- Introduction

- Components of Salary

- Taxable vs Non-Taxable Income

- HRA and LTA

- Section 80C Deductions

- Other Sections (80D, 80E, 80G, etc.)

- New vs Old Tax Regime

- Investment-linked Tax Saving

- Filing Income Tax Returns (ITR)

- Common Mistakes

- Tax-saving Tips

- Conclusion

Introduction

Income tax is a critical aspect of financial planning for salaried individuals in India. The Indian tax system classifies various components of salary and income into taxable and non-taxable categories and offers multiple avenues to reduce tax liability through exemptions, deductions, and investments. Understanding the structure of salary, applicable tax laws, and how to optimize tax savings can significantly improve one’s financial health. This guide explores the components of salary, taxable versus non-taxable income, key exemptions like House Rent Allowance (HRA) and Leave Travel Allowance (LTA), deductions under various sections of the Income Tax Act, differences between the new and old tax regimes, investment-linked tax-saving options, filing Income Tax Returns (ITR), common mistakes to avoid, and practical tax-saving tips.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Components of Salary

Salary is the most common source of income for individuals, and it comprises multiple components. Not all components are treated equally for tax purposes, so it is vital to understand their nature: In salary structures, employees face various components that greatly affect their total pay and tax responsibilities. Basic salary is the main element; it establishes the foundation for different allowances and is fully taxable under “Income from Salary.” Alongside this are specific allowances like Dearness Allowance (DA), which helps counter inflation, and House Rent Allowance (HRA), which provides partial tax breaks for rent. Employees also receive travel-related allowances like Leave Travel Allowance (LTA) and Conveyance Allowance, which offer tax relief for certain travel costs. Medical allowances, special allowances, and perks like company cars or cheap loans add to the pay package, each having its own tax rules. While bonuses and commissions are fully taxable, some benefits like provident fund contributions have partial exemptions. Understanding these complex salary components is crucial for employees; it helps them plan their taxes better and improve their financial strategies.

Taxable vs Non-Taxable Income

In salary income, some components are fully taxable, some partially exempt, and some fully exempt. Employers must provide Form 16 to detail salary components and tax deductions for accurate filing.

Fully Taxable Income: Includes basic salary, dearness allowance (unless exempted), bonus and commissions, special allowances (unless exempted), and perquisites (unless exempted).

Partially Taxable or Exempt Income:

- House Rent Allowance (HRA): Exempt up to certain limits if rent is paid.

- Leave Travel Allowance (LTA): Exempt for travel expenses within India, subject to conditions.

- Conveyance Allowance: Exempt up to ₹1,600 per month.

- Medical Reimbursement: Exempt up to ₹15,000 per annum with bills.

- Gratuity and Pension: Exempt up to prescribed limits.

- Employer’s Contribution to Provident Fund: Exempt up to 12% of salary.

Fully Non-Taxable Income:

- Gifts from Specified Relatives: Non-taxable under certain limits.

- Agricultural Income: Exempt, subject to conditions.

- Allowances for Differently-Abled Individuals: Specific exemptions apply.

Employers are required to provide a Form 16 that details salary components and tax deductions for accurate filing.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

House Rent Allowance (HRA) and Leave Travel Allowance (LTA)

House Rent Allowance (HRA)

HRA is a popular salary component that helps employees manage rental expenses. The exemption on HRA under Section 10(13A) is the least of the following three:

- Actual HRA received

- Rent paid minus 10% of basic salary

- 50% of basic salary if residing in metro cities (Delhi, Mumbai, Chennai, Kolkata) or 40% for non-metro cities

Example Calculation:

- Basic Salary: ₹50,000/month

- HRA Received: ₹20,000/month

- Rent Paid: ₹18,000/month

- City: Mumbai (Metro)

For example, if your basic salary is ₹50,000/month, HRA received is ₹20,000, and rent paid is ₹18,000/month in Mumbai

- Rent paid – 10% of basic = ₹18,000 – ₹5,000 = ₹13,000

- 50% of basic = ₹25,000

- Actual HRA received = ₹20,000

- Exempted HRA = ₹13,000 (least of the three)

- Taxable HRA = ₹7,000

Proof of rent paid is mandatory if rent exceeds ₹1 lakh annually, and Form 10BA must be submitted.

Leave Travel Allowance (LTA):

LTA covers travel expenses for the employee and family within India. It is exempt under Section 10(5) subject to:

- Eligible Travel Modes: Travel must be by air (economy class), rail (AC first class), or recognized public transport (deluxe or first class).

- Eligible Family Members: Includes spouse, children (up to two), and wholly dependent parents or siblings.

- Exemption Frequency: Available for two journeys in a block of four calendar years (e.g., 2022–2025).

- Exempt Expenses: Only actual travel fare is exempt. Food, hotel, sightseeing, and local conveyance are not covered.

- Cash Allowance: If LTA is received without actual travel, the amount is fully taxable.

LTA is not exempt if cash allowance is given instead of travel.

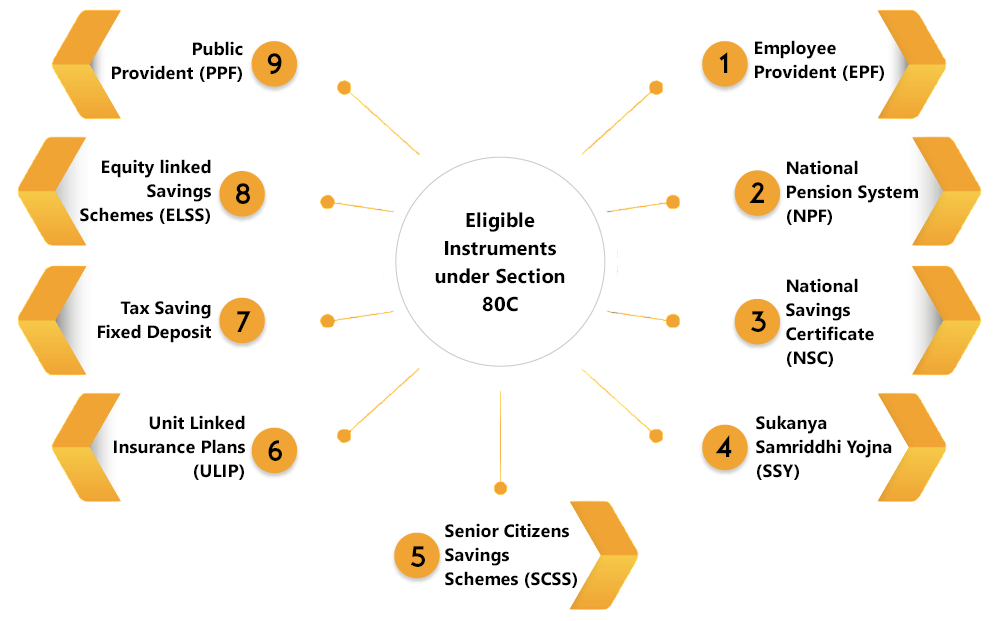

Section 80C Deductions

Section 80C is the most widely used tax-saving provision under the Income Tax Act. It offers taxpayers a practical way to improve their financial planning.

This section allows individuals to claim significant deductions up to ₹1.5 lakh each year. Deductions can be claimed on various investments and expenses, such as Employee Provident Fund, Public Provident Fund, life insurance premiums, Equity Linked Savings Scheme, National Savings Certificates, home loan principal repayments, children’s tuition fees, Sukanya Samriddhi Yojana, and Senior Citizen Savings Scheme. By using these deduction options wisely, taxpayers can lower their taxable income and improve their overall financial situation. Savvy investors understand the need to plan these investments early in the financial year. This strategy helps maximize tax benefits and ensures they fully use the available ₹1.5 lakh limit, encouraging a strong approach to personal financial management.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Other Sections (80D, 80E, 80G, etc.)

In tax planning, several key sections provide ways to reduce taxable income and improve financial efficiency. Section 80D offers important deductions for medical insurance premiums. Taxpayers can claim up to ₹25,000 for themselves and their families, plus an additional ₹25,000 for parents, which rises to ₹50,000 for senior citizens. Education loan holders can take advantage of Section 80E, which allows interest deductions on higher studies loans for up to eight consecutive years. Charitable individuals can benefit from Section 80G, which provides 50% or 100% deductions for donations. Savings account holders get tax relief from Section 80TTB, with deductions up to ₹10,000, and ₹50,000 for senior citizens. Homeowners can also claim up to ₹2 lakh in deductions on home loan interest under Section 24(b). These provisions give taxpayers effective ways to lower their tax liability and enhance financial benefits.

New vs Old Tax Regime

Old Tax Regime: Offers lower tax rates but taxpayers must forego most exemptions and deductions (like HRA, 80C, 80D, etc.). Popular among salaried taxpayers with substantial deductions.

New Tax Regime (Introduced in Budget 2020): Offers lower slab rates but without exemptions and deductions except NPS, EPF employer contribution, and a few others. For example, the tax rate for income between ₹5 lakh and ₹7.5 lakh is 10% in the new regime versus 20% in the old.

Which One to Choose:

- Taxpayers with significant deductions usually benefit from the old regime.

- Those with fewer investments and simpler incomes might prefer the new regime.

- The government allows taxpayers to choose annually for salaried individuals.

A comparative analysis helps select the best tax-saving route.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Investment-linked Tax Saving

Tax-saving investments not only reduce tax liability but also promote financial discipline and wealth creation. Popular investment options include:

- Equity Linked Savings Scheme (ELSS): Mutual funds with a 3-year lock-in, offers capital gains benefits.

- Public Provident Fund (PPF): Long-term government-backed savings with tax-free returns and 15-year lock-in.

- National Pension Scheme (NPS): Provides an additional deduction of ₹50,000 under Section 80CCD(1B) over 80C limits.

- Life Insurance Policies: Offers protection and tax benefits.

- Tax-saving Fixed Deposits: 5-year tenure with tax benefits under 80C.

Selecting the right mix depends on risk appetite, liquidity needs, and financial goals.

Filing Income Tax Returns (ITR)

Filing Income Tax Return (ITR) is mandatory for individuals earning above the basic exemption limit or having other taxable income:

- ITR Forms: Different forms exist depending on income sources, e.g., ITR-1 (Sahaj) for salaried individuals, ITR-2 for those with capital gains.

- Documents Required: Form 16, investment proofs, bank statements, rent receipts, and Form 26AS (tax credit statement).

- Filing Deadlines: Usually July 31 for individuals; extended for audit cases.

- E-filing: Government’s e-filing portal allows easy online filing with verification options (Aadhaar OTP, net banking).

- Refunds: If excess tax is paid, refunds can be claimed after processing.

- Penalties: Non-filing or late filing attracts penalties and interest on dues.

Timely and accurate filing ensures compliance and avoids legal issues.

Common Mistakes

Navigating the complicated world of tax filing can be tough. There are many potential pitfalls that could affect your financial benefits. Taxpayers often mistakenly make critical errors that can lead to hefty penalties or missed opportunities. Common mistakes include not submitting important documents like rent receipts or Form 10BA for HRA claims, ignoring interest income from savings accounts, and overlooking key deductions under sections like 80D and 80E. Many people also struggle with technical details, such as reconciling Form 26AS with actual tax payments, understanding advance tax requirements, picking the right ITR form, and meeting important filing deadlines. To reduce these risks, taxpayers should focus on careful documentation, keep thorough financial records, and stay up-to-date on changing tax rules. By taking a proactive approach and seeking help from professionals when needed, individuals can effectively manage the complex tax filing process, reduce the chances of errors, and improve their financial results.

Tax-saving Tips

- Plan Investments Early: Maximize Section 80C benefits by starting in the financial year’s beginning.

- Maintain Proof Documents: Keep rent receipts and related proofs to claim exemptions accurately.

- Use Tax-saving Mutual Funds (ELSS): Aim for higher returns with lock-in benefits and tax advantages.

- Opt for Health Insurance: Offers protection and deductions under Section 80D.

- Reconcile Form 26AS: Track tax credits and ensure accurate reporting.

- Compare Tax Regimes: Assess the new vs old regime each year to choose wisely.

- File ITR Timely: Accurate and punctual filing avoids penalties and interest.

- Use Online Tax Calculators: Plan effectively and estimate your liability.

- Claim Home Loan Deductions: Ensure proper documentation for interest and principal repayments.

These small actions help optimize tax liability and promote savings.

Conclusion

Understanding the structure of salary, the distinction between taxable and non-taxable components, various deductions under the Income Tax Act, and filing procedures is essential for efficient tax planning. Whether opting for the old or new tax regime, a well-planned investment and documentation strategy can save substantial tax and enhance financial well-being. Proactive tax planning is not just about compliance but a smart approach to wealth management. Stay informed, invest wisely, and file returns timely to reap maximum benefits under the Indian tax system.