- Introduction to Risk Management

- Types of Financial Risks

- Importance in Banking and Trading

- Risk Assessment Techniques

- Risk Mitigation Strategies

- Regulatory Compliance

- Real-World Case Studies

- Risk vs Return Balance

Introduction to Risk Management

Risk management is a critical discipline that involves identifying, assessing, and mitigating potential threats that could negatively impact an organization’s operations or financial stability. The importance of risk management lies in its ability to help businesses anticipate uncertainties and implement strategies to minimize losses while maximizing opportunities. Whether it’s a large corporation or a small enterprise, having a solid risk management framework in place ensures that decisions are made with a full understanding of potential risks and their consequences. This framework typically includes risk identification, analysis, response planning, monitoring, and review. In today’s volatile economic environment, financial risk management plays a particularly crucial role, helping firms protect assets, maintain cash flow, and remain compliant with regulatory requirements. By effectively managing financial exposures such as market volatility, credit risks, and liquidity issues, businesses can build resilience and enhance stakeholder confidence. Additionally, risk management fosters a culture of accountability and proactive decision-making, enabling long-term growth and sustainability. Ultimately, it is not about avoiding all risks, but about understanding them well enough to make informed decisions. An organization that integrates risk management into its core strategy is better positioned to achieve its goals and maintain a competitive edge in an unpredictable world.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

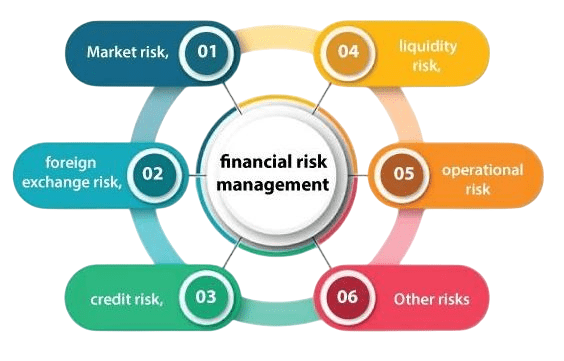

Types of Financial Risks

- Market Risk: Arises from fluctuations in market prices such as stocks, interest rates, or foreign exchange. Businesses must constantly monitor market trends to mitigate these risks.

- Credit Risk: Occurs when a borrower or counterparty fails to meet financial obligations. Effective supplier risk assessment and TPRM practices can reduce credit exposure.

- Liquidity Risk: Refers to a company’s inability to meet short-term financial obligations. Strong GRC management ensures that liquidity planning is well-governed.

Financial risks refer to the potential losses a business may face due to fluctuations in markets, credit defaults, operational failures, or external factors. Identifying and addressing these risks is essential for sustainable financial health. Leveraging tools like ServiceNow IRM, applying robust TPRM frameworks, conducting thorough supplier risk assessments, and integrating GRC management practices can help organizations stay resilient in a volatile environment. Insights from Gartner Security also guide businesses in navigating modern risk landscapes. Here are six key types of financial risks:

- Operational Risk: Involves losses from failed internal processes, systems, or external events. Platforms like ServiceNow IRM help streamline operational risk control.

- Compliance Risk: Related to legal penalties from non-compliance with regulations. GRC tools and Gartner Security standards provide guidance here.

- Reputational Risk: A decline in stakeholder trust due to financial missteps. Proactive TPRM and risk communication can protect brand integrity.

Importance in Banking and Trading

In the world of banking and trading, the importance of risk management cannot be overstated, as institutions constantly face a range of uncertainties that can impact profitability, stability, and trust. Banks and trading firms deal with high volumes of transactions, market fluctuations, credit exposures, and regulatory pressures, making it essential to implement a strong risk management framework. This framework helps identify, evaluate, and mitigate potential threats, ensuring that decisions are informed and aligned with the institution’s risk appetite. Financial risk management plays a particularly vital role by focusing on exposures such as interest rate changes, currency volatility, credit defaults, and liquidity shortages. Effective risk management protects capital, ensures compliance, and fosters investor confidence, all while maintaining operational resilience. It also aids in preventing massive losses from unforeseen events like market crashes or credit crises. Furthermore, risk-aware strategies help traders manage portfolios more effectively, reducing the chances of abrupt losses. For banks, adopting a proactive risk culture leads to better lending decisions, stronger asset quality, and improved regulatory standing. Overall, embedding risk management into every layer of banking and trading operations creates a safer, more agile, and competitive financial environment that can adapt to today’s fast-changing global markets.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

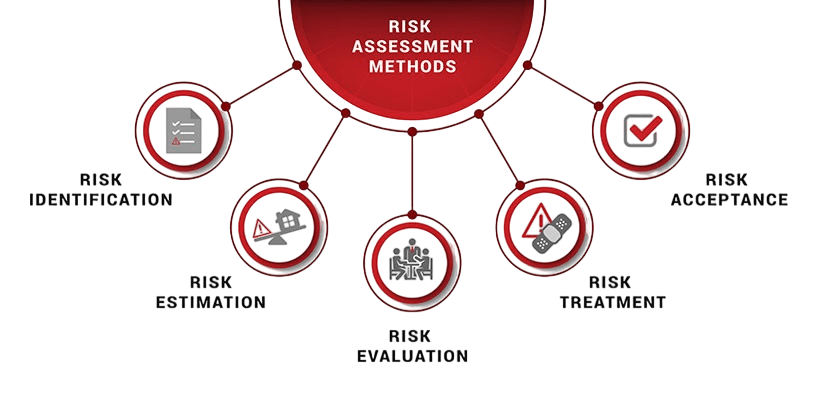

Risk Assessment Techniques

- Qualitative Risk Assessment: Focuses on subjective analysis using expert judgment, risk matrices, and scenario evaluations. Common in early risk identification phases.

- Quantitative Risk Assessment: Uses numerical data and statistical models to measure the probability and impact of risks. Ideal for financial forecasting and compliance.

- Failure Modes and Effects Analysis (FMEA): A systematic approach for identifying potential failure points in processes or systems and assessing their consequences.

Risk assessment is a foundational step in any organization’s risk management process. It involves identifying potential threats, evaluating their likelihood and impact, and determining how best to mitigate them. Effective risk assessment empowers decision-makers to allocate resources wisely and prioritize actions that protect business operations. Leveraging platforms like ServiceNow IRM, integrating TPRM frameworks, conducting supplier risk assessments, and applying robust GRC management practices are essential to achieving comprehensive risk visibility. Expert insights from Gartner Security also help shape reliable and up-to-date assessment strategies. Here are six widely used risk assessment techniques:

- Bow-Tie Analysis: Visual technique that maps out causes, controls, and consequences of risks, aiding in clarity and communication.

- SWIFT (Structured What-If Technique): Team-based brainstorming that evaluates hypothetical risk scenarios to uncover hidden vulnerabilities.

- Checklist and Questionnaire-Based Assessments: Frequently used in supplier risk assessments and TPRM frameworks to ensure standard risks are not overlooked.

- Data Protection and Privacy: Ensuring compliance with laws like GDPR and HIPAA through proper data handling, encryption, and access controls.

- Third-Party Risk Management: Using TPRM frameworks and supplier risk assessments to evaluate and monitor vendor compliance with regulatory standards.

- Operational Transparency: Leveraging GRC management systems to document policies, controls, and audit trails that regulators require.

- Financial Reporting Compliance: Meeting the standards of regulatory bodies like SEBI or SEC through accurate and timely financial disclosures.

- Cybersecurity Standards: Following security guidelines, often informed by Gartner Security, to prevent data breaches and cyberattacks.

- Automation of Compliance Processes: Implementing platforms like ServiceNow IRM to streamline compliance workflows, reduce manual errors, and ensure timely reporting.

Risk Mitigation Strategies

Risk mitigation strategies are essential components of a robust risk management framework, designed to minimize the impact of potential threats on an organization’s operations, assets, and reputation. These strategies form the backbone of proactive planning and are crucial for maintaining business continuity, especially in volatile sectors like banking, trading, and finance. The importance of risk management lies in its ability to empower organizations to prepare for uncertainties by identifying vulnerabilities and implementing measures that either reduce the probability of risk events or lessen their consequences. In the context of financial risk management, mitigation involves diversifying investment portfolios, setting risk limits, employing hedging instruments, and maintaining adequate liquidity. Other strategic actions include adopting strong internal controls, enhancing regulatory compliance, and using predictive analytics to foresee and address emerging risks. Effective mitigation also means fostering a risk-aware culture, where teams are trained to respond quickly and decisively. A well-structured risk management framework integrates these strategies at every operational level, ensuring that the organization not only survives disruptions but also thrives by turning risks into opportunities. Ultimately, businesses that invest in risk mitigation strengthen their resilience, improve stakeholder confidence, and maintain a competitive edge in an ever-evolving global landscape.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Regulatory Compliance

Regulatory compliance is a critical aspect of modern business operations, ensuring that organizations follow laws, industry standards, and internal policies to avoid legal penalties, reputational damage, and financial losses. As regulatory requirements become more complex, companies must adopt structured approaches and technologies to remain compliant. Tools like ServiceNow IRM, robust TPRM frameworks, comprehensive supplier risk assessments, and strategic GRC management practices play vital roles in supporting compliance efforts. Additionally, guidance from Gartner Security helps organizations stay ahead of evolving regulatory landscapes. Here are six key areas where regulatory compliance is essential:

Real-World Case Studies

Real-world case studies highlight the importance of risk management by showcasing how organizations have either succeeded or failed based on their ability to identify and mitigate potential threats. One prominent example is the 2008 financial crisis, where the absence of a solid risk management framework led to the collapse of major institutions like Lehman Brothers, demonstrating how poor oversight of financial exposures can trigger systemic failures. On the other hand, companies like JPMorgan Chase successfully navigated the crisis due to robust financial risk management practices, including diversified asset portfolios, liquidity buffers, and rigorous credit assessments. Another notable case is the Equifax data breach, where inadequate risk controls and delayed action resulted in severe reputational and regulatory consequences, emphasizing the need for a proactive approach to cyber risk. In contrast, firms that integrate enterprise risk management into their strategic planning such as IBM or HSBC have demonstrated resilience during crises, enabling them to recover faster and maintain stakeholder trust. These real-world examples underscore that risk management is not just a compliance tool but a strategic enabler that drives informed decision-making, safeguards financial health, and strengthens long-term business sustainability in an increasingly complex and uncertain global environment.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Risk vs Return Balance

Achieving the right balance between risk and return is a fundamental principle in finance and investment, directly linked to the importance of risk management. Investors and institutions must weigh potential rewards against the risks involved in every financial decision, understanding that higher returns often come with increased uncertainty. A well-defined risk management framework helps organizations and individuals make informed decisions by evaluating the level of acceptable risk relative to their objectives and resources. This framework includes tools and strategies to assess risk tolerance, measure potential losses, and implement controls to limit exposure. In the realm of financial risk management, techniques like portfolio diversification, asset allocation, and the use of hedging instruments are employed to optimize returns while minimizing downside risks. Striking the right balance ensures that returns are pursued without exposing the business or investor to unacceptable losses. Ignoring this balance can lead to reckless decision-making, while excessive caution may result in missed growth opportunities. Therefore, integrating risk analysis into investment and business strategy is crucial for long-term success. Ultimately, managing the risk-return trade-off through structured planning and continuous monitoring is key to building resilient portfolios and sustainable financial performance in an unpredictable economic environment.