- Introduction to Blockchain Technology

- Overview of the Banking Industry Challenges

- How Blockchain Works in Banking

- Key Benefits of Blockchain for Banks

- Use Cases of Blockchain in Banking

- Challenges and Risks of Blockchain Adoption in Banking

- Regulatory and Compliance Considerations

- The Future of Blockchain in Banking

- Conclusion

Introduction to Blockchain Technology

Blockchain technology, originally developed as the foundation for Bitcoin, is a distributed ledger system that allows secure, transparent, Future of Blockchain in Banking Blockchain In Banking Industry and tamper-proof record-keeping across multiple Block Chain Training participants without a central authority.Unlike traditional centralized databases, blockchain uses cryptographic techniques and consensus algorithms to ensure data integrity and trust among parties that may not fully trust each other.Since its inception, blockchain’s potential to transform industries has been widely recognized with banking being one of the most promising sectors for blockchain integration.

Overview of the Banking Industry Challenges

Traditional banking systems, while foundational to the global economy, face numerous challenges that have persisted for decades:

- Inefficiencies and High Costs: Legacy banking infrastructures often rely on outdated systems that are costly to maintain and slow in processing Best Blockchain Programming Language transactions.Cross-border payments, in particular, can take days and involve multiple intermediaries.

- Fraud and Security Risks: Centralized databases are vulnerable to cyberattacks and fraud, exposing banks and customers to significant risk.

- Lack of Transparency: Many banking operations lack transparency, complicating auditing and compliance.

- Complex Compliance Requirements: Banks must comply with stringent regulatory standards globally, requiring extensive manual efforts.

- Limited Access and Financial Inclusion: Many individuals and businesses, especially in developing regions, remain unbanked or underbanked.

- Distributed Ledger: Each participant (or node) maintains a copy of the ledger, reducing reliance on central servers.

- Consensus Mechanisms: These ensure agreement on transaction validity, preventing double-spending and fraud Bitcoin Mining Challenges .

- Smart Contracts: Self-executing code on the blockchain that automates contract enforcement and transactional workflows.

- Cryptography: Secure transactions and control access through public and private keys.

- Blockchain can significantly reduce the time required for transactions, especially cross-border payments. Traditional cross-border transactions can take 3-5 business days; blockchain-enabled solutions can reduce this to minutes or even seconds, lowering fees by eliminating intermediaries.

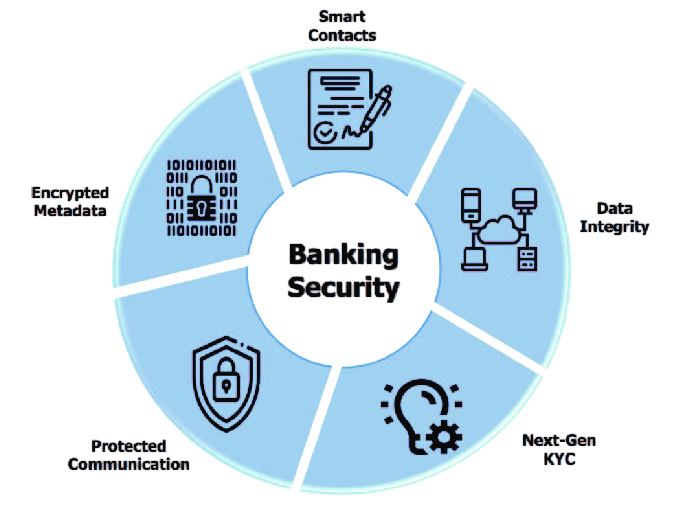

- Data on a blockchain is immutable and cryptographically secured, making fraud and unauthorized alterations extremely difficult. Decentralization also removes single points of failure.

- Every transaction on a blockchain is timestamped and visible to authorized participants, providing an audit trail that simplifies compliance and reporting What is Consortium Blockchain .

- Blockchain can automate compliance tasks through smart contracts and real-time reporting, Blockchain In Banking Industry reducing manual errors and costs associated with regulatory adherence.

- Blockchain-based banking solutions can reach unbanked populations by reducing the need for physical infrastructure and providing digital identity verification mechanisms.

- Cross-border payments traditionally require several intermediaries like correspondent banks, leading to delays and high fees. Blockchain platforms like RippleNet enable near-instantaneous settlements with reduced costs and increased transparency.

- Trade finance involves complex paperwork, multiple parties, and lengthy verification processes. Blockchain can digitize documents, automate workflows via smart contracts, and improve trust between buyers, sellers, and banks. Initiatives like we. Block Chain Training trade have already shown success in this area.

- Know Your Customer (KYC) processes are time-consuming and repetitive across institutions. Blockchain allows secure, Future of Blockchain in Banking decentralized storage of customer data where verified identities can be shared with permission, reducing redundancy and fraud risk.

- Traditional clearing and settlement systems are slow and expensive. Blockchain can enable real-time gross settlement (RTGS) by providing a shared ledger that reduces reconciliation needs.

- Blockchain can streamline syndicated loans by providing a shared, transparent ledger for lenders to track commitments, repayments, and collateral, reducing administrative overhead.

- By providing immutable transaction records and shared data, blockchain can enhance fraud detection systems with real-time monitoring.

- Many blockchain networks face scalability constraints that limit transaction throughput compared to traditional systems.

- Banks operate complex legacy IT environments, making blockchain integration a non-trivial challenge requiring significant investment.

- Many jurisdictions lack clear guidelines on blockchain use in banking, creating uncertainty and potential compliance risks What is Decentralized Finance .

- While blockchain ensures data integrity, Risks of Blockchain publicly accessible ledgers raise privacy concerns for sensitive financial data. Permissioned blockchains offer solutions but come with trade-offs.

- Blockchain is still an emerging technology; operational risks include software bugs, key management issues, and potential cyberattacks.

- Data Protection Laws: GDPR in Europe and other privacy regulations demand stringent data handling.

- Anti-Money Laundering (AML) and KYC Requirements: Blockchain solutions must incorporate robust identity verification and transaction monitoring.

- Cross-Border Regulations: Different countries have varied rules around cryptocurrencies and blockchain usage What is Cloud Mining .

- Central Bank Digital Currencies (CBDCs): Emerging CBDC projects represent the intersection of blockchain and regulatory frameworks.

- Due to privacy and compliance needs, permissioned blockchains operated by consortiums of banks are expected to grow.

- Combining blockchain with AI can enhance fraud detection, risk assessment, and personalized banking services.

- Central banks worldwide are exploring or piloting CBDCs, leveraging blockchain to modernize money issuance and payments What is Cloud Mining .

- Blockchain enables tokenization of traditional assets like stocks, bonds, and real estate, facilitating fractional ownership and increased liquidity.

- Blockchain could power more secure and transparent open banking APIs and DeFi applications, disrupting traditional banking models.

These issues create an opportunity for blockchain to enhance banking services by improving speed, security, transparency, and accessibility.

Do You Want to Learn More About Blockchain? Get Info From Our Blockchain Training Course Today!

How Blockchain Works in Banking

At a high level, blockchain’s core components relevant to banking include:

By leveraging these elements, banks can streamline traditional processes that involve multiple parties, such as payments, settlements, and compliance checks.

Would You Like to Know More About Blockchain? Sign Up For Our Blockchain Training Course Now!

Key Benefits of Blockchain for Banks

Increased Transaction Speed and Reduced Costs

Enhanced Security and Fraud Prevention

Improved Transparency and Traceability

Streamlined Compliance and Regulatory Reporting

Greater Financial Inclusion

Use Cases of Blockchain in Banking

Cross-Border Payments

Trade Finance

KYC and Identity Management

Clearing and Settlement

Syndicated Loans

Fraud Detection and Prevention

Challenges and Risks of Blockchain Adoption in Banking

Scalability Issues

Integration with Legacy Systems

Regulatory Uncertainty

Data Privacy Concerns

Operational Risks

Are You Preparing for Blockchain Jobs? Check Out ACTE’s Blockchain Interview Questions and Answers to Boost Your Preparation!

Regulatory and Compliance Considerations

Banks operate in highly regulated environments, so blockchain adoption requires careful navigation of:

Banks often work with regulators to pilot blockchain initiatives under controlled environments to ensure compliance.

The Future of Blockchain in Banking

Increased Adoption of Permissioned Blockchains

Integration with AI and Big Data

CBDCs and Central Bank Integration

Tokenization of Assets

Open Banking and Decentralized Finance (DeFi)

Conclusion

Blockchain technology holds transformative potential for the banking industry by addressing longstanding inefficiencies, enhancing security, and enabling new financial services. While challenges remain, early implementations and pilot projects demonstrate that blockchain can bring real value across payments, trade finance, compliance, Fraud Detection and beyond Block Chain Training. As the technology matures, risks of Blockchain banks that strategically adopt blockchain will be better positioned to compete, innovate, Future of Blockchain in Banking and meet the evolving needs of their customers in a rapidly changing financial landscape.