Oracle iExpense integrate with corporate travel policies for expense validation?

Ans:

Yes, iExpense can integrate with corporate travel policies, validating expenses against predefined guidelines to ensure compliance. Oracle iExpense can integrate with corporate travel policies to validate expenses against predefined travel guidelines. The system can be configured to enforce policy compliance by checking submitted expenses against predetermined rules and limits, ensuring adherence to corporate travel policies. This integration helps organizations maintain consistency, control costs, and uphold compliance with their specific travel guidelines.

76. Explain the role of the Expense Approval Hierarchy in Oracle iExpense.

Ans:

The Expense Approval Hierarchy in iExpense defines the sequence in which expense reports are routed for approval, ensuring a streamlined approval process. The Expense Approval Hierarchy in Oracle iExpense defines the sequence of approvers for expense reports within an organization. It establishes the order in which managers or designated individuals review and approve submitted expenses. This hierarchy ensures that expense reports follow the correct approval workflow based on the organizational structure, providing a systematic and controlled process for validating and authorizing expenses before reimbursement.

77. How does Oracle iExpense handle taxation for employee mileage reimbursements?

Ans:

iExpense allows organizations to configure tax rules specific to mileage reimbursements, considering the tax implications of using personal vehicles for business. Oracle iExpense typically handles the taxation of mileage reimbursements by allowing organizations to configure tax rules and guidelines specific to mileage expenses. The system can consider factors like the applicable tax rates, allowable deductions, and any relevant regulations. By capturing necessary details during the expense submission, such as mileage, purpose, and associated receipts, Oracle iExpense can calculate taxable amounts and facilitate compliance with taxation requirements for mileage reimbursements.

78. Can Oracle iExpense integrate with corporate credit card providers for seamless expense reconciliation?

Ans:

Yes, iExpense provides integration capabilities with corporate credit card providers, facilitating automated expense reconciliation for credit card transactions. Oracle iExpense can be integrated with corporate credit card providers to facilitate seamless expense reconciliation. This integration allows for the automatic import of credit card transactions into the iExpense system, streamlining the expense reporting process. Users can easily match credit card transactions with corresponding expenses, reducing manual data entry and ensuring accuracy in expense reconciliation.

79. How does Oracle iExpense handle expenses entry and approval for employees on extended business trips?

Ans:

iExpense accommodates expenses for extended business trips, allowing employees to submit and approvers to review expenses incurred over a longer duration. Oracle iExpense accommodates the entry and approval of expenses for employees on extended business trips by allowing them to submit detailed expense reports for the duration of their trips. Users can capture various expenses, such as accommodation, meals, and transportation, throughout the trip. The approval workflow ensures that these reports go through the necessary channels for validation, even if the trip spans an extended period. This process ensures accurate reimbursement for expenses incurred during the entire business trip.

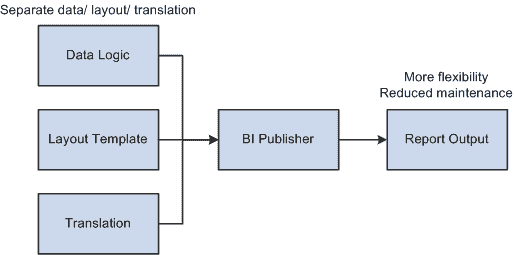

80. What role does Oracle Business Intelligence Publisher (BI Publisher) play in Oracle iExpense?

Ans:

BI Publisher in iExpense enables the creation and customization of reports, providing enhanced reporting and analysis capabilities. Oracle Business Intelligence Publisher (BI Publisher) in Oracle iExpense plays a crucial role in generating and managing various reports related to expenses. BI Publisher is often used for creating customized and formatted reports, such as expense summaries, trends, and detailed financial analyses. It enhances reporting capabilities within Oracle iExpense, providing organizations with powerful tools to extract, format, and present expense-related data for better decision-making and analysis.

81. How does Oracle iExpense handle reconciliation for remote or multi-location employee expenses?

Ans:

iExpense allows employees to specify multiple locations for expenses, and the system facilitates reconciliation for remote or varied work locations. Oracle iExpense handles the reconciliation of expenses incurred by employees working remotely or from multiple locations by allowing them to submit detailed expense reports regardless of their work location. The system is designed to capture various expenses associated with remote work, such as home office expenses or additional travel costs. The approval workflow ensures that these reports go through the necessary channels for validation, facilitating the reimbursement of expenses incurred by employees in various locations or while working remotely.

82. Can Oracle iExpense automatically categorize expenses based on predefined rules?

Ans:

Yes, iExpense supports the automatic categorization of expenses using predefined rules, streamlining the expense submission process. Oracle iExpense can be configured to automatically categorize expenses based on predefined rules. These rules can consider various factors such as expense type, amount, or description to determine the appropriate category for each expense. Automating the categorization process helps streamline data entry, ensures consistency, and facilitates more efficient expense reporting within the system.

83. Explain the role of the Expense Status Monitor in Oracle iExpense.

Ans:

The Expense Status Monitor in iExpense provides real-time tracking of the status of expense reports, allowing users to monitor progress and identify bottlenecks. The Expense Status Monitor in Oracle iExpense plays a role in tracking and providing real-time visibility into the status of expense reports. It allows users and administrators to monitor the progress of submitted expense reports, from creation to approval and reimbursement. The Expense Status Monitor provides a centralized view of the current status of each expense report, facilitating efficient management and ensuring transparency throughout the expense lifecycle.

84. How does Oracle iExpense handle the taxation of employee entertainment expenses?

Ans:

iExpense allows for the configuration of tax rules specific to entertainment expenses, ensuring compliance with tax regulations for such expenditures. Oracle iExpense handles the taxation of employee entertainment expenses by providing a configurable system where organizations can define tax rules and guidelines specific to such expenses. The system typically allows users to input details about entertainment expenses, and based on predefined tax rules, it calculates the taxable amount. This facilitates compliance with tax regulations and ensures accurate reporting of employee entertainment expenses for taxation purposes.

85. Can Oracle iExpense integrate with travel booking systems for automated expense import?

Ans:

Yes, iExpense offers integration capabilities with travel booking systems, automating the import of travel-related expenses for a seamless process. Oracle iExpense can integrate with corporate travel booking systems to automate the import of travel-related expenses. This integration streamlines the process by automatically importing data such as airfare, hotel expenses, and other travel-related costs into the iExpense system. This automation not only reduces manual data entry but also enhances accuracy and ensures that expense reports align with the travel itinerary, providing a more efficient and accurate expense management process.

86. What role does the Oracle E-Business Tax module play in Oracle iExpense?

Ans:

The Oracle E-Business Tax module in iExpense manages tax-related configurations and rules, ensuring accurate tax treatment for expenses. The Oracle E-Business Tax module in Oracle iExpense plays a crucial role in managing tax-related aspects of expenses. It provides a centralized platform for configuring and managing tax rules, rates, and jurisdictions. The E-Business Tax module helps Oracle iExpense to calculate taxes accurately based on predefined rules during expense entry or reimbursement processes. It ensures compliance with tax regulations and enables organizations to handle complex tax scenarios seamlessly within the expense management system.

87. How does Oracle iExpense handle the submission and approval of retroactive expense claims?

Ans:

iExpense supports the submission and approval of retroactive expense claims, allowing users to report expenses incurred in the past. Oracle iExpense is typically designed to handle retroactive expense claims by allowing users to submit expenses for a past period. Users can enter details of expenses incurred retrospectively, and the system supports the submission of such claims. The approval workflow accommodates these retroactive submissions, ensuring that the expense reports go through the necessary channels for validation, even if they pertain to past periods.

88. Can Oracle iExpense enforce distinct expense policies based on employees’ job roles or responsibilities?

Ans:

Yes, iExpense provides the flexibility to enforce different expense policies based on employees’ job roles or responsibilities within the organization. Oracle iExpense provides the flexibility to enforce different expense policies based on employees’ varying job roles or responsibilities. The system allows organizations to define and implement specific rules, limits, and approval workflows tailored to different roles within the organization. This ensures that employees with different responsibilities adhere to appropriate expense policies, promoting consistency and compliance across the organization.

89. Explain the role of the iExpense Dashboard in Oracle E-Business Suite.

Ans:

The iExpense Dashboard provides a centralized view of key metrics and status summaries, offering quick insights into the overall expense management process. The iExpense Dashboard in Oracle E-Business Suite provides a centralized and visual interface for users, managers, and administrators to monitor and manage expense-related activities. It typically includes key performance indicators, summary information, and quick access to important tasks. The dashboard offers an at-a-glance view of critical data such as pending approvals, submitted expense reports, and reimbursement status, allowing users to navigate and oversee the expense management process efficiently within Oracle iExpense.

90. How does Oracle iExpense handle the capture and storage of digital receipts for expense reporting?

Ans:

iExpense allows users to capture and store digital receipts by attaching them to expense reports, providing a paperless solution for expense documentation. Oracle iExpense facilitates the capture and storage of digital receipts for expense reporting. Users can typically upload digital receipts directly into the system while creating or submitting an expense report. The system stores these digital receipts securely, associating them with the respective expenses. This digital receipt capture feature not only reduces the reliance on paper receipts but also enhances the efficiency and accuracy of expense reporting by providing a digital trail of supporting documentation for each expense.