The biggest distinction between a Financial Analyst and a Business Analyst is that a Financial Analyst deals more with investments while a Business Analyst deals more with operations and management. It comes down to the field in which you feel more confident and knowledgeable.

- Introduction to Business Analyst vs Financial Analyst

- Educational Required

- Features of Business Analyst vs Financial Analyst

- Job Description: Business Analyst Vs. Financial Analyst

- Skills Needed

- Which One to Choose?

- Roles and Responsibilities: Business Analyst and Financial Analyst

- Career Path: What is Your Choice?

- Benefits of Business Analyst vs Financial Analyst

- Conclusion

Introduction to Business Analyst vs Financial Analyst:

Financial Analysts and Business Analysts judge internal or external client information and use their findings to form recommendations concerning Business choices. On the Financial facet, Analysts are asked to assist the corporation, whether or not or not it’s associate degree associate degree Analyst’s leader or an external consumer, to build investment choices. A securities Analyst analyzes Financial information, attempting to work out trends and build predictions. Typically, an associate degree Analyst prepares reports for periods of your time during which he recommends that an organization get or sell sure securities. High Financial Analysts are even referred to as upon to use Financial strategies to work out if it’s an honest time to sell an organization.

Similarly, Business Analysts analyze company information and use their findings to assist managers build Business choices. This data, instead of associated with investment, includes the everyday operations of the Business. Learning strategy for Business Analysts, Business models, processes and progress, and technology programs. they’re asked to spot the inefficiencies and to search out opportunities for the company’s operations to be simplified and improved. As Financial Analysts, a Business Analyst could also be internal, once analyzing his employer’s information, or he may fit for a firm utilized by external purchasers to perform the analysis.

Educational Required:

Unlike certified public accountants or authors (CPAs), they are not Financial Analysts or Business Analysts governed by a regulatory authority that imposes complex and expeditious educational requirements. Hiring companies determine how much education they need from potential Analysts. In any profession, most professionals have at least a bachelor’s degree, with a growing number of master’s degrees

A Business-related degree is useful for any job, but instead of getting an extensive degree in Business, some skills can put you on the easy path to a successful career as a Financial Analyst or Business Analyst. On the Financial side, the preferred college majors include finance, economics, and mathematics. As an added bonus, a bachelor’s degree in any of these fields, which carries a strong GPA and relevant job experience, should serve as a gold ticket to the MBA competition program.

Students who hope to become Business Analysts can choose from a wide range of options, including the above-mentioned Financial degrees, as well as management, accounting or, for those pursuing system analysis, information technology. Also, a bachelor’s degree is probably a given requirement, while a master’s degree becomes an annual requirement for aspiring Business Analysts.

- Being a decent perceiver and communication.

- He is willing to contemplate modification.

- Ability to perform multiple tasks with success.

- Ability to prioritize, supported the various desires of participants.

- Being a decent helper will get you purchasing on time with vital participants ’decisions.

- Identify opportunities to develop processes that may result in higher performance and improved outcomes.

- Working as a part of a team, which incorporates operating with people and teams outside the team.

Features of Business Analyst vs Financial Analyst:

The journey of a Business Analyst are easier if you have got the subsequent qualities and skills:

Features of Analyst syllable

1. Ability to research knowledge

Financial Analysts ought to take into account and appraise a large variety of knowledge from a range of sources. They have to know however knowledge is collected, knowledge quality and best ways to research it. They ought to additionally perceive however the software package or tools they use add analyzing process knowledge. Analysts use this info to see what investments they have to create or however they will proceed.

2. Sensible Speech

Financial Analysts have to be compelled to be competent in each written and spoken communication. they have to send emails or different text messages to colleagues and customers. They will additionally have to be compelled to often prepare written reports for shoppers, managers or shareholders. A securities Analyst ought to be able to answer client queries head to head or by phone and use language that an individual outside the Financial trade will perceive. Some Financial Analysts give info to the media, and that they ought to be assured publicly speaking.

3. You’re Technically Free

Many Financial analysis takes place on computers. Powerful software package and websites with insignificant amounts of information handle all data. A securities Analyst has to be comfy with the utilization of technology. This includes mobile devices and desktops or laptops and their software package. several firms have their own affiliate software package or develop their own analytics algorithms. The determination to stay up-to-date with technology is additionally vital for a securities Analyst.

4. Directed to the small print

According to the Bureau of Labor Statistics, Financial Analysts ought to even be directed to the tiniest detail of their daily activities. One tiny anomaly will build an enormous distinction in prediction. A small modification in sales numbers or different metrics, like client confidence, could have a big impact on Financial coming up with. The Analyst has to sustain with the little changes altogether the info streams they access.

5. Talent higher cognitive process Skills

Financial Analysts have to be compelled to review the data and build help choices regarding the steps to require. Once advising others on investment, budget or coming up with, they have to be competent in giving recommendations to others. Financial Analysts in massive firms are also stipendiary supporters of the success of their choices or recommendations, in order that they have an interest in exploitation quality tools and correct info. They will additionally have to be compelled to build immediate choices if they need been given a restricted quantity of knowledge throughout Associate in Nursing emergency.

- Data Analyst

- Enterprise Analyst

- Business Advisor

- Marketing Analyst

- Product Manager

- Needs Manager

- Portfolio Manager

- Investment Analyst

- Risk Analyst

- Fund Manager

- Rat Analyst, and many other Analysts working in the Financial sector.

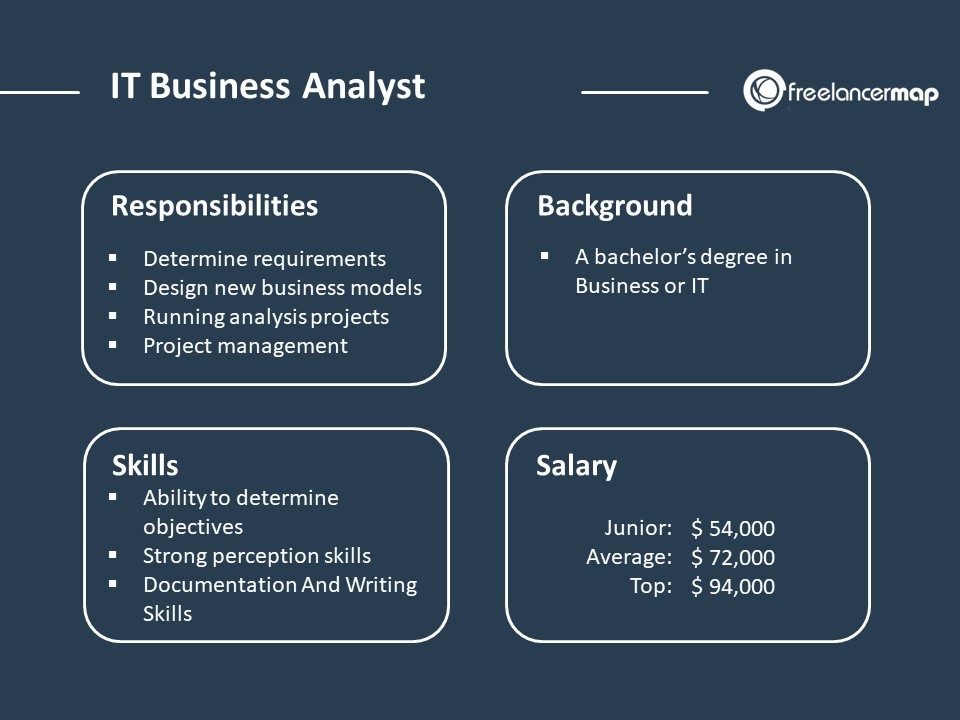

Job Description: Business Analyst Vs. Financial Analyst:

Business Analysts are flexible and play a variety of roles in different Businesses. The job description of a Business Analyst varies from department to department. A Business Analyst in the technical team, for example, is responsible for monitoring and updating systems, while the sales team is responsible for resolving customer queries and taking feedback from them.

Business Analyst is a superset of terms –

System Analyst, and many other job roles.

FA job description

The job description of a Financial Analyst is the same for most companies with the exception of a few exceptions. Financial Analysts analyze the Financial and Business performance of an organization in anticipation of future changes. These professionals assist managers by providing data-driven reports to make strategic and informed decisions.

FAs work on investing, analyzing and improving the company’s Financial position. In some organizations, these Analysts work exclusively for Business and a few companies hire them to work on market research and other Financial aspects.

Financial Analyst is an umbrella term for:

Financial Analysts are divided into two categories: buy-side Analysts and sell-side Analysts.

Buy-side Analyst: In high-investment firms, buy Analysts create investment plans. Hedge funds, insurance firms, private finance managers, and charitable organizations with large gifts, like other colleges, are role models for institutional investors.

Sell-side Analyst: Financial services brokers who sell stocks, bonds, and other assets are sell-side Analysts.

Some Analysts work for Business books or research firms with different buying and selling sides.

Skills Needed:

It doesn’t mean that rather than a commentator of any kind, robust analytical skills are needed. Whether or not you’re a Business Analyst or a securities Analyst, a triple-crown candidate ought to be able to establish trends and confusion in complicated knowledge collections and build applicable pointers supporting the findings.

On the Financial facet, robust activity skills are equally vital. Financial Analysts don’t ought to be mathematicians as advances in engineering obscure the requirement for an Analyst to unravel complicated calculations manually. However, a triple-crown securities Analyst must be robust in areas like statistics, and will have a deep understanding of opportunities, trends, and distribution.

Business Analysts ought to be smart at numbers, however additionally, they have to unravel issues from quality knowledge. For instance, a reviewer could also be appointed to look at a fancy flowchart and confirm whether a piece flow method is integrated or not needed. whereas this sort of labor doesn’t need mathematical information, it will need robust thinking and mental skills.

Which One to Choose?

Between the 2 jobs, income, average operating hours and competition are all terribly similar. you’ll create between $ fifty,000 and $ sixty,000 a year beginning, operating forty to fifty hours every week, and face a positive job market by a minimum of 2029. These similarities will create selecting one over the opposite harder.

The main distinction between an Analyst and a Business Analyst is that the Analyst is focused a lot on the investment whereas the Business Analyst is a lot targeted on performance and management. It comes right down to the sphere wherever you’re feeling assured and knowledgeable.

For a student who favorite category was mathematics and who wanted to figure with numbers, being an Analyst may be a wise move. On the other hand, someone the World Health Organization is naturally talented in providing services and creating comes as economical as potential ought to take into account changing into a Business Analyst.

- Identify areas wherever you’ll improve and implement technical solutions Work to boost Financial performance by analyzing forecasts, variances, Financial outcome designs.

- Developing existing and automatic systems reconstructed with the most recent technology in Financial instruments, and different market conditions

- Provide management associated different groups with an application Financial Strategy Model to gauge, arrange and predict investment problems

- Collaborate with purchasers, IT department, and human resource managers Collaborate with team members to budget and arrange prices

- Ensure price effectiveness and resource allocation produce jobs and policies which will facilitate boost Financial growth

- Monitoring and project management Explore numerous investment ways.

- Get info from numerous participants to supply necessary reports Prepare reports supported Financial information collected and share findings with the remainder of the corporate

- Analyze current Business processes and develop development solutions Analyze and compare marketing research to boost internal finance.

- Keep track of Business processes and anticipate future desires/issues Update existing Financial information by checking information flow

- Both professionals have a similar job while not operating in numerous domains. Business Analysts add the sector of operations and management whereas Financial Analysts add the Financial sector. A Business Analyst works on the general development of a Business whereas an Analyst works to boost Financial processes.

Roles and Responsibilities: Business Analyst and Financial Analyst:

- Method of Work: BA

- Business Analyst Career Method

- Traditional Business Analysts are developing into

- Senior Business Analyst

- Business Architect

- Great Business Designer

- With a quick draft, you can progress from BA to

- Product Owner

- PMO Director

- Vice President

- Deputy Chief President

- Chief Information Officer

- Business Plan Analyst may upgrade to

- Senior Analyst

- Technical Designer

- Enterprise Architect

- You can go from Project Manager to

- Senior Project Manager

- Program Manager

- Business Owner and more

- In order to advance to a more advanced degree, a professional may be required to have a Master’s degree or to obtain a degree in order to pursue a wide range of responsibilities. A graduate with a few years’ experience in the field can run for the position of Senior Financial Analyst.

- With strong expertise and many years of experience, Senior Financial Analysts move into authoritative positions. These professionals have management positions, such as portfolio managers or fund managers who lead a team of senior Analysts. Also, these Analysts can move to higher levels in the management field.

- In a few companies, senior Analysts direct and lead active teams within their domains. These experts are named by the Treasurer’s management. A Financial Analyst reaches the highest level of performance as Chief Financial Officer or Chief Investment Officer. They can oversee the entire company portfolio. The best professionals get this level (CFO or CIO).

Career Path: What is Your Choice?

Let’s take a look at the most important part of this blog; comparisons between BA and FA work methods. In this section, you will get a clear idea of which career to choose as your career.

To move from a senior BA to a Business Architect, you need to move from strategic thinking to strategic thinking, from internal to external emphasis, and a complete corporate vision. From BA to Product Owner, you need to build new leadership skills, customer-centered thinking, and decision-making power.

In order to make the most of your Business, you need to get out of the box and think critically and raise the level of Business.

Method of Work: FA

In the first phase of the work, the Financial Analyst is directed by the Chief Financial Analyst. Most professionals usually pursue a degree in this field, after a few years of experience as a Financial Analyst.

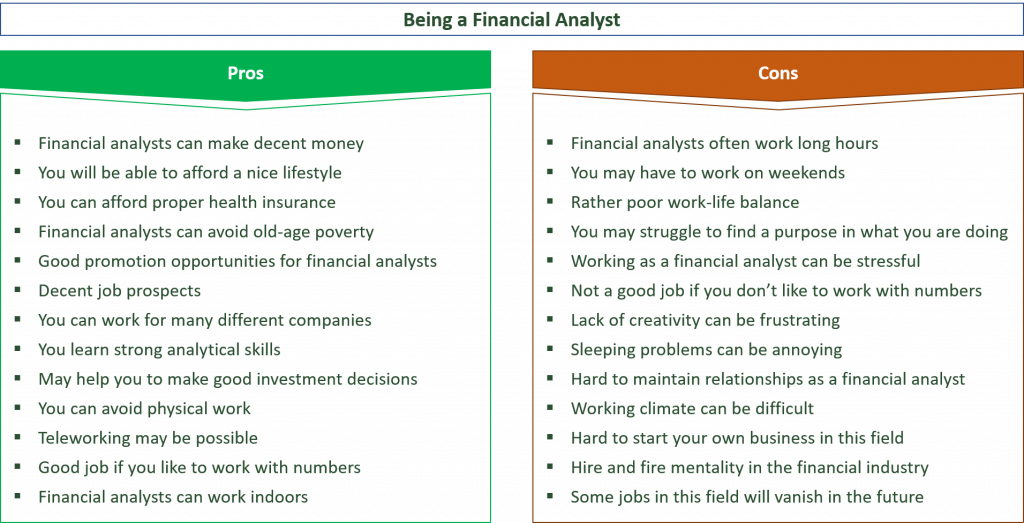

- Financial Analysts will reveal the important details regarding what drives a corporation to control, so that they will have nice potential within the Business.

- Financial Analysts will have a spread of careers and have the chance to fulfill many of us in management and finance.

- They have a pointy learning curve, ascension and receive higher compensation than their peers.

- Financial Analysts expertise positive employment growth of up to 16 PF from 2012-2022 *.

- They can add a spread of industries because the demand for securities Analysts has grown exponentially. Therefore, the flexibleness is high and that they will select any domain they like.

- Financial Analysts earn higher wages and might earn up to 16 PF over their unauthorized peers. The money services Business offers a variety of economic positions with associate degree Financial gain of six folks.

- The job security of the securities Analyst is additionally terribly high because it ensures their money capability, capital and risk management functions.

- Financial Analysts will powerfully challenge different candidates within the robust job market. Therefore, the operation of the securities Analyst will improve.

- Choosing the globe Wide securities Analyst position helps increase your credibility.

- Skills Analyst money, knowledge, and skill gained in operating in this field can improve your performance within the geographic point.

- Most money Analysts work on desks in climate-controlled offices in major cities across the country. They conjointly fancy the comfort of operating traditional Business hours.

- Financial Analysts fancy access to big and sensitive money information and have the chance to investigate that information for reportage and higher cognitive process. they’re so thought to be the highest executives within the Business and so earn a great deal of respect.

Benefits of Business Analyst vs Financial Analyst:

- Business Analyst is predicted to figure with the majority stakeholders within the project, be it the Project Team (Project Manager, project development team, analysis team), consumer (Key Stakeholders, End Users), Finance or getting Team and not forgetting the Senior Management (President, administrators and Delivery / Program Managers) and vendors.

- Analysts are typically given the chance to go to consumer sites, perceive advanced processes in new and difficult areas and expand their network on a daily basis.

- Business Analysts typically work on several things promptly and their job is much different from ‘sitting in a very chair all day’!

- Participate in a very consumer consultation method, analyze wants, analyze choices, record operational and technical needs, manage team members, manage changes, attend and record conferences and provide consumer / management presentations – generally all promptly. day.

- Given the roles and responsibilities of a Business Analyst, he ought to manage the varied areas of the project whereas being the foremost versatile and approachable. Without a doubt, Business Analyst is one among the foremost asked for professionals in any organization.

- Once you have gained a few years of expertise (3-5 years) as a Business Analyst, you may enter a crucial stage in your analysis method and you’ll opt for the method forward. you’ll work for a selected technology / domain associated become a lively Analyst otherwise you is a treater between Business and technology and not position yourself as an IT Business Analyst.

- In addition, if you want to travel straight to management, ‘Project Management ’is consequently an obvious call for knowledgeable Business Analysts as they need the required exposure and capabilities.

- Thus, Business Analysts bite nearly each project line and their contribution to the project can ne’er be questioned. Business Analysis Work is an inspiring and versatile vocation to satisfy your aspirations and deliver the goods the sort of growth you need.

- Almost everybody, no matter the background or organization he or she works for, can need to visualize his or her visible contribution and his or her restricted position within the larger system of things. However, thanks to knowledgeable limitations this doesn’t apply to any or all job topics and Business Analysts are the lucky few who are ready to capture a broad read of the project.

- They’re a part of the project from the pre-sale section and still be concerned till the project closes and in between perceive the project bidding, consumer communication, team capability, amendment management, procural method and are typically considered the project face. project (after project manager).

- Now we can simply make a case for why most of the active Project Managers are former Business Analysts!

- Due to the worth that Business Analysts contribute to the project, their contribution to the success of the project has ne’er been unsure and this adds to the Business Analyst’s interest and visibility.

- We have already seen however Business Analysts have an effect on the muse with project, operational, money and body aspects (read additional here) and since of their writing skills and technical data they’re helpful to technical architects and even the sales / sales team. Additionally, Analysts are typically asked to give a project presentation to senior management / Business executive / CFOs and to achieve attention to their understanding of the project of that they’re a neighborhood.

- Very few job titles relish this level of collaboration and organization visibility in a very comparatively short amount of your time.

- Business Analyst experience could be a comprehensive certification in numerous fields and so, you have got several opportunities ahead. On the opposite hand, securities Analysts, restricted possibility. however one becomes better in accounting and finance which provides them hope for growth.

- And if you’d prefer to become a Business Analyst, examine Intellipaat Business Analyst course which may be your start line for obtaining a decent job.

Conclusion:

As mentioned on top of, the most advantages of being a securities Analyst embody accessing and dealing with the foremost vital and sensitive money data, access to the highest management of the corporate i.e. having a revelation to the leadership team and management at the corporate, having the chance. feat the foremost vital comes and managing confidential knowledge, similarly because the ability to get valuable price for a corporation or consumer.

Along with these advantages, access to knowledge and management selections and therefore the authority to create Business development recommendations are major advantages of the securities Analyst. There are different vital advantages like the upper money Rewards List and therefore the acquisition of money bonus opportunities with stock-based compensation.

So, let’s see what the advantages of selecting a Business Analysis as a career alternative are.

1. Chance for communication and network

2. Quick work

3. Promising vocation with vital growth

4. Chance to visualize the massive image

5. The very best visibility of the Organization and respect