Oracle fusion applications include the suite of Oracle applications that help in driving the business operations efficiently. Oracle Fusion is a platform that helps in performing tasks like enterprise resource management, human relation management, customer relationship management, the crucial parts of the organization. In this article, you can go through the set of Oracle Fusion financial interview questions most frequently asked in the interview panel. And these lists will help you to crack the interview as the topmost industry experts curate these at ACTE training.

1. What are Oracle Fusion Financials?

Ans:

Oracle Fusion Financials is a comprehensive suite of financial management applications designed to streamline and modernize financial processes within organizations. It encompasses modules such as General Ledger, Accounts Payable, Accounts Receivable, Cash Management, Fixed Assets, and Financial Reporting Center, providing a unified platform for efficient financial operations. Leveraging advanced technology, Oracle Fusion Financials enhances accuracy, compliance, and decision-making in financial management.

2. Explain the key modules in Oracle Fusion Financials.

Ans:

- The key modules in Oracle Fusion Financials include General Ledger, Accounts Payable, Accounts Receivable, Cash Management, Fixed Assets, and Financial Reporting Center.

- These modules collectively address various aspects of financial management, including accounting, payments, receivables, cash forecasting, asset management, and reporting, contributing to a seamless and integrated financial solution.

- Each module addresses specific aspects of financial management, contributing to a seamless and integrated approach to financial operations.

3. How do Oracle Fusion Financials integrate with other Oracle applications?

Ans:

Oracle Fusion Financials integrates with other Oracle applications through a unified platform, ensuring real-time data sharing and consistency across modules.

This integration enhances overall organizational efficiency by providing a holistic view of financial data, enabling informed decision-making, and supporting streamlined business processes. This interconnectedness promotes better decision-making and overall operational efficiency.

4. What is the purpose of the General Ledger module in Oracle Fusion Financials?

Ans:

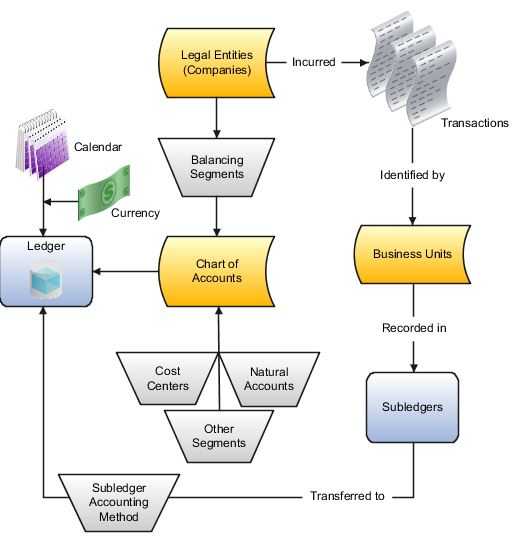

The General Ledger module in Oracle Fusion Financials is the central financial information repository. It consolidates data from various subledger modules, facilitating comprehensive financial reporting, compliance, and analysis. The General Ledger module is fundamental for maintaining accurate and consolidated financial records. It consolidates data from various subledger modules, providing a comprehensive view of an organization’s financial position.

5. How do you define a Chart of Accounts in Oracle Fusion Financials?

Ans:

In Oracle Fusion Financials, a Chart of Accounts is a structured list of values representing an organization’s accounting flexfield. It includes segments like company, cost centre, and account, allowing for the categorization and organization of financial transactions. The Chart of Accounts forms the foundation for recording and reporting financial data in a structured manner. The Chart of Accounts is a foundational element in financial accounting, providing a framework for recording and reporting financial data.

6. How does Oracle Fusion Financials differ from traditional financial management systems?

Ans:

| Aspect | Oracle Fusion Financials | Traditional Financial Management Systems | |

| Integration Approach |

Comprehensive suite of integrated applications |

Utilization of standalone, independent applications | |

| Data Model | Unified and consistent across all modules | Possibility of fragmented data and inconsistencies | |

| Deployment |

Utilizes a cloud-based model (SaaS) |

Typically implemented as on-premises solutions | |

| Reporting and Analytics | Relies on standard reporting features, may necessitate third-party tools | Relies on standard reporting features, may necessitate third-party tools |

7. What is the purpose of the Financial Reporting Center in Oracle Fusion Financials?

Ans:

- The Financial Reporting Center in Oracle Fusion Financials is a centralized hub for generating and managing financial reports.

- It provides tools for creating customizable reports, financial statements, and dashboards, empowering users to analyze and present financial data meaningfully.

- This module supports informed decision-making within the organization. This module empowers users to analyze and present financial data meaningfully, supporting informed decision-making within the organization.

8. How do Oracle Fusion Financials handle multi-currency transactions?

Ans:

Oracle Fusion Financials handles multi-currency transactions by allowing users to define and manage multiple currencies. Exchange rates can be configured, and the system automatically converts transactions into the reporting currency. This functionality ensures accuracy in financial reporting for organizations operating in a global business environment. Oracle Fusion Financials maintains an audit trail for currency-related transactions, providing transparency and supporting compliance requirements.

9. Explain the concept of sub-ledger accounting in Oracle Fusion Financials.

Ans:

- Subledger accounting in Oracle Fusion Financials involves creating detailed accounting entries for individual transactions before transferring them to the General Ledger.

- This approach allows for more granular and accurate financial data tracking, enabling organizations to maintain a detailed audit trail and comply with accounting standards.

- The sub-ledger accounting process is essential for maintaining accuracy, transparency, and compliance with accounting standards.

10. What is the role of the Cash Management module in Oracle Fusion Financials?

Ans:

The Cash Management module in Oracle Fusion Financials is crucial in effectively managing an organization’s cash position. It includes features for cash forecasting, bank reconciliation, and liquidity management.

By providing real-time visibility into cash flows and balances, the Cash Management module assists organizations in optimizing their liquidity and making informed financial decisions. Cash Management is seamlessly integrated with other Oracle Fusion Financials modules, such as General Ledger and Payables.

11. How do Oracle Fusion Financials handle bank reconciliations?

Ans:

- Bank reconciliation is a critical financial process that ensures the accuracy of financial data. In Oracle Fusion Financials, bank reconciliations are handled through the Cash Management module.

- The system lets users import bank statements directly into the application, reducing manual data entry errors.

- Matching algorithms in the Cash Management module help automatically reconcile transactions between bank statements and the company’s financial records.

- Reconciliation reports and dashboards comprehensively view the reconciliation status and outstanding items.

- Oracle Fusion Financials supports efficiently tracking unreconciled transactions, helping organizations maintain accurate financial records.

12. What is the purpose of the Accounts Payable module in Oracle Fusion Financials?

Ans:

- The Accounts Payable module in Oracle Fusion Financials manages the entire payables process, from invoice creation to payment.

- It enables the recording and tracking of all supplier invoices and credit memos.

- The module provides tools for managing payment terms, discounts, and approvals to ensure compliance with business policies.

- Users can validate invoices to ensure accuracy and adherence to predefined rules before processing payments.

- Accounts Payable facilitates the generation of payment batches for approved invoices, supporting various payment methods such as checks, electronic transfers, and more.

- Comprehensive reporting and analytics within the module offer insights into payable balances, ageing, and cash flow.

13. Describe the process of invoice validation in Oracle Fusion Financials.

Ans:

- Bank reconciliation is a critical financial process that ensures the accuracy of financial data. In Oracle Fusion Financials, bank reconciliations are handled through the Cash Management module.

- The system lets users import bank statements directly into the application, reducing manual data entry errors.

- Matching algorithms in the Cash Management module help automatically reconcile transactions between bank statements and the company’s financial records.

- Reconciliation reports and dashboards comprehensively view the reconciliation status and outstanding items.

- Oracle Fusion Financials supports efficiently tracking unreconciled transactions, helping organizations maintain accurate financial records.

12. What is the purpose of the Accounts Payable module in Oracle Fusion Financials?

Ans:

- The Accounts Payable module in Oracle Fusion Financials manages the entire payables process, from invoice creation to payment.

- It enables the recording and tracking of all supplier invoices and credit memos.

- The module provides tools for managing payment terms, discounts, and approvals to ensure compliance with business policies.

- Users can validate invoices to ensure accuracy and adherence to predefined rules before processing payments.

- Accounts Payable facilitates the generation of payment batches for approved invoices, supporting various payment methods such as checks, electronic transfers, and more.

- Comprehensive reporting and analytics within the module offer insights into payable balances, ageing, and cash flow.

13. Describe the process of invoice validation in Oracle Fusion Financials.

Ans:

- Invoice validation in Oracle Fusion Financials involves verifying the accuracy and compliance of invoices before they are processed for payment.

- Upon invoice entry, the system performs validation checks against predefined rules and policies.

- Any discrepancies or exceptions trigger alerts for further review and resolution by authorized personnel.

- Validated invoices proceed to the approval process, ensuring that only accurate and compliant invoices are considered for payment.

- This process enhances financial control, reduces errors, and helps maintain accurate financial records.

14. How do Oracle Fusion Financials handle supplier payments?

Ans:

- Oracle Fusion Financials facilitates supplier payments through the Payables module.

- Users can define each supplier’s payment terms, methods, and priorities.

- Payment batches are generated based on approved invoices, and various payment methods are supported, such as checks, electronic transfers, and automated clearing house (ACH) payments.

- The system provides manual or automatic payment processing options, giving organizations flexibility in managing their cash outflows.

- Integration with bank reconciliation ensures accurate tracking of payments and reconciliation with bank statements.

- The module also supports printing payment advice and electronic remittance advice to communicate payment details to suppliers.

15. What is the purpose of the Accounts Receivable module in Oracle Fusion Financials?

Ans:

- The Accounts Receivable module in Oracle Fusion Financials manages the entire receivables process, from customer invoicing to cash collection.

- It allows creating and tracking customer invoices, credit memos, and receipts.

- Automated workflows facilitate the approval process for credit memos and adjustments.

- Comprehensive reporting and analytics provide insights into receivables balances, ageing, and collection performance.

- Integration with other financial modules ensures a seamless flow of information across the organization’s financial processes.

16. How do Oracle Fusion Financials manage customer billing and collections?

Ans:

- Oracle Fusion Financials automates customer billing through the Accounts Receivable module, allowing efficient creation and management of invoices.

- Users can define billing schedules, payment terms, and credit limits for customers.

- The module supports automated workflows to approve credit memos and adjustments.

- Integration with the Cash Management module enables efficient tracking of customer receipts and bank reconciliations.

- Automated reminders and notifications assist in the collection process, improving cash flow management.

17. Explain the significance of the Fixed Assets module in Oracle Fusion Financials.

Ans:

- The Fixed Assets module in Oracle Fusion Financials is essential for managing an organization’s capital assets throughout its lifecycle.

- It facilitates the creation and tracking of fixed assets, including acquisitions, transfers, and retirements.

- Depreciation calculations are automated, ensuring accurate accounting for asset value over time.

- Detailed reporting and analytics provide insights into asset values, depreciation expenses, and overall asset portfolio performance.

- Integration with other financial modules ensures seamless coordination between fixed asset management and other financial processes.

18. What is the purpose of the Expense Management module in Oracle Fusion Financials?

Ans:

- The Expense Management module in Oracle Fusion Financials streamlines managing employee expenses and reimbursements.

- It allows employees to submit expense reports electronically, capturing details such as receipts and expense categories.

- Workflow approvals are integrated into the system, facilitating timely and efficient processing of expense reports.

- Automated reimbursement processes enable quick and accurate payments to employees.

- Comprehensive reporting and analytics provide visibility into employee spending patterns and help organizations control expenses.

19. How do Oracle Fusion Financials handle expense reports and reimbursements?

Ans:

- Employees submit expense reports electronically through the Expense Management module.

- The system validates expense reports against predefined policies, checking for compliance and accuracy.

- Workflow approvals facilitate the review and approval process, ensuring adherence to company spending guidelines.

- Integration with other financial modules ensures accurate recording of expenses and reimbursement transactions.

- Reporting and analytics provide insights into employee spending, helping organizations manage and control expenses effectively.

20. Describe the role of the Tax module in Oracle Fusion Financials.

Ans:

- The Tax module in Oracle Fusion Financials manages and calculates taxes associated with financial transactions.

- It supports configuring tax rules, rates, and jurisdictions to ensure local and international tax regulations compliance.

- The module integrates with other financial modules, automatically calculating taxes on sales, purchases, and payroll transactions.

- Automation within the module helps reduce manual errors in tax calculations and ensures accurate financial reporting.

- Integration with external tax services and authorities may be supported, enhancing efficiency and accuracy in tax compliance.

21. What is the purpose of the Financial Consolidation and Close module in Oracle Fusion Financials?

Ans:

The Financial Consolidation and Close module in Oracle Fusion Financials serves the crucial purpose of streamlining and automating the financial consolidation process for organizations. It facilitates the efficient closing of financial periods by automating tasks such as intercompany eliminations, currency translations, and financial statement generation. This module ensures accuracy and compliance with reporting standards, enabling organizations to produce consolidated financial statements that reflect a consolidated view of their financial performance.

22. How do Oracle Fusion Financials support period close activities?

Ans:

Oracle Fusion Financials supports period close activities through a systematic and integrated approach. It automates closing processes, including journal entries, reconciliations, and consolidation activities. The system provides real-time visibility into the status of period close tasks, allowing organizations to monitor progress and address any issues promptly. This streamlined approach enhances efficiency and reduces the risk of errors associated with manual closing procedures.

23. Explain the concept of intercompany transactions in Oracle Fusion Financials.

Ans:

Intercompany transactions in Oracle Fusion Financials involve financial transactions between entities within the same organization. The system facilitates the seamless recording and reconciliation of intercompany transactions, ensuring accuracy and consistency in financial reporting. This functionality is crucial for organizations with multiple legal entities, allowing them to maintain transparent and compliant financial records across the enterprise.

24. What is the purpose of the Cash Forecasting module in Oracle Fusion Financials?

Ans:

The Cash Forecasting module in Oracle Fusion Financials is designed to provide organizations with a reliable tool for predicting future cash flows. By analyzing historical data and considering various factors, such as payment schedules and receivables, the module helps organizations make informed decisions regarding cash management. This proactive approach to cash forecasting enables better liquidity management and strategic financial planning.

25. How do Oracle Fusion Financials handle compliance and risk management?

Ans:

Oracle Fusion Financials addresses compliance and risk management through robust features that enforce adherence to regulatory standards and internal policies. The system includes controls, audit trails, and reporting tools to monitor compliance with financial regulations.

Additionally, risk management functionalities help identify and mitigate potential financial risks, ensuring that organizations operate within established boundaries.

26. Describe the integration between Oracle Fusion Financials and Oracle Cloud Procurement.

Ans:

The integration between Oracle Fusion Financials and Oracle Cloud Procurement enables a seamless flow of information between financial and procurement processes. This integration streamlines procure-to-pay cycles, automates approval workflows, and enhances visibility into procurement expenses. This holistic approach improves overall operational efficiency and supports better financial decision-making.

27. What is the role of the Oracle Fusion Financials Cloud REST API?

Ans:

The Oracle Fusion Financials Cloud REST API serves as a powerful tool for developers and users to interact with and extend the functionality of Oracle Fusion Financials. It allows for the integration of third-party applications, data extraction, and customization, enabling organizations to tailor the system to their specific needs and leverage the full potential of the financial management platform.

28. How do Oracle Fusion Financials ensure data security and access control?

Ans:

Oracle Fusion Financials ensures data security and access control through comprehensive features. Role-based access controls define user permissions, restricting access to sensitive financial data. Encryption and auditing capabilities enhance data protection while regular security updates and patches address potential vulnerabilities, ensuring a secure and compliant financial environment.

29. Explain the purpose of the Financial Statement Generator in Oracle Fusion Financials.

Ans:

The Financial Statement Generator in Oracle Fusion Financials enables organizations to create customized financial statements tailored to their reporting requirements. This tool allows users to define report layouts, content, and formatting, ensuring flexibility and accuracy in financial reporting. The Financial Statement Generator supports the creation of ad-hoc reports and enhances the system’s overall reporting capabilities.

30. What is the significance of the Oracle Fusion Financials Work Areas?

Ans:

Oracle Fusion Financials Work Areas provide a user-centric and task-focused interface, allowing users to efficiently organize and manage their work. Work Areas streamline access to relevant information, tasks, and reports, improving user productivity. This feature enhances the overall user experience by providing a personalized and intuitive workspace within the Oracle Fusion Financials platform.

31. How does Oracle Fusion Financials handle multi-book accounting?

Ans:

- Oracle Fusion Financials supports multi-book accounting, allowing organizations to maintain multiple books to comply with different accounting standards or reporting requirements.

- Each book represents a distinct accounting representation, such as statutory, management, or tax, with its accounting method, currency, and chart of accounts.

- Users can define book hierarchies to establish relationships between primary and secondary books, facilitating consolidation and reporting.

- The system provides tools for automatic or manual journal entry creation for each book, ensuring accurate recording of financial transactions.

- Integration with other financial modules ensures consistency and accuracy across all books.

32. Describe the features of Oracle Fusion Expenses.

Ans:

- Oracle Fusion Expenses is a module designed to streamline the management of employee expenses and reimbursements.

- It lets employees capture and submit expenses electronically, including receipts and expense categories.

- The module supports policy enforcement, ensuring compliance with company spending guidelines.

- Workflow approvals are integrated into the system, facilitating efficient processing of expense reports.

- Mobile accessibility allows users to submit and manage expenses on the go.

- Comprehensive reporting and analytics provide insights into employee spending patterns, helping organizations control expenses effectively.

33. What is the purpose of the Oracle Fusion Tax Reporting module?

Ans:

- The Oracle Fusion Tax Reporting module is designed to manage and report on tax-related information within the financial system.

- It facilitates creating and managing tax reports, ensuring compliance with local and international tax regulations.

- Integration with other financial modules ensures that tax information is accurately captured in transactions and financial reports.

- Reporting and analytics capabilities within the module provide insights into tax liabilities and compliance, helping organizations meet reporting requirements.

- Automation features help reduce manual efforts in tax reporting and increase accuracy.

34. How do Oracle Fusion Financials support the creation of custom reports?

Ans:

- Oracle Fusion Financials provides a robust reporting framework allowing users to create custom reports tailored to their needs.

- Users can define report layouts, select data sources, and apply custom formatting to meet reporting requirements.

- Integration with Oracle BI Publisher allows for creating highly formatted and interactive reports.

- Custom reports can be shared across the organization, ensuring consistent and standardized reporting.

- The reporting framework supports real-time access to data, enabling users to make informed decisions based on up-to-date information.

35. Explain the concept of Oracle Fusion Financials Data Migration.

Ans:

- Oracle Fusion Financials Data Migration involves transferring data from legacy systems or external sources to Oracle Fusion Financials during the implementation or upgrade.

- Data migration includes various financial data such as charts of accounts, customer and supplier information, transactional data, and historical records.

- Validation checks are performed during migration to ensure data accuracy and integrity.

- Migration activities may involve mapping data from existing structures to Oracle Fusion Financials configurations.

- Successful data migration is crucial for the accurate and reliable functioning of Oracle Fusion Financials.

36. What is the significance of Oracle Fusion Financials SmartView?

Ans:

- Oracle Fusion Financials SmartView is a tool that allows users to access and analyze financial data from Oracle Fusion Applications in Microsoft Excel.

- SmartView provides a familiar Excel interface for financial reporting and analysis, making it easier for users to work with financial data.

- Users can create ad-hoc reports, perform analysis, and design dashboards directly within Excel.

- The tool supports real-time data connectivity, ensuring users can access the latest financial information.

- SmartView is integrated with Oracle Fusion Financials, providing a seamless experience for users who prefer Excel for financial reporting and analysis.

37. How do Oracle Fusion Financials handle electronic payments?

Ans:

- Oracle Fusion Financials facilitates electronic payments through its Payables module.

- Users can define electronic payment methods such as bank transfers and Automated Clearing House (ACH) payments.

- Payment batches are generated, including electronic payment transactions for approved invoices.

- Integration with bank reconciliation ensures accurate tracking of electronic payments and reconciliation with bank statements.

- Electronic payment details, such as remittance advice, can be communicated to suppliers for efficient reconciliation.

38. Describe the purpose of the Oracle Fusion Financials User-Defined Attributes.

Ans:

- User-defined attributes (UDAs) in Oracle Fusion Financials allow organizations to capture additional, custom information related to various financial entities.

- Organizations can define custom attributes for entities such as suppliers, customers, invoices, and transactions.

- UDAs provide flexibility in extending the standard data model to meet specific business requirements.

- Custom attributes can be used for reporting, analysis, and filtering in addition to standard fields.

- UDAs enhance the adaptability of Oracle Fusion Financials to diverse business needs without the need for extensive customization.

39. What is the role of the Oracle Fusion Financials Implementation Project?

Ans:

- The Oracle Fusion Financials Implementation Project is a structured approach to deploying and configuring Oracle Fusion Financials for an organization.

- It involves planning, designing, and executing the implementation process, ensuring alignment with the organization’s business requirements.

- Implementation projects follow best practices and methodologies to ensure a smooth transition from legacy systems to Oracle Fusion Financials.

- Project teams collaborate with key stakeholders to gather requirements, define project timelines, and manage the overall implementation process.

- The success of the implementation project is crucial for the effective utilization of Oracle Fusion Financials in supporting the organization’s financial operations.

40. How does Oracle Fusion Financials support real-time analytics and reporting?

Ans:

- Oracle Fusion Financials supports real-time analytics and reporting through tools like Oracle Transactional Business Intelligence (OTBI) and Financial Reporting Studio.

- Users can access up-to-date financial data for analysis and reporting without delays.

- Integration with SmartView allows users to perform real-time analysis directly within Microsoft Excel.

- The reporting framework provides dashboards and ad-hoc reporting capabilities for dynamic insights.

- Real-time data connectivity ensures reports reflect the latest transactions and financial information.

- Oracle Fusion Financials leverages modern technologies to deliver timely and accurate analytics, enabling users to make informed decisions based on real-time financial data.

41. Explain the purpose of the Oracle Fusion Financials Document Sequencing feature.

Ans:

The Oracle Fusion Financials Document Sequencing feature provides a flexible and configurable framework for generating and managing unique document identifiers across financial transactions. It enables organizations to establish sequential numbering for various financial documents, ensuring a systematic and organized record-keeping process. This feature allows for customization based on specific business requirements, enhancing traceability, auditability, and compliance with regulatory standards.

42. What is the significance of the Oracle Fusion Financials Audit Trail?

Ans:

The Oracle Fusion Financials Audit Trail is significant for maintaining a detailed record of changes made to financial transactions and configurations within the system. It captures and logs user activities, providing a comprehensive audit trail that aids in compliance, internal control, and investigation of discrepancies. The Audit Trail feature enhances transparency and accountability by allowing organizations to track and review historical data modifications.

43. How do Oracle Fusion Financials handle asset tracking and depreciation?

Ans:

Oracle Fusion Financials handles asset tracking and depreciation through its Fixed Assets module. This module enables organizations to record, manage, and track their assets throughout their lifecycle. It supports automated depreciation calculations based on various methods, facilitating accurate financial reporting and compliance with accounting standards. Additionally, it provides features for asset retirement and impairment testing.

44. Describe the features of Oracle Fusion Financials Allocations.

Ans:

Oracle Fusion Financials’ allocations feature offers advanced capabilities for distributing costs and revenues across different segments of an organization. It allows for creating allocation rules based on specific criteria, such as percentages, amounts, or statistical factors. This feature enhances accuracy in financial reporting by allocating expenses to appropriate cost centers or departments, supporting more meaningful and detailed analysis.

45. What is the purpose of the Oracle Fusion Financials Approval Management feature?

Ans:

The Oracle Fusion Financials Approval Management feature automates and streamlines the approval processes for financial transactions. It allows organizations to define approval hierarchies and rules, ensuring that financial transactions are routed to the appropriate individuals for review and authorization. This feature enhances control and compliance by enforcing consistent approval workflows across the organization.

46. How does Oracle Fusion Financials handle recurring journals?

Ans:

Oracle Fusion Financials handles recurring journals by providing a systematic and automated approach to record repetitive financial entries. Organizations can define recurring journal templates with specified frequency and duration, automating the generation of recurring entries. This feature simplifies the accounting process for routine transactions, reducing manual effort and minimizing the risk of errors.

47. Explain the concept of Oracle Fusion Financials Shared Services.

Ans:

Oracle Fusion Financials Shared Services concept involves centralizing certain financial processes, such as accounts payable and receivable, to achieve operational efficiency and cost savings. Shared Services enable organizations to consolidate common financial functions into dedicated service centers, promoting standardization and optimizing resource utilization across the enterprise.

48. What is the role of the Oracle Fusion Financials Task Manager?

Ans:

The Oracle Fusion Financials Task Manager plays a crucial role in managing and monitoring financial tasks within the system. It provides a centralized platform for defining, scheduling, and tracking tasks related to financial processes. The Task Manager enhances operational efficiency by allowing users to organize and prioritize tasks, ensuring timely completion and compliance with established timelines.

49. How does Oracle Fusion Financials handle automatic reconciliation of bank statements?

Ans:

Oracle Fusion Financials handles automatic reconciliation of bank statements through its Bank Reconciliation module. This feature automates matching bank transactions with internal records, reducing manual effort and errors associated with the reconciliation process. It provides tools for identifying and resolving discrepancies, ensuring accurate and timely reconciliation of bank statements.

50. Describe the purpose of the Oracle Fusion Financials Tax Configuration feature.

Ans:

The Oracle Fusion Financials Tax Configuration feature is designed to facilitate the setup and management of tax-related configurations within the system. It allows organizations to define tax rules, rates, and exemptions, ensuring accurate calculation and compliance with tax regulations. This feature supports the automation of tax-related processes, streamlining financial operations and enhancing accuracy in tax reporting.

51. What is the significance of the Oracle Fusion Financials Translation feature?

Ans:

- Multinational Operations: The Translation feature is crucial for multinational organizations where financial statements must be presented in different currencies.

- Currency Conversion: It allows for converting financial data from the functional currency to reporting currencies, ensuring consistency in financial reporting.

- Financial Reporting Accuracy: Ensures accurate financial performance and position representation by accounting for currency exchange rate fluctuations.

- Consolidation: Facilitates the consolidation of financial statements across different entities and currencies.

- Automated Processes: Provides automated tools for currency translation, reducing manual effort and minimizing the risk of errors.

52. How do Oracle Fusion Financials support multiple ledgers and legal entities?

Ans:

- Ledger Setup: Oracle Fusion Financials allows the creation of multiple ledgers, each representing a distinct accounting representation (e.g., primary, secondary, tax).

- Legal Entity Configuration: Users can define legal entities within each ledger, reflecting the organizational structure for financial reporting and compliance purposes.

- Consolidation: Multiple ledgers facilitate the consolidation of financial information across different accounting representations.

- Comprehensive Reporting: Enables comprehensive reporting at the ledger and legal entity levels, providing insights into financial performance.

- Global Compliance: Supports organizations operating in different jurisdictions, complying with diverse legal and accounting requirements.

53. Explain the concept of Oracle Fusion Financials Data Access Sets.

Ans:

- Data Segregation: Data Access Sets in Oracle Fusion Financials allow organizations to segregate and control access to specific data sets within the application.

- Security and Privacy: Data Access Sets enhance data security and privacy by restricting user access to relevant subsets of financial information.

- Flexibility: Users can define Data Access Sets based on criteria such as legal entities, business units, or other parameters.

- Customization: Provides flexibility to customize data access for different roles and responsibilities within the organization.

- Efficient Data Management: Allows for efficient data access management, ensuring that users can access only the information relevant to their roles.

54. What is the purpose of the Oracle Fusion Financials Application Composer?

Ans:

- Customization: Oracle Fusion Financials Application Composer is a tool that allows users to customize and extend Oracle Fusion Applications without extensive coding.

- Tailoring User Interfaces: Users can modify the user interfaces of Oracle Fusion Financials applications to suit their specific business processes better.

- Workflow Configuration: Users can configure workflows, notifications, and approval processes according to their business requirements.

- Adaptability: Enhances the adaptability of Oracle Fusion Financials to evolving business needs without the need for complex and time-consuming development efforts.

- User Empowerment: Allows business users to make changes to the application without relying on IT, promoting user empowerment and agility.

55. How does Oracle Fusion Financials handle financial data security?

Ans:

- Role-Based Security: Oracle Fusion Financials employs role-based security, ensuring that users have access only to the functions and data relevant to their roles.

- Data Access Controls: Security profiles and data access sets control access to specific financial data sets.

- Encryption: Utilises encryption techniques to protect sensitive financial information during transmission and storage.

- User Authentication: Implements robust user authentication mechanisms to prevent unauthorized access.

- Compliance: Adheres to regulatory standards and industry best practices for financial data security.

56. Describe the role of the Oracle Fusion Financials Metadata Loader.

Ans:

- Data Loading: The Oracle Fusion Financials Metadata Loader is a tool for loading metadata, such as charts of accounts structures, into Oracle Fusion Financials.

- Efficiency: Accelerates loading large metadata volumes, reducing manual effort and improving efficiency.

- Configuration Updates: Allows for updates to configuration elements without the need for manual data entry.

- Automation: Supports automation of metadata loading processes, ensuring consistency and accuracy.

- Integration: Facilitates integration with other systems during implementation or updates, streamlining the data migration process.

57. What is the significance of the Oracle Fusion Financials Approval Workflow?

Ans:

- Process Automation: The Approval Workflow in Oracle Fusion Financials automates and streamlines approval processes for various financial transactions.

- Efficiency: Reduces manual intervention in approval processes, leading to faster and more efficient processing of transactions.

- Policy Enforcement: Enforces organizational policies and compliance requirements by ensuring that transactions are approved.

- Configurability: Organizations can configure approval rules based on specific criteria, adapting to varying business needs.

- Integration: Integrates with other Oracle Fusion Financials modules, ensuring a seamless flow of transactions through the approval process.

58. How does Oracle Fusion Financials handle accounting for payroll transactions?

Ans:

- Integration with Payroll Systems: Oracle Fusion Financials integrates with payroll systems to capture and process payroll transactions.

- Automatic Journal Entries: The system generates automatic journal entries based on payroll data, ensuring accurate accounting

- Cost Allocation: Supports cost allocation for payroll expenses to different departments, projects, or cost centres.

- Auditability: Provides audit trails for payroll transactions, facilitating transparency and accountability.

- Reporting: Enables the generation of financial reports that include payroll-related expenses for analysis and decision-making.

59. Explain the purpose of the Oracle Fusion Financials Data Extract feature.

Ans:

- Data Extraction: The Data Extract feature in Oracle Fusion Financials allows users to extract financial data from the system for reporting, analysis, and integration purposes.

- Customised Data Sets: Users can define and customize data sets to extract specific subsets of financial information based on their reporting requirements.

- Integration with External Systems: Supports financial data integration with external systems or third-party reporting tools.

- Automation: The extraction process can be automated, ensuring users can access the latest financial data for decision-making.

- Flexibility: Enhances flexibility by allowing users to tailor data extracts to meet their unique reporting needs.

60. What is the role of the Oracle Fusion Financials Document Manager?

Ans:

- Document Storage: Oracle Fusion Financials Document Manager is a feature that allows organizations to store and manage supporting documents related to financial transactions.

- Attachment Handling: Users can attach documents, such as invoices, receipts, or contracts, directly to relevant financial records.

- Audit Trail: The Document Manager maintains an audit trail of document attachments, providing visibility into document changes and additions.

- Compliance: Supports compliance with record-keeping requirements by ensuring that supporting documents are securely stored and easily accessible.

- Integration: Documents stored in Document Manager are often integrated with other Oracle Fusion Financials modules, ensuring seamless access to supporting documentation throughout the application.

61. How do Oracle Fusion Financials handle budgeting and forecasting?

Ans:

Oracle Fusion Financials handles budgeting and forecasting by offering robust tools and functionalities within its Budgetary Control and Strategic Modeling modules. The Strategic Modeling module supports advanced forecasting and scenario analysis, enabling organizations to project future financial outcomes based on different assumptions and variables. These features give decision-makers a comprehensive and forward-looking view of their financial position, fostering effective budget planning and strategic financial management.

62. Describe the features of Oracle Fusion Financials In-Memory Cost Management.

Ans:

Oracle Fusion Financials In-Memory Cost Management features advanced capabilities for managing and analyzing costs. It leverages in-memory processing to enhance the speed and efficiency of cost calculations. The module supports detailed cost analysis, allocation, and simulation, providing organizations real-time insights into cost structures. This facilitates informed decision-making and enables organizations to optimize their cost management strategies.

63. What is the purpose of the Oracle Fusion Financials Intercompany Balancing feature?

Ans:

The Oracle Fusion Financials Intercompany Balancing feature is designed to ensure the accurate and balanced consolidation of financial data across multiple legal entities within an organization. It automatically generates intercompany accounting entries to offset transactions between entities, preventing imbalances and ensuring accurate financial reporting. This feature is crucial for organizations with complex structures and multiple subsidiaries.

64. How does Oracle Fusion Financials handle revenue recognition?

Ans:

Oracle Fusion Financials handles revenue recognition by incorporating advanced features within its Revenue Management module. The system supports the recognition of revenue based on various accounting standards, such as ASC 606 and IFRS 15. It automates revenue recognition processes, considering criteria like performance obligations and contract milestones, ensuring compliance with accounting regulations and providing accurate revenue reporting.

65. Explain the concept of Oracle Fusion Financials Subledger Accounting Rules.

Ans:

Oracle Fusion Financials Subledger Accounting Rules allow organizations to define rules that govern how accounting entries are generated and processed within subledgers. These rules enable customization and automation of accounting processes, ensuring consistency and accuracy in financial transactions. Organizations can define rules based on specific conditions, events, or criteria, tailoring sub-ledger accounting to meet their unique business requirements.

66. What is the significance of the Oracle Fusion Financials Data Security Policies?

Ans:

The Oracle Fusion Financials Data Security Policies play a significant role in ensuring the confidentiality and integrity of financial data. These policies allow organizations to define access controls and restrictions, specifying who can view, modify, or approve financial transactions. By enforcing data security policies, organizations can prevent unauthorized access, mitigate the risk of data breaches, and maintain the privacy of sensitive financial information.

67. How do Oracle Fusion Financials handle financial analytics and dashboards?

Ans:

Oracle Fusion Financials handles financial analytics and dashboards through its embedded analytics and reporting tools. It provides:

- Pre-built financial reports.

- Key performance indicators (KPIs).

- Dashboards that offer real-time insights into an organization’s financial performance. Users can customize reports to suit their specific needs, enabling effective monitoring and analysis of financial data for informed decision-making.

68. Describe the role of the Oracle Fusion Financials Financial Reporting Studio.

Ans:

The Oracle Fusion Financials Financial Reporting Studio is a tool that allows organizations to create and customize financial reports according to their specific reporting requirements. It provides a user-friendly interface for designing, formatting, and distributing financial statements, ensuring flexibility and accuracy in financial reporting. This feature empowers users to tailor reports for regulatory compliance and internal reporting needs.

69. What is the purpose of the Oracle Fusion Financials Configurable Journals feature?

Ans:

The Oracle Fusion Financials Configurable Journals feature enables organizations to create and manage journals with a high degree of flexibility. Users can define journal entry templates, rules, and approval workflows, tailoring the journal creation process to match their unique business processes. This feature streamlines the journal entry process, enhances accuracy, and ensures compliance with accounting standards.

70. How do Oracle Fusion Financials support shared service centers?

Ans:

Oracle Fusion Financials supports shared service centers by centralizing and standardizing financial processes across multiple business units or subsidiaries. The system provides tools for automating and streamlining transaction processing, reconciliation, and reporting within shared service environments. This centralization enhances efficiency, reduces duplication of efforts, and promotes standardized financial practices across the organization’s shared service centers.

71. Explain the concept of Oracle Fusion Financials Period Close Reconciliation.

Ans:

- Reconciliation Process: Oracle Fusion Financials Period Close Reconciliation is a feature that automates and streamlines the reconciliation process at the end of accounting periods.

- Data Accuracy: Ensures the accuracy and completeness of financial data by reconciling various ledger balances and financial transactions.

- Configurable Rules: Organizations can define and configure reconciliation rules based on their business requirements.

- Auditability: Maintains an audit trail of reconciliation activities, providing transparency and supporting compliance requirements.

- Efficiency: Improves efficiency by providing a systematic and controlled approach to period-end reconciliation processes.

72. What is the significance of the Oracle Fusion Financials Real-Time Balances feature?

Ans:

- Instant Access: Oracle Fusion Financials Real-Time Balances feature allows users to access up-to-date account balances and financial information without delays.

- Real-Time Decision Making: Enables real-time decision-making by providing immediate insights into the organisation’s financial position.

- Integration with Reporting Tools: Real-Time Balances seamlessly integrates with reporting tools, supporting dynamic and accurate financial reporting.

- Timely Analysis: Provides finance professionals with timely and accurate information for analysis and decision support.

- Enhanced User Experience: Enhances the overall user experience by ensuring that users have access to the latest financial data at any given time.

73. How does Oracle Fusion Financials handle automatic journal posting?

Ans:

- Journal Approval and Posting: Oracle Fusion Financials includes a feature for automatic journal posting based on predefined rules.

- Workflow Integration: Journals go through an approval workflow, and once approved, they are automatically posted to the appropriate ledgers.

- Rule-Based Configuration: Users can configure rules for automatic posting based on criteria such as journal category, source, or amount.

- Audit Trail: The system maintains an audit trail of automatically posted journals, ensuring transparency and accountability.

- Integration with Other Modules: Automatic journal posting seamlessly integrates with other Oracle Fusion Financials modules for consistency across financial processes.

74. Describe the purpose of the Oracle Fusion Financials Account Inspector.

Ans:

- Account Analysis: Oracle Fusion Financials Account Inspector is a tool for analyzing and inspecting the details of ledger accounts.

- Transaction Drill-Down: Users can drill down into specific accounts to view detailed transaction information and understand the composition of balances.

- Balance Verification: Enables users to verify account balances, investigate discrepancies, and ensure accuracy in financial reporting.

- Efficient Troubleshooting: Supports efficient troubleshooting and issue resolution by providing a comprehensive view of transactions related to a specific account.

- Integration with Reporting: The information obtained from the Account Inspector can be integrated with reporting tools for further analysis and reporting.

75. What is the role of the Oracle Fusion Financials Trial Balance feature?

Ans:

- Period-End Verification: Oracle Fusion Financials Trial Balance is a tool for verifying the accuracy of ledger balances at the end of accounting periods.

- Balance Validation: Supports the validation of account balances against expectations and predefined criteria.

- Ledger Reconciliation: Facilitates ledger reconciliation by comparing trial balance reports with other financial statements and records.

- Preparation for Financial Reporting: Trial balance reports are often used as a preparatory step for generating financial statements and disclosures.

- Audit Trail: Maintains an audit trail of trial balance activities, providing transparency and supporting compliance requirements.

76. How does Oracle Fusion Financials handle financial statement analysis?

Ans:

- Financial Reporting Tools: Oracle Fusion Financials provides powerful reporting tools like Oracle Transactional Business Intelligence (OTBI) and Financial Reporting Studio.

- Customization: Users can customize financial statements and reports based on their specific analysis requirements.

- Drill-Down Capabilities: Reports often include drill-down capabilities, allowing users to explore details behind summarized financial information.

- Real-Time Data: Integration with real-time balances ensures financial statements reflect the latest financial data.

- Comparative Analysis: Supports comparative analysis by allowing users to compare financial results across different periods or scenarios.

- Compliance: Helps organizations comply with regulatory reporting requirements and provides stakeholders with insights into financial performance.

77. Explain the concept of Oracle Fusion Financials Bank Account Reconciliation.

Ans:

- Bank Reconciliation Automation: Oracle Fusion Financials Bank Account Reconciliation automates the reconciliation of bank statements with the company’s financial records.

- Import Bank Statements: Users can import electronic bank statements directly into the system for reconciliation.

- Transaction Matching: The system employs matching algorithms to reconcile transactions between bank statements and the company’s books.

- Reconciliation Status Dashboard: The module provides dashboards and reports to monitor the reconciliation status and outstanding items.

- Enhanced Accuracy: Bank Account Reconciliation enhances the accuracy of financial records and ensures timely identification and resolution of discrepancies.

78. What is the significance of the Oracle Fusion Financials User-Defined Dashboards?

Ans:

- Customizable Insights: Oracle Fusion Financials User-Defined Dashboards allow users to create personalized dashboards tailored to their specific needs.

- Aggregated Information: Users can aggregate information from different financial modules and sources onto a single dashboard for a comprehensive view.

- Real-Time Analytics: Dashboards provide real-time analytics, enabling users to monitor key performance indicators (KPIs) and financial metrics.

- Visual Representation: Data is presented in visually appealing charts, graphs, and tables for easy interpretation.

- Decision Support: User-defined dashboards are decision support tools that facilitate quick and informed decision-making.

- Adaptability: Users can adapt dashboards as business needs evolve, ensuring ongoing relevance and effectiveness.

79. How do Oracle Fusion Financials handle cross-currency payments?

Ans:

- Currency Conversion: Oracle Fusion Financials supports cross-currency payments by allowing transactions in different currencies.

- Automatic Conversion: The system automatically converts transaction amounts into the required currency based on configured exchange rates.

- Multi-Currency Accounts: Organizations can maintain multi-currency bank accounts to facilitate cross-currency transactions.

- Transparency: Cross-currency payment details are transparently recorded, and the system supports accurate accounting for currency exchange gains or losses.

- Reporting: Financial reports reflect cross-currency transactions and provide insights into the impact of currency fluctuations on financial performance.

80. Describe the features of Oracle Fusion Financials Rapid Implementation Templates.

Ans:

- Accelerated Implementation: Oracle Fusion Financials Rapid Implementation Templates are pre-configured templates that accelerate the implementation process.

- Best Practices: Templates incorporate industry best practices and Oracle’s expertise in financial management.

- Out-of-the-Box Configuration: Organizations can leverage out-of-the-box configurations for common financial processes, reducing the need for extensive customization.

- Reduced Implementation Time: Rapid Implementation Templates help reduce the time and effort required for implementing Oracle Fusion Financials.

- Comprehensive Coverage: Templates cover various financial modules, ensuring a comprehensive approach to financial management implementation.

81. What is the purpose of the Oracle Fusion Financials In-Memory Financial Reporting feature?

Ans:

The Oracle Fusion Financials In-Memory Financial Reporting feature provides organizations with a powerful and efficient tool for generating real-time financial reports. In-memory financial Reporting enhances the user experience by delivering timely insights, facilitating quicker decision-making, and supporting dynamic and interactive reporting. This feature is instrumental in optimizing financial analysis and ensuring that stakeholders have access to the most up-to-date and accurate financial information.

82. How does Oracle Fusion Financials handle lease accounting?

Ans:

Oracle Fusion Financials handles lease accounting through its Lease Management module. This module assists organizations in managing lease contracts, automating lease accounting entries, and ensuring compliance with accounting standards such as ASC 842 and IFRS 16. It supports the calculation of lease liabilities and right-of-use assets and facilitates the generation of accurate financial statements, providing transparency and adherence to lease accounting regulations.

83. Explain the concept of Oracle Fusion Financials Multi-Org Access Control.

Ans:

Oracle Fusion Financials Multi-Org Access Control is a feature that enables organizations with multiple legal entities or operating units to manage data access across different entities. It allows users to access and work with data specific to their assigned operating units while maintaining data security and segregation. This feature ensures users can only view and modify data within their authorized organizational boundaries, enhancing data integrity and security.

84. What is the significance of the Oracle Fusion Financials Custom Dimensions feature?

Ans:

The Oracle Fusion Financials Custom Dimensions feature holds significance in providing organizations with the ability to define and use custom attributes or dimensions to categorize and analyze financial data. These custom dimensions allow for more granular and tailored analysis of financial information beyond the standard chart of accounts segments. The feature enhances reporting flexibility and supports organizations in meeting specific business requirements.

85. How do Oracle Fusion Financials support financial compliance reporting?

Ans:

Oracle Fusion Financials supports financial compliance reporting through its robust reporting capabilities and adherence to accounting standards and regulations. The system provides pre-built compliance reports, facilitates the generation of financial statements in accordance with global accounting standards, and offers tools for audit trails and controls. This ensures that organizations meet regulatory requirements and maintain transparency in financial reporting.

86. Describe the role of the Oracle Fusion Financials Subledger Accounting Methods.

Ans:

The Oracle Fusion Financials Subledger Accounting Methods allow organizations to define rules and methods for generating accounting entries within sub-ledgers. This feature provides flexibility in configuring accounting treatments for various transactions, ensuring adherence to accounting standards and organizational policies. It allows organizations to customize accounting methods based on their unique business requirements, supporting accurate and consistent sub-ledger accounting.

87. What is the purpose of the Oracle Fusion Financials Enterprise Structures feature?

Ans:

The Oracle Fusion Financials Enterprise Structures feature is designed to help organizations model and define their organizational structure within the system. It allows for the setup of legal entities, business units, and other organizational components, providing a foundation for managing financial transactions in a structured manner. This feature supports the organization in reflecting its real-world structure within the financial system.

88. How does Oracle Fusion Financials handle financial data migration?

Ans:

Oracle Fusion Financials handles financial data migration through a systematic and structured process. The system supports data migration tools and templates that facilitate financial data extraction, transformation, and loading (ETL) from legacy systems to Oracle Fusion Financials. This ensures a smooth transition, data accuracy, and consistency during the migration process, minimizing disruptions to financial operations.

89. Explain the concept of Oracle Fusion Financials Cash Positioning.

Ans:

Oracle Fusion Financials Cash Positioning is a feature designed to give organizations real-time visibility into their cash position. It enables users to monitor cash balances across multiple bank accounts and entities, facilitating accurate cash forecasting and liquidity management. This feature supports timely decision-making by providing insights into cash inflows and outflows, optimizing cash utilization within the organization.

90. What is the significance of the Oracle Fusion Financials Payment Process Requests feature?

Ans:

The Oracle Fusion Financials Payment Process Requests feature significantly streamlines and automates the payment process. It allows users to initiate payment requests, define payment methods, and configure payment parameters. The feature supports various payment formats and methods, enhancing flexibility in managing payment processes. It ensures efficiency in payment execution, compliance with payment regulations, and transparency in financial transactions.

91. How does Oracle Fusion Financials handle accounting for sales orders?

Ans:

- Order-to-Cash Integration: Oracle Fusion Financials seamlessly integrates with the Order-to-Cash process, ensuring a unified flow of information from sales orders to accounting.

- Automatic Revenue Recognition: The system automatically recognizes revenue associated with sales orders based on the configured revenue recognition rules.

- Creation of Revenue and Invoices: Sales orders trigger the creation of revenue entries and invoices in the financial system.

- Real-Time Updates: Financial records are updated in real-time as sales orders are processed, providing accurate and timely financial information.

- Comprehensive Reporting: Sales order-related financial data is available for comprehensive reporting and analysis.

92. Describe the features of Oracle Fusion Financials Revenue Management.

Ans:

- Revenue Recognition Rules: Oracle Fusion Financials Revenue Management allows users to define and configure complex revenue recognition rules to align with accounting standards.

- Multi-Element Arrangements: Supports recognition for multi-element arrangements where revenue is associated with multiple deliverables or services.

- Compliance: Ensures compliance with revenue recognition standards such as ASC 606 and IFRS 15.

- Integration with Sales Orders: Seamlessly integrates with sales orders and other financial modules for a streamlined end-to-end revenue management process.

- Auditability: Provides robust audit trails and documentation for revenue recognition activities, supporting transparency and compliance.

93. What is the purpose of the Oracle Fusion Financials Account Monitor?

Ans:

- Real-Time Account Monitoring: Oracle Fusion Financials Account Monitor is a tool that allows users to monitor and analyze account balances in real time.

- Alerts and Notifications: Users can set up alerts and notifications based on predefined thresholds or criteria, allowing proactive management of account balances.

- Exception Management: Supports exception management by highlighting accounts that require attention or further investigation.

- Efficient Account Oversight: Enhances efficiency in account oversight and ensures timely response to potential issues.

- Integration with Reporting: Account Monitor integrates with reporting tools for in-depth analysis and reporting on account balances.