- Relationship Management Role in Financial Services

- Importance in Investment Banking

- Client Segmentation

- Onboarding and Client Lifecycle

- CRM Tools and Platforms

- Communication Skills and Ethics

- Understanding Client Needs

- Cross-Selling and Upselling Strategies

- Conflict Resolution

- Building Long-Term Trust

- Conclusion

Relationship Management Role in Financial Services

Relationship management lies at the core of financial services acting as the vital link between institutions and their clients. Relationship Managers (RMs) are responsible for acquiring, servicing, and growing client portfolios through advisory, sales, and ongoing support. As a dedicated financial advisor, I take a thorough approach to client service and business growth. I actively seek out and connect with high-value prospects while creating customized portfolio management strategies that fit each client’s unique financial situation. I coordinate smoothly with product teams, including insurance, loans, and investments, to provide a complete and integrated client experience. I strictly follow compliance and risk management standards, including KYC and AML protocols, which guide every interaction. My strategic method generates revenue through stronger client relationships and builds customer loyalty by offering expert, attentive service. By consistently upholding high ethical standards and giving well-informed product recommendations, I help clients lower potential risks while also improving the firm.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Importance in Investment Banking

In the fast-paced world of investment banking, Relationship Managers (RMs) help grow the business and ensure client success. They are skilled in finding and closing deals, as well as keeping clients satisfied, by using their extensive knowledge of important areas like M&A, divestitures, equity and debt capital market transactions, and restructuring financing solutions. By building strong relationships and gaining in-depth knowledge, RMs provide valuable strategic advice and create effective pitch books. Their personalized approach leads to significant deal flow and repeat business, helping their institution stand out in a competitive market. The long-lasting nature of these relationships directly boosts advisory and underwriting income. This highlights the crucial role RMs play in driving financial performance and engaging clients effectively.

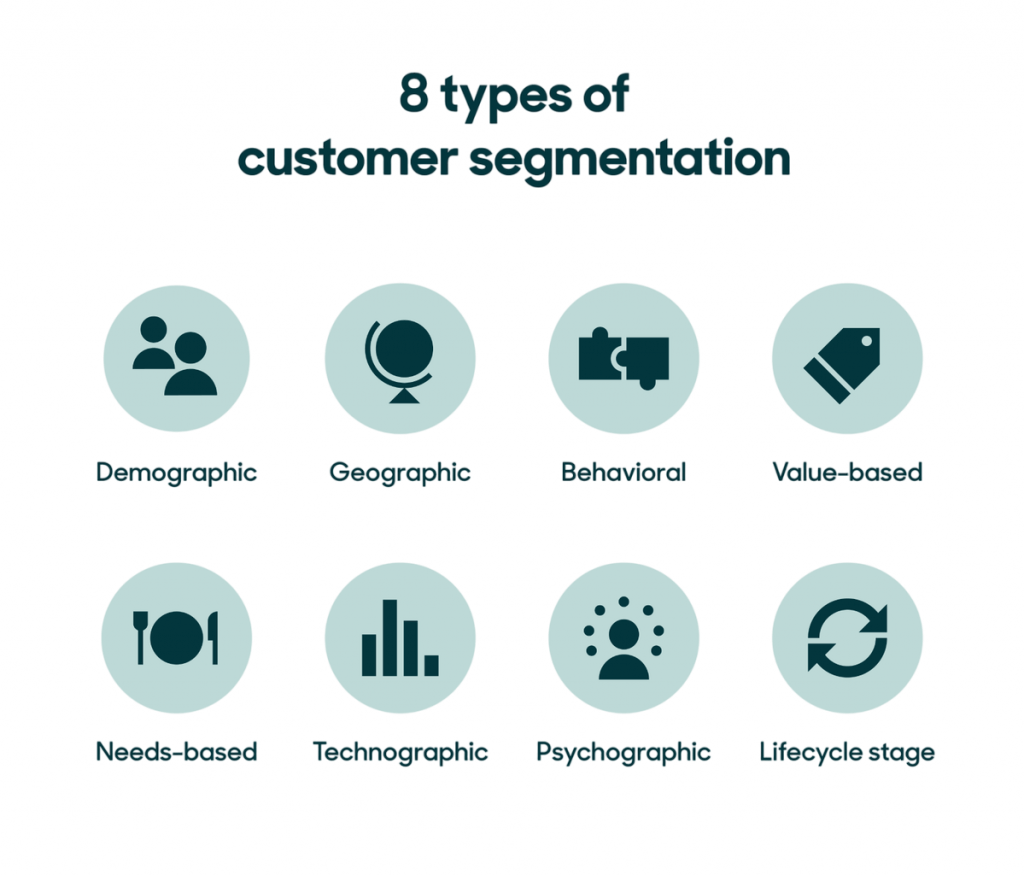

Client Segmentation

Segmenting clients allows relationship managers (RMs) to allocate resources more effectively and personalize services according to each segment’s specific needs.

Typical Segments:

- Retail Clients: Driven by advisory support and digital channel engagement

- High-Net-Worth Individuals (HNWIs): Require tailored wealth planning and investment services

- Ultra-High-Net-Worth (UHNW): Expect bespoke offerings such as access to family office structures

- Corporate Clients: Need cash management, trade finance, and risk hedging solutions

- Institutional Clients: Governed by RFPs and procurement standards; demand differentiated services

Segmentation Criteria:

- Assets under management (AUM)

- Expected revenue or profitability

- Complexity of financial needs

- Growth potential

- Strategic alignment with firm objectives

Proper segmentation enhances service delivery, enables higher fee capture, and improves overall client satisfaction.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Onboarding and Client Lifecycle

Effective onboarding sets the tone for the entire client journey and helps prevent future issues.

Onboarding Steps:

- Client Discovery: Profiling client risk appetite, financial goals, KYC completion, and documentation intake

- Account Setup: Configuring platforms, enabling access, and system testing

- Plan Presentation: Articulating investment objectives and proposing aligned solutions

- Implementation: Executing transactions and confirming account activation

- Welcome Workflow: Relationship Manager (RM) check-ins and onboarding education

Lifecycle Stages:

- Development: Strengthening relationships via tailored advisory and transparent reporting

- Growth: Broadening product exposure to support evolving client goals

- Retention: Sustaining engagement through regular reviews and proactive communication

- Exit/Legacy: Facilitating succession plans and ensuring smooth account closure

A smooth onboarding process reduces friction, builds trust, and supports long-term retention.

CRM Tools and Platforms

Financial services organizations use Customer Relationship Management (CRM) systems as essential tools to improve client interactions and boost operational efficiency. Leading platforms like Salesforce Financial Services Cloud, Microsoft Dynamics 365, and specialized solutions like Tamarac and Backstop provide strong features that centralize contact management, forecast pipelines, and support important business workflows. These systems provide teams with useful tools, including task reminders, opportunity tracking, collaboration features, and reporting dashboards. This helps create clear visibility into client relationships and revenue potential. By using a strategic CRM approach, organizations can greatly improve consistency, accountability, and team performance. This change turns scattered client interactions into a unified, data-driven engagement strategy that promotes business growth and client satisfaction.

Communication Skills and Ethics

Communication skills and ethics In client relationships, relationship managers must rely on strong communication skills and ethics standards to build trust and achieve long-term success. They need to excel in basic communication skills, starting with active listening to genuinely understand client needs and concerns. By delivering complex financial information in a clear and simple way, while showing empathy and support, especially during tough market downturns, professionals can create real connections through personalized interactions. Professionals should prioritize ethical practices that emphasize transparency. This includes clearly disclosing fees, potential risks, and any conflicts of interest. They must recommend financial products that suit a client’s unique profile, maintain strict confidentiality, and ensure compliance with regulatory standards to establish credibility. These connected principles of communication skills and ethics not only protect client interests but also lay a strong foundation for lasting, mutually beneficial relationships that foster deep trust.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Understanding Client Needs

Deeperly understanding client needs enables personalization and relevance in solutions offered.

Techniques:

- Structured Discovery: Assessing financial goals, time horizon, and constraints

- Behavioral Insights: Recognize biases and preferences

- Holistic View: Includes personal, entrepreneurial, and lifestyle factors

- Regular Reassessment: Adjusts for evolving objectives and life events

Deep understanding client needs knowledge facilitates tailored offerings like estate planning, lending, or international diversification.

Cross-Selling and Upselling Strategies

Cross-selling (complementary services) and upselling (higher-tier products) drive revenue and deepen relationships.

Strategies:

- Integrated Solutions: Bundling loans, insurance, investments, advisory

- Product Gap Analysis: Identifying unmet needs through portfolio reviews

- Event Triggers: Lifecycle changes (e.g., childbirth) prompt new financial needs

- Digitally Supported Campaigns: Targeted offers via online platforms

- Joint Meetings: Strategically involve specialists or leadership to cross over capabilities

Examples:

- Mortgage clients offered term insurance or mutual fund advice

- Company accounts introduced to FX hedging or trade finance

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Relationship Manager KPIs

Quantitative metrics help evaluate RM effectiveness and influence behavior.

Essential KPIs:

- Revenue Metrics: Fee income, interest income, sales commissions

- Portfolio Metrics: Net new asset growth, AUM change

- Client Metrics: Retention rate, referrals, Net Promoter Score (NPS)

- Activity Metrics: Meetings conducted, proposals delivered, follow-up actions

- Cross-Sell Ratio: Number of product types per client

- Risk & Compliance: KYC completion rates, data accuracy standards

KPIs should be role-specific, realistic, and purpose-driven: retention vs new acquisition vs advisory.

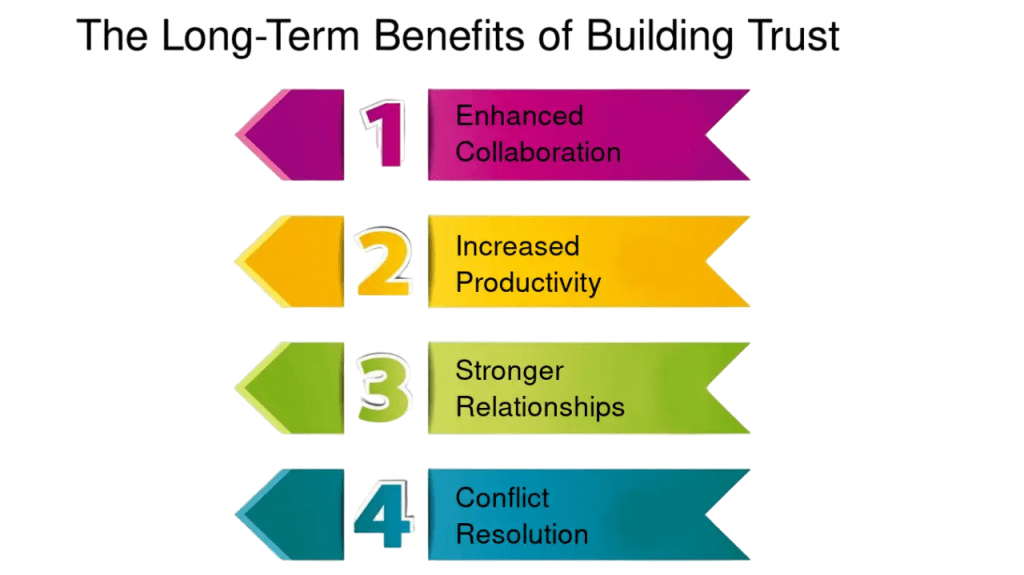

Building Long-Term Trust

Trust is cultivated over time through consistent, quality engagement and ethical stewardship.

Trust-Building Practices:

- Reliability: Timely responsiveness and follow-through

- Transparency: Clear disclosures, documented advice

- Competence: Staying informed, engaging in continuous learning

- Independence: Maintaining impartial product recommendations

- Empathy: Emotional intelligence during crises

- Proactivity: Anticipating needs before they become urgent

- Longevity: Navigating market cycles together increases bond strength

Trust isn’t transactional, it’s relational, cumulative, and foundational to long-term success.

Conclusion

In the complex world of financial services, relationship managers go beyond traditional roles, especially in high-pressure areas like investment banking and wealth advisory. A noteworthy case study shows this method through a detailed Ultra High Net Worth (UHNW) family office engagement. Here, strategic segmentation and a thorough understanding of clients lead to impressive results. By creating a thorough onboarding process that focuses on global tax planning, philanthropy, and succession strategies, relationship managers offer highly personalized experiences. They use modern CRM technologies and collaboration tools to work smoothly across different departments, allowing for targeted cross-selling of specific financial solutions such as private equity and alternative asset financing. Regular communication, including quarterly updates and annual strategic retreats, keeps clients informed, while strong conflict resolution methods provide peace of mind during market fluctuations. The results are significant: teams achieved a 20% increase in assets under management, a 95% client loyalty score, and stronger connections across various family networks. Success depends on a thoughtful and understanding approach that values each client’s unique vision, upholds ethical standards, and delivers exceptional, data-driven advisory services that consistently surpass expectations.