- Who Was Harshad Mehta?

- Indian Market Context in 1990s

- Mechanics of the Scam

- Banking System Loopholes

- Role of SBI and RBI

- Media Coverage (including The Scam 1992)

- Legal Proceedings

- SEBI Reforms Post-Scam

- Impact on Retail Investors

- Systemic Changes in Market

- Comparison with Other Scams

- Summary

Who Was Harshad Mehta?

Harshad Shantilal Mehta was a stockbroker turned market manipulator whose actions in the early 1990s shook the Indian financial markets to their core. Born in 1954 in a modest Gujarati family, Mehta entered the Bombay Stock Exchange (BSE) in the early 1980s and gradually built a reputation as a shrewd trader with an uncanny ability to spot market opportunities. Mehta’s rise to prominence came at a time when the Indian stock market was still evolving and the regulatory frameworks were not fully developed. His flamboyant lifestyle and high-profile trades made him a media sensation, earning him the moniker “The Big Bull” of the Indian stock market. However, Mehta’s success was built on exploiting loopholes within the banking and securities system, culminating in a scam that allegedly misappropriated around Rs. 5,000 crore (approximately USD 1 billion at the time), causing massive disruption to the Indian stock market and banking sector.

Indian Market Context in the 1990s

The early 1990s was a transformative period for India’s economy and financial markets. The economy had just started opening up after decades of protectionism under the License Raj. Liberalization policies in 1991, including deregulation and easing of controls, created a new environment that encouraged foreign investment and market-driven growth. The Bombay Stock Exchange (BSE) was the primary stock exchange, but the market infrastructure was still rudimentary by global standards. There was limited transparency, slow settlement systems, and weak regulatory oversight. Banking practices were also archaic. Many banks followed manual systems and lacked integration with stock market operations. The mechanisms for funds transfer and securities settlement were cumbersome, making it easier for sharp players to manipulate funds flows and exploit the gaps. In this environment, speculative trading thrived, with investors drawn by promises of high returns amid liberalization optimism. Harshad Mehta capitalized on this optimism, leveraging systemic weaknesses to inflate stock prices artificially.

Interested in Obtaining Your Data Science Certificate? View The Data Science Online Training Offered By ACTE Right Now!

Mechanics of the Scam

At the heart of the scam was Harshad Mehta’s manipulation of the banking system’s funds through a scheme exploiting ready forward (RF) deals and the government securities market.

- Ready Forward (RF) Deals: RF deals were short-term loans between banks, secured by government securities. A bank would “sell” securities to another bank with an agreement to repurchase them at a later date. These deals were essentially collateralized loans but were not subject to rigorous checks. Mehta exploited the fact that banks were supposed to hold securities as collateral but in practice, many banks did not verify the existence of securities before transferring funds. This lack of verification allowed Mehta to use fake bank receipts (BRs) to obtain funds from banks without providing the corresponding securities.

- Bank Receipts (BRs): Mehta convinced some banks to issue fake BRs for government securities that did not exist or were not actually held by those banks. He then used these BRs as collateral to raise money from other banks. With this artificially procured money, Mehta bought shares of certain companies, most notably Reliance Industries, driving up their stock prices. This created a market frenzy and attracted retail investors.

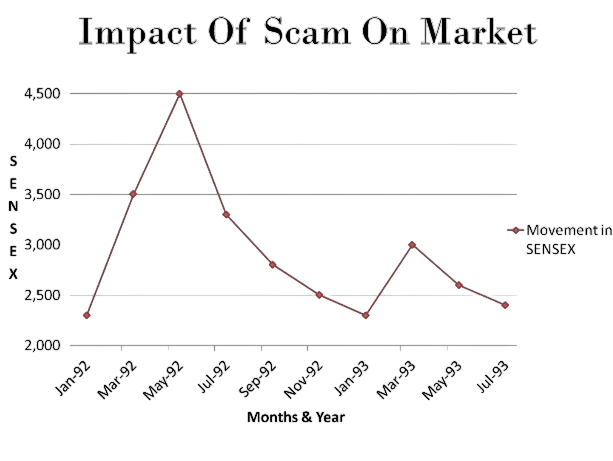

- Stock Price Manipulation: Using the funds raised through fake BRs, Mehta aggressively bought shares, causing prices to soar. His buying spree and influence convinced many investors to buy shares, further pushing prices up. The inflated stock prices allowed Mehta to sell shares at a profit to unwitting investors, pocketing huge gains. Once the scam unraveled, the prices crashed, causing heavy losses for investors.

- Lack of Verification Mechanisms: Banks did not cross-check the physical availability of securities before accepting BRs or releasing funds. This allowed the circulation of fake or duplicated BRs.

- Fragmented Banking Records: Bank branches and offices operated independently without real-time central monitoring, allowing Mehta to move funds between banks and branches without detection.

- Manual Systems: The absence of electronic transfer systems made tracking fund movements difficult, enabling Mehta to exploit delays and inconsistencies.

- Ready Forward Deal Vulnerabilities: RF deals lacked standardization and proper regulatory oversight, creating avenues for fraud.

- Securities and Exchange Board of India (SEBI)

- Central Bureau of Investigation (CBI)

- Income Tax Department

- Introduction of Dematerialization: Moving from physical share certificates to electronic formats eliminated risks of fake or duplicate securities.

- Stricter Surveillance: Enhanced monitoring of stock market transactions and improved disclosure norms.

- Regulation of Inter-Bank Transactions: Tighter control over ready forward deals and government securities trading.

- Improved Market Infrastructure: Development of electronic trading platforms and settlement systems (e.g., NSE, NSDL).

- Investor Protection: Creation of investor grievance redressal mechanisms and education initiatives.

- Strengthened Regulatory Framework: More powers and autonomy were granted to SEBI, enabling better oversight.

- Banking Reforms: Banks modernized operations, improved internal controls, and adopted electronic systems.

- Market Infrastructure: Creation of the National Stock Exchange (NSE) in 1994, providing a more transparent and efficient trading platform.

- Improved Transparency: Mandatory disclosure of insider trading and related party transactions.

- Capital Market Deepening: Greater participation by institutional investors and foreign investors, fostering market stability.

- Ketan Parekh Scam (2001): Similar market manipulation using circular trading and stock price rigging.

- Satyam Scam (2009): Corporate fraud involving inflated balance sheets and accounting irregularities.

- Nirav Modi PNB Scam (2018): Banking fraud involving fake Letters of Undertaking causing huge banking losses.

To Explore Data Science in Depth, Check Out Our Comprehensive Data Science Online Training To Gain Insights From Our Experts!

Banking System Loopholes

The scam exploited several critical weaknesses in the Indian banking system:

Role of SBI and RBI

SBI was the primary bank involved in the scam. Mehta reportedly colluded with some officials to obtain fake BRs from SBI branches, which he then used to raise funds from other banks. Certain SBI officers allegedly issued BRs without verifying securities or knowingly aided the scam. The bank suffered significant losses and reputational damage. As India’s central bank and financial regulator, RBI’s role came under scrutiny post-scam. The RBI had failed to detect the scam despite its responsibility for regulating inter-bank transactions and securities markets. The scam exposed the RBI’s regulatory weaknesses and led to calls for stricter supervision of banking practices and securities transactions. The RBI took steps after the scam to improve oversight of ready forward deals and introduced measures to enhance the transparency and monitoring of government securities.

Gain Your Master’s Certification in Data Science Training by Enrolling in Our Data Science Master Program Training Course Now!

Media Coverage (including The Scam 1992)

The media played a critical role in exposing and narrating the Harshad Mehta scam. In 1992, leading newspapers such as The Times of India published investigative reports by journalist Sucheta Dalal, who uncovered discrepancies in banking transactions and exposed the scam to the public. The widespread coverage stirred public outrage and increased scrutiny of financial markets. Decades later, the scam was dramatized in the popular web series “Scam 1992: The Harshad Mehta Story”, which renewed interest and awareness about the scam among younger generations. The series provided a detailed and nuanced depiction of Mehta’s rise and fall, and the systemic flaws that allowed the scam to happen.

Are You Preparing for Data Science Jobs? Check Out ACTE’s Data Science Interview Questions and Answers to Boost Your Preparation!

Legal Proceedings

Following the exposure, investigations were launched by multiple agencies, including:

Harshad Mehta was arrested and faced multiple charges, including criminal conspiracy, cheating, and fraud. The legal proceedings spanned years, involving complex litigation and appeals. Mehta spent time in jail but died in 2001 before the final verdicts were delivered. Several bank officials and brokers were also prosecuted, though some acquitted due to lack of evidence.

SEBI Reforms Post-Scam

The scam was a wake-up call for India’s financial regulators, especially SEBI. Post-scam, SEBI implemented several reforms to strengthen market integrity:

Impact on Retail Investors

The market scam hit retail investors hard. They were especially vulnerable to the misleading rise in stock prices. Many people invested large amounts of their personal funds, drawn in by the tempting returns. When the market eventually crashed, their financial hopes vanished. This disaster led to significant losses and deeply damaged investor confidence, affecting their participation in the market long-term. The widespread financial ruin confronted many investors, shaking their trust in stock market systems. This could discourage retail investment for years. Ironically, the tragedy also triggered an important realization. Investors began to see how crucial it is to do thorough research and exercise caution before putting their hard-earned money into financial markets.

Systemic Changes in Market

The scam triggered fundamental changes in India’s financial ecosystem:

Comparison with Other Scams

The Harshad Mehta scam stands out for its scale and sophistication, but India has witnessed other significant financial frauds, including:

While each scam had unique elements, Harshad Mehta’s remains iconic for exposing banking vulnerabilities and market manipulation on a grand scale.

Summary

The Harshad Mehta scam was a landmark event in the history of Indian financial markets. It exposed the vulnerabilities of the banking system and stock markets at a crucial time when India was opening up economically. While the scam caused severe losses and shook investor confidence, it ultimately catalyzed significant regulatory and systemic reforms. Through tighter controls, improved infrastructure, and greater transparency, India’s markets became more resilient. The scam also underscored the need for ethical conduct and vigilance, lessons that remain relevant in today’s fast-evolving financial landscape.