- Introduction to DeFi

- The Origins and Evolution of DeFi

- Core Principles and Technologies Behind DeFi

- Major Components and Use Cases of DeFi

- How DeFi Works: Smart Contracts and Protocols

- Benefits of DeFi Over Traditional Finance

- Risks, Challenges, and Criticisms of DeFi

- Conclusion

Introduction to DeFi

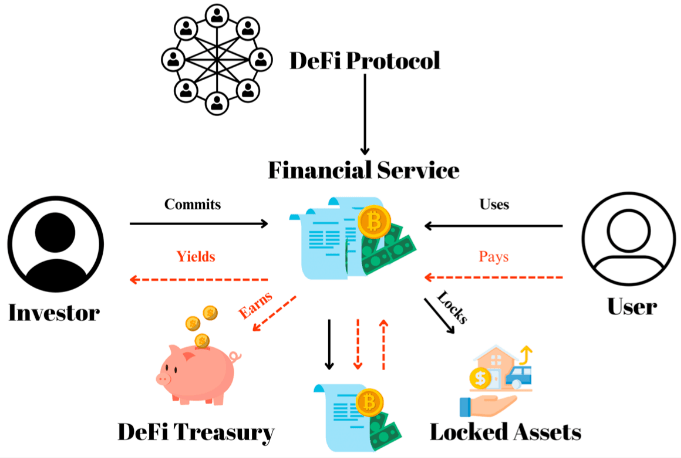

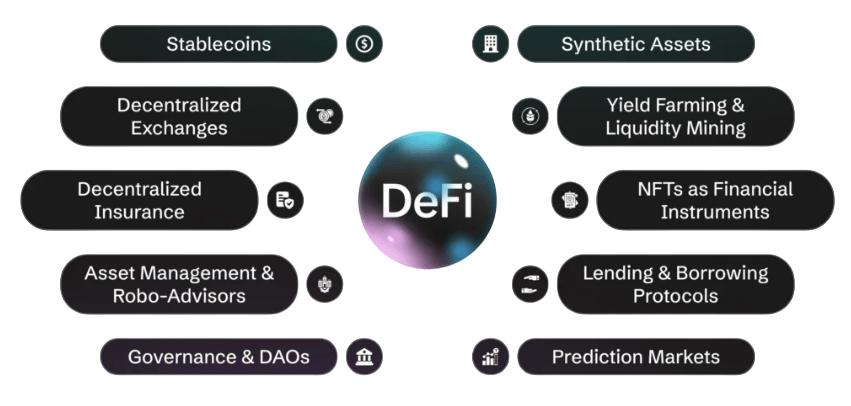

Decentralized Finance (DeFi) represents a groundbreaking transformation in the way financial services are created, accessed, and delivered. Unlike traditional financial systems, which rely heavily on centralized authorities such as banks, governments, and regulatory institutions, DeFi leverages blockchain technology to offer an open, permissionless, and decentralized alternative. By removing intermediaries, DeFi allows users to lend, borrow, trade, invest, and earn interest directly through blockchain-based platforms without the need for traditional gatekeepers. At the core of DeFi are smart contracts, which are self-executing pieces of code deployed on blockchain networks, primarily Ethereum, but also increasingly on platforms like Binance Smart Chain, Solana, and Avalanche. These smart contracts, a key component often emphasized in Blockchain Training, automate transactions and enforce rules transparently, reducing the need for human intervention and minimizing the risk of fraud or manipulation. Users interact with decentralized applications (also called dApps) through non-custodial wallets, meaning they retain control over their funds at all times. One of DeFi’s most powerful features is its global accessibility. Anyone with an internet connection and a digital wallet can participate, regardless of geographic location or socioeconomic status. This inclusivity is helping to redefine financial access, especially for individuals in underbanked or unbanked regions. DeFi also fosters financial innovation, with new models such as liquidity mining, yield farming, decentralized exchanges (DEXs), and algorithmic stablecoins gaining popularity. With billions of dollars locked in DeFi protocols and a growing user base worldwide, this ecosystem is quickly evolving into a parallel financial system. As adoption continues, DeFi is expected to play an increasingly significant role in shaping the future of finance, promoting transparency, autonomy, and global participation.

Do You Want to Learn More About Blockchain? Get Info From Our Blockchain Training Course Today!

The Origins and Evolution of DeFi

The concept of Decentralized Finance (DeFi) did not emerge overnight. Its origins can be traced back to the launch of Bitcoin in 2009, which introduced the revolutionary idea of a peer-to-peer digital currency that operates independently of central banks or financial institutions. Bitcoin demonstrated that it was possible to transfer value across the internet without relying on intermediaries. However, its primary function was limited to simple transfers and store-of-value purposes, with little flexibility for building more complex financial tools, unlike the broader potential seen in Industries That Blockchain Will Disrupt in Future. The real breakthrough came in 2015 with the launch of Ethereum, a blockchain platform that introduced smart contracts programmable contracts that execute automatically when specific conditions are met. Ethereum’s innovation enabled developers to build decentralized applications (dApps) that could offer sophisticated financial services, such as lending, borrowing, and trading, without requiring a central authority or intermediary. This advancement laid the foundation for the DeFi movement. The term “DeFi” began gaining traction around 2018–2019, as various projects emerged with the goal of replicating traditional financial functions in a decentralized way. Early pioneers such as MakerDAO, which introduced a decentralized stablecoin (DAI), and Compound, a lending and borrowing protocol, played key roles in shaping the ecosystem.

The rise of Uniswap, a decentralized exchange (DEX), further accelerated adoption by enabling trustless, automated token trading. Today, DeFi has expanded far beyond Ethereum, with ecosystems growing on blockchains like Solana, Avalanche, and Arbitrum. The DeFi landscape now includes thousands of projects, ranging from simple money markets to derivatives platforms, insurance protocols, and even decentralized asset management services, marking a new era of programmable and open financial infrastructure.

Core Principles and Technologies Behind DeFi

- Decentralization: DeFi removes central authorities, relying instead on distributed networks of computers (nodes) that collectively validate and record transactions.

- Permissionless Access: Anyone with an internet connection can access DeFi applications without needing approval or identity verification. This is particularly impactful for the unbanked population.

- Transparency: Since DeFi transactions occur on public blockchains, all activities are publicly recorded and auditable, fostering trust and accountability, which is essential knowledge for those learning How To Become a Blockchain Developer.

- Interoperability: Many DeFi protocols are designed to work together, allowing users to combine multiple services seamlessly this is often called “money legos.”

- Smart Contracts: Self-executing programs automate financial transactions, eliminating the need for intermediaries and reducing operational costs.

- Cryptographic Security: DeFi employs advanced cryptography to secure transactions and control access, enhancing security and user control over assets.

- Lending and Borrowing: Users can lend their crypto assets to earn interest or borrow assets by locking collateral. Popular platforms include Aave, Compound, and MakerDAO.

- Decentralized Exchanges (DEXs): These platforms allow users to trade cryptocurrencies directly without intermediaries, using automated market makers (AMMs) or order books. Examples are Uniswap, SushiSwap, and PancakeSwap.

- Stablecoins: Cryptocurrencies pegged to stable assets (like USD) provide a stable medium of exchange and store of value within the DeFi ecosystem, as often highlighted in Blockchain Training. Examples include USDC, DAI, and Tether (USDT).

- Yield Farming and Liquidity Mining: Users earn rewards by providing liquidity to DeFi protocols, often receiving native tokens as incentives.

- Derivatives and Synthetic Assets: Platforms like Synthetix allow users to create and trade derivatives representing stocks, commodities, or other assets on-chain.

- Reduced Computational Overhead: These consensus algorithms require significantly less computational power compared to Proof of Work, lowering energy consumption and costs.

- Lower Transaction Latency: Faster consensus mechanisms decrease transaction confirmation times, improving throughput and user experience in enterprise applications.

- Tailored Consensus Selection: The choice of consensus protocol depends on factors such as consortium size, trust levels among participants, and regulatory or compliance requirements, ensuring a balance between security and performance.

- Financial Inclusion: DeFi provides access to financial services for anyone around the world, without requiring traditional credit histories or identity verification, helping to include the unbanked and underbanked populations.

- Reduced Costs: By eliminating intermediaries such as banks and brokers, DeFi lowers transaction fees and operational expenses, making financial services more affordable for users.

- Censorship Resistance: Because DeFi applications run on decentralized networks, they cannot be easily shut down, controlled, or censored by governments or corporations, preserving users’ financial freedom and influencing the Salary for a Blockchain Developer.

- Transparency and Trustlessness: Smart contracts operate transparently and automatically on the blockchain, reducing opportunities for fraud, human error, and reliance on trusted third parties.

- Innovation and Flexibility: The modular and composable nature of DeFi protocols allows users to combine various services to create innovative financial products tailored to their specific needs.

- 24/7 Accessibility: Unlike traditional banks that operate within set business hours, DeFi platforms are accessible at any time, allowing users to interact with financial services whenever they want.

- Global Reach: DeFi platforms can serve users worldwide without geographical restrictions, making financial services more accessible across borders and enhancing economic participation.

Would You Like to Know More About Blockchain? Sign Up For Our Blockchain Training Course Now!

Major Components and Use Cases of DeFi

How DeFi Works: Smart Contracts and Protocols

At the core of Decentralized Finance (DeFi) lies the smart contract, a self-executing piece of code that operates on blockchain platforms such as Ethereum, Binance Smart Chain, and Polygon. Smart contracts automatically carry out transactions and enforce rules when predefined conditions are met, removing the need for traditional financial intermediaries like banks, brokers, or custodians. This automation introduces transparency, trustlessness, and efficiency, which are key pillars of the DeFi ecosystem. For example, in a decentralized lending protocol, a smart contract can lock a borrower’s collateral and instantly issue a loan once the loan-to-value ratio and other conditions are satisfied. It can also automatically calculate interest, track repayment progress, and trigger liquidation if the collateral value falls below a set threshold, relying on data integrity ensured by The Role of Merkle Trees in Blockchain. These actions are performed without human oversight, ensuring consistent and tamper-resistant execution. DeFi protocols are essentially networks of interconnected smart contracts that work together to deliver financial services such as lending, borrowing, trading, yield farming, and derivatives. Most DeFi platforms are open-source, allowing anyone to inspect the code, suggest improvements, or even fork the protocol to create a new one. This openness fosters rapid innovation and community-driven development but also requires constant vigilance, as bugs and vulnerabilities can lead to significant financial losses. Users interact with DeFi protocols through non-custodial wallets such as MetaMask, Trust Wallet, or Ledger. These wallets store users’ private keys and allow them to sign and approve transactions securely. By retaining full control of their assets, users gain both autonomy and responsibility, making security awareness and best practices essential when navigating the DeFi landscape.

Benefits of DeFi Over Traditional Finance

Risks, Challenges, and Criticisms of DeFi

Despite the transformative potential of Decentralized Finance (DeFi), the ecosystem faces several critical challenges that could hinder its long-term adoption and stability. One of the most pressing concerns is smart contract vulnerabilities. Since DeFi platforms are powered by code, any bugs or security flaws can be exploited, often leading to the loss of millions of dollars. Several high-profile DeFi hacks have occurred due to unchecked vulnerabilities, highlighting the importance of rigorous audits and ongoing security improvements. Regulatory uncertainty is another major hurdle. Governments and financial regulators around the world are still determining how to approach DeFi, which operates without centralized control, a concept closely related to What is Web 3 Explained. Unclear or evolving regulations can create compliance risks for developers and users, and overly restrictive policies could stifle innovation or push projects into regulatory gray areas. The custodial nature of DeFi adds another layer of risk. Unlike traditional finance, users are solely responsible for their private keys. If these keys are lost, forgotten, or stolen, access to funds is permanently lost, with no recovery options. Additionally, user error such as sending funds to the wrong address or interacting with a malicious contract can also lead to irreversible losses. The open and permissionless nature of DeFi, while fostering innovation, has unfortunately also attracted scams and rug pulls, where project creators suddenly withdraw funds and disappear, leaving users with worthless tokens. Other persistent issues include scalability and high gas fees, especially on Ethereum, which can make using DeFi platforms expensive and inefficient. Finally, complex interfaces and steep learning curves make DeFi difficult for newcomers to understand, potentially slowing mass adoption. Addressing these challenges is essential for DeFi to realize its full potential in reshaping global finance.

Want to Learn About Blockchain? Explore Our Blockchain Interview Questions and Answers Featuring the Most Frequently Asked Questions in Job Interviews.

Conclusion

Decentralized Finance (DeFi) represents a bold reimagining of the global financial system by harnessing the power of blockchain technology to build a more open, transparent, and efficient alternative to traditional finance. At its core, DeFi removes the need for centralized intermediaries such as banks, brokerages, and payment processors, instead enabling peer-to-peer financial interactions through smart contracts. This fundamental shift empowers anyone with an internet connection and a digital wallet to access services like lending, borrowing, trading, insurance, and asset management, regardless of their location or background. By eliminating middlemen, DeFi significantly reduces transaction costs, improves efficiency, and fosters greater financial inclusion, especially in regions underserved by traditional banking systems, as emphasized in Blockchain Training. The open-source nature of DeFi protocols encourages collaborative innovation, allowing developers worldwide to contribute to and improve the ecosystem. Furthermore, the transparent and immutable nature of blockchain records enhances trust and accountability, creating a system where rules are enforced by code rather than discretionary authority. While DeFi still faces challenges such as security vulnerabilities, regulatory uncertainty, and usability barriers, the rapid pace of technological advancement and growing institutional interest suggest that it is not just a passing trend but a foundational shift in financial infrastructure. New solutions are being actively developed to address existing limitations, including layer-2 scaling, improved user interfaces, and more secure smart contract standards. Whether you are an investor, a developer, or simply a curious observer, gaining a clear understanding of DeFi is crucial for comprehending the next wave of financial evolution. As this ecosystem matures, DeFi is poised to play a central role in shaping the future of global finance.