Tally is to add up, like keeping the score of a game. The word tally has to do with counting. It comes from the Latin word for “stick” because people used to keep a tally by marking a stick. Tally can be the total, or the act of adding it all up. If you count the bikers riding by, your count is a tally.

1. Explain Tally and its applications?

Ans:

Tally is accounting software used for performing the various purposes like –

- Performing all the basic accounting functions of inventory management.

- Costing like jobs and the other miscellaneous overheads

- Administering payroll of Office Staffs.

- Filing of the tax return, profit and loss statement, preparation of balance sheets, GST, trial balance, Fund flow statement, etc.

- Helping in the budgeting and variations in it.

2. What is difference between Tally ERP 9 and Tally 7.2?

Ans:

Tally is the solution that integrates the essential functions related to the accounting, reporting, and inventory in any organization. Tally ERP has included the many features including the Payroll management, TDS, and other tax parameters.

3. Mention features are available in Tally ERP 9 for Accounting?

Ans:

Tally ERP 9 offers following benefits for the any organization:

- Outstanding Management for a better Finance Management.

- Cost/Profit Centers Management for a better ledger maintenance.

- Invoicing of all the dealers.

- Budget/Scenario supervision.

4. What are features integrated into Tally ERP 9?

Ans:

E-mail option : Users can send reports to the multiple beneficiaries.

Accounting Voucher : Unique ID to every voucher which also ensures that voucher is numbered sequentially.

Printing Bank Transaction Details : Provides the choice to print bank details.

Credit Limits : The Credit Limit control set for dealer will not be applied to sales order. An alert will be notified of credit limit, whereas the user can save voucher

5. What are pre-defined ledgers available in Tally ERP 9?

Ans:

Cash: Under group Cash-in-hand, a cash ledger is created, where opening balance can be entered as books begin.

Profit and Loss Account: This ledger is created under the Primary, where previous year’s profit or loss is entered as opening balance.

6. Explain trial balance and process to check trial balance in Tally ERP 9?

Ans:

Trial Balance is mainly a synopsis of all ledger balances and checks whether mathematical accuracy and information are right and balanced. It is the way to verify that journal entries are correctly posted in a general ledger. In trial balance, total of all debt balances should be equal to total of all credit balances.

7. Explain default configuration of Tally ERP 9 provided for Balance Sheet?

Ans:

Balance Sheet in the Tally ERP 9 displays the two different columns with Liabilities and Assets. The balance sheet also displays closing balances of all primary groups and capital accounts along with net profit for the specified period as required by an organization.

8. How can Books of Accounts in Tally ERP 9 be viewed?

Ans:

To view Books of Accounts on Tally ERP 9, should press D at entry of Tally ERP 9 to pull Display menu. On display menu, have to press A to bring up Accounts Books menu.

9. Mention options available in Account Books Menu in Tally ERP 9?

Ans:

- Bank Book (s)

- Cash Book (s)

- Ledger

- Group Summary

- Sales Register

- Purchase Register

- Journal-Register

10. What is use of statement of Inventory in Tally ERP 9?

Ans:

The use of statement of inventory is to view information on Inventory based on the Godowns. Tracking each and every single detail of items in inventory, along with carrying on stock and check the budget variations v/s forecasts, plans, statistics, etc. Inventory in Tally.ERP 9 works in a same way as its accounting part with regard to the displaying, modifying, and printing reports.

11. How view the profit and loss statement in Tally ERP 9?

Ans:

To view the profit and loss statement, should press F1: Detailed which will display a data based on the default primary groups. With the every transaction/voucher that has been entered instantly.

12. How can schedule the VI profit & loss accounts generated ?

Ans:

VI balance sheet using the auditor’s edition of Tally ERP 9, need to go to gateway of Tally – Audit & Compliance – Financial Statements – Profit & Loss account. Then, should Press Ctrl+3 to load previous year’s company to generate Schedule VI profit & loss account with the two year’s data.

13. Mention requirements to connect Tally ERP 9 remotely?

Ans:

| Tally ERP 9 License | Description | |

| Tally ERP 9 License | Valid license for the required users. | |

| Server Setup | A licensed version of a Tally ERP 9 | |

| Connectivity | Dedicated server with compatible OS, static IP, and adjusted firewall settings. |

14. Explain features can use to convert data to encrypted form in Tally ERP 9?

Ans:

To convert data in the encrypted form to Tally ERP 9, can use the function of Tally Vault. To use a Tally Vault should go to the gateway of Tally and key in F3, then can select the company for which want to encrypt the data. Data will be decrypted to only those systems having valid password and persons can view encrypted data.

15. What are advantages of Tally Software?

Ans:

- Tally software provides a data reliability and security. In Tally entered data is reliable and secure.

- Several company calculations and financial records that include the net deduction, net payment, bonuses, and taxes that need to be made while disbursing salary to employees can be maintained using the Tally.

- Tally reduces chances of error to great extent Tally is self-explanatory and simple to learn. And can learn it at home or at designated institutes.

16. What are types of ledger create in Tally ERP9?

Ans:

- can create sales/purchase ledger.

- can create Income/Expense ledger.

- can create party ledger.

- can create tax ledger.

- can create bank account.

17. What is group in Tally ERP 9 software?

Ans:

In Tally ERP 9 software,a group can be defined as the compilation of ledgers of exact nature. For example, expenses like a telephone bills, electric bills, conveyance, etc., are usually included in the groups. Ledger of these expenses is shaped to be used while accounting vouchers are to be entered.

18. Explain reversing journal entries?

Ans:

Reversing journal entries specifies those made at start of an accounting period to withdraw adjusting journal entries completed at the end of earlier accounting period.

19. What types of vouchers can created in Tally ERP 9?

Ans:

Contra Voucher : This voucher is used to point to transfer of funds from bank account to cash account or cash account to a bank account or in a different bank account of the another bank

Payment Voucher : This voucher explains historical payments on each account like a payment of salary, rental, etc.

Receipt Voucher : This voucher describes transactions that relate to the payments received. The shortcut key for creating voucher is F6.

Journal Voucher : This voucher is used to cover expenses to maintain the organization’s running a costs. The shortcut key for creating voucher is F7.

20. What is deferred tax liability? Deferred taxation is part of which equity?

Ans:

Deferred tax liability is the listing on a company’s balance sheet that records the taxes that are owed but are not due to be paid until the specific future date. It is called deferred tax liability because of difference in timing between when the tax was accrued and when have to pay it. Deferred taxation is the part of owner’s equity.

21. What shortcuts used for voucher creation and alteration screen?

Ans:

In Tally ERP9 software have to enter Alt+C to create any master (ledger, stock item) on voucher or alteration screen. If want to alter or con?gure any master item on voucher, must select a speci?c ledger or stock item on sales voucher screen and press Ctrl+Enter buttons.

22. Which types of things come under Intangible Assets?

Ans:

- Copyrights

- Trade Marks

- Domain Names

- Patents

- Brand Names etc

23. What are available statutory features in Tally ERP?

Ans:

- Service Tax

- Value Added Tax

- Goods and Service Tax

- Excise Tax

- Payroll Statutory

- The tax collected at the source

- Tax deducted at source etc.

24. What is setup process for employees in Tally ERP 9 for payroll?

Ans:

Tally ERP 9 provides the great facility to create a required groups and classify them into the different categories like Employee categories, Employee groups, and Employees for the smooth processing of employees’ salaries.

25. How to create Employee group?

Ans:

- First, go under employee group creation screen and select the Primary Cost Category as the Category.

- After that, name employee’s group “Sales”.

- Now, select a group as “Primary” and click on accept to finish with an employee group creation.

- This is how employee group is created.

26. How to create Employee Master?

Ans:

- First, go to employee master.

- Here, can incorporate the information about employees like constitutional details, passport & visa, appointments letters, etc.

27. What is difference between Standard Tally Driver and Tally Text Driver?

Ans:

The key difference between Standard Tally Driver and Tally Text Driver is that Standard Tally Driver can print graphics, True Type fonts as the graphics, and printer-resident fonts. On other hand, the Tally Text Driver can print the only printer-resident fonts.

28. What is default configuration of Tally ERP 9 provided for balance sheet?

Ans:

In Tally ERP 9, balance sheet displays two different columns, i.e., Liabilities and Assets. An organization requires to display the closing balances of all the primary groups and the capital accounts and net profit for a specified period on the balance sheet.

29. How can migrate TCP from Tally 7.2 to Tally 8.1?

Ans:

- First, go to Start > Programs > Tally 8.1 > TallymigrateData.

- will see two splash screens, Tally Data Migration Tool and Tally 8.1.

- Now, choose the ‘Migrate TCP’ from Tally Data Migration Tool Menu.

- When choose ‘Migrate TCP’, tool starts to procedure Tally 7.2 TCP and produces another TCP, which is the well-matched with Tally 8.1.

30. What are main functional enhancements in Tally ERP 9 software?

Ans:

Accounting Voucher : This is newly enhanced feature included in the Tally ERP 9 software. A new kind of numbering feature added to voucher ensures that the vouchers are the numbered successively.

(VAT Option) : It facilitates the users to record numerous items with the diverse VAT rates by configuring setting of “Default Accounting Allocations for Selected Item in the Invoice.”

31. What is bank reconciliation statement?

Ans:

A bank reconciliation statement specifies a banking & business activity and reconciles an entity’s bank account with financial records. It refers to the statement prepared when passbook balance has a difference from cash book balance. It also confirms that payments have been processed and cash collections have been deposited into the bank account.

32. What are requirements to connect Tally ERP 9 remotely?

Ans:

Remote connectivity for the Tally ERP 9 is a very useful feature. There are the two ways to connect Tally ERP 9 remotely) customer end and remote location.

At Customer end :

- It is required to have the valid internet connection.

- Must need a licensed version of Tally ERP 9 with the Tally.NET subscription.

- Create and authorize the remote users for company want to operate remotely.

33. Where can find sales tax on balance sheet in Tally ERP 9 software?

Ans:

In Tally ERP 9 software, sales tax appears as one of the liabilities for a business. It appears on liability side of a balance sheet. Before inserting the sales tax in liability, can check where sales tax appears in a trial balancing sheet.

34. What is delivery notes?

Ans:

A delivery note is the record that goes with the product’s shipment. It includes the details about goods delivered. A delivery note indicates a content of a package. It also shows the details of products if a few requested products are not enclosed because of absence of stock or due to the any other reason.

35. How can activate GST in Tally ERP 9 software?

Ans:

- First, go to screen for Company Operation Alteration, enable the GST and choose set/alter GST details.

- After that, update all necessary details like name of state, registration type, the GSTIN which will be printed on the invoices, date applicable from, periodicity, e-way bill applicability, tax liability on a receipts, GST rate, and all classifications.

- Now, accept changes and save them.

36. Where can see errors arise while migrating data from Tally 7.2 to 8.1?

Ans:

Any error while migration process is stored into the file called ‘migration. err’, which is automatically generated by a Tally. And can see this file in the application folder of a Tally.

37. What falls under Intangible Assets?

Ans:

- Trade Marks

- Domain names

- Patents

- Brand names

- Copyright, etc

38. What are the steps followed for enabling payroll on Tally 9?

Ans:

Can use the Tally Vault function to encrypt data in the Tally ERP 9. Tally Vault can be accessed at gateway of Tally and key in F3, then select a company to encrypt the data. can access this encrypted data only with the valid password.

39. Why is Tally considered an essential tool in accountancy?

Ans:

Tally simplifies the daily financial transactions and is especially relevant in case of the compliance also. It has many built-in features that are useful for accounting like a payroll process, interest calculation, service tax, payroll compliances, cheque management inventory handling, etc.

40. How many groups in Tally ERP 9?

Ans:

There are 28 in-built groups of which 15 primary groups and remaining are subgroups. The groups can be termed as the collective unit of ledgers that fall under similar category. For instance, fixed costs in the company like rent, salary, insurance, etc. are grouped together. These expenses can serve as basis for a ledger that will be used to be record accounting vouchers.

41. How can person find books of accounts inside Tally ERP 9?

Ans:

Within advanced Tally, must press D at the entry of accounting software application Tally ERP 9 to see display menu. Pressing A will bring up a display menu thus can access the accounts books menu.

42. What is shortcut key for alteration screen and voucher making in Tally ERP 9?

Ans:

Advanced Tally has option, which allows to create a master that is stock and ledger, on voucher using the shortcut Alt + C. But if make any changes in master item on a voucher, have to select the specified ledger on sales voucher and press Control (Ctrl) + Enter..

43. Describe to produce schedule six P/L accounts using auditor’s edition within Tally ERP 9?

Ans:

If want to generate a schedule six balance sheet with help of auditor’s edition within Tally ERP 9, enter a gateway of the accounting software application Tally ERP 9 and move towards the audit and compliance followed by the financial statements, and click on P/L account, and previous year’s company must be loaded using shortcut key Ctrl + 3 and generate schedule six P/L account using a data of two years.

44. How do create new company in Tally?

Ans:

- Open Tally and select option to create new company.

- Enter a company name, address, and the other details.

- Select financial year and the base currency for company.

- Set up chart of accounts and enable the features such as inventory and payroll.

45. Difference between payment voucher and receipt voucher in Tally?

Ans:

A payment voucher in Tally is used to record the payments made to suppliers, vendors, or other parties. In contrast, receipt voucher records the money received from a customers, debtors, or other sources. Payment and receipt vouchers are used to be record transactions, representing different types.

46. How do delete a ledger in Tally?

Ans:

To delete the ledger in Tally, follow these steps:

- Go to Gateway of Tally and select option for Masters.

- Select option to display the list of ledgers.

- Choose ledger want to delete and press the Alt+D key combination.

- Confirm deletion by typing Y, and ledger will be deleted.

47. How do adjust inventory in Tally?

Ans:

- Go to Gateway of Tally and select the Inventory Vouchers.

- Choose option to create the stock journal voucher.

- Enter a date and the stock item want to adjust the inventory.

- Select adjustment type, such as increase or decrease, and quantity of item.

48. How do create payroll in Tally?

Ans:

- Go to Gateway of Tally and select Payroll Info.

- Select option to create a new employee record and enter their details, like name, address, and salary information.

- Set up a payroll groups, categories, and attendance types.

- Generate the payroll report to view salaries and taxes for each employee.

49. How do back up data in Tally?

Ans:

- Go to Gateway of Tally and select F3: Cmp Info.

- Select option to create a backup.

- Choose location and name of the backup file and confirm the backup.

- Save backup file to an external drive or a cloud storage.

50. What is Cost Centre in Tally?

Ans:

The Cost Centre in Tally is the feature that allows users to be allocate expenses and revenues to the different departments or projects within a company. Its purpose is to help users understand a profitability and costs associated with the other parts of business and make better decisions based on this information.

51. What is Sales Register in Tally?

Ans:

The Sales Register in Tally is a report that shows details of all sales transactions for the specific period. Its purpose is to provide the insights into the company’s sales performance and help users track the sales trends, customer behavior, and revenue.

52. Explain default configuration Tally ERP 9 provides for Balance Sheet?

Ans:

Tally.ERP 9 is accounting software that provides the default configuration for generating the Balance Sheet. The Balance Sheet is the financial statement that provides a snapshot of company’s financial position at specific point in time. The default configuration in the Tally.ERP 9 for generating the Balance Sheet

53. How do create delivery note in Tally?

Ans:

To create delivery note in Tally, follow these steps:

- Go to Gateway of Tally and select a Delivery Note.

- Choose customer and enter details of a products or services being delivered, such as quantity and rate.

- Save adelivery note, and it will be recorded in Tally.

54. What is Debit Note in Tally?

Ans:

A Debit Note in Tally is used when the supplier sends goods to customer, and customer returns some of those goods. The purpose of Debit Note is to adjust the amount payable to supplier for a returned goods. It is also used to record the reduction in invoice amount due to an error in original invoice.

55. How do create a credit note in Tally?

Ans:

- Go to Gateway of Tally and select a Credit Note.

- Choose customer and enter the details of the products or services for which credit note is being issued.

- Enter amount to be credited and the reason for a credit note.

- Save credit note, and it will be recorded in Tally.

56. What is TDS in Tally?

Ans:

TDS stands for a Tax Deducted at Source. In Tally, TDS is the mechanism where a certain percentage of tax is deducted by a payer at a time of making specified payments like the salary, rent, etc.

57. How can record opening balance of ledger accounts in Tally?

Ans:

Can record the opening balance of the ledger accounts in Tally during the creation of a ledger or by using the opening balance entry option in the voucher entry.

58. Explain ‘Interest Calculation’ in Tally?

Ans:

Tally allows to calculate interest on the outstanding amounts automatically. This feature is useful for the scenarios like calculating the interest on overdue payments.

59. What is ‘Multi-Currency’ feature in Tally?

Ans:

The Multi-Currency feature in the Tally allows businesses to transact in the multiple currencies. Can enable it in company features and define exchange rates for a different currencies.

60. How do handle VAT (Value Added Tax) in Tally?

Ans:

Tally allows to configure VAT settings and apply them to the transactions. And can set up VAT rates, create the VAT ledgers, and generate the VAT returns using Tally.

61. What is ‘Statutory & Taxation’ features in Tally?

Ans:

The Statutory & Taxation features in the Tally help businesses comply with the various tax regulations. It includes the features for GST (Goods and Services Tax), TDS (Tax Deducted at Source), and the other statutory requirements.

62. Explain ‘Cost of Goods Sold (COGS)’ concept in Tally?

Ans:

COGS represents the direct costs of the producing goods sold by the company. In Tally, it is calculated based on a stock valuation method selected and is crucial for determining a gross profit

63. Explain ‘Point of Sale’ (POS) feature in Tally?

Ans:

The Point of Sale feature in Tally is used for a retail businesses to record sales transactions efficiently. It includes the options for barcode scanning, discounts, and a real-time inventory updates.

64. How does Tally handle foreign exchange transactions?

Ans:

Tally supports the multi-currency transactions, allowing the businesses to record transactions in foreign currencies. Exchange rates can be configured, and software automatically converts the amounts based on these rates.

65. What is ‘Interest Calculation on Outstanding Receivables’ feature in Tally?

Ans:

This feature in Tally allows the businesses to calculate interest automatically on the outstanding receivables, helping in management of a credit control.

66. Explain ‘Group Company’ in Tally?

Ans:

In Tally, a Group Company is the feature that allows to consolidate financial information from the multiple companies, providing a holistic view of entire group’s financial performance.

67. How does Tally support Goods and Services Tax (GST) compliance?

Ans:

Tally provides the features for GST compliance, including ability to configure GST rates, create a GST ledgers, generate the GST returns, and manage GST-related transactions.

68. What is ‘Exception Reports’ in Tally?

Ans:

Exception Reports in the Tally highlight transactions or situations that deviate from a standard accounting practices. An example is ‘Negative Cash’ report, which identifies transactions leading to the negative cash balances.

69. How does Tally handle inventory valuation?

Ans:

Tally supports the various inventory valuation methods, including the FIFO (First In, First Out), LIFO (Last In, First Out), and Weighted Average. These methods determine how cost of goods sold and closing stock are the calculated.

70. Explain ‘Order Processing’ feature in Tally?

Ans:

The Order Processing feature in the Tally allows businesses to manage and process the sales and purchase orders efficiently. It helps in maintaining a order-related information and streamlining order fulfillment process.

71. How can handle advance payments and receipts in Tally?

Ans:

To record advance payments or the receipts in Tally,can use the Payment or Receipt voucher type and select a relevant ledger. Additionally, can use contra vouchers to the adjust advances against future transactions.

It is for the most linked with a recording of financial information identifying with the business tasks hugely and deliberately.

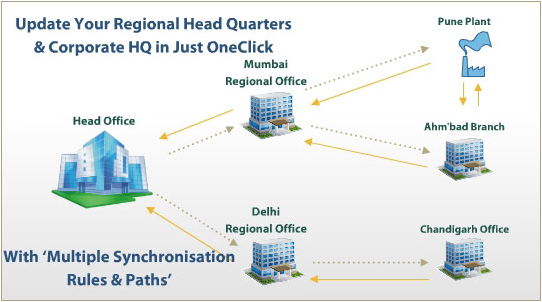

72. Explain ‘Data Synchronization’ feature in Tally?

Ans:

Data Synchronization in the Tally allows the multiple users in different locations to work on a same data simultaneously. It helps in keeping a data consistent and up-to-date across the various branches or offices.

73. What is ‘TallyVault’ feature, and how enhance data security?

Ans:

TallyVault is the security feature in Tally that encrypts a company data, providing the additional layer of protection. It ensures unauthorized users cannot access or modify a sensitive financial information.

74. How can handle reverse charge transactions in Tally?

Ans:

Tally allows to record reverse charge transactions by selecting a reverse charge applicable ledger during the voucher entry. This is commonly used in cases where recipient is liable to the pay tax instead of supplier.

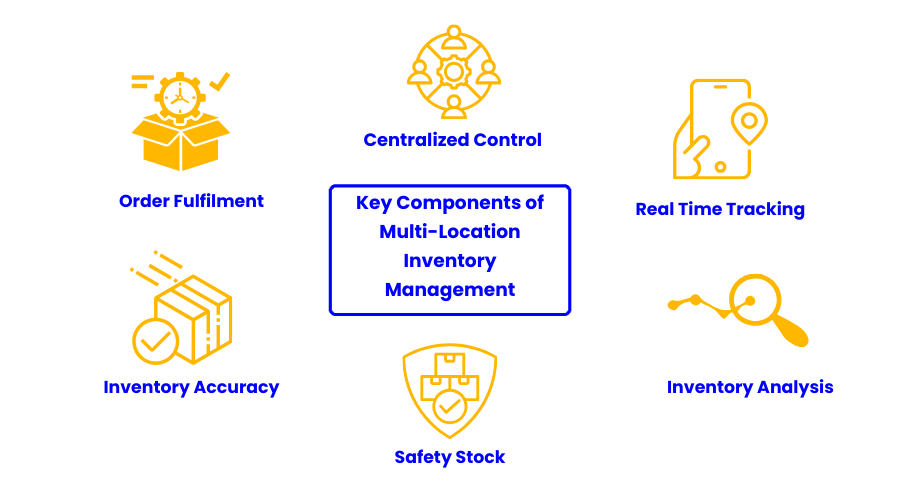

75. Explain ‘Multi-location’ inventory tracking in Tally?

Ans:

Tally supports the multi-location inventory tracking, enabling the businesses with the multiple branches or warehouses to the monitor stock levels across different locations. Every location can have its set of stock items and transactions.

76. How can handle stock transfers between different locations in Tally?

Ans:

To handle the stock transfers between locations in Tally, use Stock Journal voucher. Specify the source and destination locations, along with relevant stock items and quantities.

77. What is the ‘Manufacturing Journal’ in Tally?

Ans:

The Manufacturing Journal in Tally is used to record production of finished goods from a raw materials. It helps in tracking the manufacturing costs and managing production process.

78. Explain ‘Reorder Levels’ feature in Tally.?

Ans:

Reorder Levels in the Tally help businesses determine when to reorder stock items by setting a predefined minimum and maximum stock levels. When the stock level reaches reorder point, it triggers the reminder to replenish stock.

79. Explain ‘Zero Value Entries’ in Tally?

Ans:

Zero Value Entries in Tally are used when there is a no monetary value associated with the transaction. For example, stock transfer without any financial implication.

80. How can manage multiple cost centers within single ledger in Tally?

Ans:

Tally allows to allocate transactions to the different cost centers within the single ledger by using a Cost Center Allocation feature are during the voucher entry.

81. What is ‘Zero Rated’ sales entry in Tally?

Ans:

A Zero Rated sales entry in the Tally is used for the transactions where goods or services are sold with a 0% tax rate, typically applicable in the scenarios like exports.

82. Explain ‘Interest Calculation on Overdue Bills’ feature in Tally?

Ans:

This feature in Tally helps to calculate interest on overdue bills or invoices. Users can set interest rates and conditions to the automatically calculate and account for interest on the outstanding amounts.

83. What is ‘Cost of Capital’ report in Tally?

Ans:

The Cost of Capital report in the Tally provides insights into the cost associated with obtaining capital for a business. It includes the details such as interest paid on loans, helping in the financial analysis.

84. Explain ‘Attendance Voucher’ in Tally?

Ans:

The Attendance Voucher in Tally is used to record the attendance details of employees. It plays the crucial role in the payroll processing module by providing accurate attendance data for a salary calculation.

85. How can record a fixed asset purchase in Tally, what depreciation methods are available?

Ans:

To record the fixed asset purchase, use Purchase Voucher in Tally and select a relevant fixed asset ledger. Tally supports the various depreciation methods such as a Straight Line, Diminishing Balance, and more.

86.What are ‘Bill-wise Details’ in Tally, and how help in tracking outstanding amounts?

Ans:

Bill-wise details in Tally help in tracking the outstanding amounts for parties or customers. And can allocate payments to the specific invoices, facilitating accurate receivables and payables management.

87. Explain ‘Cost Center Class’ feature in Tally?

Ans:

Cost Center Class in Tally is used to be group similar cost centers together. It helps in generating the reports and analyzing costs based on a specific classifications within organization.

88. How can reconcile GST returns with books of accounts in Tally?

Ans:

Tally provides option to reconcile GST returns with books of accounts by comparing the figures in a GST return reports with corresponding entries in the ledgers.

89. How does Tally handle stock aging, and why is it important for businesses?

Ans:

Tally provides reports like Stock Ageing Analysis that categorize inventory based on its age. This is crucial for businesses to identify slow-moving stock, manage inventory levels, and avoid obsolescence.

90. What is ‘Remote Access’ feature in Tally, and how can it be set up?

Ans:

Tally’s Remote Access feature allows the users to access Tally data from a different locations. It can be set up by a configuring the necessary settings and permissions in the Tally.NET.