- Introduction to LBOs

- Key Terminologies

- Structure of an LBO Deal

- Funding Mechanisms

- LBO Model Explained

- Ideal LBO Candidates

- Risks and Downsides

- Case Studies of Famous LBOs

Introduction to LBOs

An Introduction to LBOs (Leveraged Buyouts) involves understanding a strategic financial move where a company is acquired using a significant amount of borrowed money. The assets of the company being acquired often serve as collateral for the loans, making leveraged buyout financing a popular method for private equity firms aiming to control companies with minimal capital outlay. This form of acquisition, also known as leveraged acquisition finance, allows buyers to gain substantial ownership while distributing financial risk across the deal structure. One of the most common forms is the leveraged management buyout, where the existing management team partners with financial backers to purchase the company they currently run. LBOs are typically pursued when a target company has strong, stable cash flows that can support debt repayment, along with undervalued assets and operational improvement potential. This structure enables significant returns if the company’s value increases post-acquisition. However, the high debt load also introduces financial risk if the company’s performance falters. In today’s private equity landscape, LBOs remain a key strategy for value creation, requiring a careful balance of financial engineering, operational expertise, and market timing to succeed. Understanding the fundamentals of LBOs is essential for anyone exploring modern corporate finance or strategic investments.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Key Terminologies

- LBO Valuation: This refers to the process of determining the worth of a target company using financial modeling, factoring in future cash flows, exit multiples, and debt repayments to estimate potential returns.

- LBO Funding: LBOs rely heavily on debt, and this term covers the different layers of financing such as senior debt, mezzanine financing, and equity contributions that together fund the acquisition.

- LBO Firms: These are private equity firms that specialize in acquiring companies through leveraged buyouts, aiming to improve operations and eventually exit with a profitable return.

Understanding the key terminologies used in leveraged buyouts (LBOs) is crucial for grasping how these complex financial transactions work. Whether you’re a finance student, an aspiring private equity analyst, or just exploring investment strategies, getting familiar with the common terms helps decode the structure and strategy behind LBO deals. Below are six essential terms that frequently appear in LBO discussions, each playing a significant role in shaping the outcome of an acquisition:

- Acquisition LBO: A general term describing the leveraged acquisition of a company, usually structured to maximize return on equity through high leverage and operational efficiency.

- Fully Leveraged Buyout: This occurs when a deal is financed almost entirely through debt, leaving minimal equity invested by the buyer and increasing both potential returns and financial risk.

- Exit Strategy: Common in LBO models, this refers to how LBO firms plan to exit the investment, typically through a sale, IPO, or recapitalization after improving the company’s performance.

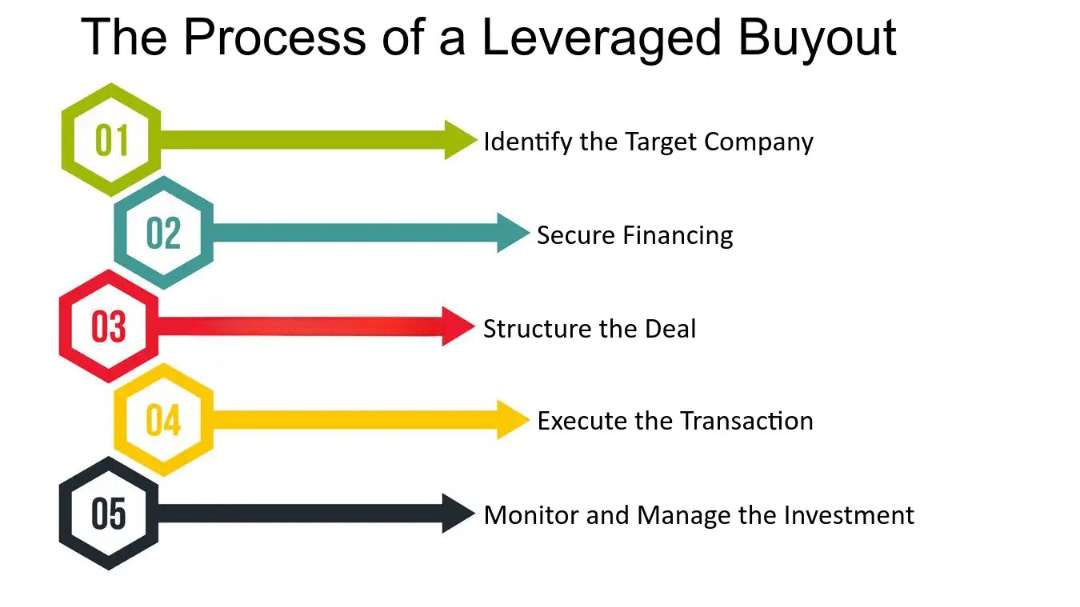

Structure of an LBO Deal

The structure of an LBO deal is strategically designed to maximize returns through a combination of debt and equity, making it a cornerstone of private equity transactions. At its core, a leveraged buyout involves acquiring a company using a substantial amount of borrowed funds, often secured by the assets and future cash flows of the target company itself. This is known as leveraged buyout financing, where various forms of debt senior loans, subordinated debt, and mezzanine financing are layered to minimize the equity contribution from the acquiring party. The equity portion, typically provided by private equity firms or financial sponsors, complements the debt and aligns interests between stakeholders. In many cases, particularly when the current leadership remains involved post-acquisition, the deal may take the form of a leveraged management buyout, where management teams co-invest alongside sponsors to retain operational control. Leveraged acquisition finance is thus a tailored approach, ensuring that the capital structure supports both the immediate acquisition and long-term value creation. Cash flow projections, operational improvements, and exit strategy planning are integral to this structure, enabling the deal to generate attractive returns while managing risk. A well-structured LBO deal reflects a deep understanding of financial engineering, strategic growth potential, and disciplined execution.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

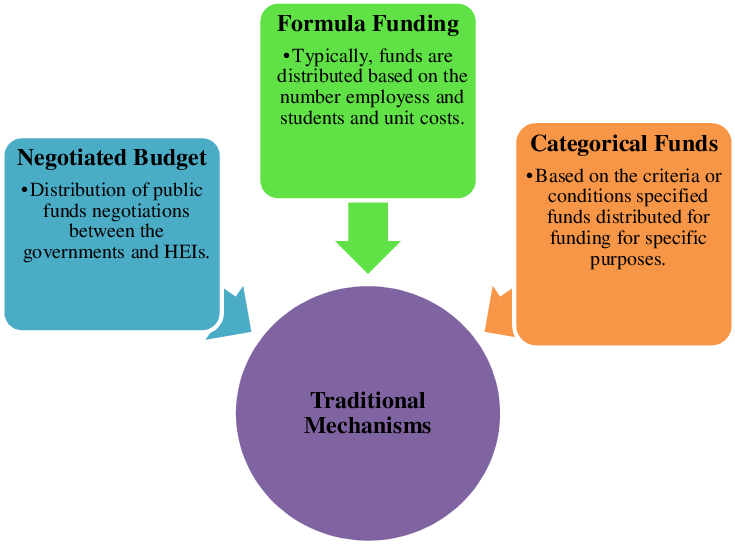

Funding Mechanisms

- Senior Debt: This is the primary source of funding in most LBOs, typically secured against the assets of the target company. It carries lower interest rates and is repaid first in case of default.

- Mezzanine Financing: A hybrid of debt and equity, mezzanine financing fills the gap between senior debt and equity. It comes with higher interest rates and may include equity kickers like warrants.

- Equity Contribution: LBO sponsors usually provide a portion of the total capital as equity, especially important in LBO valuation when calculating potential returns.

Understanding the funding mechanisms behind a leveraged buyout (LBO) is essential for evaluating the risk and return profile of such deals. In an LBO, a mix of debt and equity is used to acquire a company, with the goal of maximizing returns while minimizing the capital outlay by investors. The structure of LBO funding depends on the deal size, target company profile, and market conditions. Below are six common funding sources used by LBO firms to finance an acquisition LBO:

- Seller Financing: In some deals, the seller agrees to finance part of the purchase price, reducing immediate cash requirements for the buyer.

- High-Yield Bonds: Also known as junk bonds, these are used in larger or riskier deals, offering high returns to investors willing to take on additional risk.

- Asset-Based Lending: Common in a fully leveraged buyout, this involves borrowing against the company’s physical or receivable assets, helping reduce the upfront equity needed.

LBO Model Explained

The LBO model is a financial tool used to assess the feasibility and profitability of a leveraged buyout financing deal by projecting a company’s future performance under a capital structure dominated by debt. It outlines how an acquisition will be funded usually with a mix of debt and equity and how that structure impacts returns over the investment horizon. In a typical leveraged acquisition finance scenario, private equity firms acquire a target company by borrowing a significant portion of the purchase price, using the target’s assets and expected cash flows as collateral. The LBO model forecasts income statements, balance sheets, and cash flow statements to determine whether the company can service the debt, maintain operations, and eventually deliver a strong return upon exit usually through a sale or IPO. It includes key assumptions such as entry and exit multiples, revenue growth, margin expansion, and debt repayment schedules. In a leveraged management buyout, where the company’s existing management participates in the acquisition, the model also measures how management’s equity stake may grow in value. Ultimately, the LBO model helps investors evaluate risks, optimize the capital structure, and estimate internal rates of return (IRR), making it an essential tool in the world of private equity transactions.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Ideal LBO Candidates

Ideal LBO candidates are companies that exhibit stable cash flows, strong asset bases, and potential for operational improvements traits that allow them to support the high debt levels associated with LBO funding. These companies are typically mature, with predictable earnings, low capital expenditure requirements, and limited need for immediate reinvestment. From the perspective of LBO firms, such targets are attractive because they reduce financial risk and offer opportunities to enhance returns through strategic cost-cutting or revenue growth initiatives. In an acquisition LBO, the ability of the company to consistently generate cash flow is crucial, as it ensures timely interest payments and principal repayments on the leveraged debt. A favorable LBO valuation also plays a significant role, where the purchase price aligns well with projected returns based on EBITDA multiples and exit strategies. Companies with undervalued assets, low existing debt, and experienced management teams are often high on the list. In some cases, a fully leveraged buyout may be pursued, where almost the entire deal is financed through debt, emphasizing the importance of strong cash flow metrics. Industries such as consumer goods, manufacturing, and healthcare often produce ideal LBO candidates due to their resilience and operational consistency, making them prime targets for private equity-led buyouts.

Risks and Downsides

While leveraged buyouts can offer high returns, they also come with significant risks and downsides that must be carefully evaluated. One of the primary concerns with leveraged buyout financing is the heavy reliance on debt, which can strain a company’s cash flow and limit its financial flexibility. If the acquired business underperforms or encounters market disruptions, meeting interest and principal payments becomes challenging, increasing the risk of default or bankruptcy. In leveraged acquisition finance, even minor fluctuations in revenue or profitability can drastically impact the company’s ability to service its debt, making the deal highly sensitive to operational performance. Additionally, high leverage often leads to aggressive cost-cutting, which may hurt long-term growth or employee morale. In the case of a leveraged management buyout, where the existing management takes on significant debt to acquire the company, there’s a potential conflict of interest between short-term financial goals and sustainable business practices. Economic downturns, rising interest rates, or regulatory changes can further amplify these risks, leading to reduced investor returns or complete capital loss. Ultimately, while leveraged buyouts are powerful tools in private equity, they demand disciplined execution, accurate forecasting, and cautious risk management to avoid the pitfalls that come with excessive financial leverage.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Case Studies of Famous LBOs

Case studies of famous LBOs offer real-world insight into how leveraged buyouts can reshape industries and generate massive returns when executed correctly. One of the most iconic deals in history is the 1989 acquisition of RJR Nabisco by KKR, valued at $31.1 billion. It was a landmark acquisition LBO that brought global attention to the power and complexity of LBO funding, involving a mix of high-yield bonds and bank loans. The deal’s scale and media coverage made it a blueprint for future LBO firms, highlighting both the potential rewards and inherent risks of such transactions. Another notable example is the fully leveraged buyout of Dell in 2013 by its founder Michael Dell and Silver Lake Partners, a move that required creative LBO valuation and capital structuring to take the company private and rebuild it away from public market pressure. Similarly, the 2007 buyout of Hilton Hotels by Blackstone for $26 billion showed how operational improvements and timing could lead to exceptional returns, even through the financial crisis. These deals underscore how private equity relies on deep financial engineering, meticulous valuation, and robust funding mechanisms to transform companies, making them valuable case studies for anyone studying modern corporate finance and leveraged buyouts.