- Introduction

- Planning

- Controlling

- Decision Making

- Coordinating

- Communicating

- Financial Reporting

- Budgeting

- Cost Management

- Performance Evaluation

- Risk Assessment

- Conclusion

Introduction

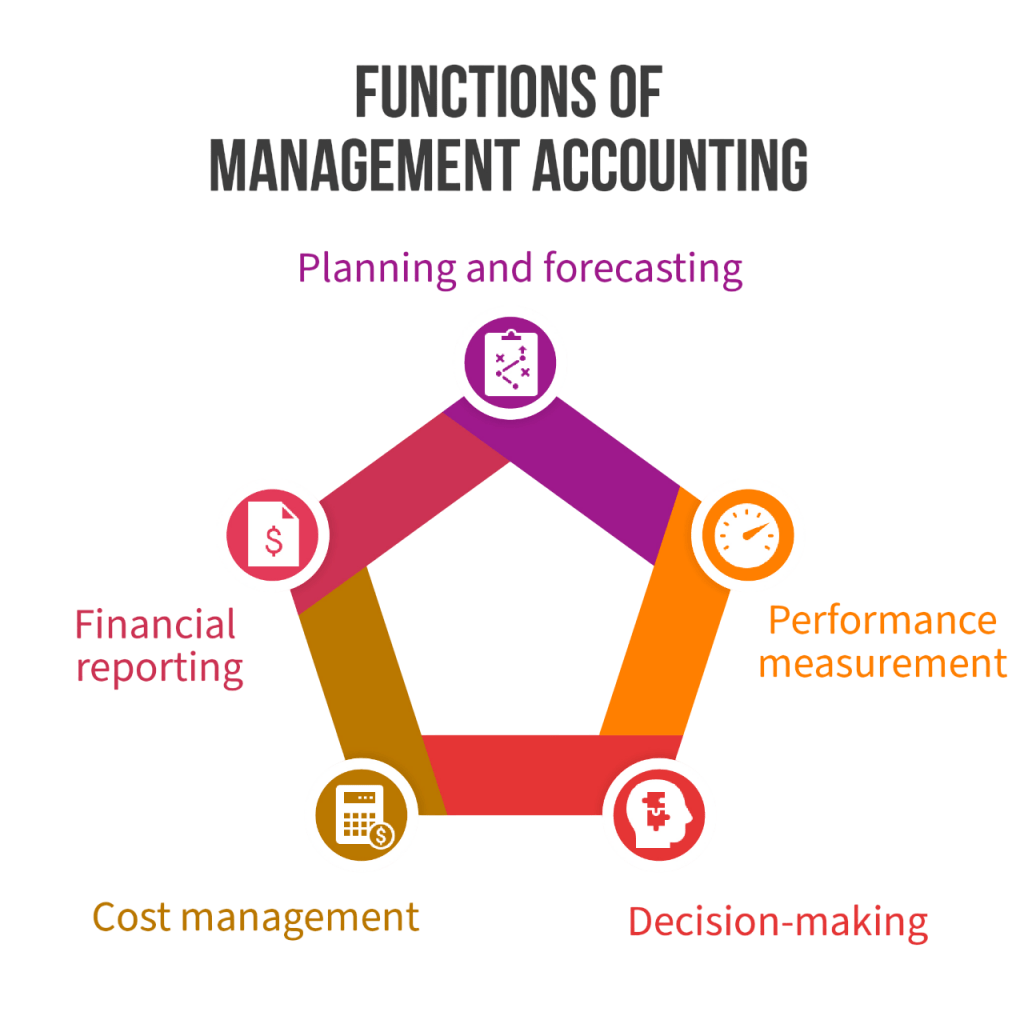

Management Accounting is preparing management reports and accounts that provide managers with accurate and timely financial and statistical information. The core objective is to aid in an organization’s short-term and long-term decision-making, planning, and control. Unlike financial accounting, which is concerned with historical data for external stakeholders, management accounting is forward-looking and internal-focused, a perspective that can be enhanced through PMP Training. It combines aspects of finance, accounting, operations, and strategy to help managers formulate policies, control performance, and drive the business toward its objectives. As companies face more complexity, management accounting becomes increasingly critical in aligning operations with strategic goals, maintaining cost efficiency, and fostering data-driven decisions.

To Explore PMP in Depth, Check Out Our Comprehensive PMP Certification Training To Gain Insights From Our Experts!

Planning

Planning is a fundamental function of management accounting. It involves setting objectives, identifying strategies, forecasting financial outcomes, and allocating resources to achieve desired goals. Management accountants develop financial and operational plans by analyzing historical data, market trends, competitor actions, and internal capabilities, all of which are integral to the Essentials of Financial Management in Business.

- Strategic Plans (long-term): For expansion, diversification, or market penetration.

- Tactical Plans (medium-term): Resource allocation, cost management, and project execution.

- Operational Plans (short-term): For day-to-day departmental activities and resource scheduling.

There are several types of plans created through management accounting:

Management accountants use tools like trend analysis, scenario planning, and predictive modeling to forecast sales, profits, costs, and capital needs. Effective planning ensures that resources are used efficiently and organizational goals are realistically attainable.

Controlling

Control is another core responsibility of management accounting. Once a plan is in place, it is essential to ensure that operations proceed according to expectations. Controlling involves monitoring performance against planned objectives and identifying variances needing corrective action. Management accountants use several tools for this function:

- Variance Analysis: Compares actual costs and revenues against the budgeted amounts.

- Key Performance Indicators (KPIs): Track progress in critical business areas.

- Responsibility Accounting: Assigns accountability for variances to the appropriate departments.

The insights gained from these tools allow for quick adjustments and performance optimization. If a department exceeds its budget or falls short of targets, management accountants investigate the root cause and recommend corrective actions. This continuous monitoring is essential to maintain efficiency and ensure financial discipline throughout the organization.

Are You Interested in Learning More About PMP? Sign Up For Our PMP Certification Training Today!

Decision Making

One of the main jobs of management accounting is to support decision-making. Managers rely on this type of accounting to evaluate options, predict financial outcomes, and choose the best and most financially sound choices. Whether the decisions involve pricing strategies, whether to continue or end a product line, outsourcing versus in-house production, investing in capital assets, or entering new markets, management accounting gives the necessary data and insights for informed choices, a capability that can be further strengthened through PMP Training. To help with these decisions, management accountants use analytical methods such as Cost-Volume-Profit (CVP) analysis, break-even analysis, contribution margin analysis, and incremental cost analysis. These methods provide clear and measurable information that helps evaluate the risks and benefits of each option. By breaking complex scenarios into straightforward comparisons, management accounting ensures that business decisions are logical and based on data while also supporting long-term strategic goals.

Coordinating

Management accounting plays a pivotal role in aligning the efforts of different departments. Management accountants foster interdepartmental coordination by ensuring that the activities of finance, marketing, production, HR, and operations are guided by a unified financial strategy. For example, if the sales team projects higher demand, the production and procurement departments must plan for increased output and material sourcing. Management accountants ensure that all departments share a common understanding of financial constraints and objectives.

They do this through:

- Preparing integrated budgets

- Organizing cross-functional meetings

- Facilitating strategic alignment between divisions

This coordination ensures that all departments work toward shared goals without resource conflict or duplication of efforts.

Are You Preparing for PMP Jobs? Check Out ACTE’s Project Management Interview Questions & Answer to Boost Your Preparation!

Communicating

Management accountants also serve as key communicators of financial information across the organization. They translate complex financial data into actionable insights that non-financial managers and stakeholders can understand, a role that parallels the importance of What is Service Marketing in bridging technical expertise with customer-focused understanding.

They use tools like:

- Dashboards and visual reports

- Summary reports with KPIs

- Presentations and briefings tailored to different managerial levels

The effectiveness of communication determines how well management accounting fulfills its purpose. Poor communication can lead to misinformed decisions, while clear, relevant, and timely information enhances strategic execution. In today’s environment, where data is abundant but insights are scarce, the management accountant’s ability to convey meaningful information is more critical than ever.

Financial Reporting

While financial reporting is traditionally associated with monetary accounting, management accountants also generate internal financial reports tailored to managerial needs. These reports provide detailed, timely insights into profitability and cash flow, cost structures, efficiency, and productivity.

Examples of internal reports include:

- Departmental income statements

- Segment-wise performance reports

- Profitability reports for products or projects

These internal financial reports are customized for internal analysis and are often not bound by regulatory formats. Their flexibility allows managers to gain micro-level insights, supporting operational improvements and strategic analysis.

Are You Considering Pursuing a Master’s Degree in PMP? Enroll in the PMP Masters Program Training Course Today!

Budgeting

Budgeting is a vital part of management accounting. It serves as a way to plan, control, and evaluate performance. Budgeting provides a numerical framework for an organization’s goals. It helps set financial targets, guides resource allocation, and tracks actual results against estimates. Management accountants prepare different types of budgets to meet various organizational needs. Operating budgets focus on expected revenues and expenses related to daily operations, highlighting the distinctions similar to those explored in Business Analyst vs Financial Analyst. Capital budgets deal with long-term investment plans, like buying equipment or upgrading facilities. Cash budgets are important for maintaining cash flow by forecasting cash inflows and outflows, ensuring the business can meet its financial commitments. Flexible budgets adjust based on actual activity levels, offering clearer financial insights in changing situations. The budgeting process promotes accountability, as financial responsibilities are assigned to specific departments or managers. Additionally, variance analysis compares actual results with budgeted figures. This helps identify differences and informs corrective actions, assisting organizations in reaching their financial goals.

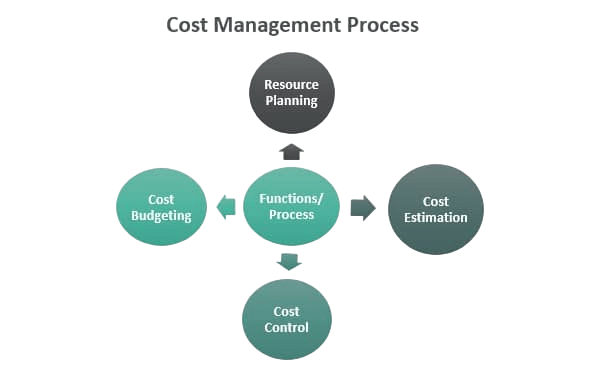

Cost Management

Management accountants use various important techniques. Standard costing involves setting cost benchmarks to evaluate performance. Activity-based costing (ABC) assigns overhead costs more accurately by linking them to the specific activities that create those expenses. Target costing starts with a market-determined price and works backward to manage production costs, ensuring that prices remain competitive, which is a vital aspect within the Scope of Financial Management. Life-cycle costing looks at the total cost of a product from its development to its disposal, helping with long-term cost planning.

By using these techniques, businesses can improve resource use, make informed decisions, and gain a competitive edge. In today’s cost-conscious market, managing costs effectively through management accounting is vital for the survival of businesses and their sustainable growth.

Performance Evaluation

Management accounting facilitates continuous performance evaluation in terms of financial results and operational and strategic achievements. This involves setting performance benchmarks, measuring actual outcomes, and interpreting the gaps, all of which are essential for effective Marketing Management.

Performance metrics include:

- Financial ratios (e.g., ROI, ROE, gross margin)

- Operational KPIs (e.g., production efficiency, delivery times)

- Customer-centric KPIs (e.g., satisfaction, retention)

- Employee-related metrics (e.g., productivity, absenteeism)

Frameworks such as the Balanced Scorecard integrate financial and non-financial indicators. By doing so, management accounting helps align daily operations with strategic objectives and encourages a culture of accountability and performance.

Risk Assessment

Risk management is a key priority in a rapidly changing business landscape. Management accountants identify, analyze, and mitigate financial and operational risks, applying various Techniques in Management Accounting to ensure stability and informed decision-making.

Risks include:

- Market volatility

- Currency and interest rate fluctuations

- Supplier disruptions

- Regulatory changes

- Credit risk and fraud

Management accountants use tools like:

- Sensitivity analysis

- Scenario planning

- Hedging evaluations

- Financial risk modeling

They also assess internal control effectiveness and ensure risk exposure is within the company’s risk appetite. Proactive risk assessment supports business continuity and resilience in unpredictable environments.

Conclusion

Management Accounting is far more than just number crunching; it is a strategic partner in guiding a business toward its objectives. Its diverse functions, planning, controlling, decision-making, coordination, communication, financial reporting, budgeting, cost management, performance evaluation, and risk assessment enable organizations to operate efficiently, respond to change, and achieve sustainable growth, a capability that can be enhanced through PMP Training. In a data-driven world, management accountants provide the insights and foresight that transform raw information into strategic advantage. They bridge financial understanding with business execution, ensuring that decisions are sound and aligned with long-term organizational success.