- Importance of Internships in Investment Banking

- Understanding the Role of Internships in Investment Banking

- Building a Strong Resume

- Key Skills and Certifications

- Networking Techniques to Land an Internship

- Applying to Top Investment Banks

- Target Schools and Programs

- Interview Preparation for IB Internships

- Final Tips for Aspiring IB Interns

- Conclusion

Importance of Internships in Investment Banking

Investment Banking (IB) is one of the most competitive and sought-after career paths in the finance industry. The path to securing a role in IB is rigorous and requires a combination of strong academic credentials, technical skills, networking, and most importantly, relevant experience. Internships serve as the critical stepping stone that bridges the gap between theoretical knowledge and practical application, providing aspiring bankers with hands-on exposure to the dynamic world of finance.In this article, we will explore the significance of internships in investment banks, what the role entails, how to build a strong resume, develop key skills, apply to top banks, prepare for Interviews for IB internships, and ultimately convert internships into full-time offers.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

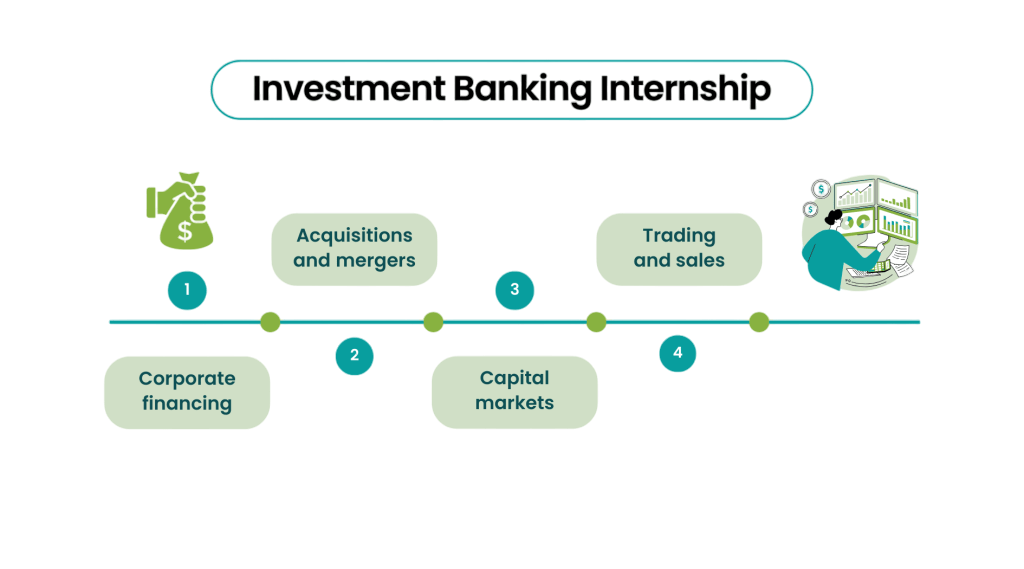

Understanding the Role of Internships in Investment Banking

Investment banking internships are designed to give students and fresh graduates real-world exposure to the high-pressure environment of IB. These internships typically last between 8 to 12 weeks during summer or sometimes part-time during academic statement

Why Internships Matter:

- Real-world exposure: Internships immerse candidates in live deals, financial modeling, valuation exercises, and client interactions, providing a practical understanding of what bankers do daily.

- Skill development: Interns learn critical technical skills like financial modeling, Excel, PowerPoint presentations, and valuation techniques.

- Industry insight: Exposure to sectors, markets, and transactions enables interns to gain insight into industry dynamics.

- Networking: Internships allow interns to build relationships with senior bankers, HR teams, and fellow interns, creating a network essential for career progression.

- Resume booster: Having an IB internship on a resume signals commitment, capability, and relevant experience, greatly increasing chances of full-time offers and future job prospects.

Building a Strong Resume

The competition for IB internships is fierce, with hundreds or thousands of applicants vying for a handful of positions. Therefore, a strong, well-structured resume is critical.

Key Resume Tips:

- Clear Objective: Start with a concise objective or summary tailored for IB.

- Education: Highlight your academic achievements, GPA, coursework relevant to finance, economics, accounting, or mathematics.

- Relevant Experience: Include internships, projects, case competitions, or research related to finance or business.

- Technical Skills: Mention proficiency in Excel, financial modeling, PowerPoint, Bloomberg, programming languages (Python, VBA), or certifications like CFA Level 1.

- Quantify Achievements: Use numbers and metrics to showcase impact, such as “Analyzed 10 companies’ financials leading to recommendations that contributed to a simulated 15% portfolio gain.”

- Extracurriculars: Highlight leadership roles in finance clubs, student government, or volunteer work demonstrating teamwork and initiative.

- Tailor for Each Application: Customize keywords and skills to align with the job description.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Key Skills and Certifications

Interns in investment banks are expected to have a strong technical and analytical foundation along with soft skills. Some essential skills include:

Technical Skills:

- Financial Modeling: Building and interpreting financial models in Excel.

- Valuation Techniques: Understanding DCF, comparable company analysis, precedent transactions.

- Accounting Fundamentals: Ability to analyze financial statements.

- Excel Proficiency: Advanced functions, pivot tables, macros.

- Presentation Skills: Creating clear, compelling pitch decks in PowerPoint.

Soft Skills:

- Attention to Detail: Accuracy is critical in IB.

- Time Management: Juggling multiple deadlines efficiently.

- Communication: Ability to explain complex concepts clearly.

- Teamwork: Collaborating with multiple stakeholders.

Certifications:

- CFA Level 1: Demonstrates commitment and foundational finance knowledge.

- Financial Modeling Courses: Offered by Wall Street Prep, Breaking Into Wall Street, or Coursera.

- Excel and VBA Training: Boost efficiency and technical capability.

Networking Techniques to Land an Internship

Landing an internship often depends as much on who you know as on what you know. Effective networking can open doors to opportunities that may not be publicly advertised. Start by identifying your target industry and researching professionals on LinkedIn, university alumni platforms, and company websites. Reach out with polite, personalized messages expressing interest in their work and asking for brief informational Interviews for IB internships. These conversations can offer insights, build relationships, and sometimes lead to referrals.Attend career fairs, industry events, and university-sponsored networking sessions to meet recruiters and professionals in person. Prepare a short “elevator pitch” about your skills and goals, role of internships in investment banking and always follow up with a thank-you note to reinforce the connection. Joining student organizations, professional associations, or online forums (like LinkedIn groups or Reddit threads) can also increase your visibility.Leverage your existing network friends, professors, family members, and former employers to ask for introductions. Be clear about what you’re looking for, and maintain professionalism in all interactions. Finally, nurture relationships over time; genuine, ongoing engagement builds trust and increases your chances of being considered when opportunities arise.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Applying to Top Investment Banks

Top global banks like Goldman Sachs, J.P. Morgan, Morgan Stanley, Citi, Bank of America, and regional powerhouses offer structured internship programs.

Application Process:

- Online Applications: Most banks have online portals open months in advance; apply early.

- Referral Importance: Use networking to get referrals inside the firm.

- Campus Recruiting: Many banks visit target universities for recruitment drives; leverage your campus career center.

- Tailored Cover Letters: Write personalized cover letters showing knowledge of the firm and passion for IB.

- Multiple Rounds: Applications usually go through multiple screening stages including aptitude tests and interviews.

Target Schools and Programs

Investment banks typically recruit from a select group of top universities and business schools known for finance and economics programs.

Target Schools:

- Ivy League and other top US universities (Harvard, Wharton, Stanford)

- Leading UK universities (Oxford, Cambridge, LSE)

- Premier Indian Institutes (IIMs, IITs, XLRI)

- Other global finance hubs with strong finance programs

Why Target Schools?

Companies often focus their internship and entry-level hiring efforts on a select group of “target schools” colleges and universities with strong academic reputations, established recruiting relationships, and a track record of producing successful hires. These schools are seen as reliable sources of top talent.Target schools usually have well-connected career centers, alumni networks, role of internships in investment banking and faculty that collaborate closely with employers. As a result, students at these institutions may get early or exclusive access to job postings, campus Interviews for IB internships, and networking events. Companies may also send recruiters directly to these campuses, making it easier for students to build relationships and learn about roles before they’re widely advertised.Additionally, the brand recognition of a target school can serve as a signal to employers that a candidate has received a rigorous education and has been trained in a competitive environment.

Interview Preparation for IB Internships

Interviews for IB internships are notoriously challenging and typically consist of multiple rounds, including both technical and behavioral questions.

Technical Interview Preparation:

- Master core finance concepts: DCF, valuation methods, accounting principles.

- Practice financial modeling and case studies.

- Review recent deals and market news.

- Brush up on mental math and logical reasoning.

- Use resources like “Investment Banking: Valuation, Leveraged Buyouts, and Mergers & Acquisitions” by Rosenbaum and Pearl.

Behavioral Interview Preparation:

- Prepare stories demonstrating teamwork, leadership, problem-solving.

- Use the STAR method (Situation, Task, Action, Result) for structured answers.

- Be ready to explain your motivation for IB and why the specific bank.

- Practice answering questions like “Tell me about yourself,” “Describe a challenge you overcame,” “How do you handle pressure?”

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Final Tips for Aspiring IB Interns

- Start early: Begin building skills and networking well before the internship application season.

- Be persistent: Rejections are common; learn and improve continuously.

- Gain related experience: Roles in corporate finance, equity research, or consulting can help.

- Stay updated: Follow market news and firm developments daily.

- Focus on fit: Understand the culture and values of each bank to tailor your approach.

- Practice mock interviews: Seek feedback to refine answers and build confidence.

Conclusion

Internships in investment banking are essential for launching a successful career in this demanding but rewarding field. They provide practical exposure, skill enhancement, networking opportunities, and a direct route to full-time employment. However, securing these internships requires strategic preparation, targeted applications, and perseverance.By developing technical skills, role of internships in investment banking building a standout resume, effectively networking, preparing thoroughly for Interviews for IB internships, and performing well during internships, aspiring investment bankers can significantly increase their chances of entering and thriving in the competitive world of investment banking.