- Introduction to Cloud Mining

- How Does Cloud Mining Work?

- Types of Cloud Mining

- Cloud Mining vs Traditional Mining

- Benefits of Cloud Mining

- Risks and Drawbacks of Cloud Mining

- How to Choose a Cloud Mining Provider

- Conclusion

Introduction to Cloud Mining

Cryptocurrency mining has evolved significantly since the launch of Bitcoin. In the early days, individuals could mine Bitcoin using a standard home computer, making it accessible to hobbyists and tech enthusiasts. As blockchain networks became more secure and competitive, mining difficulty increased, leading to the rise of specialized equipment, high electricity consumption, and substantial upfront costs. This shift made traditional mining impractical for many people. To address these barriers, a new model called cloud mining emerged. Cloud mining allows users to mine cryptocurrencies by renting computing power from remote data centers. This eliminates the need to purchase, install, or maintain any hardware or software, a benefit often highlighted in Blockchain Training. Instead, users sign up with a cloud mining provider and select a contract based on the amount of computational power they want to rent, the duration of the contract, and the expected returns. The provider handles all technical aspects, including setup, maintenance, and energy costs. Cloud mining opens the door for anyone, regardless of technical knowledge or available resources, to participate in the mining process and potentially earn rewards. It is especially appealing to newcomers or investors looking to diversify their exposure to the cryptocurrency market. However, it also comes with certain risks. Users must carefully evaluate providers for legitimacy, understand the terms of their contracts, and recognize that profitability can fluctuate with market conditions, mining difficulty, and cryptocurrency prices. Whether you are a beginner exploring digital assets or a seasoned investor expanding your strategy, understanding cloud mining is important. It offers a simplified entry point into the mining world while requiring careful research and informed decision-making.

Interested in Obtaining Your Blockchain Certificate? View The Blockchain Training Course Offered By ACTE Right Now!

How Does Cloud Mining Work?

Cloud mining allows individuals to participate in cryptocurrency mining by leasing mining hardware or computational power from a service provider located in a remote data center. This model removes the need for users to purchase, set up, or maintain physical mining equipment. The service provider takes care of all operational responsibilities, including equipment maintenance, electricity consumption, cooling systems, software updates, and security measures. As a result, cloud mining offers a simplified and accessible way for people to engage in crypto mining. The process of cloud mining typically involves several key steps, which are important to understand when learning How to Start a Career in Blockchain Technology. First, users must sign up with a cloud mining provider by registering an account on the platform. After creating an account, the user selects a mining contract. These contracts vary in terms of duration, the amount of hash power provided, and overall cost. Once the contract is selected, payment is made either in fiat currency or cryptocurrency, depending on the provider’s options. After payment is processed, mining begins automatically. The provider allocates the purchased hash power to the user’s account, and mining operations are carried out on their behalf. Users then receive payouts on a regular basis, often daily or weekly, depending on their share of the mining power and the performance of the underlying cryptocurrency network.

Cloud mining supports a variety of cryptocurrencies. While Bitcoin remains the most common option, some platforms also support other coins such as Litecoin, Ethereum (prior to its switch to proof of stake), and various altcoins. Overall, cloud mining presents a more user-friendly path into crypto mining, especially for those who want exposure without the complexities of managing hardware and infrastructure.

Types of Cloud Mining

- Hosted Mining: In hosted mining, users purchase or lease physical mining hardware that is set up and maintained by a cloud mining provider at their data center. Users benefit from mining without managing the equipment themselves.

- Virtual Hosted Mining: This type involves renting virtualized mining hardware hosted remotely. Users get access to mining power without owning or handling any physical devices, paying based on the hash rate they rent.

- Leased Hash Power: Users lease a certain amount of hash power from a provider who operates mining farms. This allows miners to participate flexibly without hardware investment, simply paying for the computing power over a contract period.

- Contract-Based Mining: Cloud mining providers sell mining contracts specifying duration, hash rate, and payout structure, which are important factors to consider in Blockchain Security.

- Multi-Coin Mining: Some cloud mining services offer mining for multiple cryptocurrencies rather than just Bitcoin. This enables users to diversify their mining portfolio and choose coins based on profitability or interest.

- Pay-as-You-Go Mining: In this model, users pay only for the mining power they use, with no long-term contracts. This offers flexibility for casual miners or those testing cloud mining without large commitments.

- Mining Pool Cloud Mining: Some cloud mining providers operate mining pools, where rented hash power is combined with others’ power to increase the chance of successful block mining. Rewards are then shared based on contributed hash power.

- Initial Investment: Traditional mining requires significant upfront costs to buy hardware, set up infrastructure, and handle electricity and cooling. Cloud mining typically requires a smaller initial payment by purchasing or leasing mining contracts or hash power.

- Technical Knowledge: Traditional mining demands technical skills to install, maintain, and troubleshoot mining equipment. Cloud mining offers a more user-friendly experience where providers manage the hardware, making it accessible to beginners.

- Maintenance and Operation: In traditional mining, the miner is responsible for maintaining hardware, ensuring uptime, and dealing with repairs, responsibilities that are thoroughly explained in Blockchain Training.

- Location Constraints: Traditional mining requires suitable physical space with access to cheap electricity and proper cooling. Cloud mining allows users to mine remotely without worrying about location or environmental factors.

- Control and Ownership: Traditional miners own their hardware and have full control over their mining setup. Cloud miners only lease or rent mining power, so they do not own the physical equipment and depend on the provider’s reliability.

- Profitability and Fees: Traditional mining can be more profitable if managed efficiently but involves higher risks and ongoing costs. Cloud mining usually charges fees or takes a percentage of earnings, which can reduce net profits.

- Scalability and Flexibility: Cloud mining offers easy scalability by renting more hash power as needed. Traditional mining requires purchasing and setting up additional hardware, which can be slower and more capital intensive.

- Scams and Fraud: The cloud mining space has been plagued by fraudulent schemes and Ponzi-like operations promising unrealistic returns. Choosing a trustworthy provider is crucial to avoid losing your investment.

- Lack of Control: When you rent mining power, you do not own the hardware or control how it is managed. If the provider faces technical issues or mismanagement, your earnings can be affected without recourse.

- Profitability Uncertainty: Cloud mining profits depend heavily on cryptocurrency prices, mining difficulty, and contract terms, all of which are influenced by the principles of What is Blockchain Technology & How Does It Work.

- Contract Lock-in: Many cloud mining contracts have fixed durations and terms. If market conditions worsen, you may still be obligated to pay or continue mining with little flexibility to exit early.

- Hidden Fees: Some providers charge maintenance fees, electricity costs, or other hidden expenses that can significantly reduce net profits from mining rewards.

- Limited Transparency: Users often have limited visibility into the mining operations, hardware quality, and actual hash power deployed, making it difficult to verify provider claims.

- Regulatory Risks: Changing regulations regarding cryptocurrencies and mining can impact cloud mining operations or the legality of contracts, exposing users to unforeseen legal challenges.

To Earn Your Blockchain Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Blockchain Training Course Today!

Cloud Mining vs Traditional Mining

Benefits of Cloud Mining

Cloud mining offers several advantages that make it an attractive option for individuals interested in cryptocurrency mining without the complexities of managing hardware. One of the main benefits is the ease of access. Since users do not need to purchase or maintain expensive mining equipment, cloud mining lowers the barrier to entry, allowing beginners and non-technical users to participate in mining simply by signing up on a platform. This accessibility democratizes mining and expands participation beyond those with technical expertise or significant capital. Another advantage is the cost-effectiveness. Cloud mining eliminates the need to invest in hardware, pay for electricity, or handle cooling and maintenance. These expenses are covered by the cloud mining provider, enabling users to avoid unpredictable costs such as rising electricity bills or hardware failures, demonstrating the efficiency and Power of Tron Blockchain. Additionally, cloud mining reduces the risks associated with equipment depreciation and obsolescence, which can quickly impact profitability in traditional mining setups. Cloud mining also provides convenience and flexibility. Users can select mining contracts that suit their budget and preferred commitment duration. Contracts can often be purchased with either fiat money or cryptocurrencies, adding to the ease of use. Furthermore, cloud mining platforms usually offer automated mining and payout systems, so users receive regular rewards without needing to monitor operations continuously. Finally, cloud mining supports mining for multiple cryptocurrencies, giving users the opportunity to diversify their mining portfolio. This diversification can help mitigate risks related to the price volatility of any single cryptocurrency. Overall, cloud mining presents a straightforward, less risky, and more flexible approach to cryptocurrency mining, making it an appealing choice for many investors and enthusiasts.

Risks and Drawbacks of Cloud Mining

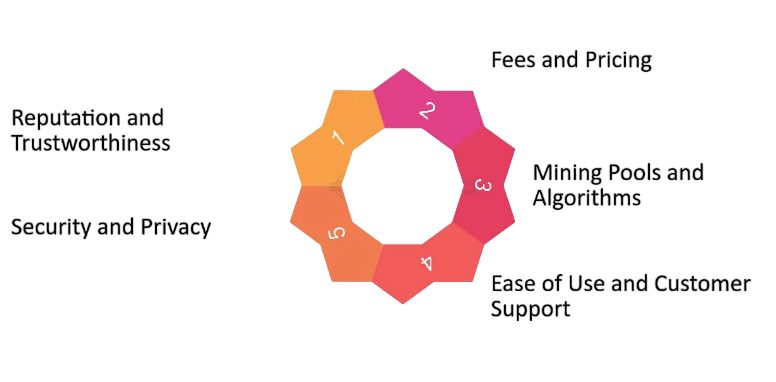

How to Choose a Cloud Mining Provider

Choosing the right cloud mining provider is crucial to ensuring a safe, profitable, and hassle-free mining experience. The first step is to research the provider’s reputation and track record. Look for companies with positive user reviews, transparent business practices, and a history of timely payouts. Trusted platforms often have active communities and third-party audits that verify their legitimacy and operational integrity. Next, consider the contract terms and fees. Providers offer various packages with different durations, hash power, and pricing structures. It is important to understand the fees involved, including maintenance costs, electricity charges, and any hidden expenses that might reduce overall profitability. Compare contracts across multiple providers to find one that balances cost and expected returns. Security is another essential factor. Since cloud mining involves entrusting your investment to a third party, verify the provider’s security measures to protect user funds and data, similar to practices outlined in the Guide To Building Quorum Blockchain using Docker. This includes secure payment methods, strong encryption, and reliable customer support to address any issues promptly. Transparency is also critical. The best providers openly share information about their data centers, mining hardware, and pool affiliations. Avoid companies that lack clear details about their operations or that make unrealistic promises of guaranteed profits. Remember that cryptocurrency mining is inherently volatile, and no provider can guarantee returns. Finally, evaluate the flexibility of contract options and payment methods. Some providers allow users to choose contracts of varying lengths or switch mining algorithms based on market conditions. Additionally, the ability to pay with multiple cryptocurrencies or fiat money can make the process more convenient. By carefully examining these factors, you can select a cloud mining provider that aligns with your goals and risk tolerance while minimizing potential pitfalls.

Preparing for a Blockchain Job Interview? Check Out Our Blog on Blockchain Interview Questions and Answers

Conclusion

Cloud mining has become an appealing option for many individuals who want to engage in cryptocurrency mining without the complexity and high costs of managing their own hardware. By renting mining power from specialized service providers, users can bypass the need to purchase expensive equipment, handle setup and maintenance, or worry about electricity consumption and cooling. This hands-off model allows people, including those without technical expertise, to potentially earn passive income by participating in blockchain mining activities. The process is straightforward: after selecting a contract and making a payment, the cloud mining provider takes care of the mining operations and distributes earnings based on the user’s share of computational power. This accessibility has broadened the reach of cryptocurrency mining and created opportunities for a wider audience to benefit from the growth of digital assets, a trend extensively covered in Blockchain Training. However, despite its simplicity, cloud mining carries certain risks that users should carefully consider. Not all cloud mining providers are trustworthy, and some have been associated with scams or fraudulent schemes. Therefore, thorough research and due diligence are essential when choosing a provider. Users must also set realistic expectations about profitability, as returns can be affected by factors such as cryptocurrency market volatility, mining difficulty adjustments, and service fees. Additionally, cloud mining contracts may lock users into fixed periods, limiting flexibility if market conditions change unfavorably. The lack of control over the mining equipment and operations means users must rely entirely on the provider’s competence and honesty. In summary, while cloud mining offers a simple entry point into cryptocurrency mining, success depends on careful provider selection, understanding the risks involved, and maintaining reasonable expectations regarding returns.