- Introduction to SAP FICO

- Contrast SAP FICO and controlling methodology

- The monetary synopses are huge for any business

- Precisely treat have any knowledge of the SAP FICO

- Number of periods in the SAP FICO

- Expenses are managed in the SAP FICO

- Significant employments of SAP FICO

- Greatest benefits of SAP FICO

- Financial Statement transformation in the SAP FICO

- Asset classes are critical in SAP

- Credit-control locale in the SAP

- Outline of SAP FICO

- Features of SAP FISCO

- Importance of SAP FISCO

- Instructions to Create a Company in SAP

- Conclusion

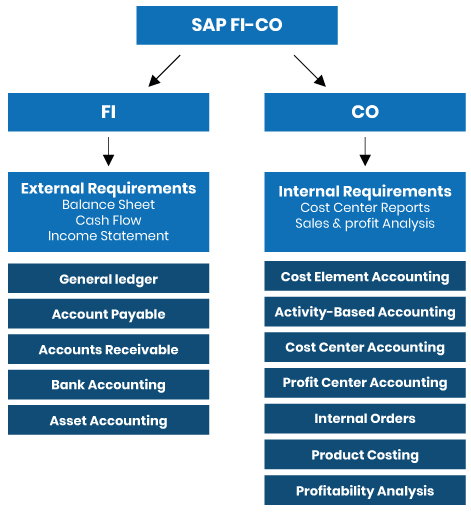

- Prologue to SAP FICO SAP FI is a module used for uncovering both from a distance and inside. The objective is to record all financial trades that are posted by a component and produce spending plan reports which are definite close to the completion of the trading time period. This educational exercise will explain the huge functionalities with SAP FI module.

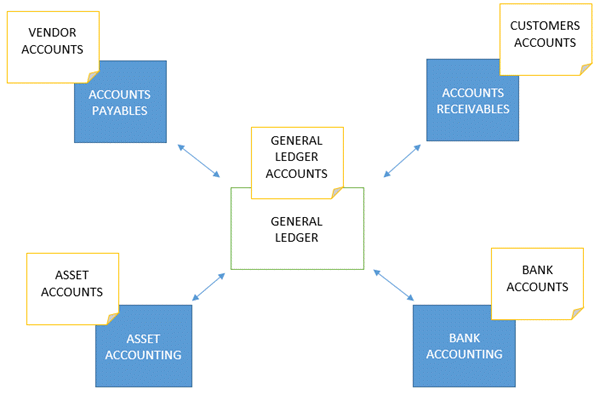

- SAP FI is included sub modules. The sub-modules that are routinely used are accounts receivables, accounts payables, asset accounting, general record Accounting and bank accounting. All of the sub modules are interlinked and fuse constantly. A fundamental balance can be isolated at a time and it will everlastingly change considering the way that all of the sub modules are related. The diagram underneath shows the mix between SAP FI modules.

- General record accounting All expansive record accounts that are used for reporting are administered through wide record accounting. In SAP a lot of all expansive record accounts used by an association or a social event of associations is known as a chart of records. These are the records that will be used for the preparation of monetary reports.

- A enormous part of the trades are recorded in sub modules and they are obliged with the general records continuously. Trades that should be conceivable in direct generally record Accounting consolidate journal vouchers which are introduced on change or right exchanges.

- Inversions should moreover be conceivable from general record accounting. Balances generally speaking record records can be shown and primer changes eliminated from the structure. Accounts receivables Accounts receivables is a sub module that gets all trades with clients and regulates client accounts.

- Separate client records will be stayed aware of and when trades are posted in client accounts, compromise accounts in general record are invigorated with the figures constantly. Trades in accounts receivables consolidate receipt posting, credit notice posting, front and center portions, receipt portion, dunning and executing client reports. Accounts payables Accounts payables is a sub module that gets all trades with vendors and supervises vender accounts.

- Separate vender accounts are stayed aware of and when trades are posted in client accounts, compromise accounts generally speaking record are revived with the figures consistently. Trades in accounts payables fuse receipt posting, credit update posting, front and center portions, receipt portion, customized portion program and executing trader reports. Asset accounting Asset accounting manages all trades realted to assets for a component.

- At the moment that trades are posted in asset accounts ,compromise accounts generally speaking record are invigorated logically. Trades in asset accounting join asset acquiring, asset retirement, asset bargain, asset move, asset revaluation and asset depreciation. Bank accounting Bank accounting gets all trades with the banks.

- Bank compromise is done to oblige all trades recorded on bank clarifications standing out them from trades in the system. All SAP FI sub-modules are joined and trades are revived continuously which infers exact monetary reports can be removed from the system whenever.

Introduction to SAP FICO :-

- In terms of versatility, SAP FICO is great Other equivalent approaches are not commonly so particularly versatile as SAP FICO

- There are additional decisions for accounting controlling and incorporation Account compromise is either confounding or missing

- SAP FICO license various financial norms to be dealt with No additional decisions for money

- While managing the SAP FICO strangely, the clients really must zero in on the trading scale

- The default transformation scale in the FICO is the Average Rate.

- It isn’t for the most part crucial that everyone needs to include the FICO in a comparable way.

- along these lines, it ought to be changed by the prerequisite.

Contrast SAP FICO and controlling technique :-

The monetary outlines are huge for any business :-

Indeed, it simply engages them to look out for the purposes behind which a specific aggregate sent including every one of its information. The clients can basically keep a high level record of the huge number of resources got or moved to another record. This engages them to prepare files for the future on which a couple of huge plans and dynamic procedures are based. Spending plan reports also enable associations to get diminishes in charges in a few cases. Also, the clients can get to the record of the large number of financial trades at whatever point the comparable is required.

Feasible for the clients to arrange financial accounting: There are a couple of accommodating modules where it is serviceable for the clients to ponder this strategy in a joined manner. These join Material Management, Sales and Distribution, Production Planning, money related trade the board, similarly as Human asset.

Year Dependent Fiscal Year in SAP:In associations, it’s unreasonable that all months have 30 days working. Dependent upon the kind of exercises which change for the most part, the affiliations need to end a month every day earlier or two. For example, the Month of May can have 29 days. The comparable should be conceivable with a decision in the SAP which is known as Year Dependent Fiscal Year.

- FICO addresses Financial Accounting and Controlling. It is basically a critical instrument that is useful in arranging announcements about the cash associated with an affiliation or a business. Additionally, FICO can similarly be considered to account, charge computations, setting up the stock sheets, money related data stockpiling.

- The clients need not worry about the security of the data and similarly, it basically guarantees regulating and involving the data in a trustworthy way.

- Normal clarifications behind bumbles in accounting and what impact do they truly have on the association.

- Mistakes are of a lot of types and can be a direct result of an alternate bunch of reasons. The clients can regularly submit blunders. A lone wrong section of just a single digit can get a huge load of issues the affiliation and can misdirect about the advantages and mishaps.

- Mistakes can be a result of remissness of clients, inadequacy in the system, wrongly set up bills or claims, gross goofs, fundamental accounting botches, bungles in light of not reviving the sheets, etc.

- Organization code and it’ss use and the limit on the financial guidelines

- It is on a very basic level a code that ought to be gone into the structure concerning making the Loss or the advantage clarifications.

- It isn’t reliably fundamental that all of the specialists are given permission to the same. It is serviceable for the clients to plan up to 3 money related structures and among which one generally remains area and the other can be considered as equal.

Precisely treat have any knowledge of the SAP FICO :-

Number of periods in the SAP FICO :-

There is a total of 165 periods among which 4 are considered one of a kind. They are all around used concerning portraying any data that is associated with the monetary year. A client is permitted to consider the exceptional period at whatever point the prerequisite for the comparable is felt.

In the SAP plan ,”Year Shift” : SAP doesn’t have any course of action to get to speed up year. It simply understands the timetable year. Regardless, it isn’t by and large fundamental that for all affiliations the timetable year is the financial year. There is every now and again a need to change months. They ought to have been added or disposed of. This should be conceivable really in the SAP and a comparable framework is known as Year Shift.

- One of the huge issues is Tax Slabs are not similar in all countries. Similarly, there are additional costs relevant there. SAP FICO has an obligation technique recently described in it for various nations and the clients are permitted to get the information concerning something almost identical. The Tax aggregates can be sent off loads obviously or the clients are permitted to make challenges in them as indicated by their need and convince. As such, charges are not an issue with the SAP FICO.

- Treat have knowledge of the Substitutions and endorsements in SAP.They have normally described assets for the different viable areas. They can be gotten to through two decisions and are Document level and line level.

Expenses are managed in the SAP FICO :-

Significant employments of SAP FICO :-

SAP FICO has a couple of huge applications for which it is truly known. It is comprehensively seen as I Financial addressing dealing with a huge load of tasks that have an effect on the affiliations. Believe it or not, the main thing that is in any capacity significant in accounting can without a very remarkable stretch be managed with this procedure.

It moreover has applications in Asset and Cost Accounting. The Project system accounting can moreover be directed in a strong manner. The clients are permitted to consider it with the ultimate objective of Consolidation. Also, SAP FICO has colossal extension applications in Real Estate which is one of the emerging spaces across the globe in the current situation.

- One of the huge benefits is accounting data is correct constantly. The clients don’t need to worry about this

- There could be no farthest limit on dealing with the records. Many records can be made due

- It is useful in analyzing as an eye can be kept on the trades made by the business

- It guarantees financial straightforwardness

- The point by point information about the expenses can be prepared and the comparable can then be considered to set up the future monetary plans

- A ton of time and money can be saved

- The clients can guarantee money related outcomes that can be trusted over the long haul

Greatest benefits of SAP FICO :-

There are certain benefits and two or three huge ones are featured underneath:

Financial Statement transformation in the SAP FICO :-

It is essentially a gadget that is used for reporting. All of the financial records can be isolated through it close by every one of the relevant information required by the clients. It is possible to pass it on to make the aftereffects of different workplaces related with a business. A comparable information can then be passed to the concerned specialists for advancement.

1. Field status Group:At the moment that trades are done, there are consistently handles that surface, this decision is used or is engaged when they are not required while managing the tasks. SAP FICO Interview Questions for Experienced

2. Requirements which clients need to manage respects to report clearing :The essential thing to guarantee is whether or not the things get cleared status by the organization. Next is to guarantee that the file is significant or not.

3. Precisely treat call a short-end Fiscal Year:A Short-end Fiscal Year is basically when a timetable year is changed by require. This can happen on account of an astoundingly enormous number of reasons and the affiliations need to embrace the new schedule.

Asset classes are huge in SAP :-

The asset class is the fundamental class that is used to legitimize the assets. The entire asset arrangement is generally given out or joined into one asset class. It is moreover attainable for the clients to include the default regards for something very similar.

Couple of critical pieces of the outlines that matter in bookkeeping:The first and the chief is the essential language. Next is controlling the joining level, name, Block Indicator, GL, account number, and the layout of Account Key.

- Credit Control Area : The client needs to give the controller name, Description, Currency decision is to be picked, danger class is to be picked and subsequently the information about the Fiscal variety is furthermore to be given.

- Posting period Variants : It is in a general sense a time span during which the trade figures are invigorated. Generally, it is dependable to control accounting periods that are complicated.

- Field Status : It is essentially an approach that is used to stay aware of the General Ledger accounts. It controls the fields which should give information on the concerned records.

- Concerning Parallel neighborhood cash in SAP : Affiliations are allowed to add two a bigger number of money decisions than their area. They can be used in the trades made at the International level by an affiliation. The affiliations are permitted to include any two decisions for equivalent that they seem to have more need. They can be named as Group cash and hard money.

Credit-control locale in the SAP :-

The credit-control is in the SAP engages the relationship to compel a serious farthest limit on the credit for the clients. This should be conceivable by using the decision controls are in the SAP. It simply guarantees avoiding the situation like the risk of horrendous commitments and momentous receivables.

Outline of SAP FICO :-

Characterizing an Organization structure is unquestionably the primary arrangement to be done during any SAP execution. Since an association is a legitimate unit for which individual financial reports can be drawn in by the significant business regulation. Thusly SAP FICO planning starts with describing the Org Structure.

An association can include something like one association codes. An association has neighborhood money related guidelines in which the trades that happened are recorded. All association codes inside an association ought to use a comparative trade framework of records and a comparative Fiscal year. Making of association in SAP is discretionary.

- A Fiscal year is apportioned into different posting periods and each posting period in an accounting period is described by a starting date and end date.

- The financial year in SAP FICO getting ready can be described as ‘Subordinate Year’ or ‘Independent Year’.

- SAP FICO planning presents two TAX assessment strategies: TAXIN(Condition Based) and TAXINJ(Formula Based).

- The TAXINN is condition-based, so we want to stay aware of condition records for each condition type, while TAXINJ is formula based, so we really want to stay aware of charge code by using FTP.

- Controlling Area is a central affiliation structure in the CO module of SAP FICO electronic arrangement and is used in cost accounting. Cost concentration and thing dominance hierarchy and advantage centers/efficiency sections are used to describe the controlling region.

- Essential cost parts are available in the standard structure through a diagram of records ADAR. The fundamental cost parts rely upon accounts in FI module of SAP FICO web getting ready and may be disseminated to various cost part gatherings.

- Auxiliary cost parts are posted uniquely in the CO module of SAP FICO web getting ready and are not kept down in the FI General Ledger.

- Auxiliary cost parts look like modern office overheads, Administration overheads, power, diesel, oil, etc General record accounting All expansive record accounts that are used for reporting are administered through wide record accounting. In SAP a lot of all wide record accounts used by an association or a social affair of associations is known as a framework of records.

- These are the records that will be used for the preparation of financial plan reports.

- The larger piece of the trades are recorded in sub modules and they are obliged with the general records continuously.

- Exchanges that should be conceivable in direct in general record Accounting fuse journal vouchers which are introduced on change or right trades. Reversals should in like manner be conceivable from general record accounting.

- Balances in general record records can be shown and fundamental changes removed from the structure. Accounts receivables Accounts receivables is a sub module that gets all trades with clients and directs client accounts.

- Separate client records will be stayed aware of and when trades are posted in client accounts, compromise accounts in general record are revived with the figures constantly.

- Exchanges in accounts receivables join receipt posting, credit notice posting, starting portions, receipt portion, dunning and executing client reports.

Features of SAP FISCO :-

Importance of SAP FISCO :-

Accounts payables Accounts payables is a sub module that gets all trades with dealers and manages shipper accounts. Separate shipper accounts are stayed aware of and when trades are posted in client accounts, compromise accounts generally speaking record are revived with the figures dynamically.

Exchanges in accounts payables consolidate receipt posting, credit notice posting, beginning portions, receipt portion, customized portion program and executing trader reports.Resource accounting Asset accounting manages all trades realted to assets for a substance.

At the moment that trades are posted in asset accounts ,compromise accounts by and large record are revived dynamically. Trades in asset accounting join asset acquiring, asset retirement, asset bargain, asset move, asset revaluation and asset decay.

Bank accounting Bank accounting gets all trades with the banks. Bank compromise is done to oblige all trades recorded on bank enunciations standing out them from trades in the structure. All SAP FI sub-modules are composed and trades are revived continuously which infers exact financial synopses can be removed from the structure whenever.

Instructions to Create a Company in SAP :-

1) Create Company Code

2) Assign Company Code to Company Define Company Code Step

3) Enter Transaction code SPRO in the request field Step

4) In the accompanying screen Select SAP reference IMG Step

5) In next screen Display IMG follow the menu way SAP Customizing Implementation Guide – > Enterprise Structure – >Definition->Financial Accounting->Edit, Copy, Delete, Check Company Code Step

6) In the accompanying screen, select activity – Edit Company Code Data In the Change View Company code screen Step

7) Select New Entries Step

8) In the Next Screen Enter the Following Details

Conclusion :-

SAP FICO plays a vital role to increase business growth. It enables the organizations to extend themselves on a robust foundation of an appropriate accounting channel. SAP FICO can meet all the accounting and financial requirements of an organization.