- Introduction to Bitcoin Mining

- How Bitcoin Mining Works

- Mining Hardware and Software

- Mining Pools Explained

- Setting Up a Bitcoin Mining Operation

- Energy Consumption and Environmental Impact

- Profitability and Challenges

- Conclusion

Introduction to Bitcoin Mining

Bitcoin mining is a crucial process in the Bitcoin network, responsible for introducing new bitcoins into circulation and maintaining the integrity of the decentralized ledger known as the blockchain. At its core, Bitcoin mining involves solving complex cryptographic puzzles that require significant computational power. These puzzles are part of the proof-of-work consensus mechanism, which ensures that only valid transactions are recorded on the blockchain. When a miner successfully solves a puzzle, they are granted the right to add a new block of transactions to the blockchain. This process not only verifies and secures transactions but also helps prevent double-spending and ensures the network remains decentralized and transparent, a concept thoroughly covered in Blockchain Training. Miners compete against each other to solve these puzzles, using specialized hardware such as ASICs (Application-Specific Integrated Circuits), which are designed specifically for mining cryptocurrencies. The first miner to solve the puzzle receives a block reward, which is a combination of newly minted bitcoins and transaction fees from the block’s transactions. This reward serves as an incentive for miners to contribute their resources to the network. Over time, the block reward halves approximately every four years in an event known as the “halving,” which reduces the rate at which new bitcoins are created, ultimately leading to a capped supply of 21 million bitcoins. Bitcoin mining is energy-intensive and has sparked debates around its environmental impact. However, it remains a cornerstone of the Bitcoin ecosystem, providing the computational power necessary to maintain the security and trustless nature of the network. Without mining, the decentralized verification and recording of Bitcoin transactions would not be possible.

Interested in Obtaining Your Blockchain Certificate? View The Blockchain Training Course Offered By ACTE Right Now!

How Bitcoin Mining Works

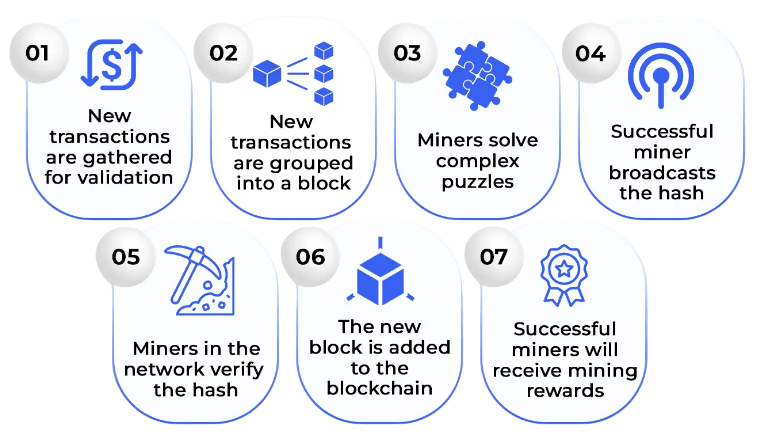

Bitcoin mining involves performing a computationally demanding task known as Proof of Work (PoW), which serves as the foundation of the Bitcoin network’s security and consensus mechanism. At the heart of this process is a cryptographic puzzle that miners must solve in order to add a new block to the blockchain. Specifically, miners use powerful hardware to repeatedly hash the block’s data with different nonce values and random numbers that are adjusted during the mining process. The goal is to find a hash output that meets a predefined condition: it must be lower than the current network difficulty target, a concept explained in What is Web 3 Explained. Since hashing is a one-way, unpredictable function, miners must use brute-force trial and error to find a suitable nonce, a process that requires significant computational resources and electricity. Each block being mined includes several components: a list of confirmed Bitcoin transactions, the hash of the previous block (which links blocks together), a timestamp marking when the block was created, and the nonce that miners adjust. Once a miner finds a valid hash that satisfies the difficulty target, the block is considered successfully mined.

The solution is then broadcast to the Bitcoin network, where other nodes independently verify its validity. If the block is confirmed to be correct, it is added to the blockchain, and the miner receives a block reward in bitcoins, along with any transaction fees contained in the block. This rigorous process not only secures the blockchain against tampering and double-spending but also ensures decentralized consensus, making Bitcoin resistant to fraud and manipulation without the need for a central authority.

Mining Hardware and Software

- Evolution of Mining Hardware: Bitcoin mining hardware has undergone significant changes since the network’s launch. Initially, mining was done using regular computer CPUs, which were sufficient when the network was small and competition low.

- Transition to GPUs: As mining difficulty increased, miners switched to Graphics Processing Units (GPUs). GPUs offered much greater parallel processing power, making them far more efficient for the complex calculations required in mining.

- Introduction of FPGAs: Next, Field Programmable Gate Arrays (FPGAs) became popular. These devices provided improved energy efficiency and speed compared to Graphics Processing Units, as they could be programmed to perform specific mining algorithms more effectively, showcasing the Power of Tron Blockchain.

- Rise of ASICs: Today, the mining industry is dominated by ASICs Application-Specific Integrated Circuits. These are custom-built chips designed specifically for mining Bitcoin’s SHA-256 algorithm, offering unmatched hashing power and energy efficiency compared to previous hardware.

- Mining Software Role: Mining software plays a critical role by connecting hardware to the blockchain network. It manages operations such as hash computations, work submission, and communication with mining pools or solo mining nodes.

- Popular Mining Software: Some of the most widely used mining software programs include CGMiner, BFGMiner, and EasyMiner. Each offers features tailored to different user needs, such as hardware compatibility, user interface, and advanced control options.

- Mining Pools and Rewards: Mining software often interfaces with mining pools, which allow miners to combine their resources and share rewards proportionally. Alternatively, miners can operate solo, but pools help reduce the variance in payout timing.

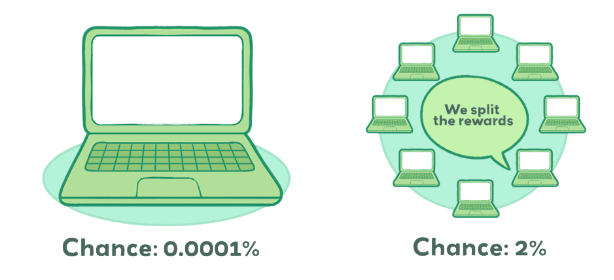

- Definition of Mining Pools: Mining pools are groups of miners who combine their computational resources to increase their chances of successfully mining blocks on a blockchain network.

- Purpose of Pools: Pooling resources reduces randomness and uncertainty in mining rewards, making earnings more predictable compared to solo mining.

- Reward Distribution: When a pool mines a block, rewards are shared among members proportionally based on the computational power each miner contributed, a principle commonly discussed in Blockchain Training.

- Income Stability: Mining pools smooth out the high variance in payouts by providing regular, smaller rewards, helping miners maintain steady income.

- Popular Mining Pools: Well-known pools include Antpool, F2Pool, and Slush Pool, each offering different features and fee structures for users.

- Joining a Pool: To join, miners configure their mining software with the pool’s server details and often create an account on the pool platform.

- Benefits of Pool Participation: Pools enable miners with limited hardware to combine efforts, share rewards, and compete more effectively, making mining more accessible and profitable.

- High Energy Usage: Cryptocurrency mining, especially Bitcoin mining, requires massive computational power that consumes significant amounts of electricity globally.

- Carbon Footprint: Much of the mining energy comes from fossil fuels, which contributes to high carbon emissions and environmental pollution, an environmental concern addressed in Guide To Building Quorum Blockchain using Docker.

- Mining Locations: Mining farms are often located in regions with cheap electricity, such as coal-powered areas or places with abundant hydroelectric power, affecting their environmental footprint differently.

- E-Waste Generation: Mining hardware quickly becomes obsolete due to rapid technological advancements, generating substantial electronic waste that poses disposal challenges.

- Renewable Energy Adoption: Some mining operations are shifting toward renewable energy sources like solar, wind, or hydropower to reduce their environmental impact and carbon footprint.

- Energy Efficiency Improvements: Newer mining hardware and innovations in cooling systems are improving energy efficiency, helping to lower overall electricity consumption per hash.

- Ongoing Debates and Solutions: The environmental impact of mining has sparked global debates, encouraging research into sustainable blockchain practices, alternative consensus algorithms, and policy regulations.

To Earn Your Blockchain Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Blockchain Training Course Today!

Mining Pools Explained

Setting Up a Bitcoin Mining Operation

Setting up a Bitcoin mining operation requires careful planning and execution across several key areas to ensure efficiency and profitability. The first step is hardware selection. Miners must choose specialized equipment known as ASICs (Application-Specific Integrated Circuits), which are designed specifically for mining cryptocurrencies. These machines vary in terms of hash rate, power efficiency, and cost. Selecting the right ASIC miner depends on your budget, power consumption targets, and mining goals. Next, choosing the right location is crucial. Electricity is one of the largest ongoing costs in Bitcoin mining, so it is important to find a place with access to cheap and stable electricity. Additionally, the mining equipment generates significant heat, so the location should have proper ventilation or cooling systems to prevent overheating and hardware failure, a critical aspect of Blockchain Security. Once the hardware is in place, software configuration is the next step. This involves installing compatible mining software that allows the ASIC hardware to communicate with the blockchain and your chosen mining pool. The mining software must be properly configured to optimize performance and ensure the system connects to the mining pool where rewards are distributed based on your contribution. Reliable networking is also essential. A stable internet connection ensures your miner stays connected to the Bitcoin network and contributes work consistently. Downtime can result in lost mining rewards. Finally, maintenance is an ongoing requirement. Miners must monitor the temperature, hash rate, and power consumption of their hardware regularly. Periodic cleaning, firmware updates, and component checks are necessary to prevent breakdowns and keep the operation running efficiently. With these steps in place, a Bitcoin mining operation can be set up to maximize performance and profitability.

Energy Consumption and Environmental Impact

Profitability and Challenges

The profitability of Bitcoin mining depends on several dynamic factors, all of which must be carefully considered before investing in a mining operation. One of the most critical factors is hardware efficiency. More efficient mining equipment can perform more computations while consuming less electricity, directly affecting operating costs and profit margins. Electricity costs are another major component, as mining hardware runs continuously and consumes large amounts of power. Miners in regions with low electricity rates often have a significant advantage over those in higher-cost areas. The price of Bitcoin also plays a central role in profitability. When Bitcoin’s price is high, mining becomes more lucrative, as the value of block rewards and transaction fees increases, a concept related to The Role of Merkle Trees in Blockchain. However, the market is highly volatile, and sudden drops in price can turn a profitable operation into a loss-making one. Another key factor is mining difficulty, which adjusts approximately every two weeks based on the total network hash rate. As more miners join the network and increase the total computational power, the difficulty rises, making it harder to earn rewards. In addition to economic factors, miners face several challenges. The upfront cost of mining hardware can be substantial, and devices often become obsolete within a few years due to rapid technological advancements. Market volatility adds financial risk, while regulatory scrutiny in some regions creates uncertainty and potential legal barriers. To remain competitive, miners must also deal with the need for constant upgrades, maintenance, and cooling solutions. Staying profitable in such an environment requires careful planning, efficient operations, and the ability to adapt to rapidly changing conditions.

Preparing for a Blockchain Job? Have a Look at Our Blog on Blockchain Interview Questions and Answers To Ace Your Interview!

Conclusion

Bitcoin mining is a cornerstone of the Bitcoin ecosystem, playing a vital role in maintaining the network’s security, transparency, and decentralization. Through the process of mining, transactions are verified and recorded on the blockchain, ensuring that the ledger remains immutable and resistant to tampering or double-spending. By relying on a decentralized network of miners to perform complex mathematical computations, Bitcoin eliminates the need for a central authority and upholds the principles of a trustless system. Despite its foundational importance, Bitcoin mining faces several challenges, particularly regarding energy consumption. The Proof of Work mechanism demands high levels of computational power, which in turn requires significant electricity, a challenge often discussed in Blockchain Training. This has led to growing environmental concerns and increased scrutiny from regulators and the public. Additionally, profitability is a constant concern for miners, as they must contend with fluctuating Bitcoin prices, increasing mining difficulty, and regular block reward halvings. These factors make mining a highly competitive and capital-intensive activity. However, the landscape of Bitcoin mining continues to evolve. Technological advancements, such as more energy-efficient ASIC miners, the integration of renewable energy sources, and improvements in cooling and heat management, are helping to address sustainability concerns. Operational strategies, including geographic relocation to areas with lower energy costs and participation in mining pools, also contribute to more stable returns. If you’re interested, I can provide more technical detail, including how mining algorithms work, share code examples demonstrating hashing functions or block structures, and discuss specific hardware and software setups for both beginner and advanced mining operations.