These SAP Bank Analyzer Interview Questions have been designed specially to get you acquainted with the nature of questions you may encounter during your interview for the subject of SAP Bank Analyzer.As per my experience good interviewers hardly plan to ask any particular question during your interview, normally questions start with some basic concept of the subject and later they continue based on further discussion and what you answer.we are going to cover top 100 SAP Bank Analyzer Interview Questions along with their detailed answers. We will be covering SAP Bank Analyzer scenario based interview questions,SAP Bank Analyzer Interview Questions for freshers as well as SAP Bank Analyzer interview questions and answers for experienced.

1. What are some of the most important features of the SAP bank analyzer?

Ans:

Some of the most important features of SAP Bank Analyzer include:

- Data integration

- Accounting and financial reporting

- Risk management

- Profitability analysis

- Regulatory compliance

2. In a Bank Analyzer, provide an overview of the system landscape.

Ans:

The SAP Bank Analyzer system landscape comprises source systems, the Bank Analyzer core, and various integrated components like databases, regulatory tools, and user interfaces. It enables data integration, financial analysis, and regulatory compliance for financial institutions.

3.In SAP, what is a setup table?

Ans:

In SAP, a setup table is a data structure used for configuring and customizing system behavior during initial setup, allowing organizations to adapt SAP systems to their specific needs without altering the system’s core code.

4. Can an info object serve as a provider of information? If so, how?

Ans:

InfoObjects in SAP BW do not serve as direct providers of information but play a pivotal role in structuring and categorizing data within InfoProviders (e.g., InfoCubes) to provide meaningful context and enable data retrieval for reporting and analysis.

5.Give a summary of the SAP bank analyzer’s primary components.

Ans:

Certainly, here are the main components of SAP Bank Analyzer in short:

- Data Management

- Accounting and Valuation Engine

- Risk and Compliance

- Performance Management

- Business Intelligence and Reporting

6.List a few SAP Bank Analyzer reporting environments.

Ans:

Reporting environments for SAP Bank Analyzer include SAP BW, SAP Analytics Cloud, SAP Crystal Reports, and custom solutions, facilitating financial reporting and analysis for institutions.

7.What functionality can be used to connect the BEx query to the SAP BW?

Ans:

Link a BEx query to SAP BW and analyze query results in a variety of ways with the aid of tools like BEx Query Designer, BEx Analyzer (Excel), Web Application Designer, SAP BusinessObjects tools, and integration into the SAP NetWeaver Portal.

8. Identify the two key SAP modules.

Ans:

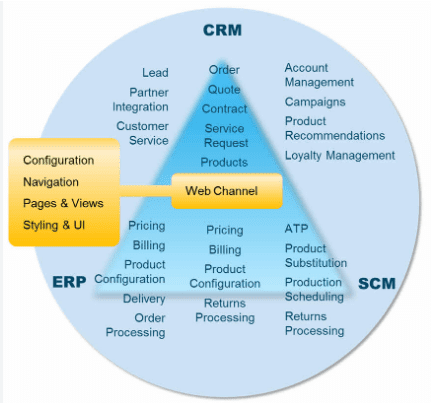

The two key SAP modules are SAP ERP (Enterprise Resource Planning) and SAP CRM (Customer Relationship Management).

9. Give an explanation of “plant-based” using SAP.

Ans:

In SAP, “plant-based” refers to data or processes organized around specific physical locations, such as manufacturing facilities or warehouses, with a focus on activities associated with those individual plants.

10. What is a plant’s extended use?

Ans:

Using a single physical location for many purposes beyond its intended usage is referred to as “plant’s extended use” in SAP Plant Maintenance (PM) in order to maximize resource utilization and operational efficiency.

11. List a few of SAP Bank Analyzer’s most beneficial features.

Ans:

- Data integration, risk management, asset and liability management, regulatory compliance, data governance, customization, interaction with other SAP solutions, and an audit trail for financial institutions are some of the main advantages of SAP Bank Analyzer.

12. Mention the central SAP Bank analyzer system’s setting procedures.

Ans:

To set up a central SAP Bank Analyzer system:

- Plan system architecture.

- Install SAP Bank Analyzer software.

- Configure the database.

- Extract, transform, and load data.

- Define data models.

13.SAP Financial Database: What is it?

Ans:

- As of my last knowledge update in January 2022, there is no specific “SAP Financial Database.

- ” Financial data in SAP is typically stored in databases like SAP HANA or SAP ASE, and there may have been developments or terminologies introduced after that date. For the latest information, consult SAP’s official documentation or resources.

14.What is included in the SAP bank analyzer’s primary setting?

Ans:

As of my last knowledge update in January 2022, there is no specific “SAP Financial Database.” Financial data in SAP is typically stored in databases like SAP HANA or SAP ASE, and there may have been developments or terminologies introduced after that date. For the latest information, consult SAP’s official documentation or resources.

15.Identify the two key SAP modules.

Ans:

Certainly, here are the two key SAP modules in a shorter format:

- SAP FI: Manages financial data, including accounting and assets.

- SAP HCM: Manages human resources processes, such as payroll and recruitment.

16.Identify the key components of SAP Financials.

Ans:

- General Ledger (GL)

- Accounts Payable (AP)

- Accounts Receivable (AR)

- Asset Accounting (AA)

- Bank Accounting (BA)

17. Differentiate between SAP Bank Analyzer and SAP Banking Services.

Ans:

| SAP Bank Analyzer | SAP Banking Services |

|---|---|

| Analyzes bank-specific data for regulatory compliance, risk management, and financial reporting. | Provides core banking functionalities such as account management, transaction processing, and customer relationship management. |

| Focuses on data analysis, reporting, and compliance for banks and financial institutions. | Focuses on operational banking activities, including customer interactions, transaction processing, and product management. |

18.What are the main features of SAP Bank Analyzer 5.0?

Ans:

The main features of SAP Bank Analyzer 5.0 include:

- Financial data integration

- Accounting and reporting, including IFRS 9 compliance

- Risk management

- Profitability analysis

- Asset and liability management (ALM)

- Regulatory compliance (Basel III and IV)

- Data reconciliation

19.What does SAP Bank Analyzer’s data provisioning serve to accomplish?

Ans:

The data provisioning feature of SAP Bank Analyzer is essential for combining and standardizing financial data from various sources. Through information transformation and reconciliation, it guarantees data quality, consistency, and accuracy. Financial reporting, risk management, and regulatory compliance are all supported by this procedure. In order to make decisions quickly, it also makes managing historical data and real-time processing easier.

20. In what ways does SAP Bank Analyzer assist banks in adhering to regulations?

Ans:

SAP Bank Analyzer assists banks in adhering to regulations through data management, regulatory reporting, accounting standard compliance, risk management, liquidity management, Basel compliance, AML/KYC, audit capabilities, real-time monitoring, process automation, and support for stress testing.

21. Describe the SAP Bank Analyzer’s data model.

Ans:

Components for general ledger accounts, financial instruments, business partners, contract management, risk data, accounting rules, aggregated data, regulatory framework, historical data, metadata, hierarchies, and calculation engines are all part of the intricate data model used by the SAP Bank Analyzer. In the banking sector, it offers a thorough framework for handling financial data, doing financial analysis, and guaranteeing regulatory compliance.

22. How does SAP Data Services fit into the SAP Bank Analyzer?

Ans:

SAP Data Services in SAP Bank Analyzer:

- Extracts data from source systems.

- Transforms and cleanses data for accuracy.

- Loads data into the Bank Analyzer.

- Ensures data quality and validation.

- Integrates with the Bank Analyzer data model.

- Supports real-time and batch processing.

23.Which SAP Bank Analyzer implementation options are available?

Ans:

SAP Bank Analyzer implementation options include on-premises, cloud-based, hybrid, managed services, S/4HANA Finance integration, industry-specific solutions, and regulatory reporting solutions. The choice depends on an organization’s needs and preferences.

24.In what ways may SAP Bank Analyzer help banks maintain an adequate level of capital?

Ans:

SAP Bank Analyzer helps banks maintain adequate capital by:

- Enabling risk monitoring and mitigation.

- Facilitating compliance with regulatory capital requirements.

- Supporting data integration for informed capital allocation.

- Optimizing profitability through analysis.

- Allowing for proactive capital planning and stress testing.

25.What function does SAP Bank Analyzer’s SAP Business Planning and Consolidation (BPC) serve?

Ans:

SAP Business Planning and Consolidation (BPC) complements SAP Bank Analyzer by offering functions for financial planning, budgeting, consolidation, and scenario analysis. It helps banks ensure they have adequate capital resources and supports risk management, profitability analysis, and reporting

26.How is credit risk modeling and analysis handled by SAP Bank Analyzer?

Ans:

SAP Bank Analyzer handles credit risk modeling and analysis by integrating data sources, supporting credit scoring models, enabling portfolio analysis, stress testing, impairment accounting, ensuring regulatory compliance, and providing reporting and visualization tools. It helps banks manage credit risk effectively and meet regulatory requirements.

27. How does data get extracted and loaded into SAP Bank Analyzer?

Ans:

To extract and load data into SAP Bank Analyzer, data sources are identified, data is extracted, transformed, and loaded into a staging area. Data mapping and validation are performed before integration into SAP Bank Analyzer’s database. Regular data maintenance and monitoring ensure data accuracy and compliance with regulations.

28.In what ways may SAP Bank Analyzer assist banks in managing their liquidity risk?

Ans:

SAP Bank Analyzer assists banks in managing liquidity risk through:

- Data Integration for a consolidated view of financial data.

- Cash Flow Forecasting to anticipate liquidity needs.

- Stress Testing to assess liquidity under adverse scenarios.

- Liquidity Reporting for compliance with regulatory ratios (LCR, NSFR).

- Intraday Liquidity Monitoring for real-time management.

- Liquidity Stress Test Models for scenario simulations.

- Collateral Management for optimizing liquidity.

29. Which databases and data structures are essential to SAP Bank Analyzer?

Ans:

Utilizing data structures and databases like SAP HANA, SAP Bank Analyzer handles financial data. Analytical engines, data integration tools, regulatory reporting elements, and a data model are the essential components, backed by user interfaces, metadata management, and security procedures. To analyze and present their financial data, financial firms require a few things.

30. Describe parallel accounting and the role it plays in the SAP Bank Analyzer.

Ans:

Parallel accounting in SAP Bank Analyzer involves managing multiple accounting standards to ensure compliance with various regulations and reporting requirements. This is essential for financial institutions operating globally. The software supports the simultaneous maintenance of different accounting sets, enabling accurate financial reporting and regulatory compliance in multiple regions.

31. How is the consolidation and aggregation of financial data handled by SAP Bank Analyzer?

Ans:

- Data from several sources is integrated using SAP Bank Analyzer.

- It guarantees consistency by standardizing data.

- Encourages concurrent accounting for various standards.

- Combines information to create consolidated financial reporting.

- Offers regulatory compliance and reporting tools.

32. What is the SAP Bank Analyzer’s Contract Valuation Engine (CVE) used for?

Ans:

In the banking sector, financial instruments are valued, recorded, and managed using SAP Bank Analyzer’s Contract Valuation Engine (CVE). In addition to supporting financial reporting, asset and liability management, and profitability analysis, it guarantees adherence to accounting rules and helps with risk management.

33. Explain how SAP Bank Analyzer is integrated with other SAP products.

Ans:

Numerous SAP products, including SAP S/4HANA, SAP BW, SAP Business Objects, SAP Compliance, and Risk Management solutions, are integrated with SAP Bank Analyzer. Financial institutions are guaranteed regulatory compliance, real-time reporting, and streamlined data flow thanks to this connectivity.

34.How is reporting and visualization of financial data handled by SAP Bank Analyzer?

Ans:

- The first step in managing financial data with SAP Bank Analyzer is gathering and combining data from multiple sources into a single repository.

- Handling intricate data processing for risk evaluation, compliance computations, and profitability analysis.

- Providing personalized reporting instruments and visualization choices, such as charts and dashboards.

- Using pre-built templates and computations for different regulatory frameworks to ensure regulatory compliance.

35.What role does hedge accounting play in SAP Bank Analyzer?

Ans:

In SAP Bank Analyzer, hedge accounting plays a crucial role in helping banks manage financial risks, comply with accounting standards, and accurately reflect the impact of hedging activities in their financial reports. It involves documenting, assessing, and applying appropriate accounting treatments to hedges, ensuring transparency and compliance.

36. Could you elaborate on the meaning of “risk provisioning” in relation to SAP Bank Analyzer?

Ans:

In SAP Bank Analyzer, “risk provisioning” refers to the practice of setting aside funds to cover potential financial losses, primarily related to credit risk. It involves data analysis, modeling, and compliance with regulatory standards to ensure that a bank is prepared for potential defaults and financial downturns.

37.What part does SAP Bank Analyzer play in banks’ regulatory reporting?

Ans:

- SAP Bank Analyzer centralizes financial data, ensuring data accuracy and consistency.

- It facilitates compliance with various regulatory requirements.

- The solution enhances reporting efficiency, transparency, and risk analysis for banks.

38. How is asset impairment computation supported by SAP Bank Analyzer?

Ans:

SAP Bank Analyzer assists banks in computing asset impairments through data integration, validation, and complex calculation capabilities. It ensures compliance with accounting standards, supports scenario analysis, and streamlines reporting and workflow processes, enhancing the accuracy and efficiency of impairment assessments.

39. How does SAP Bank Analyzer handle data mapping and transformation?

Ans:

SAP Bank Analyzer manages data mapping and transformation through:

- Data Extraction: It extracts financial data from various source systems.

- Data Mapping: It defines how source data corresponds to SAP Bank Analyzer data structures.

- Data Transformation: It converts and cleans data, applying transformation and integration rules.

- Reporting and Analysis: The processed data is used for financial reporting and analysis, helping institutions make informed decisions.

40. How is the computation of credit risk parameters handled by SAP Bank Analyzer?

Ans:

SAP Bank Analyzer handles credit risk parameters through data integration, transformation, and quality checks. It employs various credit risk models, ensures regulatory compliance, and provides reporting and analytics to manage credit risk effectively.

41. Describe SAP Bank Analyzer’s use of event-based accounting.

Ans:

SAP Bank Analyzer uses event-based accounting to capture and process financial transactions as they occur in real-time, ensuring accurate and up-to-date data for analytics, compliance, and risk management. It integrates with a bank’s systems, applies accounting rules, and supports regulatory requirements, improving auditability and decision-making.

42. What role do data preservation and archiving play in SAP Bank Analyzer?

Ans:

Certainly, here are the key points about data preservation and archiving in SAP Bank Analyzer in a brief format:

- Compliance: Ensures adherence to regulations and reporting standards.

- Long-Term Analysis: Facilitates historical data analysis.

- Performance: Improves system performance and reduces costs.

- Cost-Efficiency: Lowers storage expenses.

- Data Accessibility: Organizes data for easy retrieval and analysis.

43. In what ways does SAP Bank Analyzer fulfill Basel III and Basel IV requirements?

Ans:

SAP Bank Analyzer can help banks fulfill Basel III and Basel IV requirements by assisting with data management, risk calculation, regulatory reporting, accounting standards compliance, liquidity risk management, workflow automation, and scenario analysis. However, it’s important to note that compliance is a multifaceted process that involves various components beyond software.

44. What is the main purpose of SAP Bank Analyzer, and how does it work?

Ans:

SAP Bank Analyzer is a banking solution for data management, financial reporting, risk analysis, and compliance. It integrates data from various sources, conducts profitability analysis, and aids in risk assessment for informed decision-making. Through data extraction, transformation, and analysis, it helps banks generate reports, adhere to regulations, and optimize their operations.

45. Could you describe the SAP Bank Analyzer’s architecture?

Ans:

- Data Management: Integrates and transforms banking data.

- Analytical Engine: Performs complex calculations and ensures compliance.

- Reporting and Security Integration: Provides insights and protects data through system connections and security measures.

46.Which are the main SAP Bank Analyzer modules and components?

Ans:

- Accounting for Financial Instruments

- Risk Management

- Profitability Analysis

- Regulatory Compliance

- Data Management and Integration

47. What role does Bank Analyzer play in the banking sector?

Ans:

Bank Analyzer, a SAP solution, supports banks by enabling financial analysis, regulatory compliance, and data-driven decision-making. It aids in assessing performance, ensuring regulatory adherence, and optimizing operations for improved customer service and profitability in the banking sector.

48. What role does Bank Analyzer play in the banking sector?

Ans:

SAP offers a financial product called Bank Analyzer that helps banks with risk management, profitability optimization, regulatory compliance, performance measurement, and data integration. It is essential to the banking industry’s ability to make decisions and operate more efficiently overall.

49. Could you explain the SAP Bank Analyzer’s data model?

Ans:

- The SAP Bank Analyzer data model is a comprehensive structure that organizes banking-specific data such as financial accounting, risk information, analytics, and compliance.

- It integrates diverse data sources, supports reporting, and ensures adherence to regulatory standards, offering a multidimensional view for in-depth analysis of a bank’s operations.

50.What regulatory reporting features does SAP Bank Analyzer offer?

Ans:

- Standardized Reporting Templates: Regulatory standards are predefined templates.

- Automated Compliance Checks: This feature automatically confirms that data complies with rules.

- Integrated Data and Analytics: Provides accurate reporting by combining data and providing analytics.

51.Describe the accounting concepts that SAP Bank Analyzer supports.

Ans:

- SAP Bank Analyzer supports:

- IFRS/GAAP compliance

- Financial instruments accounting

- Risk and compliance reporting

- Profitability analysis

- Financial consolidation

52. Talk about SAP Bank Analyzer’s functionality for data reconciliation.

Ans:

SAP Bank Analyzer’s data reconciliation functionality ensures accuracy by integrating, comparing, and aligning data from various sources. It automates matching, applies rules for consistency checks, handles exceptions, and provides detailed reporting for compliance and process improvement.

53. How does SAP Bank Analyzer work?

Ans:

SAP Bank Analyzer is a software solution for banks, integrating data from various sources, performing complex calculations for reporting, compliance, and risk management, while providing tools for analytics, regulatory compliance, and profitability analysis. It helps banks manage financial data, adhere to regulations, and make informed decisions.

54.What role does SAP Bank Analyzer’s profitability analysis play?

Ans:

- SAP Bank Analyzer’s profitability analysis:

- Measures performance

- Allocates costs accurately

- Analyzes customer profitability

- Assesses risks

- Supports regulatory compliance

55. What kind of assistance does SAP Bank Analyzer provide to banks?

Ans:

SAP Bank Analyzer supports cost management, asset and liability management, accounting, risk management, regulatory compliance, performance analysis, data integration, profitability evaluation, and real-time insights for well-informed decision-making.

56.What are the key components of SAP Bank Analyzer?

Ans:

The following are some of the main functions of SAP Bank Analyzer: data processing and storage, regulatory compliance, risk management, profitability analysis, accounting and financial reporting, system integration, data governance and security, and customization and configuration capabilities.

57. Describe the SAP Bank Analyzer’s data model.

Ans:

Financial data entities comprise information about transactions, accounts, clients, financial instruments, and risk.

- Products and Accounts: Includes a range of financial products and account kinds, each with unique characteristics and conditions.

- Transactional Data: Contains information on every bank and customer transaction connected to certain accounts and clients.

58. What risk management features does SAP Bank Analyzer provide?

Ans:

SAP Bank Analyzer provides risk management features such as credit risk assessment, market risk analysis, liquidity monitoring, operational risk management, compliance support, regulatory reporting, stress testing, scenario analysis, and advanced risk modeling and analytics. These tools help banks identify, assess, and mitigate different types of risks they face in their operations.

59. How is regulatory compliance handled by SAP Bank Analyzer?

Ans:

- Flexible Adaptation: Adjusts to regulatory changes without extensive system reworks.

- Robust Reporting: Generates reports compliant with Basel III, IFRS, AML, and other standards.

- Risk Management Integration: Manages diverse risks to meet regulatory guidelines encompassing credit, market, operational, and compliance risks.

60. What is the main purpose of SAP Bank Analyzer, and how does it work?

Ans:

SAP Bank Analyzer is a specialized software for financial institutions, enabling them to manage, analyze financial data, and meet regulatory standards. It handles financial reporting, risk management, and profitability analysis by integrating, processing, and analyzing data to provide valuable insights for decision-making and compliance.

61. What benefits does SAP Bank Analyzer offer the banking industry?

Ans:

The banking sector gains from SAP Bank Analyzer by: Simplifying financial reporting and analysis, improving one’s ability to manage risks.

- Making profitability analysis easier.

- Supporting adherence to regulations.

- Enhancing integration and administration of data.

62. Describe SAP HANA’s function in the SAP Bank Analyzer.

Ans:

SAP HANA serves as the underlying database and analytics engine in SAP Bank Analyzer. It enables high-speed data processing, in-memory computing, advanced analytics, real-time reporting, and seamless data management. This integration enhances the solution’s performance, allowing banks to make data-driven decisions swiftly and comply with regulatory standards efficiently.

63.What is SAP Bank Analyzer, and what are the main features that it offers?

Ans:

- SAP Bank Analyzer is a specialized financial software for banks. Its main features include financial accounting, risk management, profitability analysis, regulatory compliance, data integration, real-time reporting, and analytics.

- It helps banks manage operations efficiently, comply with regulations, and make informed decisions using comprehensive financial insights.

64. Could you describe the parts of the SAP Bank Analyzer?

Ans:

The SAP Bank Analyzer consists of modules for financial instrument accounting (AFI), financial/management accounting, risk management, regulatory compliance, data management, analytics/reporting, and performance management, catering to banking institutions’ specific needs.

65.What role does Bank Analyzer play in the banking sector?

Ans:

- Financial Analysis and Compliance Reporting: Provides detailed financial analysis and regulatory compliance reporting for a bank’s performance and adherence to industry standards.

- Risk Management and Performance Evaluation: Assists in managing risks (credit, market, operational) and provides tools for performance evaluation, aiding in decision-making processes.

67.What is the definition of the data model that SAP Bank Analyzer uses?

Ans:

The data model in SAP Bank Analyzer is the structured framework used to organize, store, and manage financial data specific to banking operations. It includes entities like accounts, transactions, risk data, and customer information, enabling efficient processing and analysis for reporting and decision-making in the banking sector.

68. What exactly is SAP Bank Analyzer, and what is its key function?

Ans:

SAP Bank Analyzer is a specialized solution for managing financial data in banks. Financial reporting, risk management, profitability analysis, data integration, compliance, and performance evaluation are among its essential roles. It assists banks in meeting regulatory requirements, assessing risks, analyzing profitability, and making data-driven choices.

69. What is the main goal of SAP Bank Analyzer 4.0?

Ans:

The main goals of SAP Bank Analyzer 4.0 are:

- Regulatory compliance

- Financial reporting and analysis

- Risk management

- Data management and integration.

70. What are the most important modules in SAP Bank Analyzer?

Ans:

SAP Bank Analyzer’s pivotal modules include AFI for financial instrument accounting, PA for profitability analysis, risk management and compliance, and data integration. These ensure accurate accounting, profitability insights, regulatory adherence, and integrated data handling for efficient banking operations.

71. What are the primary features of SAP Bank Analyzer?

Ans:

- Data Management: Integrates and manages financial data.

- Financial Reporting: Generates reports and statements.

- Risk Management: Assesses and manages various risks.

- Profitability Analysis: Analyzes product/customer profitability.

72. What exactly is SAP Bank Analyzer?

Ans:

SAP Bank Analyzer is specialized SAP software for banks. It helps with regulatory compliance, risk analysis, financial reporting, and performance monitoring by managing banking data. It collects data, ensures compliance with accounting standards, analyzes risks, and aids decision-making for improved performance.

73. What benefits does SAP Bank Analyzer bring to financial processes?

Ans:

SAP Bank Analyzer benefits financial processes by improving risk management, ensuring regulatory compliance, enabling detailed financial reporting and analysis, optimizing profitability analysis, streamlining data management, enhancing cost efficiency, aiding in asset and liability management, providing real-time insights, enhancing performance, and offering valuable customer insights.

74. What are the main components of SAP Bank Analyzer?

Ans:

- Data Management: Handles data extraction, transformation, and loading processes from various bank systems.

- Financial and Risk Analysis: Provides modules for financial analysis, risk management, and profitability evaluations.

- Accounting and Reporting: Manages accounting processes and ensures compliance with accounting standards and regulations.

75. Describe the importance of risk management in SAP Bank Analyzer.

Ans:

Risk management within SAP Bank Analyzer is critical for financial institutions due to regulatory compliance, identifying and mitigating various risks (credit, market, operational), ensuring financial stability, aiding decision-making, aligning assets and liabilities, managing credit risks, and providing accurate data-driven insights and reports for informed decisions and regulatory compliance.

76. What advantages can SAP Bank Analyzer provide financial institutions?

Ans:

- Integrated platform for comprehensive financial data management.

- Accurate reporting, risk management, and regulatory compliance.

- Detailed profitability analysis for informed decision-making.

- Streamlined data management and reduced operational costs.

77. How is regulatory compliance handled by SAP Bank Analyzer?

Ans:

SAP Bank Analyzer handles regulatory compliance for financial institutions by integrating and consolidating data, generating reports for various regulations, enabling analysis and simulation, managing risks, adapting to regulatory changes, providing audit trails and controls, and facilitating continuous compliance monitoring.

78. What role does SAP HANA play in SAP Bank Analyzer?

Ans:

SAP HANA in SAP Bank Analyzer enables real-time processing, faster analytics, advanced data handling, predictive insights, scalability, and flexibility, enhancing banking operations by providing high-speed, in-memory computing for data management, analytics, and decision-making.

79. What are the most difficult challenges in adopting SAP Bank Analyzer?

Ans:

- Complex Integration: Integrating with existing systems and aligning data sources is complex.

- Data Quality Assurance: Ensuring accuracy and consistency of financial data is demanding.

- Regulatory Compliance: Adapting to banking regulations and accounting standards is crucial.

80.How does SAP Bank Analyzer help banks with profitability analysis?

Ans:

SAP Bank Analyzer helps banks analyze profitability by integrating data, providing insights into product and customer profitability, cost allocation, risk analysis, compliance reporting, scenario planning, and improving decision-making. It offers a comprehensive view of operations to optimize performance.

81. What is SAP Bank Analyzer, and what are its primary functions?

Ans:

SAP Bank Analyzer is a financial accounting, risk management, regulatory compliance, performance analysis, data management, business planning, asset liability management, and treasury operations application designed for banks.

82. Could you please go over the primary features of SAP Bank Analyzer?

Ans:

- Consolidates and manages data from numerous sources in financial data management.

- Accounting and reporting: Compliant with IFRS/GAAP for comprehensive financial reporting.

- Credit, market, liquidity, and operational risks are identified, measured, and mitigated.

83.How does Bank Analyzer work in conjunction with other SAP modules?

Ans:

Bank Analyzer integrates with SAP Accounting, Banking Services, Business Warehouse, Risk Management, Solution Manager, Compliance Management, Analytics, Treasury, and Financial Risk Management.

84.Can you describe the main components of Bank Analyzer?

Ans:

- Data Management

- Accounting and Financial Reporting

- Performance Management

- Risk Management

- Regulatory Compliance

85.What are the multiple data models that SAP Bank Analyzer employs?

Ans:

SAP Bank Analyzer employs various data models including Finance and Risk Data Model (FRDM), Bank Analyzer Data Model (BAM), IFRS Data Model, SAP HANA Data Models, and Regulatory Data Model to manage financial, risk, regulatory, and reporting aspects in the banking industry.

86. How does SAP Bank Analyzer handle data extraction and processing?

Ans:

- Data Extraction: SAP Bank Analyzer collects data from diverse banking systems.

- Data Transformation: It standardizes, cleans, and normalizes extracted data for consistency.

- Data Enrichment: Additional information is added to improve data quality.

87. What are the main modules in SAP Bank Analyzer and how do they work?

Ans:

- Accounting and Financial Reporting: Manages accounting processes and generates financial statements.

- Profitability Analysis: Analyzes the profitability of banking products, services, and customers.

88. Bank Analyzer handles financial instruments and their appraisal in what way?

Ans:

Bank Analyzer assists in managing and evaluating financial instruments by analyzing risk, valuing assets, monitoring performance, ensuring regulatory compliance, generating financial reports, and optimizing portfolio management.

89. What are the main obstacles to implementing SAP Bank Analyzer?

Ans:

- Complex Integration: Integrating with existing systems can be intricate.

- Data Quality: Ensuring accuracy and consistency across vast data sets.

- Regulatory Compliance: Adhering to complex banking regulations.

90.What sorts of risk assessments are accessible in Bank Analyzer?

Ans:

Bank Analyzer encompasses various risk assessments, including credit, market, operational, liquidity, regulatory risks, stress testing, and scenario analysis. However, for the most up-to-date and comprehensive details on its risk assessment capabilities, it’s best to refer to the latest documentation from SAP or contact them directly.