- Introduction to Financial Performance

- Understanding Financial Performance

- Recording Financial Performance

- Budget summaries

- The extent of Financial Mangement

- Types of Financial Analysis

- Monetary Analysis Best Practices

- To Improve Financial Performance

- Nature, Significance of Financial Management

- Conclusion

- Monetary execution informs financial backers concerning the overall prosperity of a firm. It’s a preview of its monetary wellbeing and the work its administration is doing.

- A vital archive in announcing corporate monetary execution is Form 10-K, which all open organizations are expected to distribute every year.

- Budget summaries utilized in assessing by and large monetary execution incorporate the accounting report, the pay proclamation, and the assertion of incomes.

- Monetary execution markers are quantifiable measurements used to gauge how well an organization is doing.

- No single measure ought to be utilized to characterize the monetary presentation of a firm.

- There are numerous partners in an organization, including exchange lenders, bondholders, financial backers, representatives, and the executives.

- Each gathering has its own advantage in following the monetary execution of an organization.

- The monetary presentation recognizes how well an organization produces incomes and deals with its resources, liabilities, and the monetary interests of its stake-and investors.

- There are numerous ways of estimating monetary execution, however all actions should be taken in total. Details, like income from activities, working pay, or income from tasks can be utilized, as well as all out unit deals. Moreover, the expert or financial backer might wish to look further into budget reports and search out edge development rates or any declining obligation.

- The accounting report is a depiction of the funds of an association starting at a specific date. It gives an outline of how well the organization deals with its resources and liabilities.

- Experts can track down data about long haul versus momentary obligation on the accounting report. They can likewise observe data regarding what sort of resources the organization possesses and which level of resources are financed with liabilities versus investors’ value.

- The pay articulation gives an outline of tasks to the whole year. The pay articulation begins with deals or incomes and finishes with net gain.

- Additionally alluded to as the benefit and deficit articulation, the pay proclamation gives the net overall revenue, the expense of merchandise sold, working net revenue, and net revenue.

- It likewise gives an outline of the quantity of offers exceptional, as well as a correlation against the presentation of the earlier year.

- The income explanation is a mix of both the pay articulation and the monetary record. For certain examiners, the income proclamation is the main fiscal report since it gives a compromise between net gain and income.

- This is the place where investigators perceive how much the organization spent on stock repurchases, profits, and capital consumptions.

- It additionally gives the source and employments of income from tasks, contributing, and financing.

- Vertical

- Even

- Influence

- Development

- Productivity

- Liquidity

- Proficiency

- Income

- Paces of Return

- Valuation

- Situation and Sensitivity

- Change

- This kind of monetary examination includes taking a gander at different parts of the pay proclamation and separating them by income to communicate them as a rate.

- For this activity to be best, the outcomes ought to be benchmarked against different organizations in a similar industry to perceive how well the organization is performing.

- This cycle is likewise here and there called a typical measured pay proclamation, as it permits an examiner to look at organizations of changed sizes by assessing their edges rather than their dollars.

- Even examination includes requiring quite a while of monetary information and contrasting them with one another to decide a development rate.

- This will assist an examiner with deciding whether an organization is developing or declining, and recognize significant patterns.

- While building monetary models, there will commonly be somewhere around three years of authentic monetary data and five years of determined data.

- This gives 8+ long stretches of information to play out a significant pattern investigation, which can be benchmarked against different organizations in a similar industry.

- Leverage proportions are perhaps the most widely recognized techniques examiner use to assess organization execution.

- A solitary monetary measurement, similar to add up to obligation, may not be that wise all alone, so it’s useful to contrast it with an organization’s complete value to get a full image of the capital construction.

- Dupont investigation – a mix of proportions, frequently alluded to as the pyramid of proportions, including influence and liquidity examination

- Investigating authentic development rates and projecting future ones are a major piece of any monetary investigator’s work.

- Productivity is a kind of pay proclamation examination where an expert evaluates how alluring the financial aspects of a business are.

- This is a kind of monetary investigation that spotlights on the accounting report, especially, an organization’s capacity to meet transient commitments (those due in under a year).

- Proficiency proportions are a fundamental piece of any strong monetary examination. These proportions see how well an organization deals with its resources and utilizations them to create income and income.

- As is commonly said in finance, cash is best, and, accordingly, a major accentuation is put on an organization’s capacity to create income.

- Experts across a wide scope of money vocations invest a lot of energy seeing organizations’ income profiles.

- The Statement of Cash Flows is an incredible spot to get everything rolling, including taking a gander at every one of the three principle areas: working exercises, contributing exercises, and financing exercises.

- By the day’s end, financial backers, moneylenders, and money experts, by and large, are centered around what sort of hazard changed pace of return they can bring in on their cash.

- Return on Equity (ROE)

- Return on Assets (ROA)

- Return on contributed capital (ROIC)

- Profit Yield

- Capital Gain

- Bookkeeping pace of return (ARR)

- Inner Rate of Return (IRR)

- The method involved with assessing what a business is worth is a significant part of monetary examination, and experts in the business invest a lot of energy building monetary models in Excel.

- The worth of a business can be evaluated in a wide range of ways, and experts need to utilize a mix of techniques to show up at a sensible assessment.

- Cost Approach

- The expense to construct/supplant

- Relative Value (market approach)

- Similar organization investigation

- Point of reference exchanges

- Inborn Value

- Limited income examination

- One more part of monetary demonstrating and valuation is performing situation and responsiveness examination as an approach to estimating hazard.

- Since the undertaking of building a model to esteem an organization is an endeavor to foresee the future, it is innately extremely dubious.

- Building situations and performing responsiveness investigation can assist with figuring out what the most pessimistic scenario or best-case future for an organization could resemble.

- Administrators of organizations working in monetary preparation and investigation (FP&A) will frequently set up these situations to assist an organization with setting up its financial plans and figures.

- Venture experts will check out how touchy the worth of an organization is as changes in suspicions move through the model utilizing Goal Seek and Data Tables.

- Fluctuation investigation is the most common way of contrasting real outcomes with a spending plan or conjecture.

- It is a vital piece of the inner preparation and planning process at a working organization, especially for experts working in the bookkeeping and money offices.

- The cycle ordinarily includes taking a gander at whether a fluctuation was great or ominous and afterward separating it to figure out what its main driver was.

- For instance, an organization had a spending plan of $2.5 million of income and had real aftereffects of $2.6 million. This outcomes in a $0.1 million ideal change, which was because of surprisingly high volumes (instead of greater costs).

- Being incredibly coordinated with information

- Keeping all equations and estimations as basic as could be expected

- Making notes and remarks in cells

- Reviewing and stress testing accounting pages

- Having a few people audit the work

- Working in overt repetitiveness checks

- Utilizing information tables and outlines/charts to introduce information

- Making sound, information based presumptions

- Outrageous scrupulousness, while remembering the 10,000 foot view

- Selling undesirable/unused resources

- Patching up spending plans

- Diminishing costs

- Solidifying or renegotiating current obligation; applying for government credits or awards

- Examining budget reports and execution pointers, preferably with an expert’s assistance

- A few specialists accept that monetary administration is tied in with giving assets required by a business based on conditions that are generally ideal, remembering its destinations.

- Thusly, this approach concerns basically with the acquisition of assets which might incorporate instruments, foundations, and practices to raise reserves. It additionally deals with the legitimate and bookkeeping connection between an undertaking and its wellspring of assets.

- One more arrangement of specialists accept that money is about cash. Since all deals include cash, straightforwardly or in a roundabout way, finance is worried about everything done by the business.

- The third and all the more generally acknowledged perspective is that monetary administration incorporates the acquirement of assets and their powerful use.

- For instance, on account of an assembling organization, monetary administration should guarantee that assets are accessible for introducing the creation plant and apparatus.

- Further, it should likewise guarantee that the benefits enough remunerate the expenses and dangers borne by the business.

- In a created market, most organizations can raise capital without any problem. In any case, the genuine issue is the productive use of the capital through powerful monetary preparation and control.

Introduction to Financial Performance :-

Financial examination includes utilizing monetary information to survey an organization’s exhibition and create proposals concerning how it can work on going ahead. Monetary Analysts essentially complete their work in Excel, utilizing a bookkeeping page to investigate verifiable information and make projections of how they figure the organization will act later on. This guide will cover the most well-known kinds of monetary examination performed by experts. Learn more in CFI’s Financial Analysis Fundamentals Course.

Financial execution is an emotional proportion of how well a firm can utilize resources from its essential method of business and create incomes.The term is additionally utilized as an overall proportion of an association’s in general monetary wellbeing over a given period.Investigators and financial backers utilize monetary execution to analyze comparative firms across a similar industry or to look at businesses or areas in total.

KEY TAKEAWAYS :

Understanding Financial Performance :-

Recording Financial Performance :-

A critical record in revealing corporate monetary execution, one vigorously depended on by research experts, is Form 10-K. The Securities and Exchange Commission (SEC) requires all open organizations to record and distribute this yearly archive. Its motivation is to furnish partners with precise and solid information and data that give an outline of the organization’s monetary wellbeing.Autonomous bookkeepers review the data in a 10-K, and friends the board signs it and other revelation reports.

Accordingly, the 10K addresses the most exhaustive wellspring of data on monetary execution made accessible to financial backers yearly.An organization’s Form 10-K must be open to the general population. Any individual who wishes to look at one can go to the SEC’s Electronic Data Gathering, Analysis and Retrieval (EDGAR) data set. You can look by organization name, ticker image, or SEC Central Index Key (CIK). Many organizations likewise post their 10-Ks on their sites, in an “Financial backer Relations” segment.

Budget summaries :-

Remembered for the 10K are three budget summaries: the accounting report, the pay explanation, and the income proclamation.

Accounting report :

Pay Statement :

Income Statement :

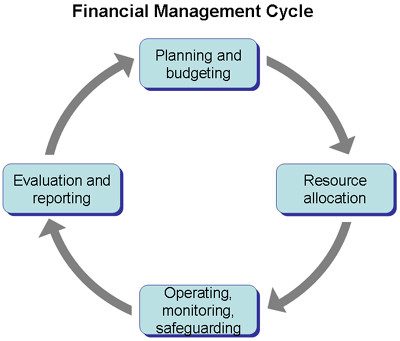

The extent of Financial Mangement :-

The prologue to monetary administration additionally expects you to comprehend the extent of monetary administration. Monetary choices should deal with the investors’ advantages. Further, they are maintained by the expansion of the abundance of the investors, which relies upon the increment in total assets, capital put resources into the business, and furrowed back benefits for the development and flourishing of the association.

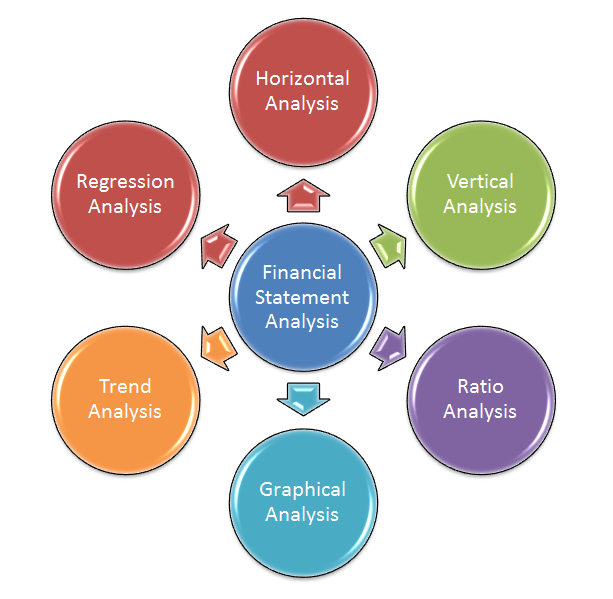

Types of Financial Analysis :-

The most well-known sorts of monetary investigation are:

Vertical Analysis :

Horizontal Analysis :

Leverage Analysis :

Growth Rates :

Profitability Analysis :

Liquidity Analysis :

Efficiency Analysis :

Cash Flow :

Rates of Return :

Thusly, surveying paces of profit from venture (ROI) is basic in the business. Normal instances of paces of return measures include:

Valuation Analysis :

Ways to deal with valuation include:

Scenario and Sensitivity Analysis :

Variance Analysis :

Monetary Analysis Best Practices :-

All of the above techniques are regularly acted in Excel utilizing a wide scope of recipes, capacities, and console easy routes. Examiners should be certain they are utilizing best practices while playing out their work, given the huge worth that is in question and the penchant of enormous informational indexes to have mistakes.

Best practices include:

To Improve Financial Performance :-

An organization’s monetary exhibition can be worked on in various ways. Obviously, attempting to distinguish any barriers or grinding focuses and the wellspring of these issues is the initial step. Different techniques include:

Nature, Significance of Financial Management :-

Monetary administration is a natural capacity of any business. Any association needs funds to acquire actual assets, complete the creation exercises and other business activities, pay to the providers, and so on There are numerous speculations around monetary administration:

Conclusion :-

Financial analysis determines a company’s health and stability, providing an understanding of how the company conducts its business. But it is important to know that financial statement analysis has its limitations as well.