- Introduction to Activity based costing

- Key Takeways

- The ABC estimation is as per the following

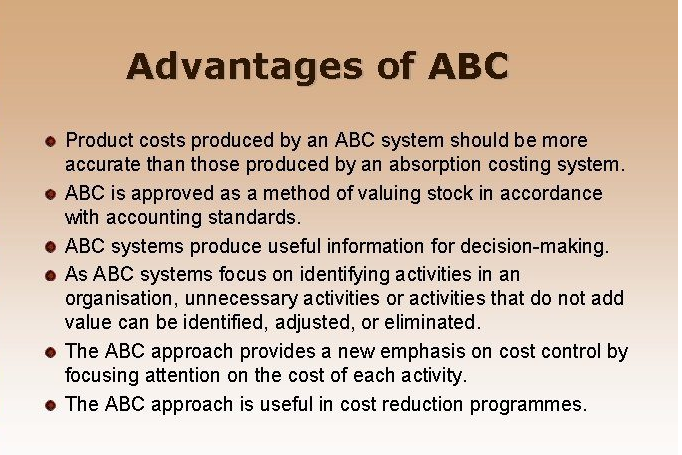

- Advantages of Activity-Based Costing (ABC)

- By utilizing action based costing, you can

- Advantages and disadvantages of Action based costing

- Advantages of Action based costing

- Disadvantages of an ABC framework

- Conclusion

- Action based costing (ABC) is a strategy for doling out upward and roundabout expenses, for example, pay rates and utilities-to items and administrations.

- The ABC arrangement of cost bookkeeping depends on exercises, which are viewed as any occasion, unit of work, or errand with a particular objective.

- An action is an expense driver, for example, buy requests or machine arrangements.

- The expense driver rate, which is the expense pool all out partitioned by cost driver, is utilized to work out how much upward and roundabout expenses connected with a specific action.

- ABC is utilized to improve handle on costs, permitting organizations to shape a more proper estimating methodology.

- This costing framework is utilized in target costing, item costing, product offering benefit examination, client productivity investigation, and administration valuing. Action based costing is utilized to improve handle on costs, permitting organizations to shape a more fitting evaluating system.

- The equation for action based costing is the expense pool absolute separated by cost driver, which yields the expense driver rate. The expense driver rate is utilized in action based costing to ascertain how much upward and aberrant expenses connected with a specific action.

- Recognize every one of the exercises expected to make the item.

- Partition the exercises into cost pools, which incorporates every one of the singular expenses connected with an action like assembling. Ascertain the complete upward of each cost pool.

- Appoint each cost pool action cost drivers, like hours or units.

- Ascertain the expense driver rate by isolating the all out upward in each cost pool by the complete expense drivers.

- Partition the complete upward of each cost pool by the all out cost drivers to get the expense driver rate.

- The ABC arrangement of cost bookkeeping depends on exercises, which are any occasions, units of work, or errands with a particular objective, like setting up machines for creation, planning items, disseminating completed products, or working machines. Exercises consume upward assets and are viewed as cost objects.

- Under the ABC framework, a Action can likewise be considered as any exchange or occasion that is an expense driver. An expense driver, otherwise called a Action driver, is utilized to allude to an allotment base. Instances of cost drivers incorporate machine arrangements, support demands, consumed power, buy orders, quality investigations, or creation orders.

- There are two classifications of Action measures: exchange drivers, which includes counting how frequently an action happens, and length drivers, which measure how long an action requires to finish.

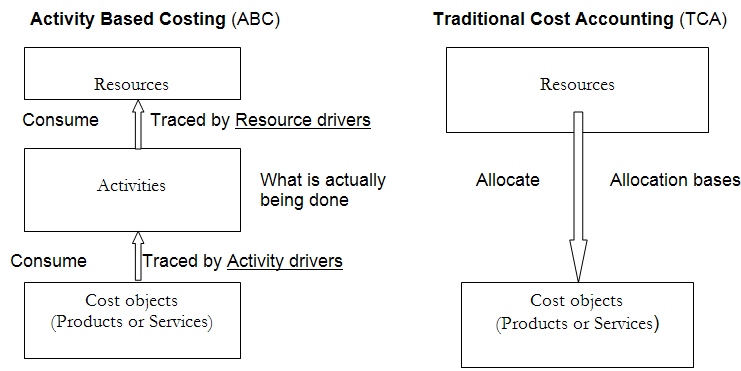

- Not at all like customary expense estimation frameworks that rely upon volume count, like machine hours and additionally direct work hours to distribute aberrant or upward expenses for items, the ABC framework groups five wide degrees of Action that are, partially, irrelevant to the number of units are delivered. These levels incorporate bunch level action, unit-level Action, client level action, association supporting action, and item level action.

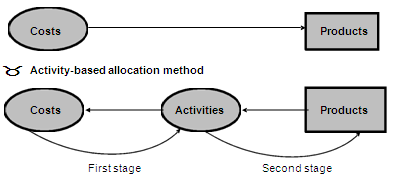

- Action based costing (ABC) improves the costing system in three ways. To begin with, it extends the quantity of cost pools that can be utilized to gather upward expenses. Rather than amassing all costs in a single vast pool, it pools costs by action.

- Second, it makes new bases for appointing upward expenses for things to such an extent that expenses are apportioned in view of the exercises that produce costs rather than on volume measures, for example, machine hours or direct work costs.

- At last, ABC adjusts the idea of a few backhanded expenses, making costs recently thought to be aberrant like devaluation, utilities, or pay rates recognizable to specific exercises. On the other hand, ABC moves upward expenses from high-volume items to low-volume items, raising the unit cost of low-volume items. Action based costing (ABC) is a framework you can use to observe creation costs. It separates upward expenses between creation related exercises. The ABC framework allocates expenses for every action that goes into creation, for example, laborers testing an item.

- Action based costing (ABC) is a framework that separates upward expenses between creation related exercises. Producing organizations with high upward costs use Action based costing to get a more clear image of where cash is going. Since ABC gives explicit creation cost breakdowns, you can see which items are really beneficial.

- Think about both the immediate and upward expenses of making every item

- Perceive that various items require different roundabout costs

- All the more precisely set costs

- See which upward costs you could possibly scale back

- ABC gives an option in contrast to customary costing. Customary costing applies a normal upward rate to coordinate creation costs in view of an expense driver (e.g., hours or volume).

- In any case, some creation related exercises utilize more upward costs than others. Accordingly, customary costing can give an incorrect expense of making every item.

- Conventional costing is less difficult yet less explicit than action based costing. You should think about going with customary costing assuming you just make a couple of items.

- You may likewise involve customary costing for revealing remotely (e.g., to financial backers) and action based costing for announcing inside (e.g., to supervisors).

- One more advantage of ABC is exact item evaluating. Evaluating items can be one of the most tough choices you make in business. Neglecting to think about every one of your expenses could bring about setting your costs excessively low. Thus, you probably won’t end up with a solid overall revenue.

- With an ABC framework, you can allocate expenses for every action in the creation cycle. This shows you every one of the costs that go into delivering a particular item. You can utilize this information to set a value that all the more precisely represents the amount it costs you to make the item.

- (Upward for Cost Pool/Cost Drivers) X Amount of Activity Cost Driver. Presently, we should make a stride back and go over what precisely this implies.

- An expense pool is a gathering of individual expenses related with a Action. You can make cost pools by recognizing the exercises that go into making an item. Whenever you’ve gathered your expenses into a pool, see as the complete upward. Remember that there’s no set number of gatherings you really want to have.

- An expense driver is something that controls changes in the expense of a Action. Instances of cost drivers incorporate units, work or machine hours, and parts. Relegate cost drivers (you can have mutiple) to each cost pool.

- At the point when you partition the all out upward in an expense pool by your all out cost drivers, you get an expense driver rate.

- Distinguish every one of the exercises that go into making an item (tip: assuming you burn through cash on it, add it in!)

- Separate every Action into gatherings (e.g., product offering)

- Track down the all out upward for each cost pool

- Allocate Action cost drivers (units, hours, parts, and so on that control changes in costs) to each gathering

- Partition the complete upward in each gathering by the all out action cost drivers to get your expense driver rate

- Suppose you apportion $10,000 in upward to setting up 4,000 machines (your expense drivers). Your expense driver rate would be $2.50 ($10,000/4,000). Presently, you need to realize how much goes toward Product XYZ. 200 of the machines you set up were Product XYZ. Your upward expenses for Product XYZ were $500 ($2.50 X 200).

- Keep steady over your business’ accounts by refreshing your books. With Patriot’s internet bookkeeping programming, following your costs and pay doesn’t need to be troublesome. Get your free preliminary today!

- Action based costing (ABC) is a framework you can use to observe creation costs. It separates upward expenses between creation related exercises. The ABC framework allocates expenses for every action that goes into creation, for example, laborers testing an item. Action based costing (ABC) is a framework that separates upward expenses between creation related exercises.

- Producing organizations with high upward costs use Action based costing to get a more clear image of where cash is going. Since ABC gives explicit creation cost breakdowns, you can see which items are really beneficial.

- Perceive that various items require different roundabout costs

- All the more precisely set costs

- See which upward costs you could possibly scale back

- ABC gives an option in contrast to customary costing. Customary costing applies a normal upward rate to coordinate creation costs in view of an expense driver (e.g., hours or volume).

- In any case, some creation related exercises utilize more upward costs than others. Accordingly, customary costing can give an incorrect expense of making every item.

- Conventional costing is less difficult yet less explicit than action based costing. You should think about going with customary costing assuming you just make a couple of items.

- You may likewise involve customary costing for revealing remotely (e.g., to financial backers) and action based costing for announcing inside (e.g., to supervisors).

- Planning

- Upward choices

- Item estimating

- While making your spending plan for the year, you likely attempt to get as explicit as conceivable with regards to your approaching and active cash.

- Action based costing can assist you with putting a precise financial plan that separates precisely where your cash is going-and which items are the most beneficial.

- The ABC framework shows you how you utilize upward expenses, which assists you with deciding if certain exercises are fundamental for creation.

- Action based costing assists you with recognizing where you’re squandering cash. Assuming you see that a few exercises cost more than they ought to, you can track down new strategies to accomplish something. Or then again, you can remove steps (and even items.

- One more advantage of ABC is exact item evaluating. Evaluating items can be one of the most tough choices you make in business.

- Neglecting to think about every one of your expenses could bring about setting your costs excessively low. Thus, you probably won’t end up with a solid overall revenue.

- With an ABC framework, you can allocate expenses for every action in the creation cycle. This shows you every one of the costs that go into delivering a particular item. You can utilize this information to set a value that all the more precisely represents the amount it costs you to make the item.

- Action based costing is more confounded than conventional costing. Rather than general upward expenses and creation related exercises, you should be explicit.

- How long is Employee A spending on Activity XYZ? Shouldn’t something be said about power how might you separate utility expenses by Action?

- Getting off course can make it hard to follow information without an intricate (and proven) framework. Also, a few organizations don’t have the work positions and assets to deal with an ABC framework.

- Sadly, there isn’t a costing technique that provides you with a totally exact breakdown of your expenses. So albeit an ABC framework is more exact and nitty gritty than customary costing, it isn’t 100 percent precise.

- For instance, the ABC framework expects representatives to follow how long they spend on every action (e.g., research, creation, and so on) Your representatives may misjudge or even overstate their time spent chipping away at an action.

- (Upward for Cost Pool/Cost Drivers) X Amount of Activity Cost Driver

- Presently, we should make a stride back and go over what precisely this implies.

- An expense pool is a gathering of individual expenses related with a Action. You can make cost pools by recognizing the exercises that go into making an item. Whenever you’ve gathered your expenses into a pool, see as the complete upward. Remember that there’s no set number of gatherings you really want to have.

- An expense driver is something that controls changes in the expense of a Action. Instances of cost drivers incorporate units, work or machine hours, and parts. Relegate cost drivers (you can have mutiple) to each cost pool.

- At the point when you partition the all out upward in an expense pool by your all out cost drivers, you get an expense driver rate.

- Distinguish every one of the exercises that go into making an item (tip: assuming you burn through cash on it, add it in!)

- Separate every Action into gatherings (e.g., product offering)

- Track down the all out upward for each cost pool

- Allocate Action cost drivers (units, hours, parts, and so on that control changes in costs) to each gathering

- Partition the complete upward in each gathering by the all out action cost drivers to get your expense driver rate

- Suppose you apportion $10,000 in upward to setting up 4,000 machines (your expense drivers). Your expense driver rate would be $2.50 ($10,000/4,000). Presently, you need to realize how much goes toward Product XYZ. 200 of the machines you set up were Product XYZ. Your upward expenses for Product XYZ were $500 ($2.50 X 200).

- Keep steady over your business’ accounts by refreshing your books. With Patriot’s internet bookkeeping programming, following your costs and pay doesn’t need to be troublesome. Get your free preliminary today!

Introduction to Activity based costing

Action-based costing (ABC) is a costing strategy that allocates upward and aberrant expenses to related items and administrations. This bookkeeping technique for costing perceives the connection between costs, upward exercises, and made items, appointing roundabout expenses for items less discretionarily than conventional costing strategies. Be that as it may, a few roundabout expenses, for example, the board and office staff compensations, are hard to dole out to an item.

Action Based Costing (ABC)

How Activity-Based Costing (ABC) Works?

Action based costing (ABC) is generally utilized in the assembling business since it upgrades the unwavering quality of cost information, subsequently creating almost obvious expenses and better ordering the expenses caused by the organization during its creation cycle.

Key Takeways

The ABC estimation is as per the following:

Duplicate the expense driver rate by the quantity of cost drivers.

As a Action based costing model, consider Company ABC that has a $50,000 each year power bill. The quantity of work hours straightforwardly affects the electric bill. For the year, there were 2,500 work hours worked, which in this model is the expense driver. Computing the expense driver rate is finished by separating the $50,000 every year electric bill by the 2,500 hours, yielding an expense driver pace of $20. For Product XYZ, the organization involves power for 10 hours. The upward expenses for the item are $200, or $20 times 10.

Action based costing benefits the costing system by extending the quantity of cost pools that can be utilized to investigate upward expenses and by making roundabout expenses recognizable to specific exercises.

Prerequisites for Activity-Based Costing (ABC)

Advantages of Activity-Based Costing (ABC)

By utilizing action based costing, you can:

Action based costing versus customary costing.

Advantages and disadvantages of Action based costing

Albeit an action based costing framework gives you exact creation cost subtleties, it very well may be hard to carry out. That is the reason you ought to think about the upsides and downsides prior to choosing if it’s ideal for your business.

Item evaluating

Investigate an action based costing recipe you can utilize:

Bit by bit breakdown

Here is a breakdown of the means that go into Action based costing:

Duplicate the expense driver rate by how much Action cost drivers:

By utilizing action based costing, you can:

Think about both the immediate and upward expenses of making every item:

Action based costing versus customary costing.

Advantages and disadvantages of Action based costing

Albeit an action based costing framework gives you exact creation cost subtleties, it very well may be hard to carry out. That is the reason you ought to think about the upsides and downsides prior to choosing if it’s ideal for your business.

Advantages of Action based costing

ABC costing can assist with:

Planning

Upward choices

Item evaluating

Disadvantages of an ABC framework

Prior to executing this kind of costing technique, think about the cons:

Complex

Not 100 percent precise

Action based costing estimation

Keen on involving the ABC framework in your business? To utilize this costing framework, you want to comprehend the most common way of appointing expenses for exercises. Investigate an action based costing recipe you can utilize:

Bit by bit breakdown

Here is a breakdown of the means that go into Action based costing:

Duplicate the expense driver rate by how much Action cost drivers

Too Many Cost Pools

The upside of an ABC framework is the excellent of data that it produces, however this comes at the expense of utilizing countless expense pools – and the more expense pools there are, the more noteworthy the expense of dealing with the framework. To lessen this expense, run a continuous examination of the expense to keep up with each cost pool, in contrast with the utility of the subsequent data. Doing as such should keep the quantity of cost pools down to sensible extents.

Hard to Install

ABC frameworks are famously hard to introduce, with long term establishments being the standard when an organization endeavors to introduce it across all product offerings and offices. For such thorough establishments, it is hard to keep a significant degree of the board and monetary help as the months roll by without establishment being finished. Achievement rates are a lot higher for more modest, more designated ABC establishments.

Requires Data from Many Sources

An ABC framework might require information input from numerous divisions, and every one of those offices might have more noteworthy needs than the ABC framework. Accordingly, the bigger the quantity of offices engaged with the framework, the more noteworthy the danger that information data sources will come up short after some time. This issue can be kept away from by planning the framework to just need data from the most strong supervisors.

Data Only Collected Once

Numerous ABC projects are approved on a task premise, so data is just gathered once; the data is valuable for an organization’s present functional circumstance, and it progressively decreases in helpfulness as the functional design changes after some time. The executives may not approve subsidizing for extra ABC projects later on, so ABC will in general be “done” once and afterward disposed of. To alleviate this issue, work as a large part of the ABC information assortment structure into the current bookkeeping framework, so the expense of these tasks is diminished; at a lower cost, all things considered, extra ABC ventures will be approved later on.

Evasion of Slack Time Reporting

At the point when an organization requests that its representatives report on the time spent on different exercises, they have a solid propensity to ensure that the announced sums equivalent 100 percent of their time. Notwithstanding, there is a lot of slack time in anybody’s work day that might include breaks, managerial gatherings, messing around on the Internet, etc. Workers generally cover these exercises by allotting more opportunity to different exercises. These expanded numbers address misallocations of expenses in the ABC framework, once in a while by very significant sums.

Requires Additional Data

An ABC framework seldom can be developed to pull all of the data it needs straightforwardly from the overall record. All things considered, it requires a different data set that pulls in data from a few sources, just one of which is existing general record accounts. It very well may be very hard to keep up with this additional data set, since it calls for critical additional staff time for which there may not be a sufficient financial plan. The best work-around is to plan the framework to require the base measure of extra data other than that which is as of now accessible in the overall record.

Just Needed in a Complex Environment

The advantages of ABC are most clear while cost bookkeeping data is hard to recognize, because of the presence of different product offerings, machines being utilized for the creation of numerous items, various machine arrangements, etc – as such, in complex creation conditions. On the off chance that an organization doesn’t work in such a climate, then, at that point, it might burn through a lot of cash on an ABC establishment, just to see that the subsequent data isn’t excessively important.

Conclusion

The expansive scope of issues noted here should clarify that ABC will in general follow a rough way in numerous associations, with an inclination for its handiness to decay after some time. Of the issue moderation ideas noted here, the central issue is to develop a profoundly designated ABC framework that delivers the most basic data at a sensible expense. On the off chance that that framework flourishes in your organization, think about a steady extension, during which you possibly extend further assuming there is a reasonable and evident advantage in doing as such. The most terrible thing you can do is to introduce a huge and thorough ABC framework, since it is costly, meets with the most opposition, and is the probably going to fall flat over the long haul.