- Introduction to Scam 2003: The Stamp Paper Fraud

- Background of Abdul Karim Telgi

- Modus Operandi

- Timeline of Events

- Legal & Political Connections

- Impact on the Economy

- Role of Law Enforcement

- Judiciary and Convictions

Introduction to Scam 2003: The Stamp Paper Fraud

Scam 2003: The Stamp Paper Fraud is one of India’s most notorious financial scams, masterminded by Abdul Karim Telgi, who orchestrated a massive counterfeit stamp paper racket that shook the entire country. Estimated at over ₹30,000 crore, the scam infiltrated various layers of bureaucracy, police departments, and financial institutions, exposing deep-rooted corruption in the system. Telgi’s fraudulent network extended across multiple states, with fake stamp papers being sold to banks, insurance companies, and government offices. This landmark case drew significant attention from institutions like the Criminal Justice Academy, which began using it as a reference point for training modules and awareness initiatives. Additionally, it spurred reforms and enhancements in law enforcement programs, focusing on white-collar crime detection and prevention. The scandal served as a grim reminder of how systemic gaps can be exploited on a national scale, prompting a reevaluation of India’s regulatory mechanisms and the urgent need for digitization of such high-value instruments. Today, Scam 2003 The Stamp Paper Fraud not only stands as a case study in financial crime but also as a catalyst that redefined approaches to law enforcement, legal accountability, and the education of future officers and legal professionals.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Background of Abdul Karim Telgi

- Humble Beginnings: Born in Khanapur, Karnataka, Telgi started with humble roots and initially worked as a fruit and peanuts vendor at railway stations.

- Overseas Exposure: He moved to Saudi Arabia for several years, where he is believed to have learned the early tricks of forgery and document manipulation.

- Entry into Counterfeiting: After returning to India, Telgi began by creating fake passports and documents before moving into printing counterfeit stamp papers.

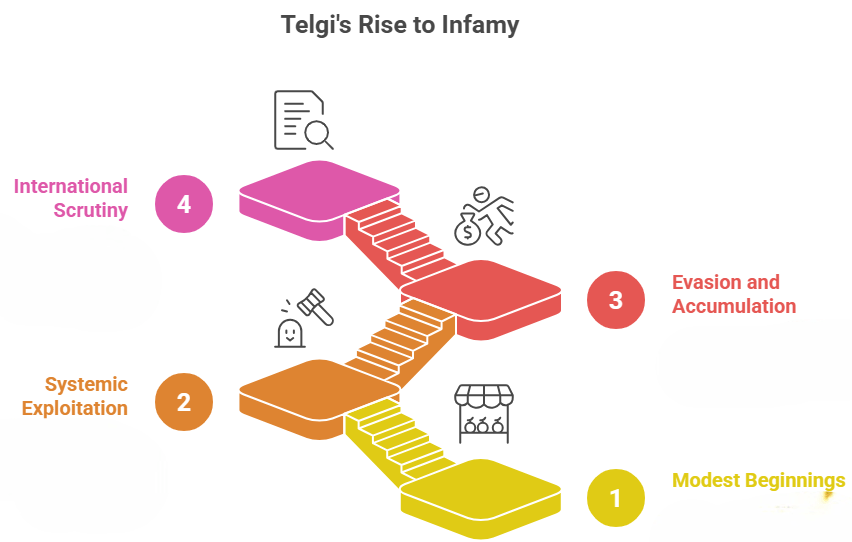

Abdul Karim Telgi was the mastermind behind one of India’s biggest financial frauds the Stamp Paper Scam that exposed the vulnerabilities in the country’s administrative and legal systems. His journey from a fruit seller to a criminal kingpin is both shocking and revealing, especially in how he managed to outsmart multiple law agencies and evade scrutiny for years. His case became a subject of interest not only in India but also for international federal agents studying large-scale financial frauds and their modus operandi.

- Modus Operandi: Telgi built a vast network, using bribery and connections within the bureaucracy, banks, and police departments to circulate fake stamp papers across India.

- Evading Law Agencies: Despite multiple red flags, he remained under the radar for years, manipulating systems that even the best types of FBI agents would find challenging to crack.

- Eventually Busted: His empire crumbled when joint efforts by federal agents and Indian law enforcement agencies finally exposed the scale of the scam, leading to nationwide investigations and arrests.

Modus Operandi

The modus operandi of Scam 2003: The Stamp Paper Fraud was both intricate and audacious, showcasing Abdul Karim Telgi’s deep understanding of systemic loopholes and institutional vulnerabilities. At the heart of the operation was the illegal printing of counterfeit stamp papers, which were then distributed to banks, insurance firms, stock brokerage houses, and even government offices across multiple states. Telgi obtained genuine stamp printing machinery and licenses by bribing officials and forging documents, which allowed him to replicate government-issued stamp papers almost flawlessly. He built a vast network of agents and corrupt insiders, ensuring smooth circulation of fake documents without immediate detection. The scam revealed shocking lapses in oversight mechanisms and drew the attention of the Criminal Justice Academy, where it became a case study for analyzing the failings of regulatory bodies and the effectiveness of fraud detection protocols. The scale of the operation was so massive that it exposed the urgent need to upgrade law enforcement programs, particularly in financial fraud investigations and forensic audits. Today, the Scam 2003 The Stamp Paper Fraud stands as a powerful example of how white-collar crime can undermine public institutions and why legal education and proactive enforcement remain critical in preventing such breaches.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Timeline of Events

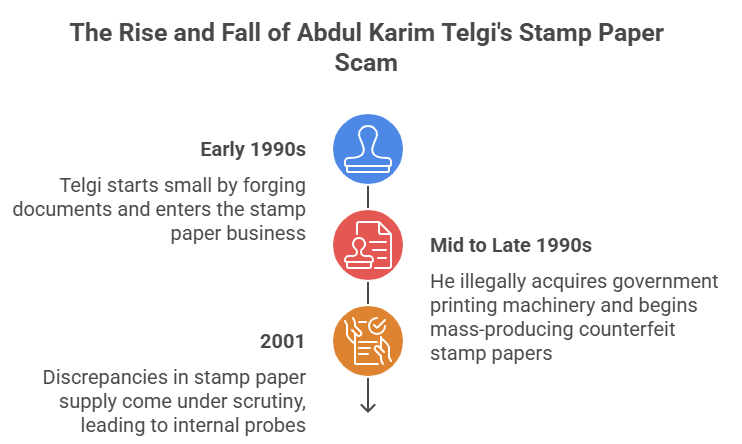

- Early 1990s: Telgi starts small by forging documents and soon enters the stamp paper business, aiming to manipulate a system that lacked tight regulation.

- Mid to Late 1990s: He illegally acquires government printing machinery and begins mass-producing counterfeit stamp papers for wide-scale distribution.

- 2001: Discrepancies in stamp paper supply come under scrutiny, leading to internal probes by various departments.

The timeline of Scam 2003 The Stamp Paper Fraud reveals how Abdul Karim Telgi built one of India’s most shocking financial scams through forgery, bribery, and a deeply rooted network of corruption. His criminal empire went unnoticed for years, exploiting systemic flaws. Today, this case is studied at the Criminal Justice Academy and has become a key reference for updating law enforcement programs to better address complex financial crimes.

- 2003: The scam breaks open when Maharashtra Police uncover the massive fraud, officially marking it as Scam 2003 The Stamp Paper Fraud.

- 2004–2007: The investigation unearths a trail of corrupt officials, leading to nationwide arrests and disciplinary actions.

- Post-2007: Reforms are initiated, and law enforcement programs are revamped; the case becomes a core study module at the Criminal Justice Academy.

- Massive Revenue Losses: The government suffered a direct revenue loss of thousands of crores due to the use of fake stamp papers in place of genuine ones.

- Financial Sector Disruption: Banks, insurance companies, and stock brokers unknowingly used counterfeit documents, leading to legal complications and loss of investor confidence.

- Delay in Legal Proceedings: Cases involving fake stamp papers flooded the judiciary, delaying numerous property, loan, and business-related litigations.

- Institutional Trust Erosion: Public trust in financial documentation and government-issued instruments was severely shaken.

- Costly Reforms: The government had to invest heavily in digitizing and securing stamp paper distribution systems, increasing operational costs.

- Enhanced Training Programs: The case led to curriculum upgrades at the Criminal Justice Academy and modernization of law enforcement programs focusing on financial fraud detection.

Legal & Political Connections

The Scam 2003 The Stamp Paper Fraud wasn’t just a financial crime it unveiled a complex web of legal and political connections that allowed Abdul Karim Telgi to operate his racket for years without detection. Telgi’s modus operandi thrived on deep-rooted corruption, with several government officials, politicians, and even members of the judiciary allegedly on his payroll. He managed to infiltrate the very institutions meant to uphold the law, using bribery and influence to silence dissent and avoid scrutiny. These revelations shocked the nation and drew the attention of federal agents and international watchdogs, who studied the case to understand how large-scale economic crimes can be enabled by systemic corruption. Indian law agencies came under fire for their slow response and lack of internal checks, prompting immediate reforms and tighter oversight protocols. The case also became a topic of study among different types of FBI agents, especially those focusing on economic and white-collar crimes, as it mirrored global patterns of fraud and misuse of public trust. Ultimately, the Telgi scam highlighted the urgent need for accountability within political and legal frameworks and underscored how critical it is for enforcement bodies to remain independent and resistant to external pressures.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Impact on the Economy

The Scam 2003 The Stamp Paper Fraud had a far-reaching impact on the Indian economy, exposing deep flaws in regulatory systems and trust-based financial transactions. The circulation of counterfeit stamp papers not only caused direct financial losses but also weakened institutional credibility. The scam is now widely analyzed at the Criminal Justice Academy and has shaped several law enforcement programs aimed at curbing white-collar crimes.

Role of Law Enforcement

The role of law enforcement in uncovering and addressing the Scam 2003 The Stamp Paper Fraud was both critical and transformative. Initially, the scam went undetected due to the involvement of several corrupt officials within the system, allowing Abdul Karim Telgi to operate freely across multiple states. However, once the Maharashtra Police launched a serious investigation, the magnitude of the fraud became evident. Their efforts led to the arrest of Telgi and the exposure of a vast network of accomplices, including government officials, police officers, and political figures. This landmark case not only highlighted the weaknesses in traditional policing but also triggered a nationwide call for reform. In response, law enforcement programs across the country were updated to focus more on financial crimes, inter-agency coordination, and white-collar criminal tracking. The Criminal Justice Academy adopted the scam as a case study, using it to train future officers on the importance of integrity, vigilance, and modern investigative techniques. Ultimately, Scam 2003 The Stamp Paper Fraud served as a wake-up call, emphasizing the need for proactive, well-equipped, and corruption-resistant law enforcement bodies to protect public institutions and maintain economic order in a rapidly evolving financial landscape.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Judiciary and Convictions

The Judiciary and Convictions phase of the Scam 2003 The Stamp Paper Fraud played a crucial role in bringing justice to one of India’s most complex white-collar crimes. After the elaborate modus operandi of Abdul Karim Telgi was exposed where he printed and circulated fake stamp papers worth thousands of crores the legal system faced the enormous task of prosecuting those involved. The case saw trials in special courts, where evidence was presented against not only Telgi but also a long list of accomplices, including bureaucrats, police officers, and politicians. Telgi was eventually convicted and sentenced to 30 years of rigorous imprisonment along with a hefty fine, marking one of the most high-profile convictions in Indian legal history. His case drew international attention, prompting federal agents and global observers to evaluate how such scams could go undetected for so long. Various law agencies were criticized for their initial inaction, but later collaborated to support the judiciary in gathering critical evidence. The scam also sparked interest among different types of FBI agents, particularly those focused on economic crimes and corruption. In the end, the judiciary’s handling of the case emphasized the importance of transparency, legal reform, and swift justice in maintaining public trust.