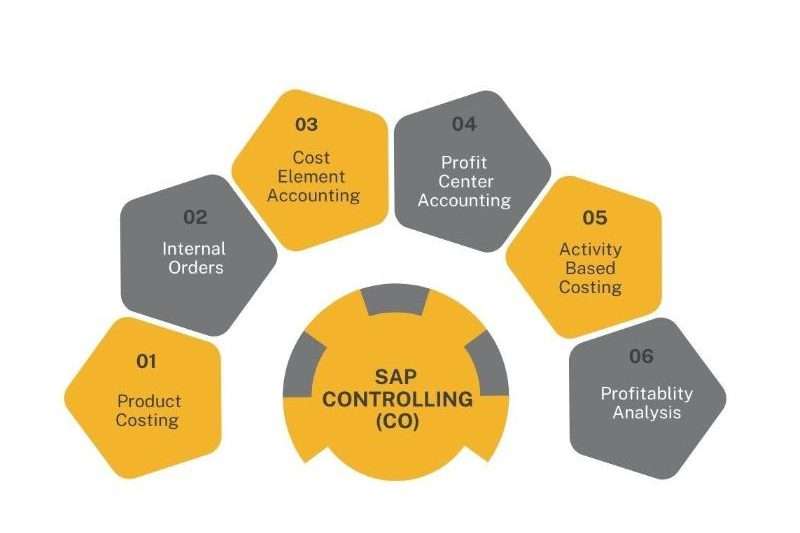

A SAP CO (Controlling) course provides comprehensive training on SAP’s Controlling module, which focuses on managing an organization’s internal accounting processes. This course typically covers various aspects, including cost accounting, profitability analysis, internal orders, and product costing. Participants learn how to configure and customize SAP CO to meet specific business requirements, analyze cost structures, track costs, and generate relevant reports for decision-making purposes.

1. What’s the purpose of cost centres in SAP CO?

Ans:

Cost centres in SAP CO are used for controlling purposes within a company. They represent locales where costs arise and help in tracking the charges of different departments or conditioning. By allocating costs to specific cost centres, associations can cover internal costs, optimize coffers, and ameliorate budget operations. Setting up a cost centre involves:

- Defining its characteristics.

- Assigning it to a cost-center scale.

- Regularly reviewing its performance to make informed fiscal opinions.

2. How is cost allocation handled in SAP CO?

Ans:

In SAP CO, cost allocations are handled using various styles like assessments and distributions. These styles help in transferring costs between different cost objects, such as cost centres, orders, or profit centres. The choice of system depends on the specific business demand. For example, the distribution uses original cost rudiments, while the assessment uses secondary cost rudiments. Proper configuration and regular monitoring are pivotal to ensure that allocations reflect the true resource consumption and support accurate operation reporting.

3. Explain the process of internal order in SAP CO?

Ans:

- Internal orders in SAP CO are used for detailed shadowing of costs and, in some cases, earnings for specific business processes or systems.

- They can be used for investment operations, cost shadowing for internal jobs, or overhead operations.

- Setting up an internal order involves defining the order type, controlling area, and order orders, and frequently integrating it with modules like MM or SD for flawless sale inflow.

- Effective use of internal orders provides grainy perceptivity into expenditures and supports strategic business opinions.

4. what is the different between Internal Orders and Product Cost Controlling ?

Ans:

| Aspect | Internal Orders | Product Cost Controlling |

|---|---|---|

| Purpose | Used to track costs and revenues associated with specific projects, jobs, or activities. | Focuses on calculating and analyzing product costs, including both direct and indirect costs. |

| Scope | Typically used for short-term projects or activities with a defined start and end date. | Applies to the entire production process, covering the costs of materials, labor, and overhead for manufactured goods. |

| Flexibility | Offers greater flexibility in terms of defining and managing budgets, allocations, and settlement rules for individual orders. | Generally follows standard costing methods and structures, with less flexibility in cost allocation and analysis. |

| Analysis and Reporting | Provides detailed analysis of costs and revenues for each internal order, enabling precise tracking and evaluation of project performance. | Focuses on analyzing product costs at the aggregate level, providing insights into overall production costs and profitability. |

5. Discuss period- end ending in SAPCO.

Ans:

- Period-end ending in SAP CO is a critical process that involves several ways to ensure that all fiscal conditioning within the period is directly recorded and reported.

- This includes vindicating deals, allocating costs, settling orders, and running assessments and distributions.

- The process ensures that the fiscal data is harmonious and ready for new business deals in the forthcoming period.

- This regular ending cycle is essential for maintaining the integrity of fiscal data and furnishing stakeholders with timely and accurate fiscal information.

6. How does SAP CO integrate with other SAP modules?

Ans:

SAP CO integrates considerably with other modules, such as SAP FI( Financial Accounting), SAP MM( Accoutrements operation), SAP SD( Deals and Distribution), and SAP PP( product Planning). This integration is pivotal for the flawless inflow of cost information across the enterprise, enabling comprehensive fiscal reporting and analysis. For illustration, costs from MM on material purchases flow directly into CO for cost account purposes, and deal data from SD helps in profitability analysis.

7. What are some of the challenges faced with SAP CO, and how to overcome them?

Ans:

- Challenges in SAP CO frequently relate to data delicacy, integration issues, or complex business processes taking customized results.

- Prostrating these challenges requires a deep understanding of both the SAP system and the specific business terrain.

- For illustration, I addressed integration issues by conducting thorough testing and collaboration with other module experts to ensure flawless data inflow and functionality

- For custom results, engaging with the business to understand their exact requirements and also using ABAP development for advancements proved effective.

8. Explain the significance of conciliation checks in SAPCO.

Ans:

Reconciliation checks in SAP CO are essential for ensuring that all cost-related bulletins in CO are directly imaged in FI. They play a pivotal part in the integration between CO and FI, helping to maintain thickness across fiscal accounts and controlling. By enabling real-time updates and furnishing a comprehensive view of all cost flows, conciliation checks help associations maintain accurate fiscal statements and misbehave with account norms.

9. What’s the difference between cost rudiments and cost centres?

Ans:

- Cost rudiments in SAP CO represent types of costs and are used for posting and grading charges, similar to hires or raw accoutrements.

- They’re basically the ground between FI and CO, landing all expenditure data for detailed analysis.

- Cost centres, on the other hand, are locales or departments where costs are.

- They give a structure for monitoring and controlling these charges by assigning them to specific areas of responsibility within the association.

10. How to ensure data delicacy and integrity in SAP CO?

Ans:

Ensuring data delicacy and integrity in SAP CO involves setting up rigorous confirmation rules, periodic checkups, and user training. Configurations should be completely tested before going live, and nonstop monitoring should be in place to identify any disagreement beforehand. Regular user training sessions help minimize crimes due to incorrect data entry. Also, enforcing automated workflows and blessing processes can significantly enhance data integrity and delicacy by reducing homemade interventions.

11. How to manage cost rudiments in SAP CO?

Ans:

- Cost rudiments in SAP CO are basically the structure blocks for recording costs and earnings.

- They’re distributed into primary and secondary rudiments, where primary rudiments are deduced from fiscal accounts, and secondary rudiments are used within controlling for internal allocation purposes.

- To manage cost rudiments, one must first produce them in the FI module, ensuring they’re rightly classified. Regular checkups of cost element groups help maintain structure and ensure reporting delicacy.

12. What’s exertion-grounded going, and how is it enforced in SAP CO?

Ans:

Exertion-grounded going ( ABC) in SAP CO is a methodology that assigns manufacturing and outflow costs to products more logically than traditional cost allocation.

It involves relating major conditioning, assigning costs to this conditioning, and also allocating these costs to products grounded on their consumption of conditioning.

Perpetration requires setting up exertion types linked to cost centres, and costs are also applied to products grounded on the conditioning they bear.

13. Explain the conception of a Profit Center and its part in SAP CO.

Ans:

- A Profit Center in SAP CO is used for internal controlling purposes, specifically for tracking the profitability of different business parts singly.

- It allows the operations to estimate different areas of the company without affecting external fiscal reporting.

- In SAP, setting up a Profit Center involves assigning it to a Profit Center Group and integrating it with profit and cost rudiments to track fiscal performance directly.

14. Describe the process of creating a new internal order type in SAP CO?

Ans:

Creating a new internal order type in SAP CO involves specifying settings that determine how internal orders are reused and controlled. The process begins by defining the order type characteristics, similar to whether it’ll be used for capital investments or functional charges. Next, one must assign number ranges and screen layouts to knitter the order’s appearance and functionality to specific business requirements. This configuration ensures that the internal orders serve their intended operation and shadowing purposes effectively.

15. Discuss the integration of SAP CO with SAP MM.

Ans:

- The integration of SAP CO with SAP MM( Accoutrements operation) is vital for flawless cost operation.

- This integration ensures that material costs are captured directly into Controlling from Accoutrements Management.

- Crucial integration points include the automatic advertisement of material costs to corresponding cost centres via goods movements and the involvement of material tally in valuing material costs at factual prices, which provides accurate cost reflections for product and force operation.

16. What’s the purpose of friction analysis in SAP CO?

Ans:

Friction analysis in SAP CO is a critical function used to compare factual data with planned data. It identifies diversions in areas similar to manufacturing, where it analyzes differences between the standard costs of produced goods and factual product costs. This analysis helps operations understand the reasons behind cost dissonances and apply corrective conduct, thereby enhancing functional effectiveness and cost control.

17. How to configure and use the cost centre standard scale in SAP CO?

Ans:

- The cost centre standard scale represents the structured grouping of all cost centres in an association, reflecting the functional and organizational structure.

- To configure this scale, one creates a root-knot, which represents the topmost position.

- Under this, various sub-nodes or individual cost centres are arranged as demanded.

- This scale is essential for reporting and provides a frame for allocating costs effectively across the association.

18. Explain how overhead costs are handled in SAP CO.

Ans:

Outflow costs in SAP CO are managed through cost centres and exertion types. Costs that can not be directly attributed to products, similar to administration and serviceability, are collected in cost centres. Using assessment and distribution cycles, these charges are also allocated to the products or departments that use these services, which are grounded on predefined keys or factual consumption, ensuring accurate product going and fiscal control.

19. What’s the difference between direct and circular exertion allocation?

Ans:

- Direct exertion allocation in SAP CO involves assigning costs directly from a cost centre to a cost object( like a product) grounded on measurable conditioning.

- circular exertion allocation, on the other hand, uses statistically crucial numbers or fixed probabilities to allocate costs when the direct dimension isn’t doable.

- Both styles ensure that overhead costs are attributed fairly to bringing objects, reflecting more accurate cost geste.

20. Explain how to close a financial time in SAP CO?

Ans:

Ending a financial time in SAP CO involves several ways to ensure all fiscal conditioning is directly recorded and confirmed. This includes indicating that all deals are posted, completing all necessary allocations, and running time-end reports. It’s also pivotal to lock the financial time to help with any further bulletins that might alter the fiscal data, ensuring compliance and data integrity for fiscal reporting and analysis.

21. What’s a statistically crucial figure( SKF) in SAP CO, and how is it used?

Ans:

- Statistical crucial numbers( SKFs) in SAP CO are quantitative data or rates used to allocate costs in overhead operations, acting as tracers.

- Exemplifications include square footage or headcount, which help allocate costs more directly grounded on factual operation or presence.

- SKFs are configured in the system and can be fixed or variable.

- They’re assigned to cost centres and used during assessment and distribution cycles to allocate costs grounded on factual consumption data, enhancing the delicacy of internal cost operation.

22. Explain the difference between standard cost and factual cost in SAP CO.

Ans:

In SAP CO, standard costs relate to predefined costs anticipated for manufacturing a product or furnishing a service under normal conditions. These are used primarily for planning and budgeting purposes. Factual costs, however, are the real costs incurred during product or service delivery. The difference between standard and factual costs is pivotal for friction analysis, which helps businesses identify and understand the reasons for disagreement and take corrective action to optimize operations and ameliorate profitability.

23. How does SAP CO support budget operation and monitoring?

Ans:

- SAP CO supports budget operations and monitoring through its cost centres and internal order functionalities.

- Organizations can allocate budgets to different cost centres or systems( via internal orders) and also track factual expenditures against these budgets in real time.

- Cautions can be configured for when spending approaches budget limits, enabling visionary operation.

- This integration helps ensure fiscal discipline and enables detailed reporting on budget adherence, which is critical for fiscal planning and analysis.

24. Explkain Company law in the system?

Ans:

This includes specifying attributes similar to country, currency, and dereliction language. Fiscal operation areas like account, controlling, and duty regulations are also configured to align with original legal conditions and internal commercial programs. Eventually, integration points with other modules like SAP FI are established to ensure flawless data inflow and reporting capabilities across modules.

25. What functionalities does the controlling area give in SAP CO?

Ans:

- The controlling area is a central organizational element in SAP CO that consolidates data from various company canons for cost monitoring and profitability analysis.

- If multiple company canons partake in the same functional currency, they can be mapped under a single controlling area.

- This setup supports harmonious cost account practices across different corridors of the association and simplifies internal deals and rapprochements, which is particularly precious for transnational pots.

26. How to manage cost transfers between different company canons in SAP CO?

Ans:

- Managing cost transfers between different company canons in SAP CO is generally handled through intercompany bulletins, which bear careful configuration to ensure compliance with both internal and external account norms.

- These transfers involve recording charges or earnings in one company law and negativing entries in another, which is eased through SAP’s automatic document adaptation features.

- Detailed mapping and regular rapprochements are essential to maintain delicacy and transparency in fiscal reporting across company canons.

27. Explain the lifecycle of an internal order in SAP CO?

Ans:

The lifecycle of an internal order in SAP CO begins with its creation and the assignment of a budget. It progresses through active operation, where costs and earnings are collected and covered. Towards the lifecycle’s end, the order undergoes agreement, where the collected costs are allocated to applicable cost objects like cost centres, profit centres, or fixed means. Eventually, the order is closed, which prohibits further bulletins and signifies the completion of the intended task or design, ensuring fiscal clarity and responsibility.

28. What are the counter accusations of indecorous configuration in SAP CO?

Ans:

- Indecorous configuration in SAP CO can lead to inaccurate cost shadowing, reporting crimes, and fiscal disagreement, which could mislead decision-making processes.

- For example, inaptly defined cost rudiments or misaligned integration with SAP FI can affect fiscal statements that don’t reflect the company’s true profitable condition.

- Regular system checkups and confirmation checks are recommended to maintain system integrity and ensure that all configurations align with organizational and nonsupervisory norms.

29. Discuss how SAP CO can be used in design operation?

Ans:

In design operation, SAP CO can be employed considerably to cover design costs, ensuring they remain within calculated limits. By setting up design-specific internal orders or WBS( Work Breakdown Structure) rudiments, directors can track all affiliated expenditures and compare them against planned costs. Also, SAP CO facilitates script analysis to read unborn costs and profitability, furnishing design directors with tools to acclimate design strategies proactively grounded on fiscal perceptivity.

30. What’s commitment operation in SAP CO, and why is it important?

Ans:

- Commitment operation in SAP CO helps associations track anticipated charges before they’re actually incurred, furnishing a clearer picture of unborn fiscal scores.

- It records scores like purchase orders or contracts as commitments against budgets.

- This functionality is pivotal for maintaining fiscal control and ensuring that the association doesn’t exceed its popular constraints, enabling better cash inflow operation and financial discipline.

31. What are the primary functionalities of the SAP CO module?

Ans:

The primary focus of SAP CO(Controlling) is the management and configuration of master data pertaining to internal orders, cost and profit centres, and other cost structures and rudiments. It handles internal accounts, including cost accounts, budgeting, soothsaying, and profitability analysis. SAP CO integrates nearly with other SAP modules, ensuring that data flows seamlessly for accurate and timely fiscal reporting, helping operations make informed opinions grounded on company-wide fiscal performance.

32. How do internal orders contribute to cost operation in SAP CO?

Ans:

- Internal orders in SAP CO give a means to cover costs and, in some cases, earnings for a specific event, design, or task.

- They allow associations to track these costs independently from regular functional costs, easing precise control and monitoring of popular spending.

- Through the lifecycle of an internal order, from budgeting and advertising factual costs to the final agreement, directors can dissect dissonances, manage costs effectively, and ensure systems stay on fiscal track.

33. Explain how profit centre reorganization can be handled in SAPCO..

Ans:

Profit centre reorganization in SAP CO involves conforming the structure of profit centres to reflect changes in the organizational strategy or structure. This process can be complex, taking updates to master data, ensuring that literal data is transferred rightly and that all reporting systems reflect the new association directly. SAP provides tools for mass changes and redistribution of balances, ensuring that these reorganizations are reflected duly across fiscal reports without losing literal integrity.

34. What’s the difference between cost centres and profit centres in SAP CO?

Ans:

- Cost centres and profit centres serve different functions within SAP CO.

- Cost centres are primarily used for shadowing charges within the association and don’t directly induce profit.

- They help understand where costs are incurred within the company.

- Profit centres, on the other hand, are treated as separate realities for which profit, as well as costs, are recorded.

- This allows for profitability analysis by parts of the business, abetting strategic decision-making and performance dimensions.

35. How to handle currency conversion in SAP CO for transnational operations?

Ans:

Handling currency conversion in SAP CO is pivotal for transnational companies to ensure accurate fiscal reporting in various currencies. SAP CO utilizes exchange rate tables that are maintained centrally and integrate with SAP FI to perform real-time currency conversion. This point enables companies to consolidate fiscal statements in a home currency while maintaining sale-position detail in original currencies, which is pivotal for compliance and global fiscal analysis.

36. Explain how SAP CO and SAP FI are integrated?

Ans:

- SAP CO and SAP FI are tightly integrated to ensure that all fiscal deals are seamlessly connected across the enterprise.

- Integration points include data inflow from FI to CO for detailed cost shadowing and from CO back to FI for accurate external reporting.

- For illustration, deals posted in FI that impact costs are automatically reflected in CO, helping ensure that both fiscal and operation accounts are always accompanied.

37. What’s the purpose of exertion types in SAP CO?

Ans:

Exertion types in SAP CO represent the conditioning performed by a cost centre and are used to allocate the costs of that conditioning to various cost objects grounded on consumption. They serve as a link between cost generation and cost allocation, playing a pivotal part in the exertion-grounded Costing ( ABC) process within SAP. Duly defining and managing exertion types helps associations more directly distribute costs grounded on factual conditioning, furnishing a clearer picture of the profitability of different business parts.

38. How does SAP CO help in cost reduction strategies?

Ans:

- SAP CO provides detailed and real-time data about costs incurred across the entire association, easing targeted cost-reduction strategies.

- By exercising tools like cost element account, cost centre account, and profit centre account, businesses can pinpoint areas where costs can be reduced without immolating quality.

- Also, SAP CO’s capability to pretend cost scripts helps the operations to estimate the implicit impact of cost reduction plans before they’re enforced, ensuring informed decision-making.

39. Explain the integration of SAP CO with SAP Material Management( MM).

Ans:

The integration of SAP CO with SAP MM is pivotal for accurate cost reporting and operation. When goods are bought, information flows from MM to CO to reflect the consumption of accoutrements in products or services. This ensures that material costs are duly allocated to corresponding products or systems, helping in precise cost computation and effective force operation. This integration is also essential for maintaining the integrity of cost data across procurement and product processes.

40. Discuss the significance of the cost element account in SAP CO.

Ans:

- The cost element account in SAP CO classifies the company’s charges and links them to corresponding fiscal accounts.

- It acts as a ground between the general tally( SAP FI) and Controlling ( SAP CO) modules, ensuring that all fiscal deals are reflected directly in the cost account.

- This bracket enables detailed shadowing, analysis, and reporting of costs, which is essential for internal cost control, decision timber, and external fiscal reporting.

41. How is profitability analysis handled in SAP CO?

Ans:

- Profitability analysis(CO-PA) in SAP CO is designed to estimate the profitability of various request parts, including products, guests, deals areas, and business units.

- It provides detailed information on profit, cost of deals, and marketing charges, which helps in making informed strategic opinions.

- CO-PA supports both cost-ground and deals-ground profitability analysis, offering inflexibility in how fiscal data is anatomized and reported, therefore conforming to different business requirements.

42. Explain the significance of master data in SAP CO?

Ans:

- Master data in SAP CO, including cost centres, profit centres, exertion types, and internal orders, forms the foundation of the controlling module.

- It ensures that data is constantly captured and reported across different corridors of the association.

- Accurate master data is pivotal for dependable fiscal and directorial reporting, enabling strategic decisions—timber.

- This data needs to be managed with perfection, as inaccuracies can lead to defective analysis and misinformed business opinions.

43. What’s the use of assessment and distribution in SAP CO?

Ans:

Assessment and distribution are styles used in SAP CO to allocate costs from a given cost centre to philanthropist cost centres or profit centres. Distribution retains the original cost element, which allows for detailed tracing back to the source, whereas assessment uses secondary cost rudiments and is generally used for more complex allocations. Both styles support accurate reflection of resource operation across the association, easing internal cost control and profitability analysis.

44. Discuss the benefits and challenges of using SAP CO for design control.?

Ans:

- SAP CO is largely beneficial for design controlling as it provides detailed shadowing of design-related costs, budget operation, and profitability analysis.

- It helps directors keep systems on budget and schedule by allowing real-time sapience into fiscal criteria.

- Still, challenges can arise due to the complexity of integrating design data across various other SAP modules and the need for precise configuration to match specific design conditions.

- Prostrating these challenges requires thorough planning and expert knowledge of SAP functionalities.

45. In What way are you involved in the conciliation tally in SAP CO?

Ans:

The conciliation tally in SAP CO is used to attune costs and earnings between CO, FI, and other SAP modules to ensure thickness across fiscal reporting. This involves gathering data from various deals across modules, relating disagreements, and making necessary adaptations to align the data. This process is pivotal for maintaining the integrity of fiscal statements and supporting comprehensive checkups, thereby enhancing the trustability of fiscal information across the association.

46. How do you handle crimes in cost bulletins in SAP CO?

Ans:

Handling crimes in cost bulletins within SAP CO generally involves:

- Assaying the incorrect bulletins.

- Determining the root cause of the error.

- Making the necessary corrections either through reversal or acclimated entries.

SAP CO provides various tools for relating and correcting similar crimes, including reports that track disagreement and tools for directly confirming entries.

Proper operation of these crimes is essential to maintain accurate and dependable cost account records.

47. What are the crucial considerations when integrating SAP CO with external systems?

Ans:

Integrating SAP CO with external systems requires careful planning to ensure flawless data inflow and maintain data integrity. Crucial considerations include:

- Establishing secure and effective data transfer protocols.

- Ensuring comity between system infrastructures.

- Configuring data mappings to align with business processes.

48. How does SAP CO support decision-making in a business?

Ans:

SAP CO provides detailed and practicable fiscal and functional data, enabling directors to understand costs, profitability, and effectiveness across various corridors of the association. By delivering comprehensive perceptivity into cost structures, performance criteria, and profitability analysis, SAP CO aids in strategic planning, budgeting, and soothsaying. This support is pivotal for making informed business opinions that aim to enhance functional effectiveness and fiscal performance.

49. What are the two parts of the product going?

Ans:

- A product going in SAP is generally divided into two crucial parts: planting and cost object controlling.

- Cost planning involves the estimation of costs before the product, using tools like cost estimates with or without volume structures and cost element planning.

- Cost object controlling, on the other hand, is concerned with shadowing and assaying the costs associated with specific cost objects(e.g., products, services) during and after the product, including factual going/material tally, product cost by period, and product cost by order.

50. Unfold on the Bill of Material( BOM)?

Ans:

A Bill of Material( BOM) in SAP is a comprehensive list that defines the factors or corridors demanded to produce a product. It outlines amounts, raw accoutrements, sub-assemblies, intermediate assemblies,sub-components, corridors, and the amounts of each demanded to manufacture an end product. BOMs are pivotal for product planning and control, force operation, and cost computation. They ensure that all needed accounts are available at the right time and place, easing effective product processes and accurate cost estimation.

51. What’s a multi-level product going?

Ans:

- A multi-level product going in SAP is a detailed going system that accounts for the costs at each position of the product process, from raw accoutrements to finished goods.

- It involves rolling up costs from the smallest position assemblies to the top-position finished product, ensuring that every element’s cost is included in the final product’s cost.

- This system is particularly useful for complex manufacturing processes with multiple product stages and varying material and labour costs, enabling precise cost shadowing and operation.

52. Describe POP settings or routing.

Ans:

In SAP, Product Operation Profile( POP) settings or routing define the sequence of operations needed to manufacture a product. Routing specifies the work centres, machines, labour, and sequence of operations involved in the product process. It’s essential for planning and managing products efficiently, determining lead times, and calculating labour and machine costs at each product stage. Routing ensures that each step of the manufacturing process is predefined, optimizing resource application and product scheduling.

53. What’s the POP configuration?

Ans:

- POP configuration in SAP refers to setting up the product Operation Profile, which includes defining and configuring the necessary parameters for product operations.

- This configuration involves specifying operation times, machine and labour conditions, and control parameters similar to scheduling and capacity planning.

- Effective POP configuration is pivotal for directly modelling the product process within SAP, ensuring realistic planning and prosecution of product orders according to the defined functional guidelines.

54. How is the cost per unit calculated?

Ans:

In SAP, the cost per unit is determined by dividing the product’s total cost by the quantity of units produced. This involves adding up all direct costs, such as accoutrements and labour and allocated circular costs( charges) related to the product process. Fiscal reporting, profitability analysis, and product planning all depend on the capacity to calculate cost per unit. It supports companies in evaluating the performance of their product processes, formulating well-informed judgments regarding product planning tactics, and putting control mechanisms in place.

55. What are the different allocation styles used in overhead operations?

Ans:

- Outflow operation in SAP uses various allocation styles to assign circular costs to bring objects.

- Crucial styles include assessment, distribution, periodic reposting, and exertion-grounded going.

- Assessment allows for broad allocation using secondary cost rudiments, while distribution retains original cost rudiments for detailed shadowing.

- Periodic reposting reallocates primary costs and exertion-grounded going and assigns costs grounded on factual conditioning, furnishing a precise system for linking circular costs to products and services grounded on resource consumption.

56. What are secondary cost rudiments, and how are they created?

Ans:

Secondary cost rudiments in SAP CO are used for internal cost overflows and can not be directly posted from external deals. They’re essential for processes like internal exertion allocation, overhead distribution, and agreement. Secondary cost rudiments are created in the controlling module and aren’t linked with any general tally accounts. They act as placeholders to ease the allocation of costs within various controlling conditions, allowing for more accurate shadowing and analysis of internal costs.

57. Describe the two arrangements made for applying cost centres and making necessary changes.

Ans:

- In SAP CO, two common arrangements for applying and modifying cost centres include the standardized cost centre scale template and the individual cost centre system.

- The scale template provides a structured approach where cost centres are grouped under applicable cost centre orders, allowing for methodical cost shadowing and effectiveness across departments.

- The individual cost centre system allows for specific, detailed changes to be made to individual cost centres, accommodating unique business requirements and easing precise cost operation.

58. What’s the standard seat for preparing scripts and demonstrating how to do it?

Ans:

In SAP, the” standard seat” generally refers to a training or simulation terrain used for preparing scripts and demonstrating procedures. This setup is pivotal for users to exercise and understand various SAP functionalities without affecting live data. It provides a controlled setting where scripts from simple to complex can be dissembled, helping users learn how to navigate the system, enter deals, produce reports, and troubleshoot issues before enforcing them in a real-world terrain.

59. Explain the association structure and what its factors are.

Ans:

- The association structure in SAP defines an enterprise in terms of its functional and executive scale.

- It generally includes factors similar to company canons, which are the lowest units for which a complete, tone-contained set of accounts can be drawn; business areas that represent different business parts within an association; and shops, which are locales that perform functional functions.

- This structured approach is critical for managing and reporting on various aspects of the business cohesively.

60. Mention profitability analysis or COPPA, and why it is important.

Ans:

Profitability Analysis(CO-PA) in SAP CO is designed to give detailed information on the company’s profit and loss according to various business confines, such as products, guests, deals channels, and business units. CO-PA is pivotal because it allows businesses to track profitability at a veritably grainy position, easing better strategic opinions grounded on accurate, real-time profitability data. It helps to relate profitable business lines to areas where cost advancements are necessary, eventually optimizing overall business performance.

61. Define enterprise structure and its factors.

Ans:

The enterprise structure is a crucial configuration in SAP that outlines the organizational and reporting structure of a company. Its factors include:

- Company law is the introductory organizational unit for which a complete set of accounts can be drawn for external reporting.

- The controlling area can encompass multiple company canons for internal reporting.

- Deals association, which is responsible for distributing goods and services.

- Factory, which generally represents a manufacturing position or storehouse.

62. What’s a map of accounts, and how is it used to produce a controlling area?

Ans:

- A map of accounts is a structured list of all general tally accounts used by an association.

- It’s essential for organizing fiscal deals and preparing fiscal statements.

- In SAP CO, a map of accounts is linked to a controlling area to ensure that all accounts used in fiscal deals are available for cost shadowing and control.

- The link between the two ensures thickness in fiscal data across counting and controlling, easing accurate reporting and compliance.

63. How is a cross-company law cost account done?

Ans:

Cross-company law cost account in SAP involves handling costs and earnings across different company canons within the same controlling area. This is managed through intercompany bulletins and allocations that allow for the sharing and allocation of costs between realities. SAP provides tools like the Cross-Company Code advertisement point, which automates entries across company canons, ensuring delicacy and effectiveness in internal cost transfers and simplifying the connection process for fiscal reporting.

64. Tell me about the part of the planning and price computation tabs in the system.

Ans:

- The planning tab in SAP CO is used to enter and manage budget data, vaticinations, and other planning data related to costs and operations.

- This functionality supports detailed fiscal planning and cost control by allowing directors to set and compare planned versus factual numbers.

- The price computation tab, on the other hand, is employed to define and calculate prices for internal conditioning and services, using various accounting styles to ensure accurate and fair pricing that reflects the factual consumption of coffers.

65. What’s the interpretation for standard, and what’s a zero interpretation?

Ans:

In SAP,’ performances’ are used to manage and separate various sets of data in control, similar to factual, plan, cast, and budget data. The standard interpretation( generally interpretation’ 0′) represents the original or primary plan data set that’s used for comparison and analysis purposes. It forms the birth for evaluations and decision-making. Zero interpretation may also relate to this primary or original interpretation, serving as a dereliction script against which all performance can be measured.

66. Define group valuation.

Ans:

Group valuation in SAP refers to the valuation of force and product costs at a consolidated group position, as opposed to individual company situations. This is particularly applicable in the environment of transnational groups with multiple accessories, where force might need to be valued according to group account programs rather than the original GAAP. Group valuation helps in preparing consolidated fiscal statements that reflect a unified fiscal position and performance of the entire group, not just individual realities.

67. Describe obligatory conditions for creating a cost element in a cost element account.

Ans:

- Cost Element Category: Assign a cost element category (e.g., primary or secondary) that defines the role of the cost element within the cost accounting framework.

- Cost Element Code: Provide a unique cost element code that identifies the cost element in the system.

- Cost Element Description: Enter a descriptive name for the cost element to clarify its purpose and usage.

- Cost Center Assignment: Ensure the cost element is linked to a relevant cost center or internal order to track and allocate costs properly.

- Accounting Integration: Configure integration settings to align with financial accounting and controlling areas for accurate cost tracking and reporting.

- Control Parameters: Set up control parameters, such as whether the cost element is to be used for internal or external reporting and how it should be handled in various financial processes.

68. How do you define ‘ number ranges ’ in CO?

Ans:

Number ranges in SAP CO are defined to assign unique identifiers to various documents and realities within the system, similar to cost centres, internal orders, or cost rudiments. These ranges are pivotal for organizing data totally and ensuring that each entry or document can be distinctly honoured and tracked. Number ranges can be customized to follow specific numerical sequences, which aids in maintaining chronological order and facilitates easy data reclamation and inspection processes.

69. What are the two documents that are generated when posting deals in a system?

Ans:

- When posting deals in SAP systems, generally, two documents are generated: an accounting document and a controlling document.

- The account document serves the purpose of recording the fiscal sale in the fiscal tally, landing all applicable details such as disbenefit and credit accounts, quantities, and document date.

- The controlling document, on the other hand, records details applicable to cost accounts, similar to cost centres, profit centres, and otherCO-related information.

- Both documents ensure that the fiscal and directorial aspects of all deals are directly captured and can be tracked and checked.

70. How Does ‘ crack Data ’ Differ From ‘ sale Data ’ In Co?

Ans:

In SAP CO, master data refers to the core data that are used as the base for processing deals. This includes structures and crucial realities like cost centres, profit centres, exertion types, and internal orders. Master data is fairly stationary and defines the frame within which sale data operates. Sales data is still dynamic and records factual business operations and events that are similar to charges posted to a cost centre. While master data sets up the organizational and reporting structure, sale data provides the content that moves through that structure.

71. Explain ‘ parts ’ And ‘ cycles. ’?

Ans:

- In SAP CO,’ parts’ relate to the corridor of an association that can be anatomized for profitability and are frequently aligned with areas of responsibility similar to deal areas or business units.

- Parts are essential for operation accounts as they allow businesses to estimate the performance of different corridors of the association singly.’ Cycles,’ on the other hand, are used in cost allocations within control to describe the inflow of costs through repetitious processes.

- These cycles help define how costs should be methodically distributed across various cost objects during the periodic allocation processes, similar to overhead cost control or profitability analysis.

- Both parts and cycles are abecedarian for detailed analysis and effective internal fiscal operation.

72. What Is the ‘ iterative Processing ’ Of Cycles?

Ans:

Iterative processing in cycles within fiscal and going systems like SAP CO refers to the repeated allocation of costs until a specified position of delicacy is achieved. This process is essential when dealing with complementary cost overflows between cost centres, where each centre may give and admit services from others. Iterative processing ensures that the distribution of circular costs is as accurate as possible, reflecting the true profitable operation of coffers across the association.

73.. What Is ‘ blistering ’? Explain The ‘ blistering Structure. ’?

Ans:

- Splitting in SAP CO refers to the system used to break down and allocate process costs directly across various business confines when multiple cost objects are involved.

- The blistering structure defines how costs are to be resolved, generally grounded on destined rules or factors similar to operation or reason principles.

- For illustration, mileage costs in a manufacturing factory might be resolved across different departments based on the machine hours used by each.

- This system ensures that each department or product bears a fair share of the total costs, reflecting more accurate cost geste and abetting in precise operation reporting and decision-making.

74. What Is Known As The ‘ political Price ’ For An exertion Type?

Ans:

In SAP CO, the ‘ political price ’ of an exertion type refers to a rate not inescapably grounded on factual costs but rather set due to strategic, political, or directorial reasons. This might be used to impact internal geste, allocate costs in a masked manner, or manage cross-departmental resource operation more effectively. For example, a company may set a lower rate for certain conditions to encourage further operation of those services within the association.

75. What Is ‘ allocation Price Friction?

Ans:

- Allocation price friction in SAP CO occurs when the planned( calculated) rate for an allocated resource is different from the factual rate incurred during its operation.

- This friction can arise due to changes in consumption patterns, cost increases, or inefficiencies.

- Understanding and assaying these dissonances is pivotal for associations to control costs effectively, identify areas where functional advancements are demanded, and upgrade unborn budgeting and pressuring strategies.

- It also assists in managing internal charge- tails and ensuring departments are charged fairly for participated services.

76. What Is ‘ budgeting ’ ?

Ans:

Budgeting in the environment of SAP CO is the process of planning and controlling unborn income and expenditures to ensure fiscal stability and profitability. It involves setting fiscal targets for earnings and charges, which are also used as a standard for factual performance monitoring and control. Effective budgeting helps associations allocate coffers optimally, anticipate implicit fiscal challenges, manage cash inflow effectively, and make informed strategic opinions. In SAP CO, budgeting integrates with other modules to align fiscal operations with financial goals.

77. Explain ‘ co Automatic Account Assignment. ’?

Ans:

- In SAP CO,’ CO Automatic Account Assignment’ refers to the system’s capability to automatically assign costs and earnings to applicable objects like cost centres, profit centres, or orders based on predefined settings.

- This automatic assignment simplifies the advertisement process, reduces crimes, and ensures the thickness of fiscal deals recorded.

- It relies heavily on the configuration within the master data and the setup of assignment rules, which mandate how different fiscal deals should be handled within the system.

78. How Does ‘ confirmation ’ Differ From ‘ negotiation ’?

Ans:

In SAP,’ confirmation’ and’ negotiation’ serve to ensure data delicacy but operate elsewhere. Confirmation checks data entries against specific conditions and rejects the data if the conditions aren’t met, egging users to correct crimes. In discrepancy, negotiation automatically replaces or supplements entered data grounded on predefined rules when certain conditions are met. While confirmation prevents incorrect data entry, negotiation adjusts it to meet certain criteria without user intervention.

79. What Is A ‘ call- up Point ’?

Ans:

- A’ call-up point’ in SAP is a predefined point in a sale or process where specific user exits, or system advancements can be invoked.

- These are generally used in fiscal processes to allow for custom sense or fresh confirmation without altering the core operation.

- Call-up points are pivotal for conforming SAP functionality to meet unique business conditions and can be set to spark under certain conditions to ensure that business rules are executed constantly.

80. What Is ‘ boolean sense ’?

Ans:

- Boolean sense refers to a subset of algebra used for creating true or false statements. It underpins computational sense in programming and software development, including SAP.

- It involves drivers similar to AND, OR, and NOT that combine or modify conditions to control program inflow and decision-making processes.

- In SAP, Boolean sense is essential for writing conditions in configurations, attestations, and negotiations to mandate how data is reused and opinions are made.

81 Explain ‘ reposting ’ In Cost Center Accounting.?

Ans:

- Reposting in SAP CO Cost Center Accounting is a process used to correct or reallocate costs and earnings between cost centres.

- This function is necessary when original bulletins are incorrect or when organizational changes demand a revision of charges to reflect new operation structures.

- Reposting helps ensure that fiscal reports directly reflect the distribution of costs and earnings across different corridors of the association, thereby abetting in more accurate performance dimension.

82. Explain ‘ homemade Cost Allocation. ’?

Ans:

Homemade cost allocation in SAP CO involves the direct assignment of costs to various cost objects without the use of automated rules. This system is used when specific, detailed control over cost inflow is demanded or when unique circumstances mandate a non-standard allocation that automated rules can not handle. Homemade allocations are important for systems, special events, or other scripts where costs need to be nearly covered and controlled based on operation opinions.

83. How to calculate ‘ accrued Costs ’?

Ans:

- Accrued costs in SAP are calculated by fetching charges that have been incurred during a period but have yet to be paid or formally recorded in the fiscal statements.

- The process involves estimating the quantum of the expenditure that corresponds to the accounting period and recording it as an accrued liability.

- This ensures that fiscal statements give a true and fair view of the company’s fiscal status by feting all costs associated with earnings of a given period, indeed, if those costs still need to be settled in cash.

84. Explain The ‘ input friction. ’?

Ans:

Input friction in SAP refers to the difference between the planned cost of input accoutrements or coffers and the factual cost incurred. This friction helps relate inefficiencies and cost diversions in the product process. Assaying input dissonances assist associations in conforming procurement and product strategies, optimizing resource application, and controlling costs effectively.

85. What Is An ‘ affair friction ’?

Ans:

- Affair friction’ occurs when there’s a distinction between the anticipated affair value from a product process and the factual affair value achieved.

- This can be affected by variations in product effectiveness, product quality, or the selling price of finished goods.

- Affair friction analysis is pivotal for assessing the performance of product operations and enforcing advancements to enhance profitability and effectiveness.

86. How are ‘dissonances’ addressed?

Ans:

Dealing with’ dissonances’ involves relating, assaying, and amending disagreement between planned and factual numbers. In SAP CO, this is generally handled through friction analysis, which helps in understanding the reasons behind the diversions and taking corrective conduct. Strategies include:

- Conforming to unborn plans.

- Modifying functional procedures.

- Revising budget allocations to align more with factual performance.

87. What Is ‘ summarization ’ In Co?

Ans:

Summarization in CO involves the aggregation of detailed data into epitomized formats for brisk data reclamation and better performance in reporting and analysis. This process reduces the volume of data that needs to be reused and maintained, thereby enhancing system effectiveness and enabling quicker decision-making grounded on a terse view of crucial criteria.

88. What Is A ‘ plan interpretation ’?

Ans:

A’ plan interpretation’ in SAP CO allows for the creation of multiple performances of planning data, similar to budgets or vaticinations, enabling relative analysis and script planning. Plan performances help associations estimate different fiscal strategies and issues by maintaining separate sets of data that reflect various hypotheticals or conditions. They also facilitate more accurate forecasting by accommodating diverse business conditions and assumptions.

89. What Is ‘ intertwined Planning ’ InCo-om-cca?

Ans:

- Integrated planning’ inCO-OM-CCA( Cost Center Accounting) refers to the comprehensive approach of aligning cost centre planning with organizational objects and other functional plans.

- It ensures that planning data is harmonious across various departments, easing effective budget control, resource allocation, and performance operation within the association.

90. Explain ‘ plan Layout. ’?

Ans:

Plan layout’ in SAP CO refers to the structured format in which planning data is organized and displayed. It determines the arrangement of rows and columns in planning tables, specifying which data fields are to be included and how they are to be presented. Effective plan layout design enhances the usability of the planning system, making it easier for users to enter, dissect, and interpret planning data directly.